The landscape of blockchain infrastructure is undergoing a seismic shift, and at the epicenter is the rise of restaking protocols. These innovative mechanisms are unlocking new dimensions of yield optimization and shared security, particularly for modular blockchains like Celestia and Ethereum’s expanding ecosystem. If you’re a validator, investor, or builder, understanding how restaking is rewriting the rules of capital efficiency isn’t just optional, it’s essential to staying ahead in 2025’s high-stakes modular blockchain game.

Restaking Unpacked: The Engine of Modular Blockchain Synergy

Traditional staking locks your assets to a single chain, limiting both flexibility and earning potential. Restaking protocols break these chains, literally. By enabling staked assets (like ETH or ERC-20 tokens) to secure multiple networks or services simultaneously, restaking transforms passive capital into an active, multi-yield powerhouse. This is especially relevant for modular blockchains, where the separation of consensus, execution, and data availability layers demands agile, scalable security solutions.

As recent research highlights, this approach not only amplifies returns for stakers but also distributes economic security across a broader swath of the decentralized ecosystem. The result? A more resilient, adaptable, and lucrative blockchain landscape for everyone involved.

Meet the Trailblazers: Top Restaking Protocols in 2025

Let’s break down the protocols leading the charge in restaking for modular blockchains:

Top Restaking Protocols Maximizing Yield & Security

-

EigenLayer: As a trailblazer in restaking, EigenLayer empowers Ethereum validators to restake their ETH and secure additional networks and dApps. This approach not only amplifies staking rewards but also reinforces Ethereum’s security by extending its economic guarantees to new services.

-

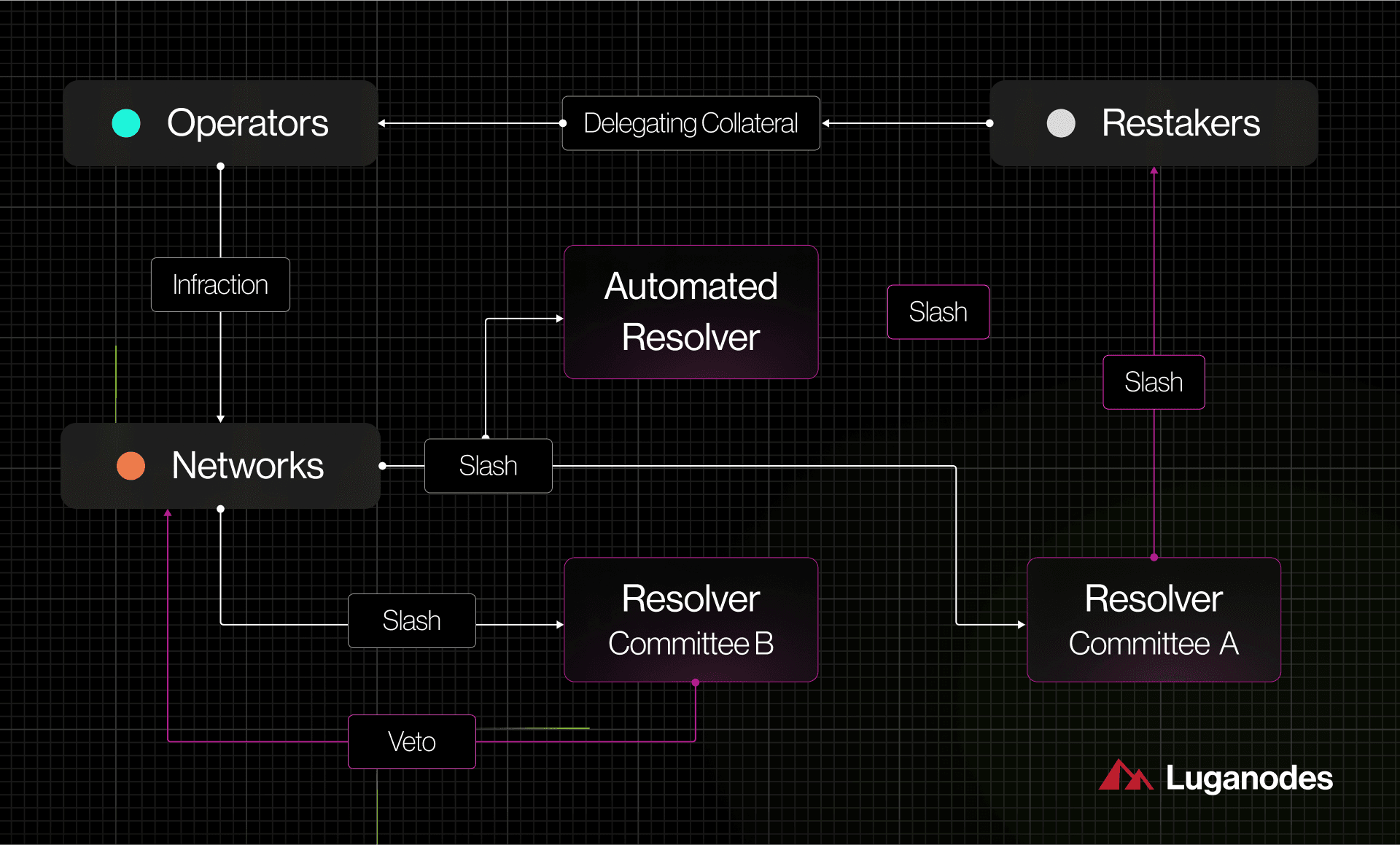

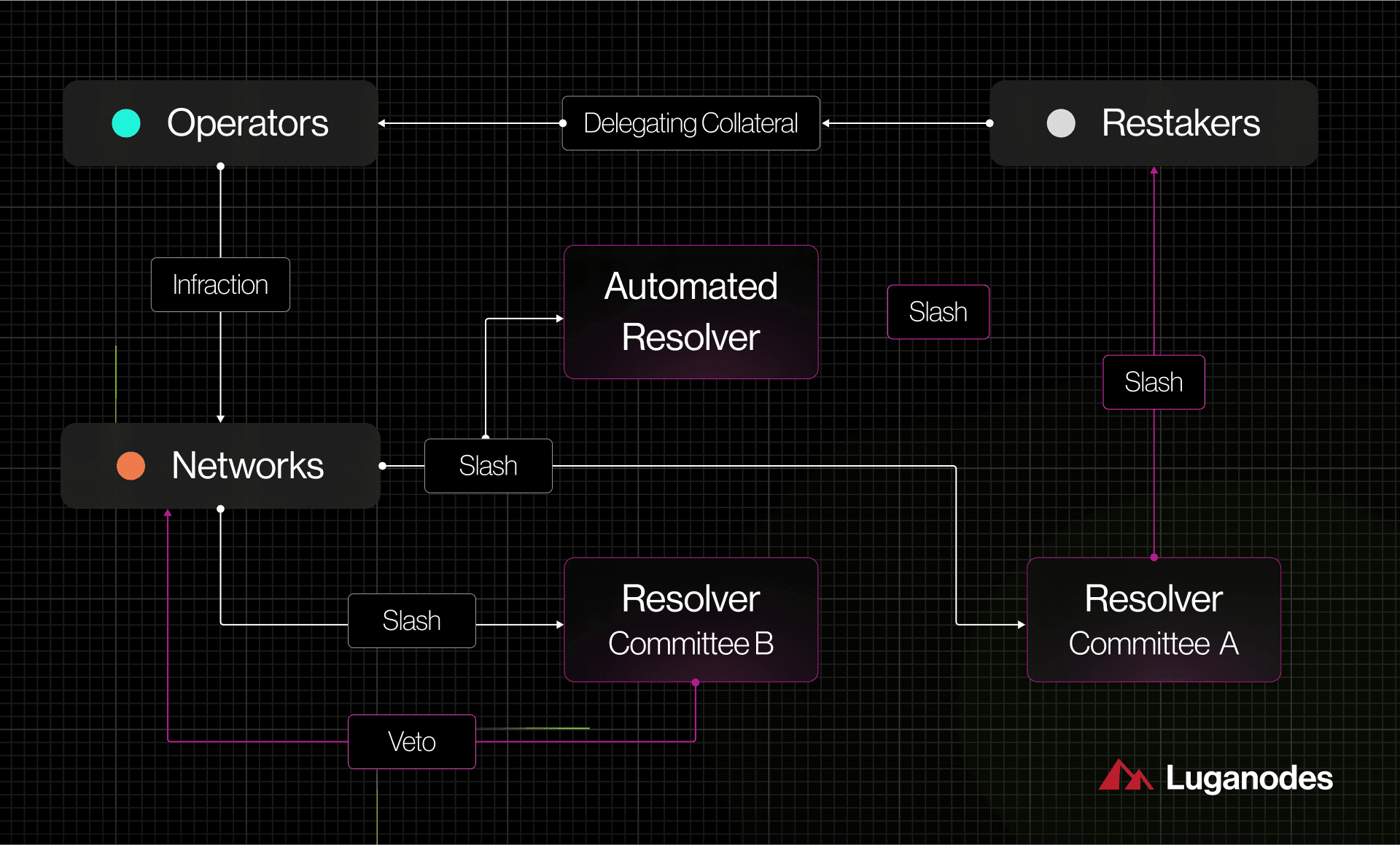

Symbiotic: Known for its permissionless and modular architecture, Symbiotic enables users to restake a variety of ERC-20 tokens. This flexibility allows decentralized networks to customize security models—including validator sets and slashing rules—delivering both enhanced yield and a resilient, adaptable infrastructure.

-

Mitosis: Mitosis introduces cross-chain restaking, transforming passive staked assets into programmable liquidity. By abstracting and wrapping restaked assets across multiple chains, Mitosis facilitates seamless deployment into diverse vaults and strategies, optimizing both yield and security for modular blockchains.

EigenLayer is the undisputed heavyweight, allowing Ethereum validators to restake their ETH to secure new networks and decentralized applications. This not only boosts validator rewards but also reinforces Ethereum’s broader infrastructure. The protocol’s modular security framework is fueling a new wave of DeFi integrations and cross-chain opportunities. Dive deeper at CoinBackyard.

Symbiotic brings a permissionless, modular approach that supports a diverse range of ERC-20 tokens. This flexibility lets DA layers and dApps craft bespoke security models, tailoring slashing conditions and validator sets to their unique needs. Symbiotic’s design is a game-changer for modular blockchain networks seeking adaptable, resilient protection. More on Symbiotic’s architecture can be found here.

Mitosis is making waves with its cross-chain restaking capabilities. By abstracting restaked assets and wrapping them into portable strategy units, Mitosis allows seamless deployment across chains, vaults, and yield strategies. This programmable liquidity model transforms static security into dynamic opportunity, pushing the boundaries of what’s possible in modular blockchain finance. For a technical deep dive, visit Mitosis University.

Why Restaking? The Real-World Advantages for Modular Chains

The impact of restaking on modular blockchains isn’t just theoretical, it’s measurable and immediate. Here’s what’s driving adoption at breakneck speed:

- Yield Optimization: Validators can now earn multiple streams of rewards from a single staked asset, maximizing returns without additional capital outlay.

- Shared Security: By leveraging the economic weight of staked assets, restaking protocols distribute trust and protection across an array of networks, oracles, and DA layers.

- Modular Flexibility: Protocols like Symbiotic empower networks to define their own security rules, validator sets, and slashing logic, supporting specialization and rapid innovation.

- Capital Efficiency: Restakers can deploy their assets wherever the highest risk-adjusted yields exist, creating a dynamic market for blockchain security services.

This new paradigm is especially powerful for data availability layers like Celestia, which benefit from robust, flexible security models as they scale to support the next generation of decentralized applications.

Yet, with all this momentum, it’s crucial to recognize that restaking protocols are not a silver bullet. The race to maximize yield and fortify modular networks comes with its own set of trade-offs and strategic considerations. As more validators and investors flock to platforms like EigenLayer, Symbiotic, and Mitosis, the ecosystem is learning, sometimes the hard way, about the risks that ride shotgun with opportunity.

Navigating the Risks: What Every Restaker Should Know

Restaking isn’t just about stacking rewards. When you commit your assets to multiple protocols, you’re also multiplying your exposure. Compounded slashing risk is real: if any network you help secure suffers a breach or validator misbehavior, you could face penalties across all your staked positions. And as the number of interconnected smart contracts grows, so does the attack surface for would-be exploiters.

Market volatility can also turn yield-chasing into a double-edged sword. Protocols promising outsized returns often attract risk-tolerant capital, but if underlying security assumptions break down, losses can cascade fast. It’s not just about finding the highest APY, but about weighing it against the protocol’s robustness and the quality of its audits. As industry experts emphasize, due diligence and risk management are non-negotiable.

How to Get Started: A Practical Checklist for Restakers

Ready to dive in? Here’s a step-by-step approach to maximize your upside while managing the downside:

Smart restakers don’t just chase yield – they build a resilient strategy. Start by researching each protocol’s security track record, governance model, and slashing mechanics. Diversify your staked assets across protocols with proven audit histories, and leverage monitoring tools to stay ahead of network events or governance changes. Remember, capital efficiency is only as strong as the weakest link in your security chain.

The Road Ahead: Restaking and the Modular Blockchain Future

The restaking boom is already reshaping the modular blockchain landscape. As protocols iterate and competition heats up, expect to see:

Top 5 Upcoming Trends in Restaking for Modular Blockchains

-

Cross-Chain Interoperability: Restaking protocols like Mitosis are pioneering seamless cross-chain restaking, allowing staked assets to secure multiple modular blockchains and decentralized applications. This unlocks new avenues for capital efficiency and network security across diverse ecosystems.

-

Liquid Restaking: The rise of liquid restaking protocols, such as those building on EigenLayer and Symbiotic, enables users to maintain liquidity while earning layered yields from multiple networks. This flexibility is driving DeFi integrations and unlocking new yield strategies.

-

Advanced Slashing Insurance: As restaking expands risk exposure, new insurance solutions are emerging to protect validators and delegators from slashing events. Protocols are integrating advanced slashing insurance mechanisms, helping users manage the compounded risks of multi-network participation.

-

DAO-Led Security Markets: Decentralized Autonomous Organizations (DAOs) are increasingly shaping security markets by governing restaking pools, setting slashing conditions, and customizing validator incentives. This democratizes security provisioning and fosters more resilient modular blockchain infrastructures.

-

Real-Time Risk Analytics: Cutting-edge analytics platforms are now offering real-time monitoring of restaking positions, slashing risks, and protocol health. These tools empower users to make informed decisions and dynamically manage their exposure in complex, multi-chain environments.

For DA layers like Celestia, the integration of advanced restaking solutions is a force multiplier, enabling new forms of decentralized data marketplaces and turbocharging the scalability of dApps. Meanwhile, Ethereum’s continued evolution as a security hub through EigenLayer is setting the standard for shared security models across the industry.

Ultimately, the modular blockchain era rewards those who are agile, informed, and proactive. Whether you’re optimizing yield, bolstering network security, or building next-gen infrastructure, restaking protocols offer the tools – but it’s up to you to wield them wisely.

Stay sharp, manage your risks, and keep riding the waves of innovation in modular blockchain finance.