In December 2025, with Ethereum holding steady at $3,039.72 despite a recent 4.14% pullback, the EigenLayer ecosystem stands as a beacon for those eyeing compounded yields in data availability. EigenDA restaking, powered by EigenLayer ETH, offers a sophisticated avenue to secure blobspace while tapping into layered rewards. This isn’t mere speculation; it’s a calculated extension of Ethereum’s security model into the modular era, where blobspace demands robust, decentralized guarantees.

EigenDA, nestled within EigenLayer’s Actively Validated Services (AVSs), addresses the escalating need for scalable data availability in layer-2 rollups. By enabling restakers to leverage their staked ETH or liquid staking tokens (LSTs) like stETH, it constructs custom quorums tailored for rollup security. Recent advancements, such as native token restaking for ERC-20s and the PEPE upgrade in September 2024, have slashed gas costs and bolstered forward compatibility, making EigenLayer blobspace restaking more efficient than ever. EigenLayer’s TVL, hovering around $19.5 billion, underscores the protocol’s traction, fueled by operator growth and AVS experimentation tracked on DeFiLlama.

EigenDA’s Role in Blobspace Security and Yield Optimization

Blobspace, the ephemeral yet critical storage layer for rollup data in Ethereum’s post-Dencun world, requires unwavering availability to prevent censorship or data loss. EigenDA steps in as a specialized AVS, allowing node operators to restake ETH and secure transactions with EigenLayer’s shared security paradigm. This setup not only amplifies base staking yields but introduces EigenDA-specific rewards, creating a yield stack that reflective investors can’t ignore.

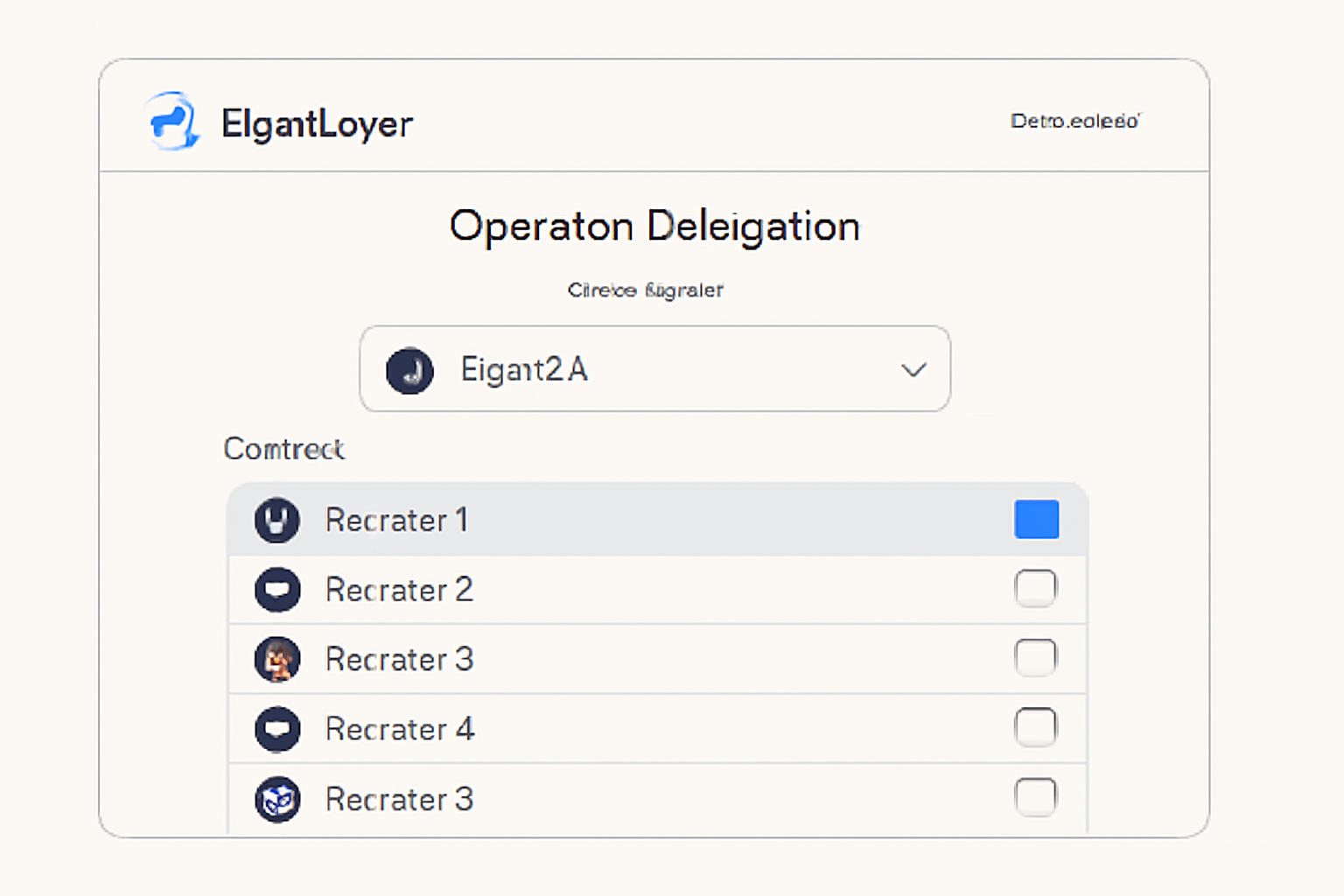

Consider the mechanics: restakers deposit LSTs into EigenLayer, delegating to operators running EigenDA nodes. These operators validate data availability proofs, earning emissions from the AVS alongside Ethereum consensus rewards. The EIGEN token stakedrop, with its Season 1 allocation from a March 2024 snapshot, further sweetened the pot, distributing 5% of supply to early participants. Yet, depth demands scrutiny; centralization risks in operator sets and slashing vectors warrant thorough due diligence before committing capital.

Strategic Advantages of ETH Restaking for EigenDA in 2025

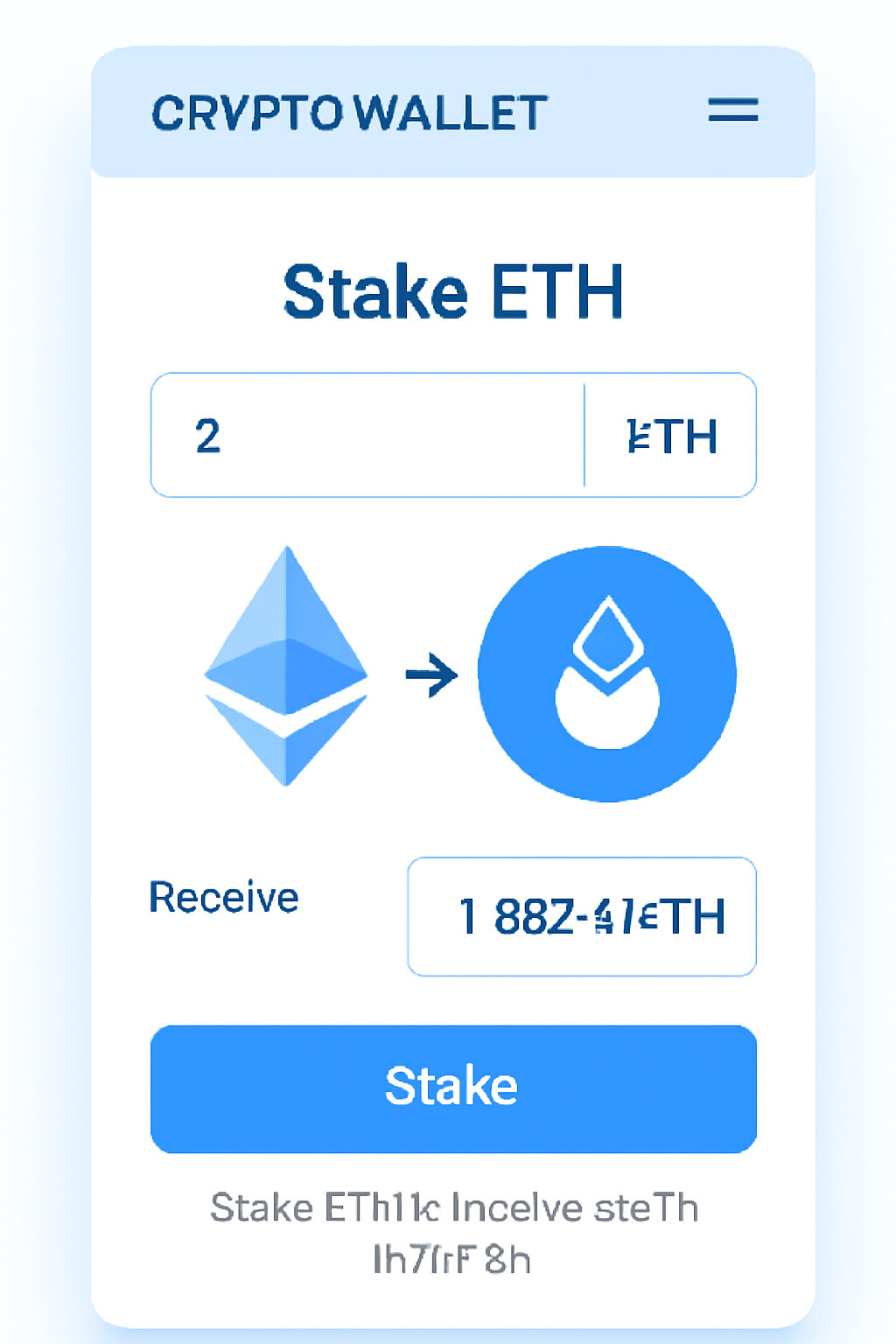

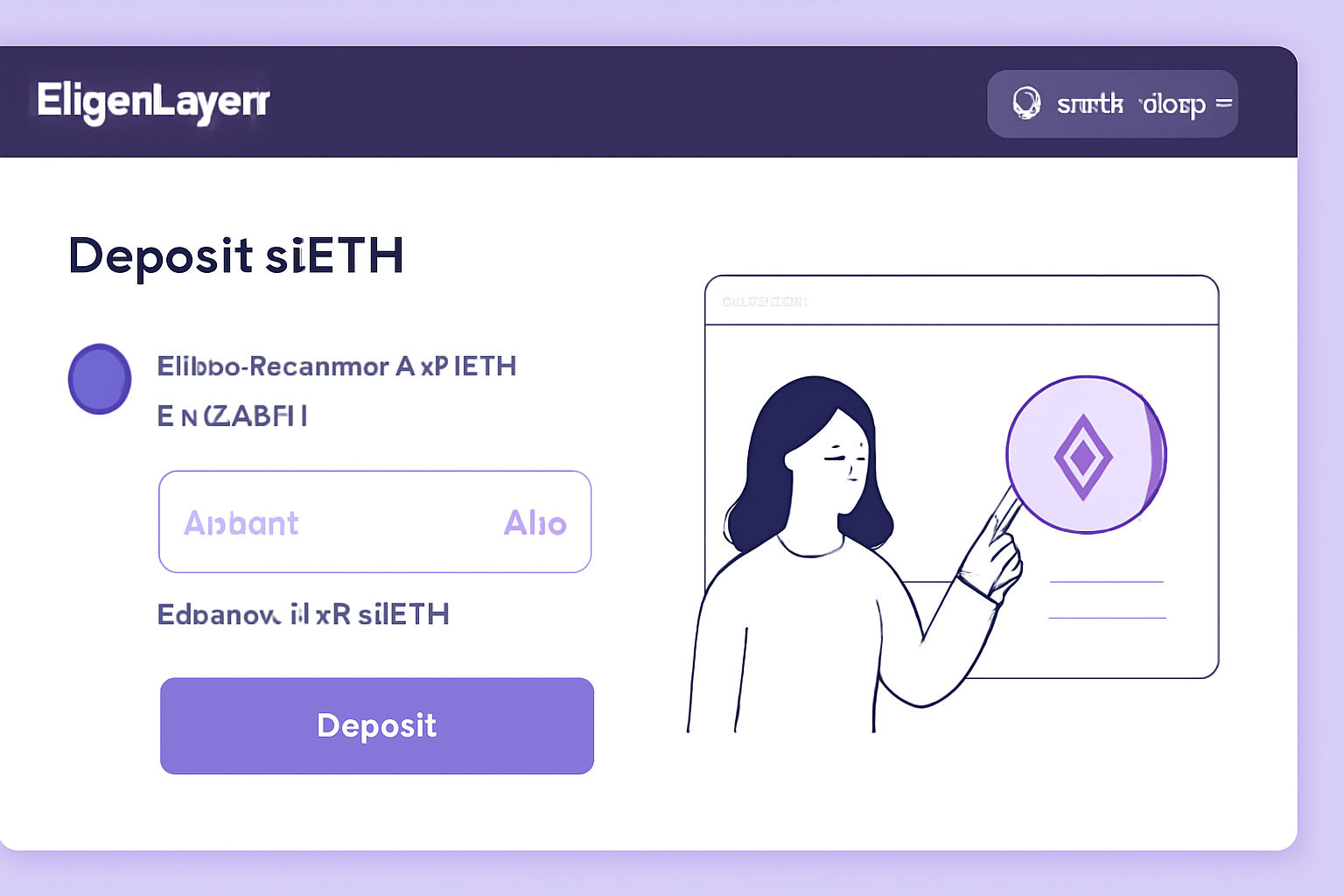

ETH restaking via EigenLayer for EigenDA transcends incremental yield; it positions participants at the nexus of DeFi’s restaking boom and L2 integrations. Liquid staking protocols like Lido enable seamless entry: convert staked ETH to stETH, deposit into EigenLayer’s contracts, and select operators attuned to EigenDA workloads. Native restaking, post-PEPE, simplifies this for validators through the EigenLayer Web App, encompassing restaking new validators, checkpointing, and yield withdrawals.

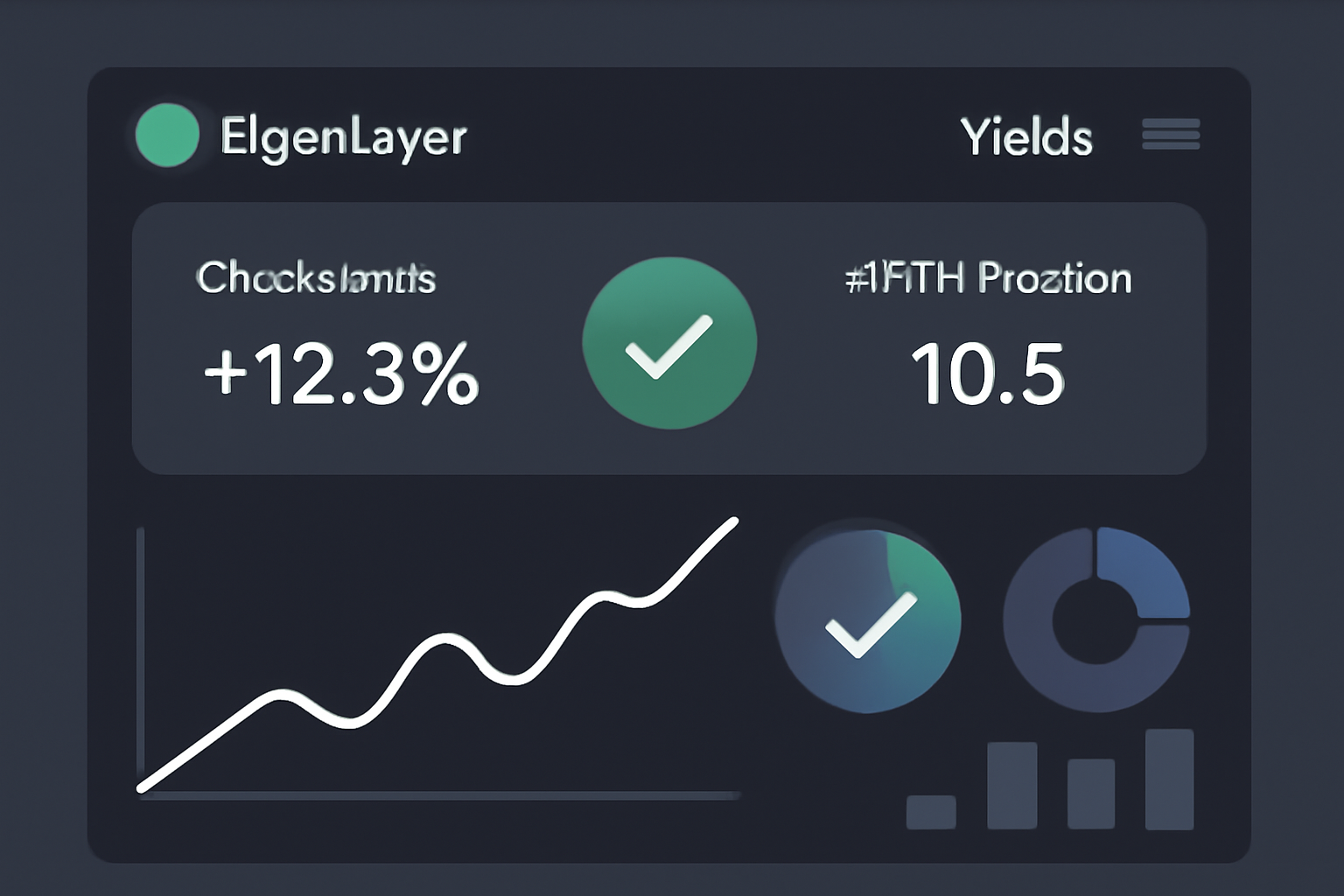

Analytically, the protocol’s operator growth signals maturation. From forum campaigns heralding mainnet to real-world AVS deployments, EigenLayer redefines ETH staking rules. Restakers benefit from shared security economics, where diversified AVS exposure mitigates single-point failures. In a market where ETH at $3,039.72 reflects resilience, layering EigenDA yields could push annualized returns beyond 5-7%, depending on operator performance and AVS maturity. However, smart contract vulnerabilities and correlation risks with base staking loom; my view favors diversified LST bundles over full native exposure for prudent long-term positioning.

For a detailed walkthrough, explore our step-by-step guide on EigenLayer restaking, tailored for DA layer enthusiasts.

Navigating Risks and Rewards in EigenDA Blobspace Restaking

Restaking’s allure lies in its dual promise: elevated yields for stakers and outsourced security for nascent networks. EigenDA exemplifies this, with node operators earning dual rewards for blobspace duties. Yet, reflective analysis reveals nuances; slashing for AVS misbehavior could compound losses, while liquidity constraints on LSTs demand careful position sizing.

Eigen (EIGEN) Price Prediction 2026-2031

Forecasts driven by restaking TVL expansion, EigenDA AVS adoption, and Ethereum ecosystem integrations amid 2025 restaking boom

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2026 | $1.80 | $4.20 | $9.50 |

| 2027 | $3.20 | $7.80 | $15.00 |

| 2028 | $5.00 | $12.00 | $22.00 |

| 2029 | $7.50 | $18.00 | $32.00 |

| 2030 | $11.00 | $25.00 | $45.00 |

| 2031 | $15.00 | $35.00 | $65.00 |

Price Prediction Summary

EIGEN is positioned for strong growth from 2026-2031, propelled by EigenLayer’s $19.5B+ TVL, EigenDA blobspace security via restaking, and AVS proliferation. Average prices projected to rise from $4.20 (2026) to $35.00 (2031), a ~53% CAGR, with min/max reflecting bearish regulatory hurdles vs. bullish adoption surges. YoY avg growth: 86% (26), 54% (27), 50% (28), 39% (29), 40% (30), 40% (31).

Key Factors Affecting Eigen Price

- EigenLayer TVL growth surpassing $50B by 2028 via native restaking and LST deposits

- EigenDA and AVS adoption for L2 blobspace/security, enhanced by PEPE upgrade

- Ethereum price correlation (ETH ~$3,000 baseline) and staking yield multipliers

- Market cycles: post-2025 bull run with halving effects and DeFi boom

- Regulatory clarity on restaking vs. risks like slashing/centralization

- Competition from other protocols; operator/mainnet expansions

- Tech improvements: EigenPods, custom quorums, reduced gas costs

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Operators’ mainnet campaigns and Eigen Foundation announcements highlight ecosystem momentum. As TVL swells, so does the imperative for due diligence on operator reliability. In my 11 years dissecting tokenomics, EigenDA restaking shines for those prioritizing depth: select operators with proven uptime, monitor quorum diversity, and hedge against ETH volatility at current levels.

Forward-thinking restakers will appreciate how EigenDA’s custom quorums, now bolstered by ERC-20 native restaking, empower layer-2 networks to bootstrap security without diluting Ethereum’s core guarantees. This evolution, detailed in recent EigenLayer updates, positions blobspace as a yield-bearing asset class in its own right.

Step-by-Step Execution for EigenDA Restaking

Executing ETH restaking for EigenDA demands precision, blending liquid staking efficiency with operator delegation savvy. Begin by assessing your LST portfolio; stETH from Lido remains the gold standard for liquidity and composability. Deposit into EigenLayer’s core contracts, then delegate to EigenDA-specialized operators exhibiting low downtime and diversified AVS exposure. Post-PEPE, native restaking via the Web App streamlines validator integration, but LST paths suit most for their withdrawal flexibility.

Checkpointing ensures seamless yield capture, while withdrawals reclaim principal plus rewards. In practice, this layered approach has driven EigenLayer’s operator campaigns, with TVL at $19.5 billion reflecting disciplined capital allocation. My analysis favors operators with EigenPods for native staking depth, yet LST delegation offers the reflective investor a hedge against validator-specific risks.

Yield optimization hinges on AVS maturity; EigenDA’s data availability proofs generate emissions atop Ethereum’s 3-4% base, potentially stacking to 6-8% annualized at ETH’s $3,039.72 valuation. Track DeFiLlama for real-time operator performance, prioritizing those securing multiple quorums to diversify slashing exposure.

Future Horizons: EigenDA in the Blobspace Economy

Looking to 2026, EigenLayer blobspace restaking will likely anchor modular scaling, as rollups vie for premium data slots amid blobspace scarcity. Native token restaking expands this to non-ETH assets, fostering interoperable security models that challenge Celestia’s dominance in pure DA plays. EigenDA’s edge lies in Ethereum-aligned economics: shared slashing auctions and EIGEN incentives align operators with long-term protocol health.

Yet, tokenomics scrutiny reveals EIGEN’s stakedrop as a one-time catalyst; sustained value accrues from AVS demand. With ETH resilient at $3,039.72 post-pullback, restakers positioning now capture upside from L2 integrations and DeFi restaking loops. Depth over speed dictates selecting quorums with verifiable uptime histories, avoiding overleveraged operators amid centralization whispers.

For deeper dives into blobspace dynamics, see our analysis on how restaking shapes DA layer economics.

Ultimately, EigenDA restaking embodies Ethereum’s modular pivot: securing blobspace not as charity, but as a yield engine demanding rigorous vetting. In a landscape of fleeting narratives, this protocol rewards the analytical eye attuned to operator quorum resilience and AVS reward accrual. Stake thoughtfully, monitor diligently, and let compounded security compound your returns.