Celestia’s ascent in 2025 is more than a technical narrative – it’s a story of how a single architectural breakthrough can redefine the boundaries of blockchain scalability and composability. As the modular blockchain thesis matures, Celestia stands at the epicenter, offering developers, DAOs, and investors a new paradigm: blobspace as a commodity and multi-rollup deployments as the engine of decentralized innovation.

Blobspace Surge: The New Gold Rush for Modular Blockchains

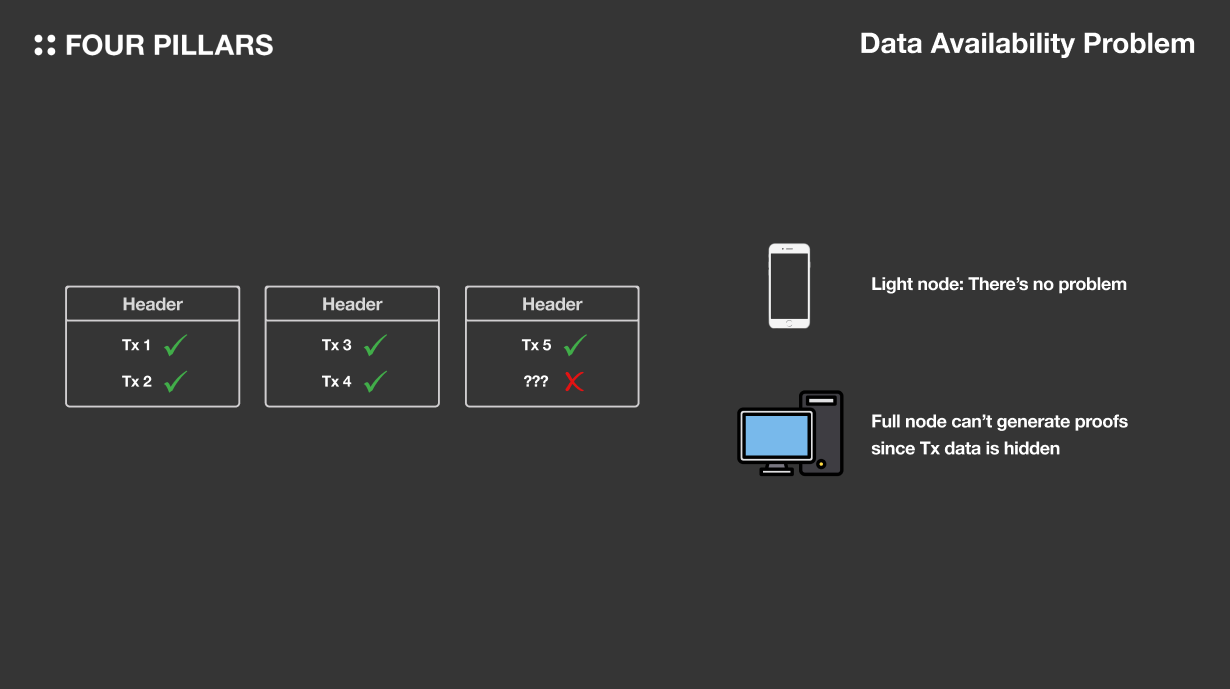

The term blobspace has become shorthand for data availability bandwidth – and in 2025, demand is surging. Celestia’s unique approach to data availability (DA), where transaction data is posted as ‘blobs’ on-chain, decouples execution from consensus. This design unlocks massive throughput for rollups, allowing each application or ecosystem to function independently yet securely atop shared DA infrastructure.

The statistics are staggering: by Q2 2025, Celestia’s network processes over 4 million blobs monthly, driven by a proliferation of app-specific rollups and cross-chain integrations. The modular stack now resembles a bustling marketplace for blockspace, with developers able to deploy custom rollups without the overhead of building or maintaining their own validator sets. For many, this positions Celestia as the “AWS of blockspace” – making scalable blockchain infrastructure accessible and economically predictable.

Multi-Rollup Deployments: Unlocking Scalability Without Congestion

The real magic behind the blobspace surge lies in multi-rollup deployments. Unlike monolithic chains where all applications compete for finite blockspace (and often suffer from congestion spillover), Celestia-powered rollups operate as isolated execution environments. This means that an NFT minting craze on one rollup doesn’t spike fees or slow down DeFi protocols elsewhere.

This architecture is already bearing fruit across the ecosystem:

- Dymension’s RollApps: Purpose-built rollups leveraging Celestia DA have achieved aggregate throughputs around 30,000 TPS, while maintaining composability and security.

- Ecosystem Growth: Over 50 and independent rollups are live by mid-2025 with total value locked (TVL) exceeding $500 million – evidence that modularity breeds both scale and diversity.

- Blobstream Integration: With Blobstream enabling direct posting to Ethereum via Celestia DA, cross-chain liquidity flows more freely than ever before.

This multi-rollup pattern isn’t just about performance; it’s about sovereignty and specialization. Developers can fine-tune execution layers for gaming, DeFi, identity or privacy use-cases while relying on Celestia’s battle-tested DA guarantees under the hood. For step-by-step insights into deploying your own custom rollup on Celestia, see this detailed guide at Rollup Frameworks.

Ecosystem Interoperability and Blobspace Economics

The modular revolution isn’t just about scaling up – it’s about connecting previously siloed ecosystems. With innovations like Lazybridging, asset transfers between rollups are seamless and efficient, sidestepping much of the overhead typical in traditional smart contract bridges. This composable interoperability is crucial for liquidity migration and user experience across DeFi primitives and beyond.

Equally important are blobspace economics: predictable pricing models for DA mean that projects can budget for growth without fear of sudden fee spikes or resource contention. As restaking protocols emerge atop Celestia’s DA layer, new yield opportunities arise for TIA holders willing to secure blobspace – creating feedback loops that reinforce both network security and developer adoption.

Celestia (TIA) Price Prediction 2026–2031

TIA price scenarios post-blobspace upgrades and multi-rollup ecosystem growth

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.54 | $0.75 | $1.10 | +21% | Consolidation after huge 2025 growth; adoption steady, but market volatility remains high. |

| 2027 | $0.68 | $1.05 | $1.65 | +40% | Bullish cycle as modular blockchain adoption accelerates; more rollups and cross-chain DeFi. |

| 2028 | $0.92 | $1.40 | $2.10 | +33% | Major apps launch on Celestia; TVL surpasses $1B; regulatory clarity boosts investor confidence. |

| 2029 | $1.15 | $1.85 | $2.80 | +32% | Competing DA solutions emerge, but Celestia remains a leader; further block size upgrades possible. |

| 2030 | $1.40 | $2.25 | $3.60 | +22% | Mainstream enterprise adoption; ecosystem matures; upside from new interoperability protocols. |

| 2031 | $1.28 | $2.10 | $4.00 | -7% | Market correction after strong growth; increased competition tempers price, but fundamentals strong. |

Price Prediction Summary

Celestia (TIA) is poised for significant growth in the coming years, driven by its first-mover advantage in modular blockchain data availability and the rapid expansion of multi-rollup deployments. While the price outlook is bullish, especially as ecosystem adoption and technological upgrades continue, volatility and competition will create both opportunities and risks for investors. The price could see a steady rise through 2030, with a possible correction or consolidation in 2031 as the market matures.

Key Factors Affecting Celestia Price

- Adoption of Celestia as the default data availability layer for new rollups and application-specific blockchains.

- Successful implementation and scaling of blobspace upgrades (e.g., block size and throughput increases).

- Growth in Total Value Locked (TVL) and developer activity within the Celestia ecosystem.

- Regulatory developments affecting blockchain interoperability, data privacy, and token economics.

- Emergence of competing modular DA solutions and their impact on Celestia’s market share.

- Broader crypto market cycles influencing risk appetite and capital flows.

- Continued innovation in cross-chain interoperability (e.g., Lazybridging) and rollup-centric DeFi.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These dynamics are catalyzing a Cambrian explosion of modular protocols, as DA restaking and blobspace leasing become core primitives for both users and investors. The ability to restake TIA and participate in securing blobspace is drawing sophisticated capital into the ecosystem, while also incentivizing a new generation of protocol designers to think modular-first. This marks a profound shift: data availability is no longer a passive resource, but an active economic layer fueling decentralized application growth.

Meanwhile, Celestia’s technical roadmap continues to push boundaries. The Lemongrass and Ginger upgrades, delivering 6-second block times, have doubled throughput, laying the groundwork for the network’s ambitious plan to support 1GB blocks. Such scale will be vital as more rollups onboard mission-critical applications and mainstream user bases. For developers aiming to experiment with app-specific chains or hybrid rollup architectures, resources like this practical insights guide are invaluable.

Restaking, Security, and the Path Forward

The emergence of blobspace restaking on Celestia is transforming how security is provisioned at scale. Instead of siloed validator sets per chain, restakers can now collectively secure multiple rollups by delegating TIA, earning rewards proportional to their contribution to network resilience. This model not only democratizes participation but also aligns incentives across DA providers, rollup operators, and end users.

Security as-a-service, enabled by modular DA layers like Celestia, means that even niche or experimental rollups can access robust guarantees without deep pockets or bespoke infrastructure. As these patterns mature, expect to see a proliferation of specialized DA solutions, blending Celestia with emerging players like Espresso or EigenDA, to further optimize for performance and cost.

Why Modular Matters: Lessons for Investors and Builders

The numbers speak volumes: with TIA trading at $0.6204, over $500 million in TVL locked across more than 50 independent rollups, and monthly blob throughput exceeding 4 million units, Celestia has proven that modular architecture isn’t just theory, it’s production-grade infrastructure. For investors eyeing yield opportunities in DA layers or developers seeking composable scaling solutions, the message is clear: the future belongs to those who embrace modularity.

If you’re ready to dive deeper into deploying your own custom chain or want a hands-on look at how hybrid rollups are evolving on Celestia and beyond, check out this comprehensive breakdown at Rollup Frameworks.

The modular blockchain ecosystem has entered its next phase, one where blobspace is liquid and programmable, interoperability is seamless by design, and scalability no longer comes at the expense of sovereignty or specialization. As we look ahead into 2026 and beyond, one thing is certain: the real surge has only just begun.