Celestia’s modular approach to blockchain data availability has fundamentally changed how developers, investors, and validators engage with on-chain infrastructure. In 2025, as Celestia (TIA) trades at $0.6631, the focus for yield-seekers is clear: maximize returns through advanced blobspace restaking strategies that leverage protocol innovation and cross-layer integrations. With network upgrades, tokenomics changes, and new staking products reshaping the landscape, a nuanced approach is essential for anyone aiming to optimize yield in the DA (Data Availability) layer ecosystem.

Why Blobspace Restaking Is Central to Modular Blockchain Yield

Blobspace restaking on Celestia unlocks a dual opportunity: securing the network’s critical data availability layer while compounding rewards through innovative protocols. In contrast to traditional staking, blobspace restaking enables users to earn rewards not only from base-layer validation but also from providing liquidity and security across multiple DA layers. This dynamic is especially relevant as Celestia continues its phased airdrop programs and implements economic reforms such as a proposed 33% reduction in TIA inflation, moves designed to boost sustainability without sacrificing validator incentives.

To navigate these evolving conditions, three advanced strategies have emerged as front-runners for maximizing yield:

Top 3 Advanced Celestia Blobspace Restaking Strategies (2025)

-

Leverage Liquid Restaking Protocols (e.g., stTIA) for Dual Yield: Platforms like MilkyWay and Super enable you to restake TIA and receive liquid tokens such as stTIA. This allows you to earn base staking rewards while simultaneously deploying stTIA in DeFi protocols for additional yield, maximizing capital efficiency across Celestia and partner ecosystems.

-

Diversify Blobspace Delegations Across High-Performance Validators: Enhance your yield and network security by delegating TIA to multiple top-performing validators with proven uptime and reliability. Use platforms like RestakingLayer or Kiln.fi to research validator performance and distribute your stake, reducing risk and optimizing rewards, especially as Celestia’s validator landscape evolves in 2025.

-

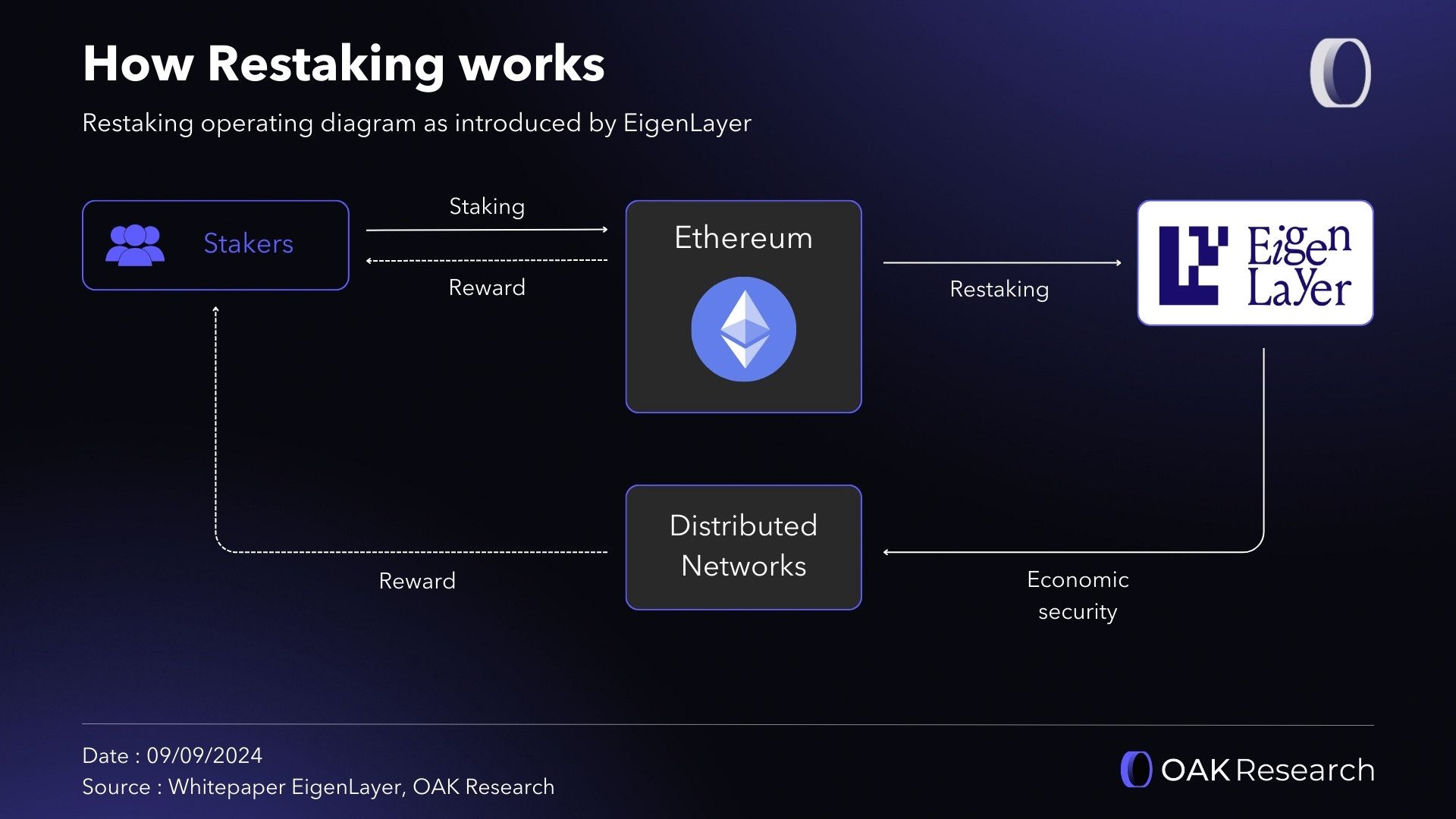

Participate in Cross-DA Layer Restaking Opportunities (Celestia-EigenLayer Integrations): Advanced users can maximize yield by engaging in restaking initiatives that bridge Celestia with other data availability (DA) layers like EigenLayer. These integrations enable you to restake assets across multiple modular DA solutions, tapping into new incentive programs and expanding your yield potential as cross-chain interoperability matures.

Strategy 1: Leverage Liquid Restaking Protocols (e. g. , stTIA) for Dual Yield

One of the most effective approaches in 2025 is utilizing liquid restaking protocols such as stTIA. These platforms allow users to stake their TIA tokens and receive a liquid derivative (like stTIA) in return. This derivative can then be deployed across DeFi ecosystems or additional DA layers for extra yield generation, essentially allowing you to earn twice on the same capital base.

The advantage here is twofold: you maintain exposure to TIA staking rewards while unlocking liquidity that can be used in lending pools or as collateral elsewhere. With APRs on select platforms reaching up to 22%, this dual-yield mechanism has become a cornerstone of sophisticated blobspace yield strategies in 2025.

Strategy 2: Diversify Blobspace Delegations Across High-Performance Validators

The performance of your chosen validators directly impacts your staking returns and risk profile. In Celestia’s ecosystem, it’s critical to diversify delegations across validators with proven uptime, low slashing history, and robust infrastructure. This mitigates downtime risk and maximizes participation in block proposals, especially important given Celestia’s focus on predictable blob economics.

Validator performance analytics are more accessible than ever thanks to enterprise-grade dashboards and community-run leaderboards. By actively monitoring these metrics, and shifting delegations when necessary, you position your portfolio for consistent returns even amid market volatility or network upgrades.

Celestia Technical Analysis Chart

Analysis by Market Analyst | Symbol: BINANCE:TIAUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

Start by marking the dominant downtrend with a clear trend line from the June 2025 high (around $3.20) down to the current price region. Highlight the most recent breakdown below the $0.75 support, illustrating how price failed to hold above this level and is now testing new lows. Add a horizontal support line at the current price ($0.639) as this is a fresh low for the move. Place a resistance line around $0.75, the last failed support, and another at $1.00, a psychological level and former consolidation area. Draw a rectangle to highlight the recent tight consolidation between $0.75 and $0.90 during October–early November 2025, then an arrow marker downward to show the breakdown. Mark potential entry for aggressive contrarians near $0.64 with a high-risk label, and exits at $0.75 (first) and $0.90 (secondary) for mean-reversion trades. For momentum shorts, mark short entry below $0.63 with stop loss above $0.75 and profit target at $0.50. Use callouts to note the importance of monitoring volume and MACD for any bullish divergence signals.

Risk Assessment:high

Analysis: Persistent downtrend, fresh breakdowns, and lack of reversal confirmation increase downside risk. Only consider long entries with tight stops and reduced size. Shorts favored until reversal patterns emerge.

Market Analyst’s Recommendation: Avoid aggressive long positions. Consider shorting below key support with defined stops and targets. If attempting mean-reversion, keep risk tight and position small. Closely monitor for volume/MACD reversal signals.

Key Support & Resistance Levels

📈 Support Levels:

- $0639 – Fresh low and current price level—immediate support, but weak due to no prior historic confirmation.weak

- $05 – Psychological round number and next likely support if breakdown continues.moderate

📉 Resistance Levels:

- $075 – Recent breakdown level, now acting as immediate resistance.moderate

- $1 – Round-number resistance and former consolidation area.strong

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

- The Current Market Context for Maximizing Yield

- Celestia (TIA) led the sector with a 109.5% price increase, far surpassing both DA competitors and major L1 assets.

- EigenLayer (EIGEN) and Avail (AVAIL), key DA and restaking tokens, saw only modest gains of 6.4% and 5.4%, respectively.

- Ethereum (ETH) outperformed most assets except TIA, with a 46.9% rise, while Bitcoin (BTC) lagged with just 4.3% growth.

- Solana (SOL), Cosmos (ATOM), and Optimism (OP) all showed limited 6-month price appreciation, ranging from 4.9% to 6.5%.

- The data highlights Celestia’s strong momentum and potential appeal for yield-maximizing strategies in the DA and restaking landscape.

- Main Asset: https://coinmarketcap.com/currencies/celestia/

- Ethereum: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- Bitcoin: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- Avail: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- EigenLayer: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- Solana: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- Cosmos: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- Optimism: https://www.gsr.io/wp-content/uploads/2025/03/Mar-18-2025.pdf

- Impact of inflation reduction and staking reward lockups on tokenomics

- Adoption of blobspace restaking and liquid staking protocols

- Competition from other data availability layers (EigenDA, Avail)

- Rate of developer and user onboarding via airdrops and ecosystem incentives

- Market cycles, regulatory changes, and macroeconomic trends

- Token unlock schedule and supply dilution risks

- Technological advancements in data availability and modular blockchains

- Regularly rebalance your delegations across top-performing validators to adapt to changing network conditions.

- Diversify your exposure by using both native staking and liquid restaking derivatives (e. g. , stTIA).

- Track protocol governance proposals that affect reward lockups or inflation rates.

- Utilize analytics dashboards for real-time monitoring of validator performance and cross-layer APRs.

- Engage early with new restaking protocols: Early adopters often benefit from bonus incentives or higher initial yields.

- Monitor Celestia’s price movements closely: With TIA currently at $0.6631, yield calculations must account for both APRs and market volatility.

- Pursue education on protocol upgrades: Network changes can profoundly impact your strategy’s effectiveness.

As of November 21,2025, Celestia (TIA) is trading at $0.6631, reflecting recent volatility due to major token unlocks and ongoing economic model adjustments. The intraday high reached $0.7503 while the low touched $0.6467, a range that underscores both opportunity and risk for active restakers.

Cryptocurrency Price Comparison: Celestia vs. Major DA & Restaking Tokens (2025)

6-Month Performance of Celestia (TIA), EigenLayer, Avail, and Leading Blockchain Assets as of November 21, 2025

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Celestia (TIA) | $0.6632 | $0.3166 | +109.5% |

| Ethereum (ETH) | $2,770.07 | $1,885.00 | +46.9% |

| Bitcoin (BTC) | $85,268.00 | $81,742.00 | +4.3% |

| Avail (AVAIL) | $0.008220 | $0.007800 | +5.4% |

| EigenLayer (EIGEN) | $0.5855 | $0.5500 | +6.4% |

| Solana (SOL) | $129.09 | $123.00 | +4.9% |

| Cosmos (ATOM) | $2.53 | $2.40 | +5.4% |

| Optimism (OP) | $0.3090 | $0.2900 | +6.5% |

Analysis Summary

Celestia (TIA) significantly outperformed all comparison assets over the past six months, with a 109.5% price increase. In contrast, EigenLayer (EIGEN), Avail (AVAIL), and other major tokens such as Solana (SOL) and Cosmos (ATOM) saw modest single-digit growth. Ethereum (ETH) posted strong gains, while Bitcoin (BTC) experienced minimal growth.

Key Insights

All prices and percentage changes are sourced directly from the provided real-time market data as of November 21, 2025. The table compares current prices to those from six months ago, calculating the exact 6-month price change for each asset.

Data Sources:

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Celestia (TIA) Price Prediction 2026-2031

Professional Analyst Outlook Post-Inflation Reduction and Blobspace Restaking Adoption

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.42 | $0.78 | $1.12 | +17% | Continued inflation reduction and staking adoption, but risk of further unlock-driven volatility |

| 2027 | $0.55 | $1.05 | $1.56 | +35% | Blobspace restaking matures, modular blockchain adoption rises; competition with EigenDA and Avail intensifies |

| 2028 | $0.80 | $1.48 | $2.25 | +41% | Increased developer engagement, DA solutions gain traction, possible regulatory clarity supports growth |

| 2029 | $1.10 | $2.05 | $3.10 | +38% | Network upgrades and scaling solutions drive utility; macro crypto cycle turns bullish |

| 2030 | $1.40 | $2.62 | $4.10 | +28% | Wider rollup deployments, Celestia solidifies as DA leader, but potential for new disruptive entrants |

| 2031 | $1.75 | $3.10 | $5.25 | +18% | Long-term adoption, stable tokenomics, and ecosystem maturity; price stabilizes with sustainable growth |

Price Prediction Summary

Celestia (TIA) is forecasted to experience gradual price recovery and growth from 2026 onward, following inflation reduction and increased adoption of blobspace restaking. While short-term volatility may persist due to token unlocks and competitive pressures, the long-term outlook remains positive as modular blockchain and data availability solutions gain traction. By 2031, TIA could see a 4–5x increase from current levels in a bullish scenario, provided technological and ecosystem milestones are met.

Key Factors Affecting Celestia Price

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This environment amplifies the importance of staying agile, not just by tracking macro price movements but by understanding how protocol-level changes (like reward lockups or inflation tweaks) impact real yield over time.

Beyond validator selection and liquid restaking, the next leap in yield optimization comes from capitalizing on cross-DA layer restaking opportunities, particularly through integrations between Celestia and EigenLayer. These integrations allow users to restake their TIA or stTIA across multiple data availability layers, compounding security contributions and unlocking additional incentive streams.

Strategy 3: Participate in Cross-DA Layer Restaking Opportunities (Celestia-EigenLayer Integrations)

In 2025, cross-layer composability is no longer a theoretical advantage, it’s a practical route to higher returns. By leveraging protocols that enable TIA or stTIA to be restaked on EigenLayer alongside Celestia, participants can earn rewards from both ecosystems. This approach not only boosts aggregate yield but also supports the broader modular blockchain vision by enhancing interoperability and shared security.

It’s crucial, however, to monitor protocol risks such as smart contract vulnerabilities and shifting incentive models. As these integrations mature, expect more sophisticated reward structures and potentially new forms of slashing or lockup requirements. Staying engaged with protocol governance forums and monitoring technical updates can help you avoid pitfalls while capturing upside.

Risk Management and Forward-Looking Considerations

While advanced strategies like liquid restaking and cross-DA participation offer compelling upsides, they come with nuanced risks. For example, large token unlocks, like the recent release of over 174 million TIA, can dilute yields if not properly anticipated. Economic reforms such as the proposed 33% inflation reduction may tighten base yields but could also stabilize long-term value for committed stakers.

Risk management tips:

Your Next Steps for Maximizing Blobspace Yield

The modular blockchain landscape in 2025 is defined by rapid innovation and evolving incentive structures. To stay ahead:

For a deeper dive into advanced blobspace restaking techniques, especially those involving EigenLayer, see our comprehensive guide here.

Which Celestia blobspace restaking strategy do you prefer for maximizing yield in 2025?

With Celestia (TIA) currently trading at $0.6631, restakers have several advanced strategies to boost their yield. Which approach are you most interested in or already using?

The future of maximizing yield in Celestia’s DA ecosystem will belong to those who combine technical diligence with strategic agility. By leveraging liquid restaking protocols like stTIA, diversifying validator delegations, and embracing cross-layer innovations with EigenLayer, you can position your portfolio for sustainable growth, even as the modular blockchain sector redefines what’s possible in decentralized infrastructure.