In 2025, Celestia’s modular blockchain architecture has firmly established itself as a backbone for scalable decentralized applications, with its Data Availability (DA) layers driving both performance and yield. As the market for DA solutions matures, restaking on Celestia’s DA layers stands out as a sophisticated strategy for maximizing returns while actively contributing to network security and innovation. With Celestia (TIA) currently priced at $0.8781, understanding how to optimize your restaking approach is more relevant than ever.

Celestia Restaking Strategies 2025: Navigating the New Yield Frontier

The evolving landscape of modular blockchains has given rise to creative restaking strategies tailored for DA layers. To stay ahead, it’s essential to focus on a curated set of approaches that blend risk mitigation, yield optimization, and active participation in Celestia’s expanding ecosystem. Below we break down the top five strategies dominating discussions among professional validators and institutional DeFi players:

Top 5 Celestia DA Restaking Strategies for 2025

-

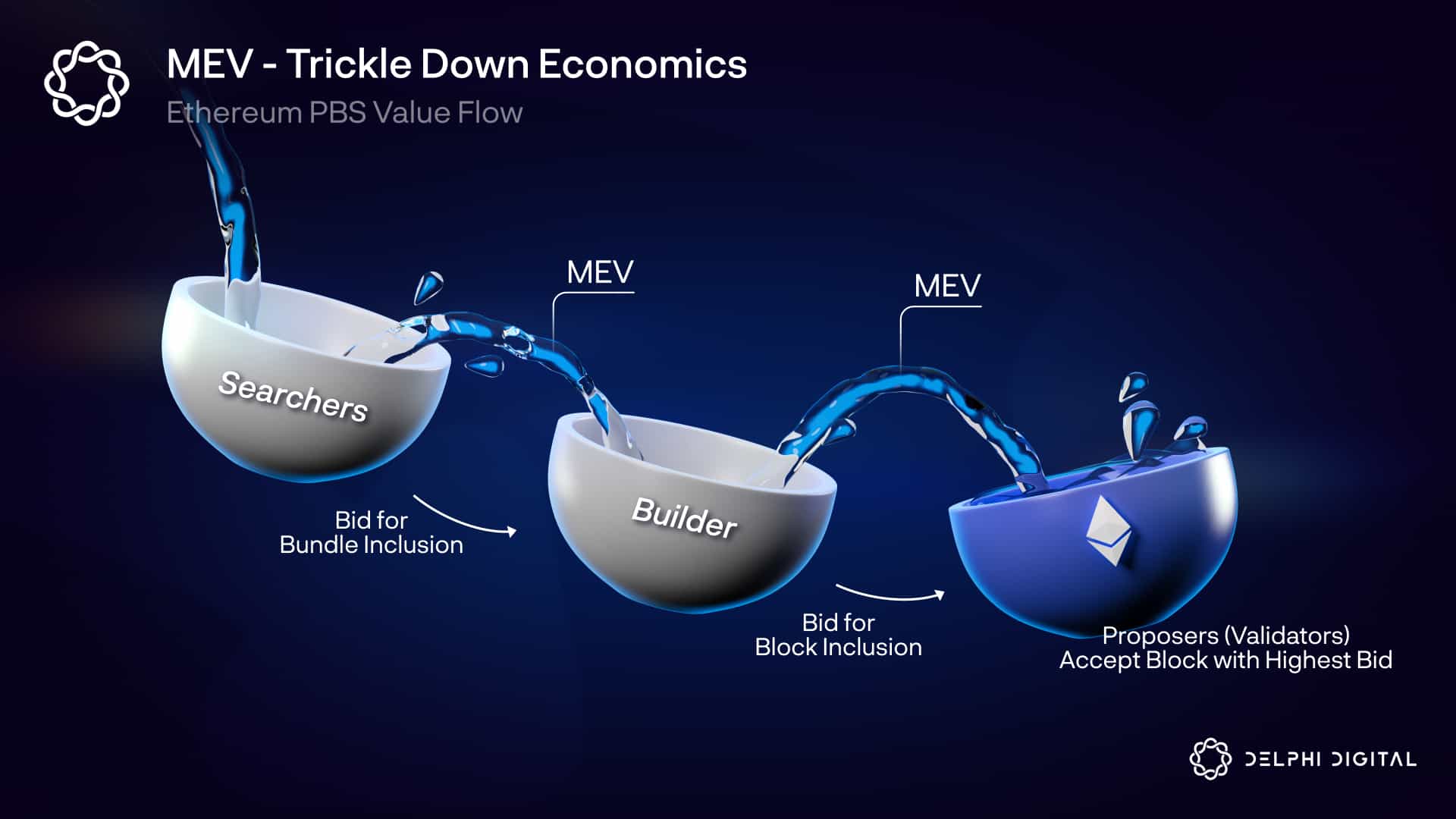

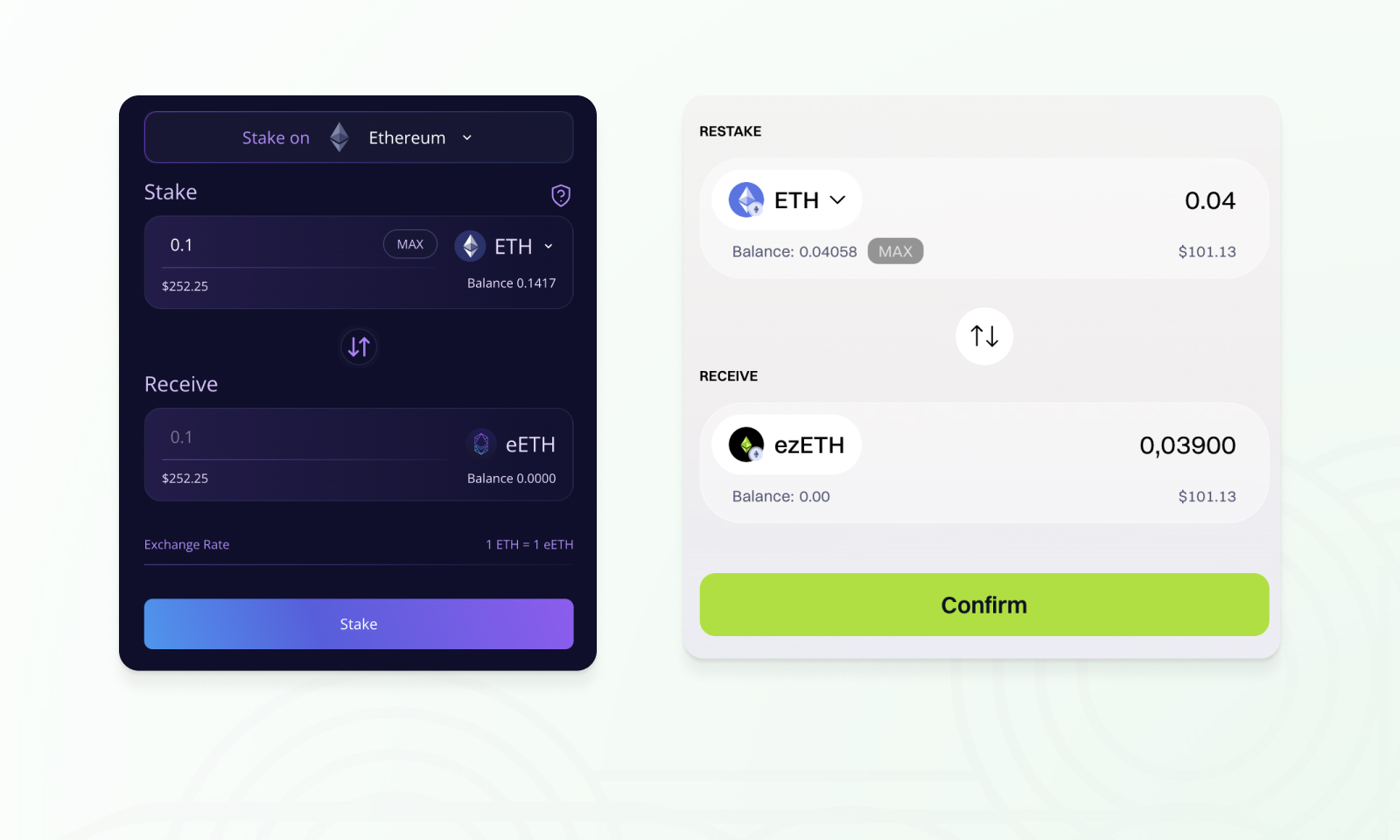

Leverage Liquid Restaking Protocols to Compound Celestia DA YieldsUtilize established liquid restaking protocols such as ether.fi and Symbiotic to restake your Celestia (TIA) tokens. These platforms allow you to earn additional yield by providing liquid restaking tokens (LRTs), which can be further deployed in DeFi for compounding rewards, all while maintaining access to your underlying assets.

-

Optimize Blobspace Allocation by Participating in High-Demand Rollup AuctionsMaximize your yield by actively engaging in Celestia’s rollup auctions, where projects compete for blobspace. By allocating your stake to high-demand rollups, you can capture premium rewards as demand for data availability surges, especially following network upgrades like the Matcha Upgrade.

-

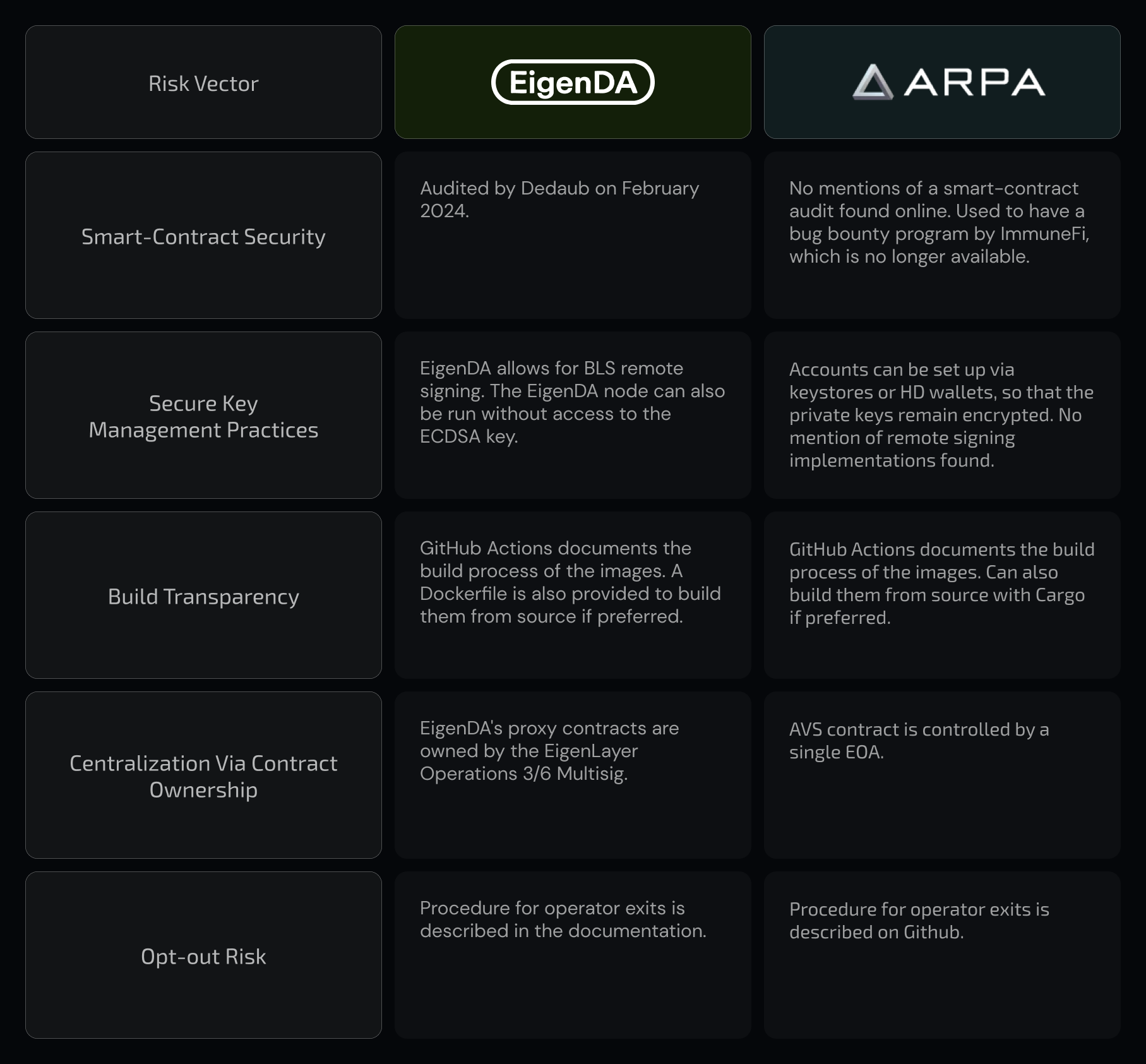

Diversify Restaking Across Multiple DA Layers (e.g., EigenDA, Avail) for Risk Mitigation and Bonus IncentivesSpread your restaked TIA across top data availability layers such as EigenDA and Avail in addition to Celestia. This diversification reduces exposure to single-network risks and can unlock bonus incentives or cross-chain rewards offered by multichain restaking protocols like Karak.

-

Utilize Automated Restaking Platforms for Dynamic Yield Optimization and Fee MinimizationAdopt automated restaking tools and platforms—such as Karak and Symbiotic—that monitor yields and rebalance your portfolio in real time. These platforms help minimize transaction fees and maximize returns by dynamically reallocating your staked assets based on market conditions.

-

Engage in Early Governance and Validator Programs to Capture Enhanced Rewards and AirdropsParticipate early in Celestia’s governance and validator initiatives. Early adopters often benefit from enhanced staking rewards, exclusive airdrops, and voting incentives, especially during major roadmap milestones or protocol upgrades.

1. Leverage Liquid Restaking Protocols to Compound Celestia DA Yields

Liquid restaking protocols have become foundational in 2025 for those seeking capital efficiency without sacrificing flexibility. By utilizing liquid restaking tokens (LRTs), such as those offered by leading DeFi protocols, you can stake your TIA tokens on Celestia’s DA layer while retaining the ability to deploy these LRTs across other DeFi platforms for additional yield opportunities. This approach transforms static staking rewards into layered, compounding returns – a must-have tactic in any advanced modular blockchain yield portfolio.

2. Optimize Blobspace Allocation by Participating in High-Demand Rollup Auctions

Blobspace is the lifeblood of rollup scalability on Celestia. In 2025, rollup auctions have intensified as new projects compete for precious blobspace allocations during periods of peak demand. By strategically participating in these auctions – either directly or via managed pools – you can capture premium rewards when demand spikes. Savvy participants monitor network activity and upcoming protocol launches to time their bids and maximize their share of high-yield blobspace rewards.

Celestia Technical Analysis Chart

Analysis by Lila Morton | Symbol: BINANCE:TIAUSDT | Interval: 1D | Drawings: 5

Technical Analysis Summary

Draw a primary downtrend line from the May 2025 high near $3.20 through each successive lower high, extending to the current price around $0.87. Add horizontal support at $0.80 and resistance at $1.00 and $1.20. Mark the recent local lows and highs with horizontal lines to highlight the consolidation range between $0.80 and $1.00 post-October. Use a rectangle tool for the $0.80-$1.00 zone. Volume and MACD are not visible, but annotate likely low momentum and possible oversold conditions based on persistent downtrend. Highlight the sharp drop in early October as a breakdown event. Add text/callout notes for risk assessment and strategic comments.

Risk Assessment:medium

Analysis: The market shows persistent bearishness but is now approaching a strong historical support zone.

My hybrid approach suggests waiting for evidence of a reversal or credible base, as catching falling knives is rarely rewarding.

Opportunity exists for partial, tactical accumulation if risk is tightly managed.

Lila Morton’s Recommendation: Monitor for stabilization above $0.�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8�8$ and signs of reversal.�9Accumulate slowly on confirmed strength, not on breakdowns.�9Use stops and be ready to exit if $.�9$ fails.

�9

\ Key Support & Resistance Levels

📈 Support Levels:

-

$08 – Key horizontal support tested multiple times since October ; psychological round number.

strong

📉 Resistance Levels:

-

$10 – Recent ceiling for any attempted bounces, now acting as near-term resistance.

moderate -

$12 – Previous support, now flipped to resistance post-October breakdown.

moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

- $08 – Potential for accumulation at strong support if price stabilizes and forms a base Only for partial position size due to ongoing downtrend.medium risk

🚪 Exit Zones:

- $10– First logical profit target on mean-reversion or relief rally.💰 profit target

- $075– Protective stop-loss if support at $08 decisively breaks.🛡️ stop loss

Technical Indicators Analysis