In 2025, blobspace restaking is reshaping the modular blockchain landscape, acting as a catalyst for both scalability and security in data availability (DA) layers. As the modular thesis matures, protocols like Celestia and EigenLayer are proving that separating execution from consensus and DA is not just theory but a practical path to high-throughput, low-cost decentralized applications. The synergy between blobspace and restaking unlocks a new paradigm for decentralized application yield, capital efficiency, and shared security.

Blobspace: The Backbone of Modular Data Availability

Blobspace refers to specialized storage zones within blockchains designed for large data blobs, chunks of transaction or state data critical for rollups and L2s. Instead of forcing every node to process all execution logic, modular chains like Celestia provide a scalable DA layer where rollups can post their data cost-effectively. This architecture is central to the efficiency of modern DeFi ecosystems.

By decoupling consensus from execution and DA, Celestia enables rollups to scale independently while relying on its robust blobspace for secure data publication. This approach dramatically reduces transaction costs compared to monolithic chains. For a deep dive into optimizing yield through blobspace restaking in modular environments, see this resource.

The Mechanics of Restaking: Compounding Security Across Layers

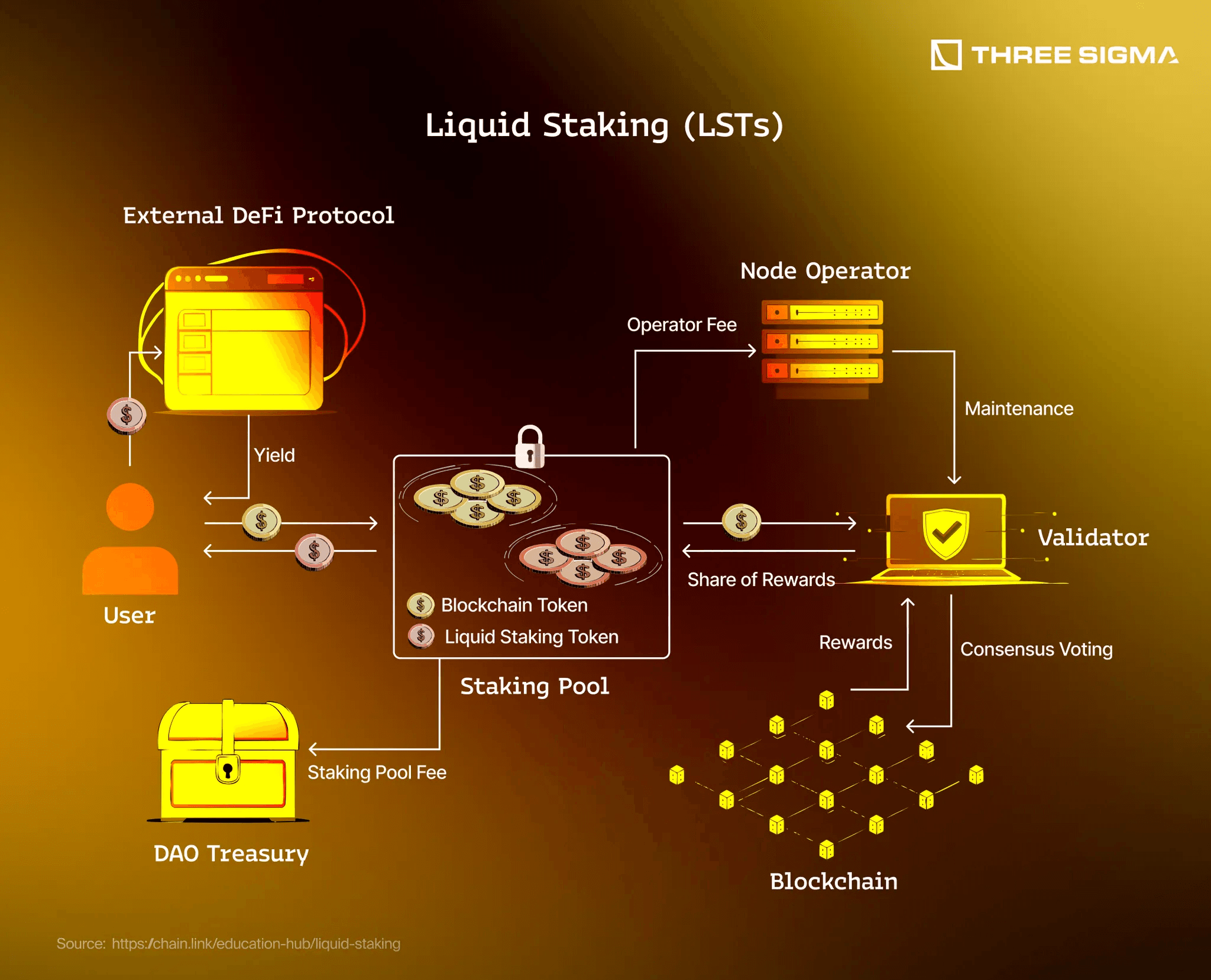

Restaking is more than just a yield strategy; it’s an innovation that lets validators extend their staked assets beyond their primary protocol. With EigenLayer’s restaking mechanism, Ethereum validators can secure additional Actively Validated Services (AVSs), including DA layers like Celestia or Avail, without unstaking their ETH.

This model compounds security by pooling economic guarantees across multiple services. The result is twofold: enhanced trustworthiness for emerging AVSs and improved capital efficiency for validators who can now earn layered yields without fragmenting their collateral base.

The Blobspace-Restaking Flywheel: Security Meets Scalability

The integration of blobspace with restaking forms a powerful flywheel:

- Security Amplification: Restaked assets back multiple services simultaneously, distributing risk and increasing the cost-to-attack across protocols.

- Scalability Unlocked: Rollups leverage blobspace to publish massive volumes of transaction data without bottlenecking the main chain.

- Cost Optimization: Posting data on dedicated DA layers like Celestia slashes fees for rollup operators and end-users alike.

This synergy has led to heightened demand for tokens tied to DA layers and restaking protocols, an emerging trend attracting both retail participants seeking yield optimization and institutions prioritizing reliability at scale.

The Modular Stack in Practice: Celestia and EigenLayer Lead the Charge

Celestia’s modular approach, paired with EigenLayer’s shared security model, exemplifies how these innovations converge in real-world deployments. As more applications migrate from monolithic chains to modular stacks, developers are able to choose best-in-class components for each layer, consensus, execution, settlement, and now data availability secured by blobspace restakers.

The result? A composable ecosystem where scalability does not compromise decentralization or security. For those looking deeper into how these economics are evolving through auctions and validator incentives, see this analysis.

Amid this transformation, the interplay between blobspace restaking and modular DA layers is not only a technical breakthrough but also a market catalyst. The emergence of liquid restaking derivatives and AVS-specific incentive programs have created a secondary market for staked assets, further amplifying capital efficiency and liquidity. Validators are now able to diversify their exposure across multiple DA layers and rollups, compounding returns while contributing to the security of the broader ecosystem.

Top Strategies for Maximizing Yield with Blobspace Restaking in 2025

-

Diversify Restaked Assets Across Multiple AVSs on EigenLayer: By allocating staked ETH across several Actively Validated Services (AVSs) on EigenLayer, validators can compound rewards from various protocols, enhancing overall yield while spreading risk.

-

Leverage Celestia’s Modular Data Availability for Rollup Integration: Utilize Celestia’s blobspace to provide scalable, cost-efficient data availability for rollups. This strategy allows validators to earn additional fees from rollup operators seeking reliable DA solutions.

-

Participate in Liquid Restaking Protocols for Enhanced Flexibility: Engage with liquid restaking solutions (such as those integrated with EigenLayer) to unlock liquidity from staked assets, enabling participation in DeFi opportunities without sacrificing security or yield.

-

Optimize Staking Across Multiple Modular DA Layers: Allocate resources not only to Celestia but also to other leading modular DA layers like Avail to capture emerging incentives and diversify exposure to the evolving modular ecosystem.

-

Monitor and Adapt to Dynamic Restaking Incentives: Stay informed about evolving incentive structures and governance proposals on platforms like EigenLayer and Celestia. Proactively adjusting staking allocations in response to changing rewards can maximize yield and minimize opportunity costs.

This evolution is driving new standards for decentralized application yield. Rather than chasing unsustainable inflationary rewards, sophisticated participants are optimizing for real yield, generated by securing mission-critical data infrastructure. As more modular blockchains onboard high-value applications, the demand for reliable DA grows, reinforcing the positive feedback loop underpinning token valuations in this sector.

Risks and Considerations: Navigating Fragmentation and Security Tradeoffs

While blobspace restaking offers compelling advantages, it introduces new complexities that must be managed with discipline. The proliferation of AVSs and DA layers can lead to fragmentation if interoperability standards lag behind innovation. Additionally, over-concentration of restaked assets on a handful of services could create systemic risks reminiscent of early DeFi composability challenges.

To mitigate these risks, leading protocols are investing in robust slashing conditions, transparent governance frameworks, and cross-chain monitoring tools. For investors and validators alike, due diligence on AVS reliability and economic sustainability is paramount, patience pays when selecting long-term partners in a rapidly evolving modular landscape.

Looking Forward: The Modular Blockchain Stack in 2026 and Beyond

The momentum behind blobspace restaking shows no sign of slowing as we approach 2026. With Celestia continuing to refine its DA throughput and EigenLayer expanding support for heterogeneous AVSs, the foundation is set for even greater scalability leaps. Interoperability protocols are emerging to unify fragmented DA landscapes, while new auction mechanisms promise more efficient allocation of blobspace resources across competing rollups.

Ultimately, blobspace restaking is cementing its role as the linchpin of high-performance modular blockchain infrastructure. By enabling validators to extract layered yield while securing critical data rails for decentralized applications, this paradigm delivers on both scalability and security, without compromise.

The next wave of blockchain adoption will be defined by how effectively protocols harness these innovations to serve real-world use cases, from DeFi settlement to NFT marketplaces and beyond. As always in markets both old and new: those who invest with discipline, diversify intelligently, and prioritize sustainable returns will be best positioned to thrive as modular stacks reshape the digital asset landscape.