The landscape of data availability (DA) layers is rapidly evolving, and as we approach 2025, the competition between Celestia and EigenLayer’s EigenDA has become a focal point for blockchain developers, investors, and modular ecosystem builders. Both platforms are designed to address the core challenge of scalable, secure DA for rollups and Layer 2s, but their underlying philosophies and technical architectures diverge in ways that have major implications for restaking strategies and blockchain interoperability.

Architectural Divergence: Modular Independence vs Ethereum Integration

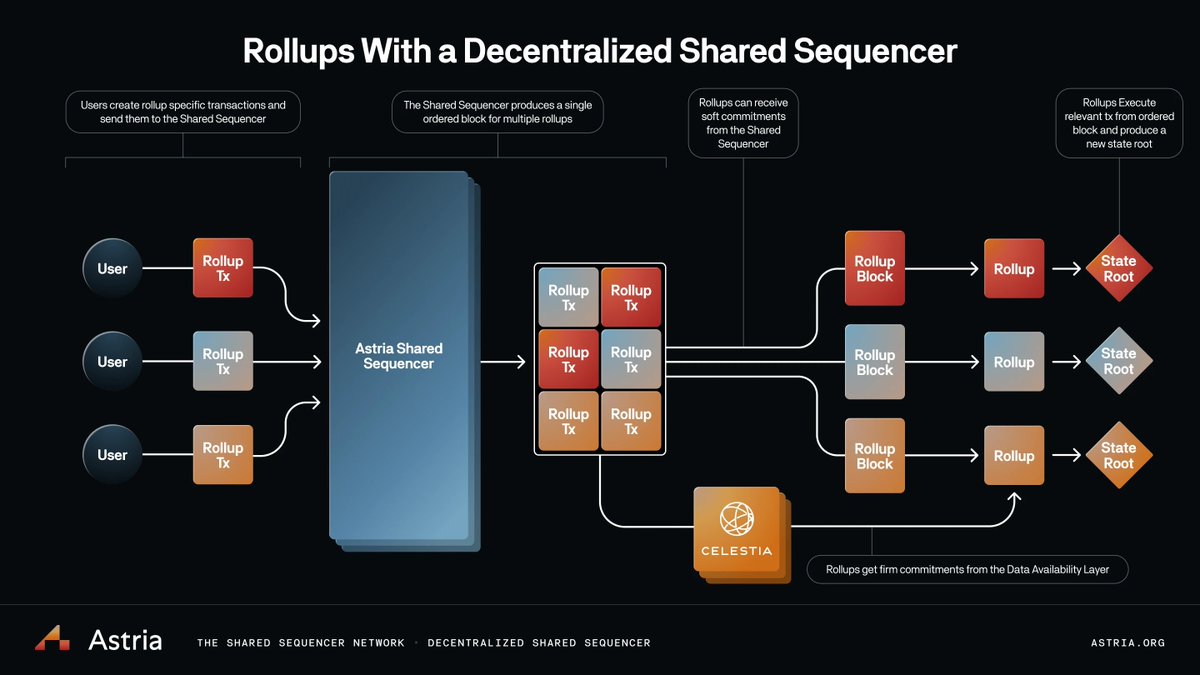

Celestia operates as a fully standalone modular blockchain, purpose-built to provide DA and consensus without being tethered to any single execution environment. It leverages Data Availability Sampling (DAS) and Namespaced Merkle Trees (NMT), enabling even light nodes to efficiently verify data availability across massive block sizes. This approach allows Celestia to serve both EVM-compatible chains and non-EVM ecosystems equally, making it a truly blockchain-agnostic DA solution.

EigenDA, by contrast, is an Active Validation Service (AVS) layered atop Ethereum’s EigenLayer protocol. Rather than operating independently, EigenDA is deeply intertwined with the Ethereum security model. It utilizes KZG commitments for data verification and is optimized for EVM-based rollups that want seamless integration with Ethereum’s consensus layer. This design choice gives EigenDA access to Ethereum’s vast validator base through restaking, a powerful network effect but also a limiting factor for projects outside the EVM orbit.

The architectural choice between Celestia’s independence and EigenDA’s Ethereum dependency shapes everything from developer flexibility to potential network effects in DA layer restaking.

Consensus Mechanisms and Security Models: Staking TIA vs Restaking ETH

The security models of Celestia and EigenLayer reflect their architectural philosophies:

- Celestia: Employs its own Proof-of-Stake consensus mechanism, with validators staking the native TIA token ($0.9828 as of now). This independent security framework distributes trust across a diverse validator set. The use of DAS allows light nodes to directly participate in data verification, democratizing security beyond just full node operators.

- EigenDA: Inherits its security from Ethereum by allowing ETH holders ($3,546.75 current price) to restake their assets via EigenLayer. This restaking model means validators can simultaneously secure multiple services, including DA, creating an incentive-aligned mesh within the Ethereum modular stack. Slashing conditions apply if validators misbehave or fail service-level guarantees.

This distinction is not just academic: it impacts risk profiles, slashing conditions, yield stacking opportunities, and how quickly each system can adapt governance or parameter changes independent of other chains.

Finality Times and Performance Benchmarks: Speed vs Ecosystem Gravity

An often-overlooked but critical factor is finality, the time it takes for submitted data blocks to be considered irreversible:

- Celestia: Utilizes Tendermint consensus with block finality every ~15 seconds. This rapid finality benefits real-time applications such as DeFi or gaming dApps that demand fast user feedback loops.

- EigenDA: Relies on Ethereum’s canonical finality times (~12-15 minutes), which can be a bottleneck for latency-sensitive applications but offers deep integration with existing EVM infrastructure.

The tradeoff here is clear: Celestia offers speed and cross-ecosystem compatibility; EigenDA provides the gravitational pull of Ethereum’s mature validator set and liquidity depth, but at the cost of slower confirmation times.

Celestia (TIA) Price Prediction 2026-2031

Professional Analyst Outlook Based on Celestia vs EigenLayer Comparison and 2025 Market Context

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg, YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.85 | $1.25 | $2.10 | +27% | Recovery from 2025 lows as DA adoption grows; volatility remains from competition |

| 2027 | $1.00 | $1.75 | $3.20 | +40% | Modular blockchain narrative strengthens; increased rollup deployments |

| 2028 | $1.30 | $2.50 | $4.50 | +43% | Sustained growth from multi-chain integrations; regulatory clarity improves |

| 2029 | $1.80 | $3.20 | $5.80 | +28% | Celestia matures as a leading DA layer; competitive pressure from EigenDA and new entrants |

| 2030 | $2.10 | $4.10 | $7.00 | +28% | Mainstream adoption of modular DA; institutional interest rises |

| 2031 | $2.50 | $5.00 | $8.20 | +22% | Celestia ecosystem consolidates; bullish scenarios depend on ecosystem dominance |

Price Prediction Summary

Celestia (TIA) is projected to see steady, progressive price appreciation from 2026 through 2031, supported by increasing adoption of modular data availability layers and the growing need for scalable blockchain solutions. While competition from EigenLayer and other DA solutions will influence volatility and cap upside, Celestia’s blockchain-agnostic approach and rapid finality position it well for multi-chain expansion. The price outlook assumes continued ecosystem growth, improved regulatory clarity, and wider institutional participation.

Key Factors Affecting Celestia Price

- Adoption of modular DA solutions by new Layer 2s and rollups

- Ecosystem growth and partnerships (EVM and non-EVM chains)

- Competition from EigenLayer, Avail, 0G, and other DA providers

- Regulatory developments affecting DA layer utility tokens

- Advancements in Celestia’s technology (e.g., DAS, interoperability tools)

- Market cycles and macro crypto sentiment

- Institutional and developer interest in modular blockchain infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ecosystem Compatibility and Developer Flexibility

If your project requires broad interoperability or plans to expand beyond EVM rollups in the future, Celestia’s agnostic approach may be more attractive. Its support for both EVM-based chains (such as those built on OP Stack or Polygon CDK) and non-EVM environments like Cosmos SDK-based chains positions it as a universal DA substrate.

If you are building exclusively within the Ethereum ecosystem, leveraging its DeFi protocols, liquidity pools, or existing L2s, then EigenDA offers tight integration that may simplify development workflows while maximizing composability within the largest smart contract platform by TVL.

Ultimately, the decision between Celestia and EigenDA is a reflection of your project’s priorities: independence and rapid innovation versus the security and network effects of Ethereum. With Celestia (TIA) currently trading at $0.9828 and Ethereum (ETH) at $3,546.75, the economic calculus for restaking also diverges sharply. TIA stakers are directly exposed to Celestia’s native growth, while ETH restakers benefit from Ethereum’s established market depth but take on additional service-layer risks.

Restaking Incentives and Yield Dynamics in 2025

The evolution of restaking incentives has become central to DA layer competition. On Celestia, yield is derived from transaction fees paid in TIA for blobspace, with validator rewards tightly coupled to network usage and governance-set parameters. This direct relationship incentivizes validators to optimize for network health and DA throughput, but also exposes them to volatility as demand ebbs and flows.

EigenDA’s model is more nuanced: ETH holders can stack yields by securing multiple AVSs beyond just data availability, think oracle networks, bridges, or middleware protocols, amplifying potential returns but introducing complex slashing vectors. The modularity of EigenLayer means that DA is just one of several services vying for validator attention and capital allocation.

Security Tradeoffs and Slashing Risks

Security assumptions are not fungible across these models. Celestia’s native PoS framework means that TIA stakers are directly accountable for DA guarantees; slashing is enforced on-chain for equivocation or downtime. The risk profile here is isolated, failures in other ecosystems do not impact Celestia’s security budget.

By contrast, EigenDA inherits both the strengths and weaknesses of Ethereum’s validator set. Restaked ETH can be slashed not only for failures within EigenDA but also across any AVS using the same collateral, introducing correlated risk that must be weighed carefully by sophisticated stakers seeking yield through restaking.

Looking Forward: Composability, Interoperability, and Modular Futures

The battle between Celestia vs EigenLayer will shape how modular blockchains scale throughout 2025 and beyond. As rollups proliferate across both EVM and non-EVM domains, demand for flexible DA solutions will only intensify. Projects prioritizing speed-to-finality, cross-chain compatibility, or governance autonomy will likely gravitate toward Celestia’s independent model. Those seeking deep Ethereum integration and composable restaking opportunities may prefer EigenDA despite its longer finality times.

The optimal choice depends on:

- Your target user base (EVM-native or multi-chain)

- Your tolerance for latency versus network effects

- Your appetite for managing slashing risk across multiple AVSs

- Your long-term vision for interoperability or ecosystem lock-in

If you’re ready to dive deeper into hands-on strategies or want a step-by-step walkthrough on staking or restaking within these ecosystems, explore our dedicated guide at /restaking-on-eigenlayer-step-by-step-for-da-layer-enthusiasts.