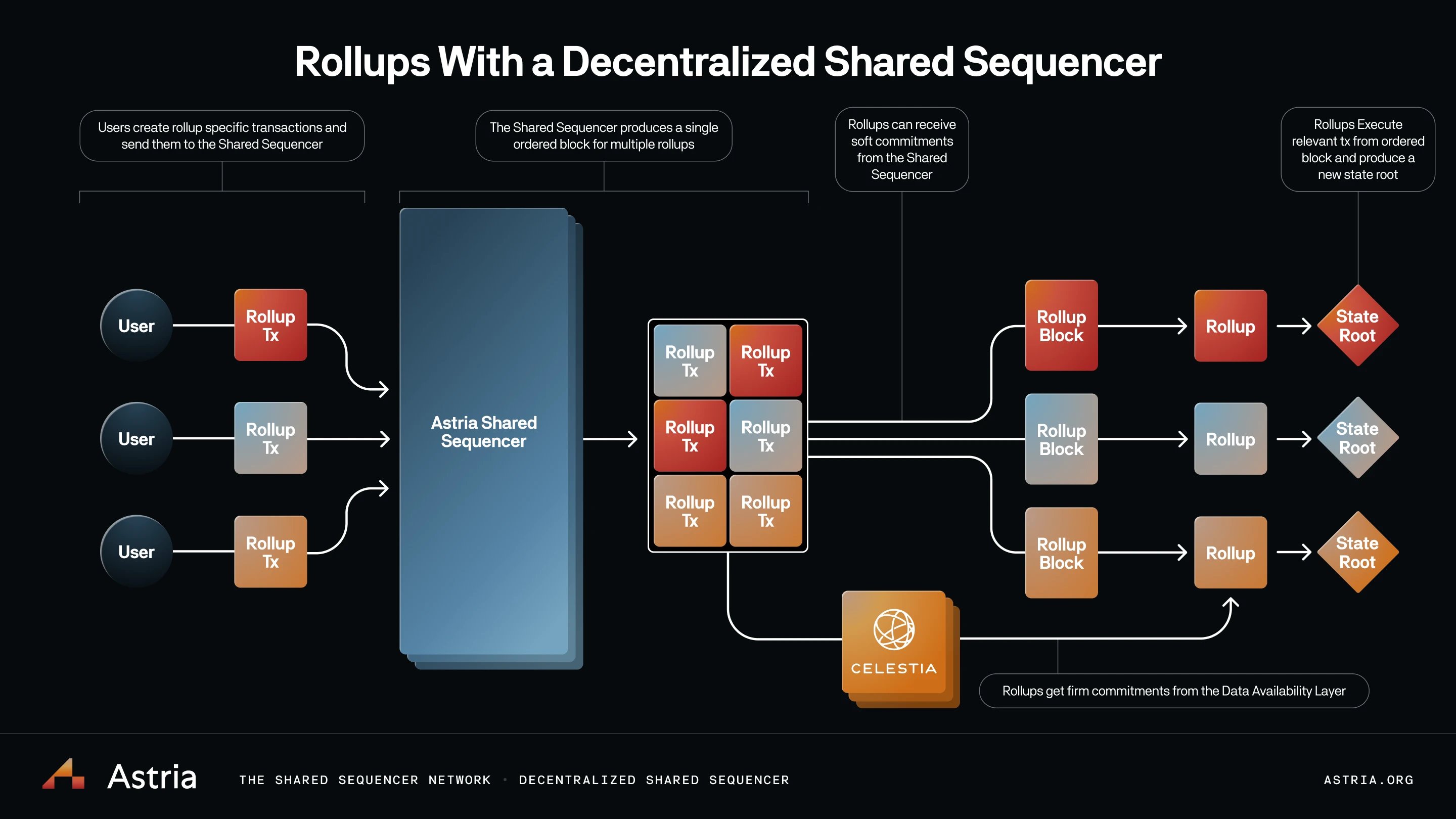

Rollups are the backbone of Ethereum scalability, but their economics have long been constrained by one critical bottleneck: data availability (DA) costs. As L2 ecosystems mature and the modular blockchain thesis gains traction, understanding how Celestia’s DA layer slashes rollup costs by up to 3,000x is essential for developers, investors, and anyone tracking the future of decentralized infrastructure.

Why Data Availability Costs Matter for Rollups

Every rollup, whether optimistic or zk, must publish transaction data somewhere verifiable and censorship-resistant. On Ethereum mainnet, this takes the form of calldata or blobs. Historically, these costs have been prohibitive. For instance, Arbitrum spent approximately $1,980 per MB in DA fees last month on Ethereum, while Manta paid just $3.41 per MB using Celestia DA. The difference is staggering and directly impacts user fees and rollup sustainability.

Recent data from conduit. xyz highlights that Celestia is currently 64% cheaper than Ethereum blobs, with average fees at $7.31 per MB versus $20.56 per MB. This cost gap is not a fleeting anomaly but a structural advantage driven by Celestia’s technical design.

The Mechanics Behind Celestia’s Blobspace Economics

Blobspace, or the space reserved for large chunks of transaction data (blobs), is a new frontier in modular blockchain design. Unlike monolithic chains that process execution and DA together, Celestia unbundles these layers for maximum efficiency.

The secret sauce lies in two key innovations:

- Data Availability Sampling (DAS): Instead of requiring every node to download full blocks, DAS lets light nodes verify large data blocks by sampling random portions encoded with Reed-Solomon erasure codes. This reduces bandwidth requirements exponentially while preserving security guarantees.

- Namespaced Merkle Trees (NMTs): NMTs allow applications to retrieve only relevant namespaces within a block, think targeted data access rather than sifting through irrelevant information. This further cuts down computational overhead and storage needs.

Together, these technologies enable Celestia to offer scalable blobspace at a fraction of legacy costs, a paradigm shift for any project seeking affordable yet secure DA.

The Real-World Impact: Rollup Cost Comparisons and Market Data

The numbers speak volumes. At today’s market price of $0.9882 per TIA, posting 1MB of data on Celestia costs as little as $7.31, compared to $20.56 on Ethereum blobs or nearly $1,980/MB for certain rollups still relying on L1 calldata. Simulations suggest that if all major Ethereum rollups switched to Celestia for DA over six months, they could collectively save up to $50 million in fees (Datalenses via Medium). These savings aren’t just theoretical; they’re already materializing across projects like Manta and others leading the modular charge.

If you want to track blob pricing trends in real time or analyze historical usage patterns, check out resources like this guide on analyzing Celestia blob pricing trends on Blobspace Markets.

Celestia (TIA) Price Prediction 2026-2031

Forecasts based on DA adoption rates, technical innovation, and competitive landscape

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg vs. Prev Year) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.85 | $1.18 | $1.65 | +19% | Rollup DA adoption grows steadily, but overall crypto market remains volatile |

| 2027 | $0.97 | $1.46 | $2.10 | +24% | Major Layer 2s and new rollups leverage Celestia, driving demand |

| 2028 | $1.10 | $1.78 | $2.69 | +22% | Competing DA solutions emerge; Celestia maintains lead via technology upgrades |

| 2029 | $1.26 | $2.12 | $3.38 | +19% | Regulatory clarity and new use cases (modular chains) expand adoption |

| 2030 | $1.45 | $2.48 | $4.21 | +17% | Wider market recovery; TIA establishes itself as DA standard for rollups |

| 2031 | $1.71 | $2.92 | $5.13 | +18% | Celestia ecosystem matures, but faces pressure from both competition and market cycles |

Price Prediction Summary

Celestia (TIA) is projected to see a gradual but consistent price increase from 2026 through 2031, driven by growing adoption of its data availability solutions among rollups and modular blockchains. The average price could rise from $1.18 in 2026 to $2.92 by 2031, with yearly growth rates reflecting both technological progress and market cycles. Price volatility is expected due to competition and broader crypto market dynamics, but Celestia’s cost advantage and technical innovations are likely to sustain long-term demand.

Key Factors Affecting Celestia Price

- Adoption rates of Celestia’s DA layer by Ethereum rollups and other chains

- The evolution and competition from alternative DA solutions (e.g., EigenDA, NEAR, Avail)

- Regulatory developments impacting modular blockchain adoption

- Further technological improvements (e.g., enhancements to DAS, NMTs, scalability)

- General crypto market cycles and investor sentiment

- Potential for new use cases (e.g., modular appchains, cross-chain DA)

- Market cap growth relative to major L1 and L2 platforms

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Modular Blockchain Advantage: Scaling Without Compromise

This isn’t just about lowering fees, it’s about unlocking entirely new use cases by making high-frequency or data-heavy dApps economically viable. By decoupling execution from DA and leveraging innovations like DAS/NMTs, modular blockchains like Celestia can scale horizontally without sacrificing security or decentralization.

For developers, this means the ability to launch rollups and application-specific chains that would have been cost-prohibitive on legacy L1s. High-throughput gaming, social platforms, and real-time analytics dApps can now access affordable DA without the overhead of Ethereum’s blob or calldata pricing. For users, the savings translate directly to lower transaction fees and a more accessible DeFi landscape.

It’s important to note that Celestia’s approach doesn’t just create short-term arbitrage opportunities; it fundamentally shifts the economics of blockchain scaling. As more rollups migrate to Celestia or integrate with its blobspace, network effects kick in: increased demand for TIA (the native token), deeper liquidity for DA services, and a virtuous cycle of innovation as costs continue to drop.

Risks, Competition, and What Comes Next

Of course, no technology is without tradeoffs. While Celestia leads in cost efficiency today, competitors like EigenDA and NEAR DA are pushing boundaries in their own ways. For instance, recent analysis shows NEAR DA can be up to 85,000x cheaper than Ethereum blobs and 30x cheaper than Celestia under certain conditions. The modular DA race is far from over, but what sets Celestia apart is its robust adoption by live rollups and proven mainnet performance.

There are also open questions about long-term security incentives as TIA price fluctuates (currently $0.9882). Sustained low prices could theoretically impact validator rewards or network liveness if not balanced by growing usage. However, as seen in recent months, increased rollup adoption tends to drive both demand for TIA and healthy fee markets for validators, a dynamic worth monitoring closely.

For those looking to dive deeper into how blobspace pricing works under the hood, including fee mechanisms like BlobBaseFee, resources such as this comprehensive BlobBaseFee guide can help you understand market dynamics from both a developer and trader perspective.

Why Blobspace Economics Matter for the Next Wave of dApps

The modular revolution isn’t just technical jargon, it’s a new design space where costs are transparent, scaling is flexible, and economic sovereignty returns to builders. With Celestia’s data availability layer slashing rollup costs by up to 3,000x compared to monolithic models (and currently offering $7.31/MB at a TIA price of $0.9882), the economics speak for themselves.

- Developers: Can deploy higher-throughput apps without fear of prohibitive DA fees.

- Investors: Gain exposure to an asset directly tied to modular blockchain adoption curves.

- dApp Users: Benefit from lower fees and more innovative applications made possible by sustainable economics.

If you’re tracking emerging trends in decentralized infrastructure or want granular insight into blobspace markets, keep an eye on live data feeds and expert analysis at platforms like Blobspace Markets. For a broader view on how blob usage trends impact both pricing and chain design over time, consider exploring Celestia blob usage trend reports.

The bottom line: By rethinking how data availability is provided at scale, with innovations like DAS and NMTs, Celestia has not only made rollups radically cheaper but also catalyzed a new era of blockchain experimentation where economics are finally aligned with ambition.