Celestia’s modular blockchain architecture is rewriting the economics of rollup deployment and scaling. For developers and protocol architects, the ability to decouple data availability (DA) from consensus and execution is more than a technical nuance – it’s a fundamental shift in how blockchains can scale, cut costs, and remain secure. With Celestia’s current price at $0.8166, the ecosystem continues to attract attention from builders seeking to optimize rollup transaction costs and DA efficiency.

Why Data Availability Matters: The Modular Rollup Revolution

At its core, data availability is about ensuring that all transaction data for a given block is publicly accessible so anyone can verify state transitions independently. This isn’t just an academic concern – it’s what allows optimistic and zero-knowledge rollups to inherit security from their DA layer while remaining lightweight and scalable. Historically, Ethereum has served as the gold standard for DA, but with mainnet congestion and storage costs often spiking above $1–$10 per transaction, new solutions were needed.

Celestia answers this call by offering a dedicated DA layer where rollups post their transaction blobs at a fraction of Ethereum’s cost – sometimes as low as $0.01–$0.10 per blob. The result? Projects like Aevo, Lyra, Hypr, Orderly, and Public Goods Network have reported up to 10x cost reductions after migrating to Celestia-powered DA. Caldera’s integration alone slashed total rollup operating expenses by roughly 75%. These aren’t theoretical savings; they’re being realized in production today.

Inside Celestia’s Technical Innovations: DAS, Erasure Coding and Blobspace

The magic behind these cost reductions lies in three key innovations:

- Data Availability Sampling (DAS): Light nodes randomly sample small portions of block data rather than downloading entire blocks. This dramatically reduces bandwidth requirements without sacrificing security or decentralization.

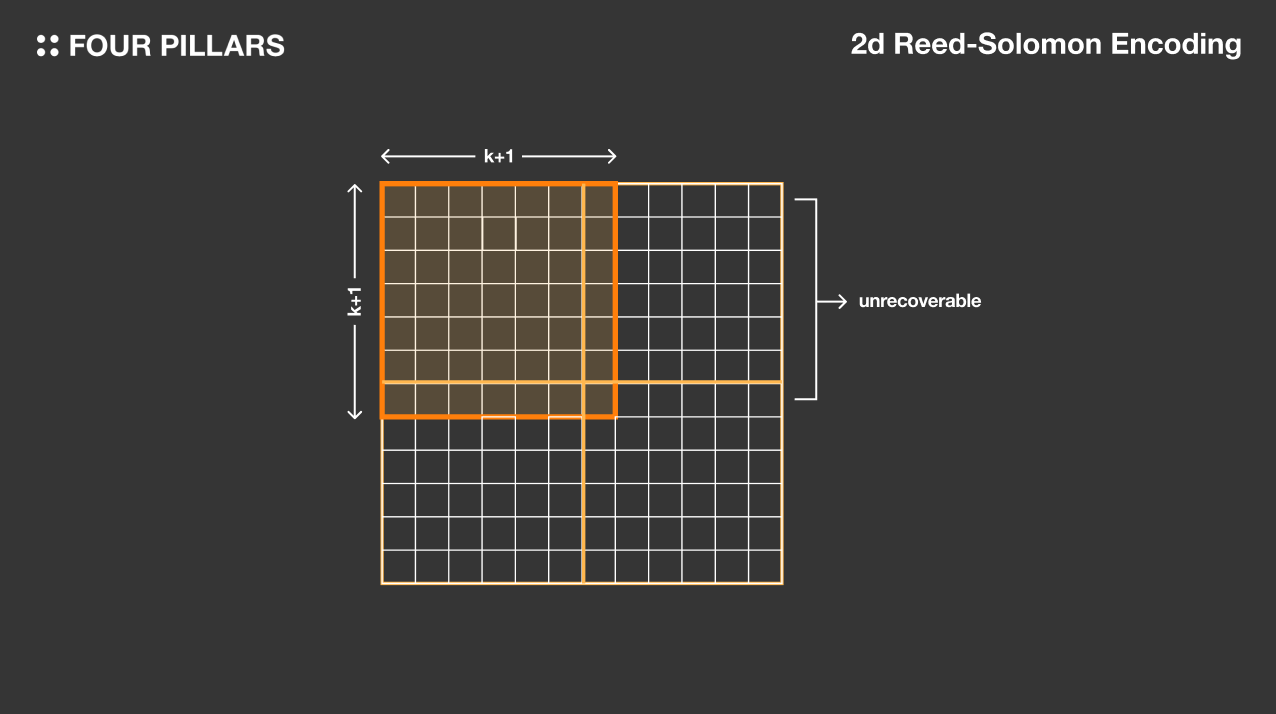

- Erasure Coding: By encoding each block with redundant pieces, the network ensures that even if some data is missing or withheld by malicious actors, the full dataset can be reconstructed efficiently.

- Blobspace Utilization: Instead of posting individual transactions or calldata directly on expensive L1s like Ethereum, rollups submit large blobs containing batched transaction data to Celestia at much lower rates.

This modular approach lets developers focus on application logic while outsourcing heavy-duty data storage to a specialized layer optimized for scale and cost-efficiency. For those interested in hands-on implementation details or deploying custom rollups using Celestia’s DA layer, I recommend reviewing this comprehensive developer guide: How to Deploy a Custom Rollup on Celestia.

Celestia Technical Analysis Chart

Analysis by Owen Sinclair | Symbol: BINANCE:TIAUSDT | Interval: 1W | Drawings: 5

Technical Analysis Summary

Given the pronounced and sustained downtrend in TIAUSDT from early 2025 to November 2025, the technical picture is overwhelmingly bearish. I recommend drawing a primary downtrend line from the January high (just above $9.00) through major lower highs into November (now ~$0.81). Key horizontal support can be marked at $0.79 (recent low) and $0.81 (current price). Resistance should be drawn at former consolidation levels: $1.50 and $2.00. Use rectangles to highlight the extended distribution range from $4.00-$2.00 (March–August) and the current accumulation attempt near $0.80. Arrows may be used to indicate failed rallies and breakdown points. Overlay a text annotation at the current price noting ‘New 2025 Lows, Caution Warranted.’ Use a callout on the $0.79 level labeling ‘Potential Support Zone.’

Risk Assessment:high

Analysis: The technical downtrend remains unbroken with no apparent reversal.The current price is at new yearly lows, and support is unproven.Until signs of stabilization or a clear catalyst emerge, downside risk is significant.

Owen Sinclair’s Recommendation: Remain on the sidelines or deploy only minimal, highly risk-managed capital if entering.Wait for a confirmed bottom and improvement in both technicals and on-chain/fundamental metrics before accumulating.Prioritize capital preservation.

Key Support & Resistance Levels

📈 Support Levels:

- $0 .79 – Recent local low ; potential psychological and technical support.moderate

- $081 – Current price zone ; may offer short-term support if buyers step in.weak

📉 Resistance Levels:

- $15 – Former minor consolidation and pivot area in summer2025.moderate

- $2 – Significant breakdown point and former support during spring2025.strong

Trading Zones (low risk tolerance)

🎯 Entry Zones:

The numbers speak volumes when comparing modular blockchain DA layers head-to-head:

Cryptocurrency Price Comparison: Celestia vs Major Layer 1 & Layer 2 Assets

6-Month Price Performance Snapshot (as of 2025-11-07)

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Celestia (TIA) | $0.8161 | $0.3166 | +157.8% |

| Ethereum (ETH) | $3,325.06 | $1,912.00 | +73.9% |

| Bitcoin (BTC) | $101,468.00 | $81,553.00 | +24.5% |

| Optimism (OP) | $0.3684 | $0.5000 | -26.3% |

| Arbitrum (ARB) | $0.2690 | $0.4000 | -32.7% |

| Solana (SOL) | $156.70 | $124.00 | +26.4% |

| Avalanche (AVAX) | $16.28 | $12.00 | +35.7% |

| Polygon (MATIC) | $0.8000 | $0.6000 | +33.3% |

Analysis Summary

Celestia (TIA) has outperformed all major Layer 1 and Layer 2 assets over the past six months, surging +157.8%. In contrast, Ethereum and Bitcoin posted strong but smaller gains, while Layer 2 solutions like Optimism and Arbitrum experienced notable declines. This reflects growing market interest in Celestia’s modular blockchain and data availability innovations.

Key Insights

- Celestia (TIA) leads the sector with a +157.8% price increase, far outpacing other assets.

- Ethereum (ETH) and Bitcoin (BTC) saw significant gains, but lagged behind Celestia’s explosive growth.

- Layer 2 tokens Optimism (OP) and Arbitrum (ARB) declined over the period, highlighting shifting market dynamics.

- Other Layer 1s like Avalanche (AVAX), Polygon (MATIC), and Solana (SOL) posted moderate gains, but none matched Celestia’s momentum.

All prices and 6-month changes are sourced directly from the provided real-time market data as of 2025-11-07. No estimates or external data were used; only the supplied figures populate the table for accurate, up-to-date comparison.

Data Sources:

- Main Asset: https://coinmarketcap.com/currencies/celestia/

- Ethereum: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

- Bitcoin: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

- Optimism: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

- Arbitrum: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

- Solana: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

- Avalanche: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

- Polygon: https://www.gsr.io/wp-content/uploads/2025/03/Mar-11-2025.pdf

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

This stark difference in fees has immediate implications for builders optimizing capital efficiency and user experience. Lower DA costs mean more frequent batch submissions, faster finality for users, and greater flexibility in designing custom execution environments without being shackled by L1 gas spikes.

The impact isn’t limited to theory – it’s visible across live deployments today. As more projects migrate away from monolithic chains toward modular stacks leveraging Celestia for blobspace restaking and efficient DA provisioning, we’re witnessing an acceleration in both innovation velocity and ecosystem diversity.

Celestia (TIA) Price Prediction 2026–2031

TIA price forecast based on modular blockchain adoption, rollup cost reductions, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.72 | $1.05 | $1.48 | +29% | Rollup adoption accelerates, but broader market remains volatile. |

| 2027 | $0.95 | $1.38 | $2.10 | +31% | Major rollup projects migrate to Celestia DA; regulatory clarity grows. |

| 2028 | $1.15 | $1.75 | $2.65 | +27% | Institutional interest increases; modular blockchains reach mainstream awareness. |

| 2029 | $1.38 | $2.21 | $3.35 | +26% | Celestia ecosystem matures; competition from other DA layers intensifies. |

| 2030 | $1.62 | $2.68 | $4.10 | +21% | Widespread rollup-as-a-service adoption; broader crypto bull cycle. |

| 2031 | $1.90 | $3.19 | $5.05 | +19% | Celestia achieves significant market share in DA solutions; global blockchain scaling. |

Price Prediction Summary

Celestia (TIA) is poised for steady growth through 2031 as its data availability innovations drive down rollup costs and modular blockchain adoption expands. While short-term volatility remains possible, the long-term outlook is bullish, especially if Celestia secures a leadership position in the modular blockchain stack. Price ranges reflect both upside from technology adoption and downside risks from competition and broader market cycles.

Key Factors Affecting Celestia Price

- Adoption of Celestia DA by major rollups and Layer 2 projects

- Regulatory clarity around modular and rollup-based blockchains

- Expansion of rollup-as-a-service providers leveraging Celestia

- Continued technological improvements (e.g., DAS, erasure coding)

- Competition from alternative DA layers and blockchains

- General crypto market cycles (bull/bear trends)

- Institutional and enterprise participation in modular blockchain infrastructure

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For modular blockchain builders, the practicalities of integrating Celestia’s DA layer are refreshingly straightforward. Rather than reinventing the wheel, rollup teams can modify their batchers to submit data directly to Celestia’s blobspace, harnessing Namespace Merkle Trees (NMTs) for efficient data retrieval and organization. This design not only minimizes technical overhead but also future-proofs deployments for evolving DA standards and cross-chain interoperability.

“Celestia’s DA innovations have made it possible to launch performant rollups with a fraction of the infrastructure previously required, we’re seeing new appchains go from testnet to mainnet in weeks, not months. “

The network’s use of erasure coding is especially significant for those prioritizing resilience and censorship resistance. By ensuring that any subset of nodes can reconstruct full block data, Celestia reduces reliance on centralized operators and mitigates risks posed by partial data withholding attacks. This is a marked improvement over legacy systems where full node operation was a costly necessity for security.

Deployment Playbook: Optimizing Rollups on Celestia

The efficiency gains are not just theoretical or limited to high-profile projects. Even smaller teams are leveraging these innovations to deploy custom execution environments tailored for DeFi, gaming, and public goods funding. The result is a more inclusive and competitive modular ecosystem, where new entrants can match or surpass incumbents on both performance and cost metrics.

As the TIA token trades at $0.8166, its value proposition as a foundational asset in the modular DA landscape becomes increasingly clear. The price stability around this level reflects both market confidence in Celestia’s architecture and growing demand from rollup builders seeking sustainable economics at scale.

Looking Ahead: The Future of Modular DA Layers

The rapid adoption of Celestia’s approach signals a broader paradigm shift toward specialized layers optimized for discrete blockchain functions. As more developers embrace blobspace restaking and modular stack compositions, expect further reductions in rollup transaction costs alongside improvements in throughput, UX, and security guarantees.

If you’re exploring how to maximize yield or security by leveraging restaked assets within this ecosystem, or want deeper technical guidance on deploying your own modular chain, resources like Optimizing Data Availability for Rollups with Celestia offer actionable insights directly from leading protocol engineers.

Ultimately, Celestia’s innovations don’t just lower costs, they unlock new design space for decentralized applications previously constrained by monolithic architectures. With real-world savings already evident across major networks and a thriving developer community pushing boundaries daily, the case for adopting modular DA layers has never been stronger.