Restaking on Celestia is quickly becoming a cornerstone strategy for blockchain enthusiasts and investors seeking to maximize yield within the modular DA (Data Availability) layer landscape. With Celestia’s unique approach to data availability and its native TIA token, restaking is not just about earning passive income – it’s about actively participating in the security and scalability of next-generation blockchain infrastructure. As of today, Celestia (TIA) is trading at $0.7810, making it an accessible entry point for those eager to leverage DA layer restaking for optimal rewards.

Why Restake on Celestia? Unlocking Modular Blockchain Yield

Celestia’s modular design separates consensus from execution, allowing rollups and chains to post their data without carrying the burden of full node verification. This architecture makes restaking not only lucrative but also vital for network robustness. By restaking your TIA, you are compounding your staking rewards while reinforcing the security backbone of emerging DA layers. In a market where every fraction of yield counts, understanding how to efficiently restake can put you ahead of the curve.

Step 1: Set Up and Fund Your Keplr Wallet with TIA Tokens

Your journey begins with a secure, compatible wallet. The Keplr wallet is widely recognized in the Cosmos ecosystem for its reliability and seamless integration with Celestia’s network. After installing Keplr as a browser extension or mobile app, create a new wallet or import an existing one using your seed phrase. Next, fund your wallet by purchasing TIA tokens from reputable exchanges and transferring them directly to your Keplr address.

This initial step sets the foundation for all subsequent staking operations. Double-check that your wallet reflects your TIA balance before proceeding – this ensures you’re ready to move swiftly as opportunities arise in real time.

Step 2: Select a High-Performance Validator on the Celestia Network

The choice of validator is critical when it comes to maximizing both yield and security in DA layer restaking. Validators are responsible for producing blocks and validating transactions; their performance directly impacts your potential rewards and exposure to slashing risks. Within Keplr, navigate to the Celestia network dashboard where you’ll find a curated list of validators ranked by commission rate, uptime, voting power, and historical performance.

Pro Tip: Don’t just chase high yields – evaluate validators based on their track record for reliability, community reputation, and transparent communication. Diversifying across multiple reputable validators can further mitigate risk while optimizing returns.

Step 3: Stake TIA Tokens and Monitor Initial Rewards

Once you’ve selected a validator that aligns with your risk tolerance and reward expectations, delegate your TIA tokens directly through Keplr’s interface:

- Select your preferred validator from the list

- Enter the amount of TIA you wish to stake (ensure you leave some tokens unstaked for transaction fees)

- Confirm and sign the transaction using Keplr

You’ll begin earning staking rewards almost immediately after delegation. These initial rewards are an excellent indicator of validator performance – monitor them closely within Keplr or through third-party dashboards designed for DA layer analytics.

The Power of Early Monitoring in Modular Blockchain Yield Strategies

The first few epochs post-staking are crucial for establishing baseline expectations regarding reward frequency and validator reliability. If inconsistencies or downtime become apparent early on, don’t hesitate to reevaluate your choices before compounding further into underperforming nodes.

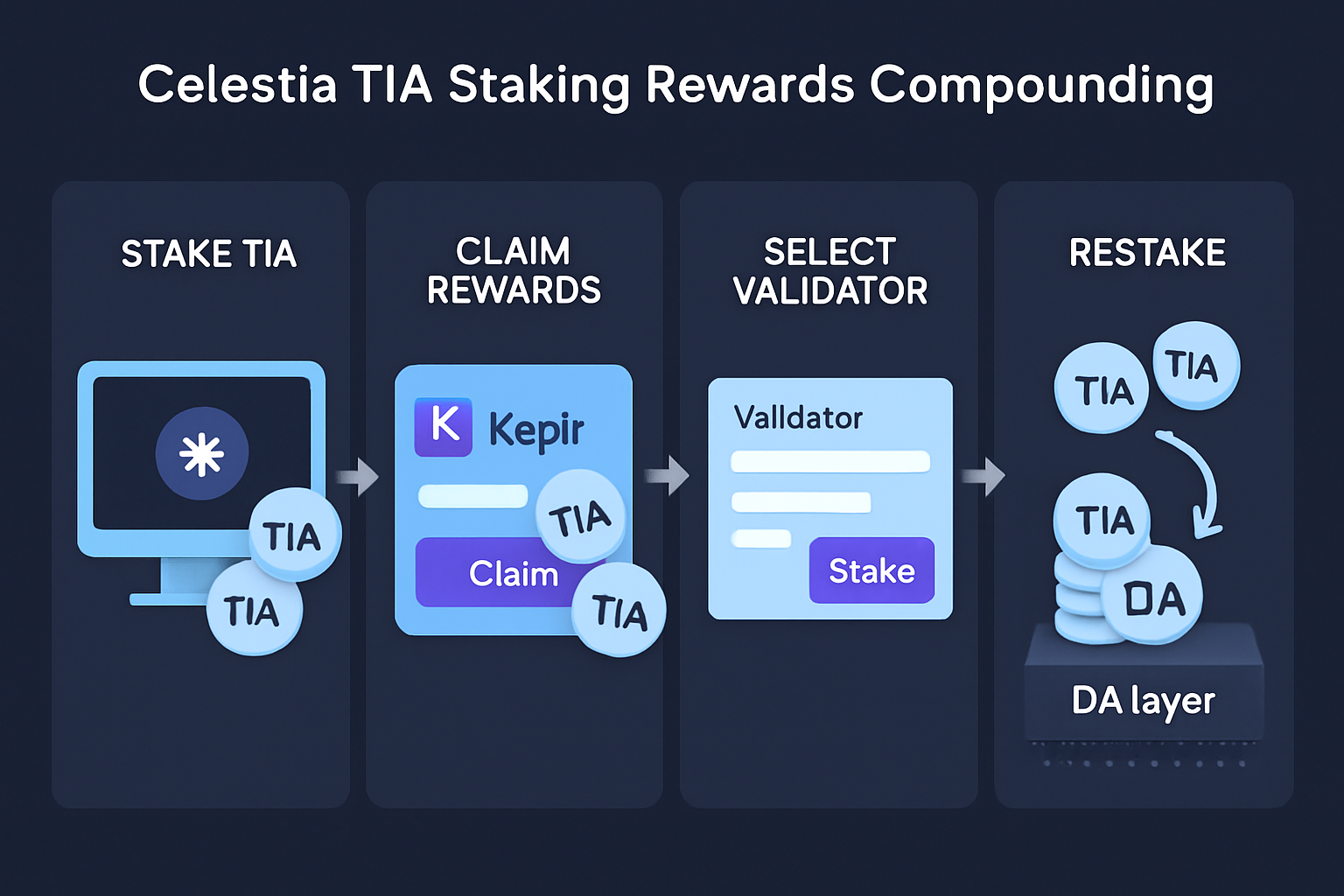

Step 4: Restake Earned Rewards Regularly to Compound Yield

To truly maximize your returns in the Celestia ecosystem, make restaking a habit. As your staked TIA accrues rewards, you have two options: manually claim and redelegate your earnings or leverage auto-compounding tools if available. Manual restaking gives you full control and allows for strategic adjustments, while automated solutions like REstake by Eco Stake can streamline the process by automatically compounding your rewards as soon as they are claimable.

Compounding is a force multiplier in modular blockchain yield strategies. By consistently reinvesting your earned TIA, you not only accelerate the growth of your principal but also benefit from the exponential effect of earning rewards on an ever-increasing base. In volatile markets where yield compression is common, this disciplined approach can set you apart from passive stakers who leave rewards idle.

Step 5: Evaluate and Adjust Validator Choices Based on Performance and Security Metrics

The modular nature of Celestia’s DA layer means validator performance can shift rapidly as new participants join and network dynamics evolve. Regularly review your validators’ uptime, commission rates, slashing history, and community feedback. If a validator’s performance declines or their security practices come into question, use Keplr’s redelegation feature to swiftly move your stake to a higher-performing node without triggering the full unbonding period.

Staying agile is key. Don’t hesitate to rotate between top validators or diversify across several nodes to hedge against unforeseen risks. The most successful restakers treat validator selection as an ongoing process rather than a one-time decision, this vigilance helps protect both your capital and the broader network.

Staying Ahead in DA Layer Restaking

With Celestia (TIA) currently trading at $0.7810, there’s never been a more accessible moment to get involved in DA layer restaking strategies that support both personal yield goals and network resilience. The combination of modular architecture and robust staking incentives makes Celestia an ideal platform for those eager to experiment at the frontier of decentralized infrastructure.

Your Restaking Checklist for Maximum Yield:

Restaking isn’t just about chasing numbers, it’s about building habits that compound over time while actively contributing to the health of the ecosystem. By following this Celestia restaking guide, you’re positioning yourself at the intersection of innovation and opportunity within modular blockchains.

As always, remain vigilant about slashing risks by delegating only to trustworthy validators with transparent histories. Leverage analytics tools for real-time monitoring and stay active in community discussions, these are essential habits for anyone serious about optimizing their modular blockchain yield.

The future of decentralized application scaling relies on engaged participants like you who understand both the mechanics and mission of DA layer restaking. Empower yourself through knowledge, and let every TIA token work harder for both your portfolio and the next generation of blockchain infrastructure.