The Solana DeFi landscape has entered a new phase of innovation and competition, with six protocols now boasting over $1 billion in Total Value Locked (TVL) as of October 18,2025. At the heart of this surge is the rise of restaking mechanisms, which allow users to amplify yield opportunities by leveraging staked assets across multiple protocols. While Jito leads the charge with more than $2 billion in TVL and a robust restaking framework, the conversation is rapidly shifting toward the next frontier: blobspace restaking and its potential to redefine both security and composability on Solana.

Blobspace Restaking: The Next Evolution for Solana DeFi?

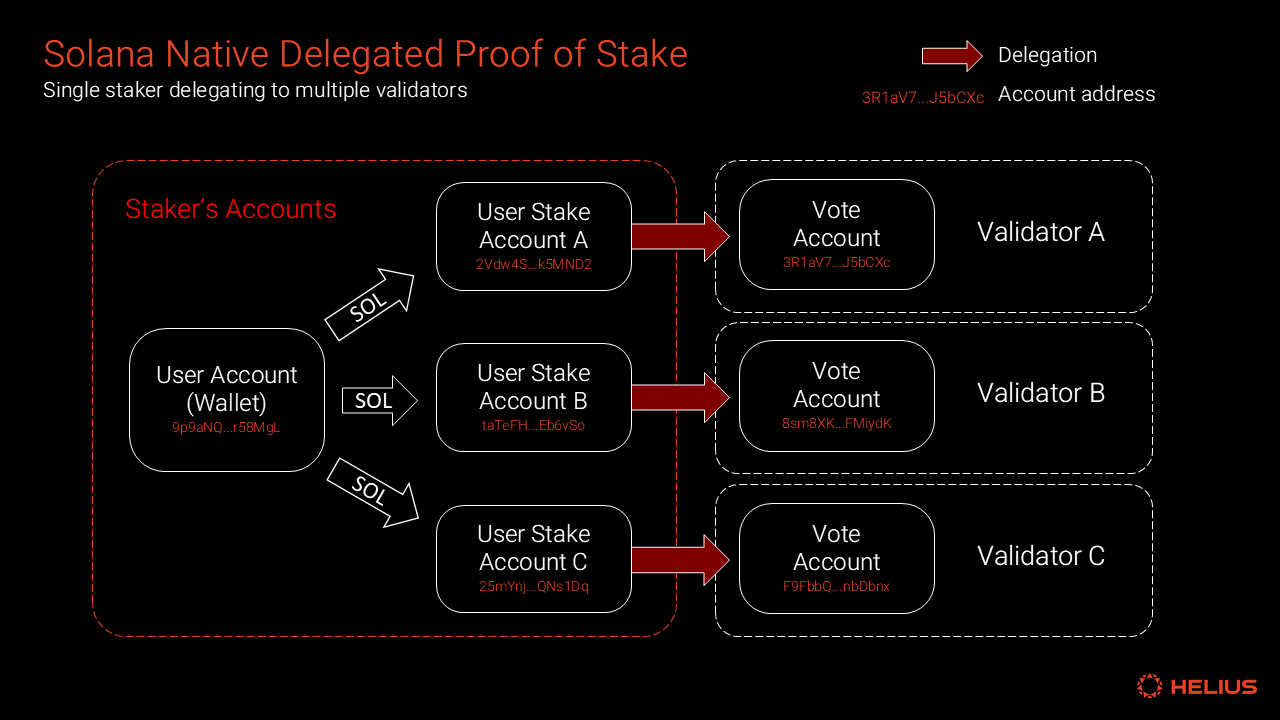

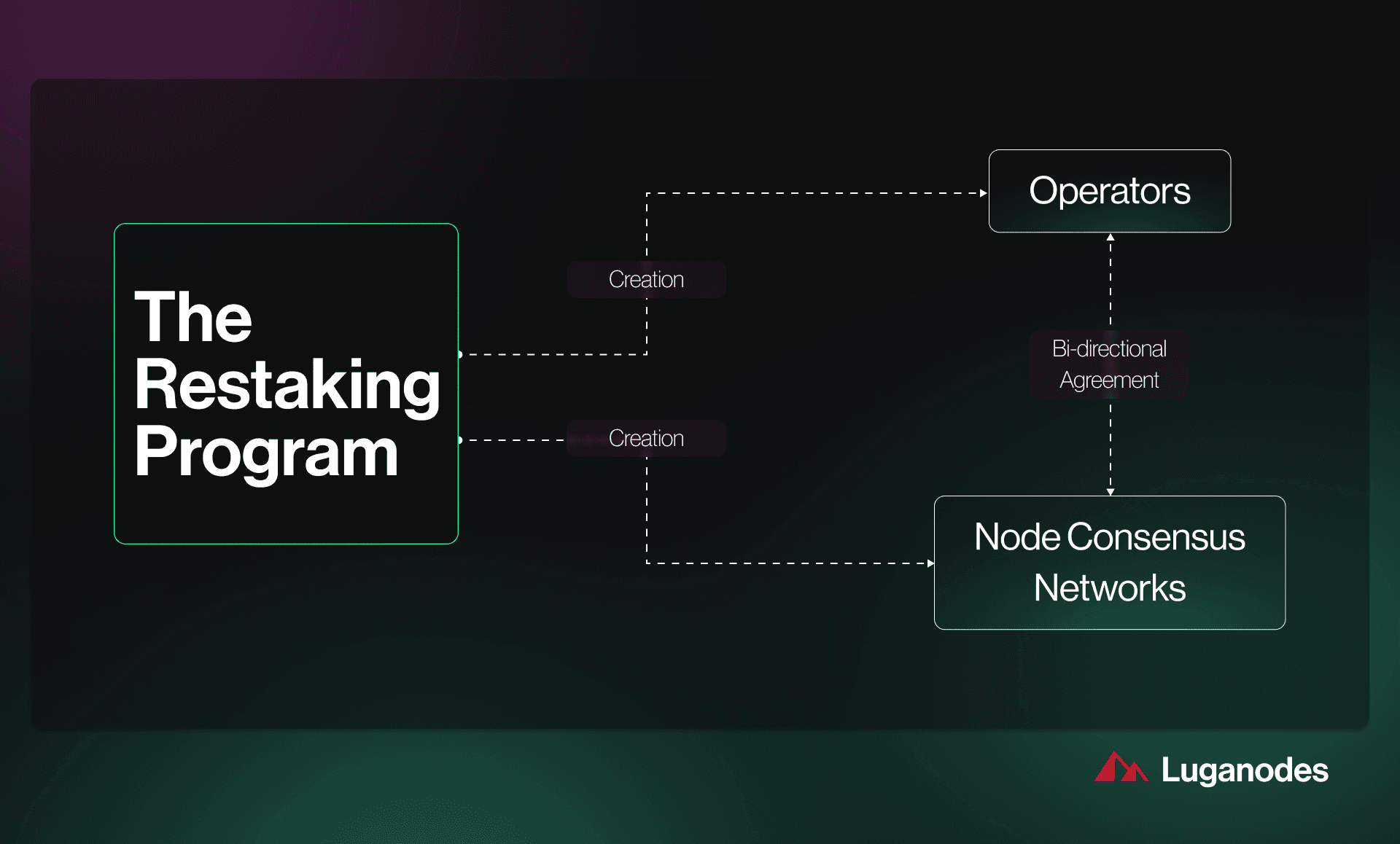

Restaking is not a novel concept in modular blockchain ecosystems; Ethereum’s EigenLayer has already demonstrated how securing additional networks with re-used staking collateral can unlock new forms of utility. However, what sets blobspace restaking apart is its focus on securing data availability (DA) layers and maximizing throughput for high-volume applications. In theory, blobspace restaking enables users to delegate their staked SOL or liquid staking derivatives into pools that simultaneously secure both the base layer (Solana) and emerging DA layers or rollups.

This approach holds particular promise for Solana due to its unmatched transaction throughput and low-latency architecture. By integrating blobspace restaking, projects can potentially offer:

- Boosted yields through multi-layer rewards

- Expanded security guarantees for new DeFi primitives

- Simplified participation via risk-mitigated staking pools

The result? A more capital-efficient ecosystem where users no longer have to choose between yield optimization and network contribution.

BloopFi, $BLOOP, and the Rise of Specialized Restaking Pools

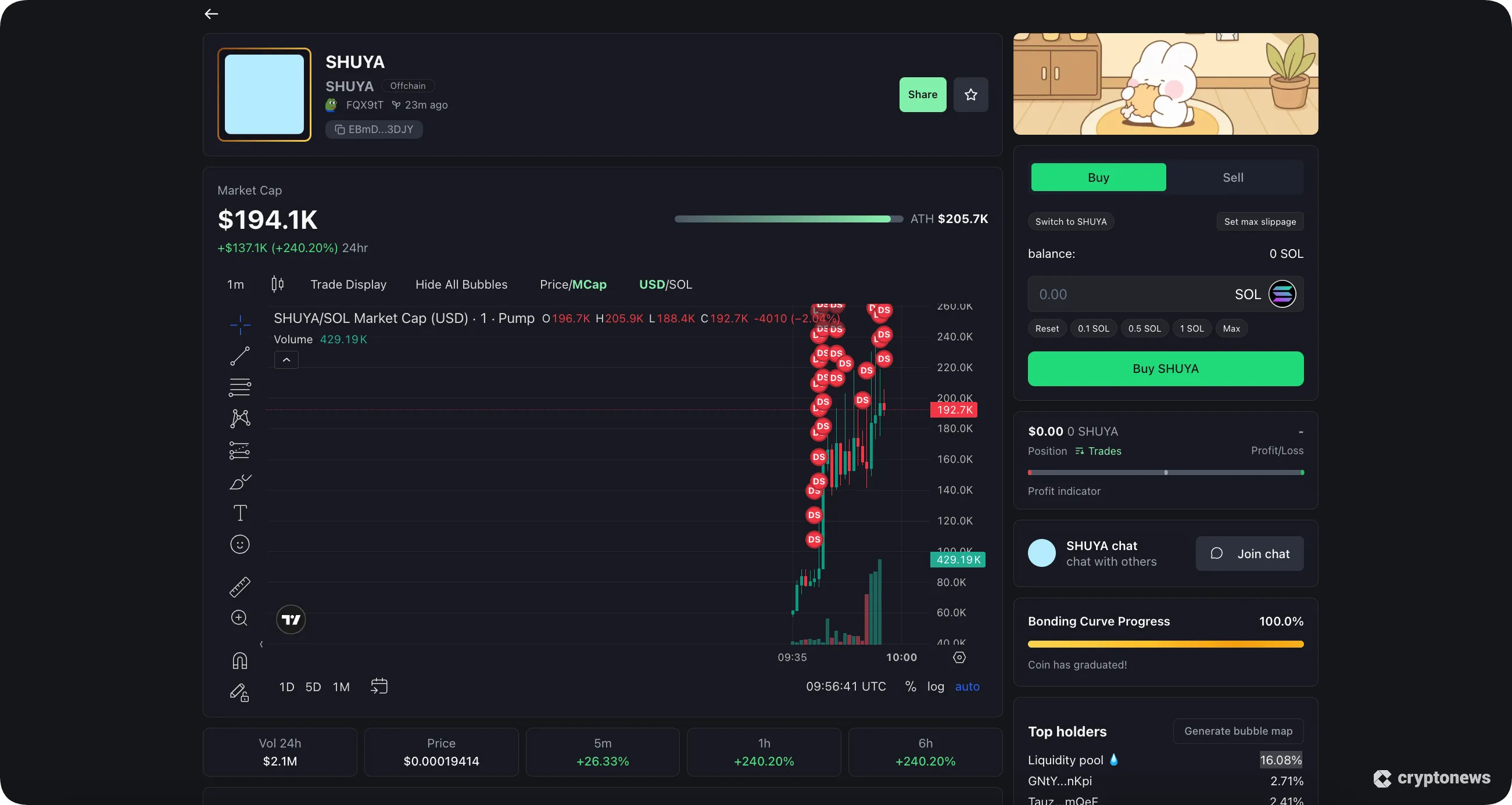

Although there is currently no official documentation or live product for BloopFi or $BLOOP within the public Solana DeFi ecosystem, their rumored emergence has generated significant buzz among power users seeking exposure to next-generation staking strategies. If realized, BloopFi could represent a new breed of platforms purpose-built for blobspace restaking on Solana, potentially enabling:

- $BLOOP staking pools: Combining memecoin culture with real utility by allowing holders to participate in both speculative upside and robust network security.

- BloopFi DeFi platform integrations: Offering anti-rug crypto tools, risk-free staking interfaces (as far as protocol design allows), and multi-chain expansion features.

- User-centric dashboards: Real-time insights into TVL growth, APYs across pools, and risk metrics tailored for advanced stakers.

This aligns closely with ongoing trends noted by analysts at Ark Invest, who observe that DeFi is following SaaS and fintech playbooks, unbundling legacy products before rebundling them into modular financial super-apps.

The Current State: Liquid Restaking Protocols and Lessons Learned

The rapid ascent of liquid staking on Solana, epitomized by Jito’s $2 billion TVL milestone, highlights both user appetite for enhanced yields and the inherent risks involved. Not every experiment has succeeded; notably, Inception’s sunset after failing to find product-market fit demonstrates that innovation must be paired with sustainable demand (source). As new entrants like BloopFi prepare to launch specialized blobspace pools, lessons from these early movers will be critical in shaping best practices around smart contract audits, slashing protection mechanisms, and transparent fee structures.

Top 5 Innovations Powering Solana DeFi Growth

-

Liquid Staking with Jito: Jito has emerged as Solana’s leading liquid staking protocol, amassing over $2 billion in TVL. By enabling users to stake SOL and receive liquid staking tokens, Jito boosts capital efficiency and unlocks new DeFi strategies.

-

Restaking Mechanisms: Restaking allows staked assets to secure additional networks or services, enhancing yield opportunities and network resilience. Solana protocols like Jito are pioneering restaking, driving ecosystem expansion and composability.

-

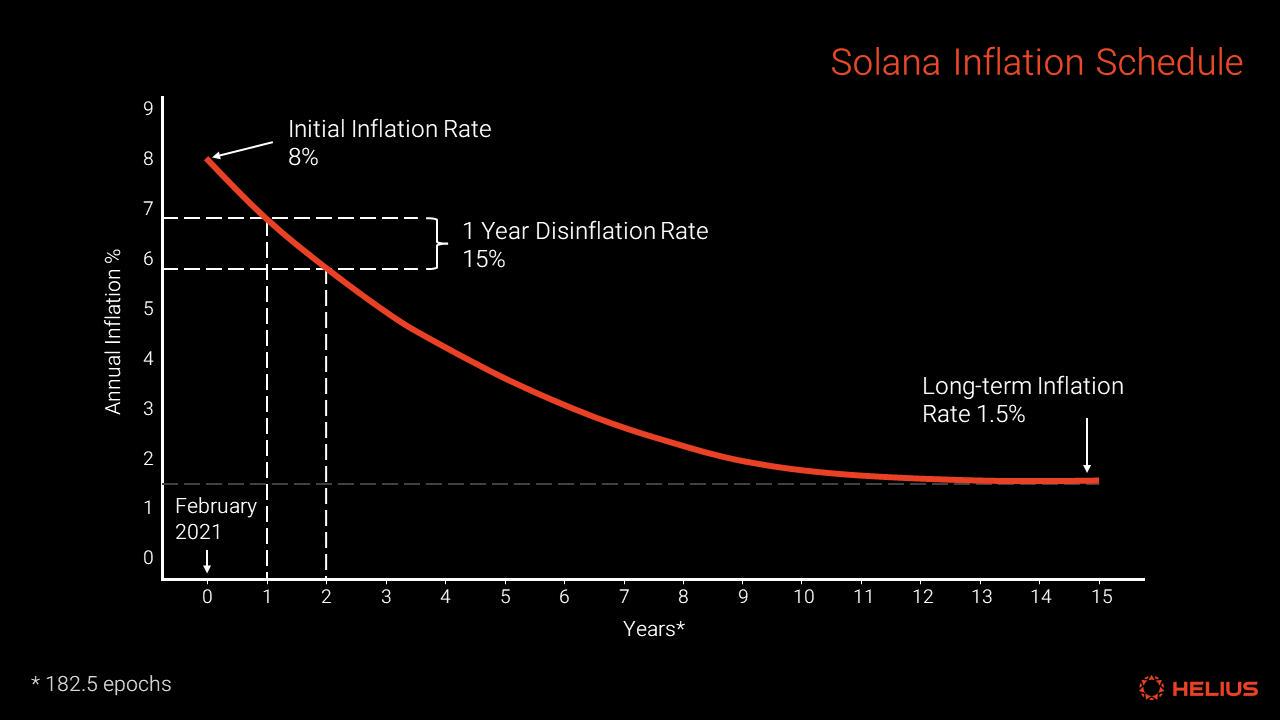

High-Performance Blockchain Infrastructure: Solana’s technical breakthroughs—such as its unique Proof of History consensus and 50,000+ TPS throughput—enable fast, low-cost transactions, making it ideal for scalable DeFi applications.

-

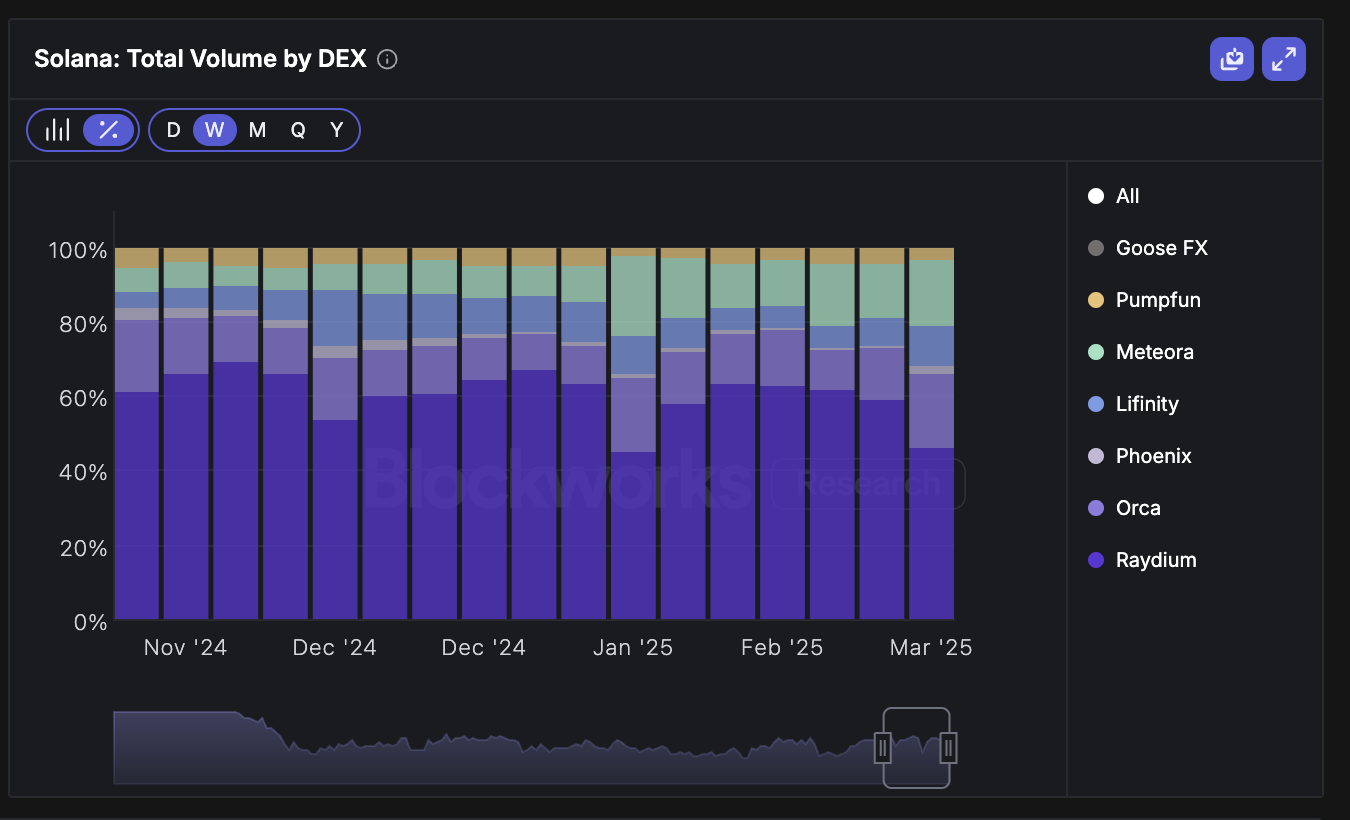

Decentralized Exchanges (DEXs) and Aggregators: Platforms like Orca and Raydium provide deep liquidity, low slippage, and innovative AMM designs, serving as the backbone for trading, yield farming, and composability in Solana DeFi.

-

Launchpads and Yield Platforms: Launchpads such as Solanium and leading yield platforms are driving user engagement by offering vetted IDOs, staking, and competitive yield opportunities, further fueling Solana’s DeFi adoption.

The Mechanics Behind Blobspace Restaking Pools on Solana

If implemented effectively, blobspace restaking could enable seamless cross-layer security provisioning while minimizing user friction. Imagine a scenario where depositing SOL or a liquid derivative like JitoSOL into a BloopFi pool automatically allocates your stake across multiple DA layers as well as emerging rollup solutions, maximizing yield while contributing to network resilience. This model would also appeal to meme-driven communities seeking utility beyond speculation; $BLOOP holders could earn protocol fees while supporting anti-rug initiatives through pooled insurance funds or automated monitoring tools.

For those eager to stay ahead of these developments, or compare current yield opportunities across top platforms, resources such as SolanaFloor’s coverage of TVL milestones provide invaluable real-time market context.

As we look deeper into the potential impact of blobspace restaking, it’s clear that Solana’s modular design and high throughput are uniquely suited for experimentation in this domain. The convergence of DA layer security and DeFi composability could unlock a new class of yield strategies, particularly as capital seeks both efficiency and safety in an increasingly competitive ecosystem.

While the technical underpinnings of blobspace restaking are still being refined, community sentiment remains bullish. Enthusiasts are already speculating about how platforms like BloopFi could create a new meta for Solana memecoin staking, where $BLOOP pools serve as both speculative assets and foundational infrastructure for DA layer security. This dual-purpose model could attract not just degens but also more risk-averse participants seeking diversified returns with built-in slashing protection.

Risks, Rewards, and What to Watch

The promise of boosted yields through multi-layer staking is inherently attractive, but it comes with nuanced risks. Smart contract vulnerabilities, cross-protocol dependencies, and insufficient slashing protection remain top concerns. The recent shutdown of Inception underscores the importance of robust product-market fit and transparent protocol governance. As more platforms experiment with blobspace restaking, users should prioritize:

Key Risk Factors: Liquid Staking vs. Restaking Pools on Solana

-

Smart Contract Risk: Both traditional liquid staking protocols (e.g., Jito) and restaking pools rely on complex smart contracts. However, restaking pools introduce additional layers of contract logic, increasing the potential attack surface for exploits or bugs.

-

Slashing Risk: In liquid staking, users face slashing if validators misbehave. Restaking pools compound this risk, as assets may be slashed on multiple networks or services simultaneously, amplifying potential losses.

-

Liquidity Risk: Liquid staking tokens like JitoSOL are widely accepted and have deep liquidity. Restaking derivatives may have less established markets, making it harder to exit positions quickly without significant price impact.

-

Yield Volatility: Traditional liquid staking typically offers predictable staking rewards. Restaking pools promise boosted yields, but rewards can be highly variable and depend on the performance of multiple protocols or services.

-

Protocol Complexity: Restaking pools are inherently more complex, involving cross-protocol integrations and additional layers of governance. This complexity can obscure risks and make it harder for users to fully understand how their assets are being used.

-

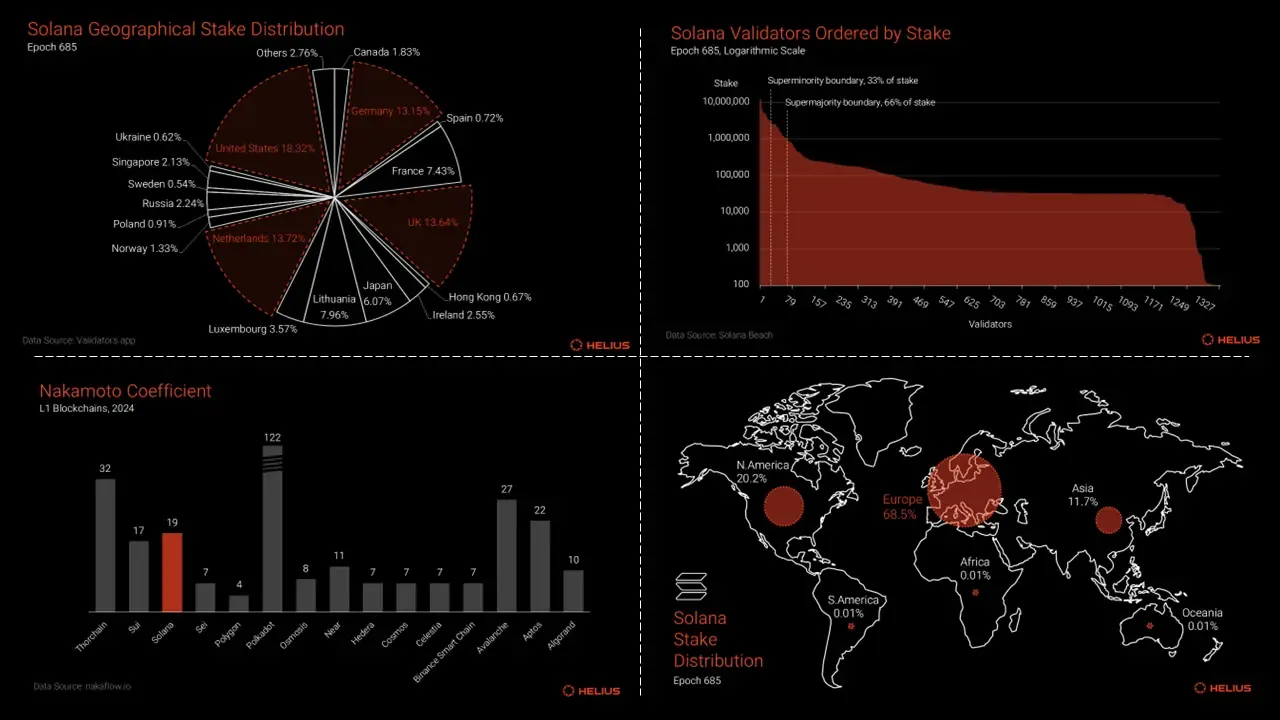

Centralization Risk: Liquid staking protocols on Solana, like Jito, are working to improve decentralization. Restaking pools may concentrate power among a smaller set of operators or protocols, increasing systemic risk if a major participant fails.

Additionally, the rise of anti-rug crypto tools within these platforms signals a maturing market that values user protection as much as yield optimization. Expect to see more integrations focused on automated monitoring, insurance-backed staking pools, and real-time risk dashboards tailored for power users.

What’s Next for Blobspace Restaking on Solana?

With six protocols now above $1 billion in TVL, and Jito leading with over $2 billion, the appetite for innovative staking solutions is undeniable. If BloopFi or similar projects succeed in launching user-friendly blobspace restaking pools, we could witness a rapid migration of liquidity from single-layer to multi-layer staking strategies. This would not only drive up APYs but also strengthen the overall security posture of Solana’s DeFi stack.

For investors and builders alike, the key will be staying informed and agile as this narrative unfolds. Monitoring TVL trends, scrutinizing audit reports, and engaging with community governance will be essential steps for anyone looking to capitalize on this emerging opportunity.

Ultimately, whether $BLOOP becomes the poster child for blobspace restaking or simply inspires further innovation remains to be seen. What is certain is that Solana’s DeFi meta is evolving faster than ever, and those who understand the mechanics behind risk-mitigated staking pools will be best positioned to thrive.