In the modular blockchain landscape of 2026, Celestia’s blobspace stands out as a cornerstone for scalable data availability, especially with its price holding steady at $0.3380 amid a 24-hour gain of and $0.003340 ( and 0.009970%). The Ginger upgrade has doubled throughput, slashed block times, and paved the way for 1GB blocks, fueling applications from high-frequency trading to real-time gaming. Pairing this with EigenLayer’s restaking unlocks unprecedented yield opportunities for validators and investors eyeing Celestia blobspace restaking.

Celestia’s evolution reflects the intensifying modular wars against rivals like EigenDA and Avail. While EigenDA leverages Ethereum’s restaking for decentralized DA, Celestia’s native blobspace offers superior bandwidth, roughly 40x Ethereum’s EIP-4844 blobs. The upcoming Fibre protocol promises 1Tb/s across 500 nodes, positioning Celestia to dominate rollup ecosystems and enterprise chains.

Celestia’s Blobspace Surge: From 128MB to 1GB Horizons

The Matcha upgrade bumped block sizes to 128MB, but 2026’s Ginger refinement marks a quantum leap. Block times now hover lower, capacity doubled, and blobspace utilization surges to support multi-rollup architectures. This isn’t mere scaling; it’s a deliberate pivot toward absorbing demand from DeFi protocols, gaming dApps, and governance systems craving cheap, verifiable data posting.

Consider the numbers: at $0.3380, TIA trades near its 24-hour low of $0.3341, yet blobspace demand from rollups like Eclipse and MegaETH alternatives underscores long-term value accrual. Validators securing this infrastructure earn paymers from data posters, with yields compounding as Fibre rolls out. For developers, Celestia’s data availability sampling ensures light clients verify massive blobs efficiently, sidestepping full downloads.

Celestia (TIA) Price Prediction 2027-2032

Forecasts amid blobspace scaling, EigenLayer restaking yields, and modular blockchain competition (baseline: $0.338 in 2026)

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.45 | $1.50 | $4.00 | +344% |

| 2028 | $0.70 | $2.80 | $7.00 | +87% |

| 2029 | $1.10 | $4.50 | $11.00 | +61% |

| 2030 | $1.60 | $6.50 | $15.00 | +44% |

| 2031 | $2.20 | $9.00 | $20.00 | +39% |

| 2032 | $3.00 | $12.00 | $26.00 | +33% |

Price Prediction Summary

Celestia (TIA) is forecasted to see strong growth from 2027-2032, propelled by blobspace expansions (e.g., Ginger upgrade, 1GB+ blocks), EigenLayer restaking synergies (10-12% APRs), and modular blockchain adoption. Average prices are projected to rise from $1.50 in 2027 to $12.00 by 2032 (CAGR ~51%), with min/max reflecting bearish competition and bullish dominance scenarios.

Key Factors Affecting Celestia Price

- Blobspace scaling to 1TB/s via Fibre, supporting high-frequency trading and gaming

- EigenLayer restaking integration maximizing validator yields and security

- Increasing rollup and modular chain adoption driving TIA demand

- Competition from EigenDA/Avail potentially capping market share in bear cases

- Crypto market cycles, BTC halvings, and institutional inflows boosting upside

- Regulatory developments on DA layers and restaking impacting adoption

- Technological upgrades reducing costs and enhancing throughput

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

This infrastructure maturity draws parallels to ancient divides, Celestia as the expansive kingdom, EigenDA the Ethereum loyalist, Avail the agile contender. Yet Celestia’s sovereign rollups and blobspace economics give it an edge in cost per byte, critical as modular theses mature.

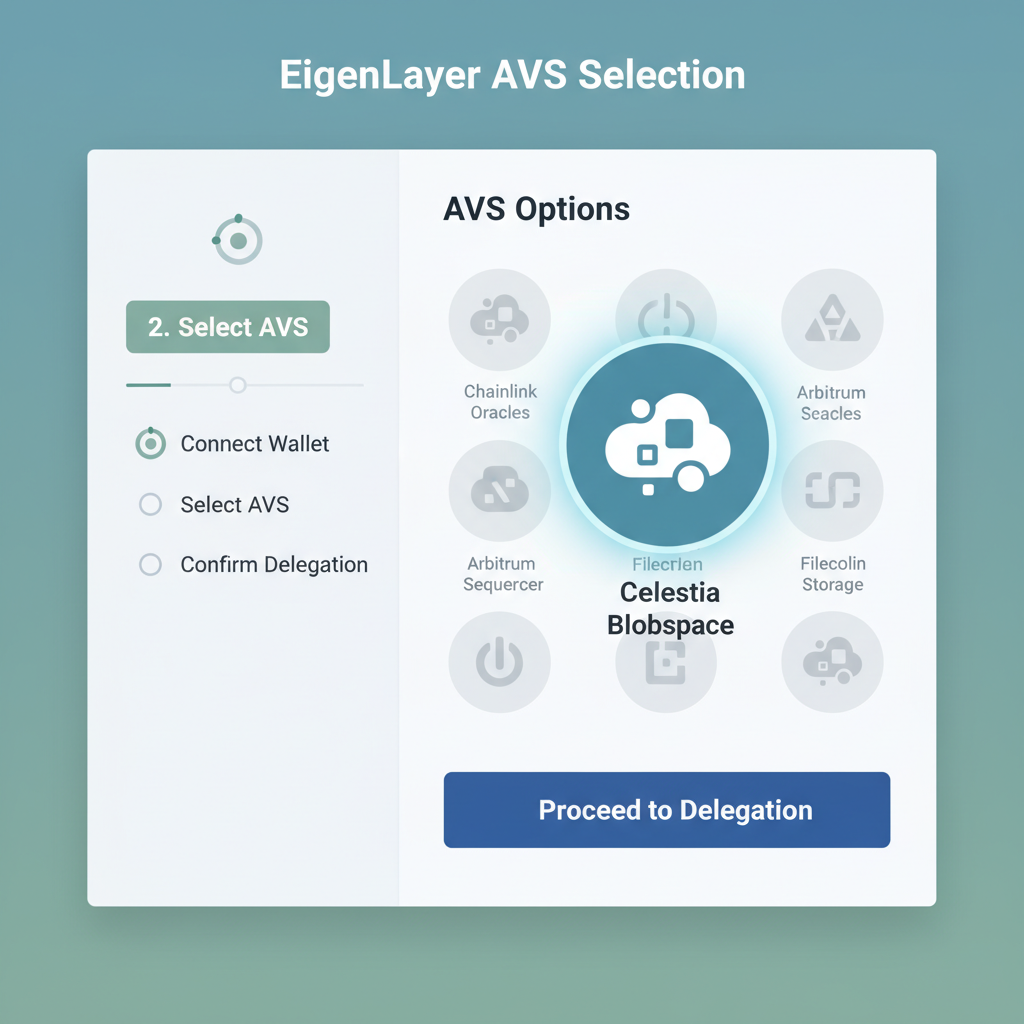

EigenLayer’s Restaking Revolution Meets DA Layers

EigenLayer transforms Ethereum’s staked ETH into a shared security powerhouse, powering Actively Validated Services (AVSs) like EigenDA. Restakers opt-in to secure external networks, earning blended APRs projected at 10-12% as slashing activates and more AVSs launch. Slashing live since late 2025 enforces accountability, tilting risk-reward favorably for sophisticated operators.

EigenDA, as the flagship AVS, posts data on Ethereum blobs while offloading verification to restaked validators. This hybrid model blends Ethereum’s liquidity with modular efficiency, but Celestia’s pure-play blobspace often undercuts costs. The real innovation? Cross-protocol restaking, where operators allocate to Celestia blobspace via EigenLayer wrappers, diversifying slash risks across DA layers.

With over a decade in digital assets, I’ve seen restaking evolve from experimental to essential. EigenLayer’s model isn’t flawless, correlation risks loom if Ethereum falters, but its operator diversity and yield bootstrapping make it indispensable for EigenLayer DA restaking.

Synergies Unlocked: Restaking Celestia Blobspace via EigenLayer

Integrating Celestia’s blobspace with EigenLayer isn’t additive; it’s multiplicative. Validators restake ETH to secure Celestia namespaces, earning dual yields: native TIA rewards plus EigenLayer points or AVS fees. Projections show blobspace yield optimization pushing total APRs beyond traditional staking, especially as Ginger enables 1GB blocks.

Picture this: a high-frequency trading rollup posts terabytes daily to Celestia blobs, verified by EigenLayer-rested nodes. Costs plummet 90% versus Ethereum L1, security scales with $50B and restaked ETH, and yields flow to participants. Enterprise builders favor this stack for sovereign chains, per modular architecture guides, blending Celestia’s DA with EigenLayer’s consensus.

Operators gain exposure to Celestia’s surging blobspace demand without forking new capital, a boon as TIA holds at $0.3380 despite market volatility. This setup mitigates single-protocol risks, blending Celestia’s cost leadership with EigenLayer’s economic security.

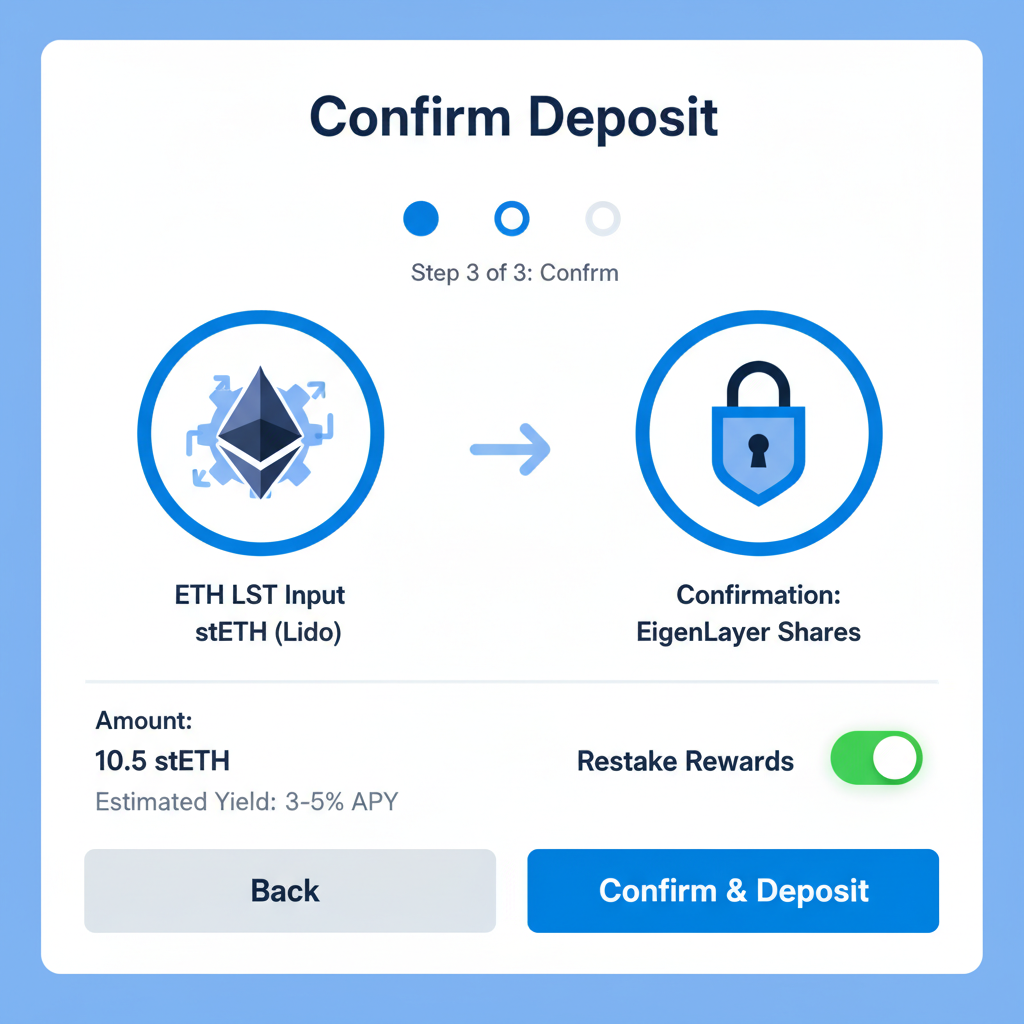

Hands-On Implementation: Step-by-Step Celestia EigenLayer Restaking

Getting started demands precision, not haste. First, grasp prerequisites: an Ethereum wallet with staked ETH or LSTs like stETH, familiarity with EigenLayer’s dashboard, and TIA for gas on Celestia if bridging. The process routes restaked assets to secure Celestia namespaces via AVS integrations, now maturing post-Ginger.

Post-delegation, track performance via EigenLayer analytics. Yields accrue from blob posting fees, shared proportionally among operators based on stake weight. As Fibre deploys, expect namespace auctions to heat up, rewarding early allocators with premium bandwidth slices.

Yield Optimization Checklist for 2026

Maximizing returns in blobspace yield optimization hinges on disciplined strategies. Diversify across AVSs to cap correlated slashing at 5-10% of portfolio. Monitor TIA’s $0.3380 price against blob utilization rates; spikes signal rotation opportunities. Rebalance quarterly as new DA competitors like Avail erode edges.

Advanced players layer Symbiotic for permissionless restaking, comparing security models head-to-head with EigenLayer. Blended APRs could hit 15% if 1TB/s Fibre materializes, but anchor expectations to proven 10-12% baselines. My take: prioritize operator uptime above 99.5%, as downtime slashes earnings faster than market dips.

Navigating Risks in Modular Restaking

No yield comes gratis. EigenLayer’s slashing, live since 2025, introduces real teeth: faulty attestations on Celestia blobs trigger penalties up to 50% of stake. Correlation remains the silent killer; Ethereum congestion cascades to restaked DA, inflating costs. Celestia’s sovereign model dodges this somewhat, yet TIA’s $0.3380 valuation reflects blobspace bets amid three-way DA wars.

Avail’s lightweight sampling tempts defectors, EigenDA clings to Ethereum liquidity. Celestia counters with raw throughput, 40x Ethereum blobs, ideal for rollups like high-frequency DeFi. Investors: stress-test via simulations, allocate no more than 20% to any DA layer. Data-driven? EigenLayer’s TVL crossed $50B, underscoring conviction despite risks.

For enterprises, this stack shines in sovereign rollups: post governance data to Celestia cheaply, secure via EigenLayer, scale to 1GB blocks. Gaming dApps posting real-time states benefit most, costs dropping 90% versus L1 alternatives. As modular blockchains proliferate, modular blockchain restaking becomes table stakes.

Looking ahead, 2026 pivots on Fibre’s rollout and AVS proliferation. If Celestia captures 40% DA market share, TIA breaks higher from $0.3380, yields follow. Operators blending protocols astutely will thrive, turning infrastructure into alpha. This Celestia EigenLayer guide 2026 equips you to lead, not follow, the modular surge.