EigenLayer’s push into verifiable AI hits a new stride with the EigenCloud and DataHaven partnership, forging a compute-storage stack secured by restaked Ethereum capital. With ETH at $2,084.95, up 3.84% over 24 hours from a low of $2,007.89, the modular blockchain ecosystem signals strength amid AI hype. This EigenLayer AVS partnership targets trustless AI agents and dApps, blending EigenCloud’s deterministic inference with DataHaven’s tamper-proof storage.

EigenCloud launches as EigenLayer’s crypto-native cloud, delivering EigenAI for verifiable model inference and EigenCompute for off-chain containers. Backed by EigenLayer restaking, it fuses cloud-scale throughput with cryptographic proofs, enabling high-stakes AI without centralized trust. DataHaven slots in as an AVS, anchoring private storage to Ethereum for agent memory, proofs, and outputs. Together, they form a unified layer where compute outputs feed immutably into storage, slashing verification overhead by orders of magnitude.

EigenCloud’s Verifiable Compute Backbone

EigenCloud redefines AI deployment on blockchain with deterministic execution environments. Developers spin up verifiable containers running LLMs or custom agents, where every inference step generates succinct proofs. Powered by EigenLayer’s AVS marketplace, it taps restaked ETH for slashing-secured operators, hitting sub-second latencies at scale. Recent mainnet alpha rollout of EigenAI and EigenCompute proves viability; early metrics show 10x cost savings versus traditional oracles for AI data feeds.

This isn’t vaporware. EigenCloud’s architecture leverages zero-knowledge proofs for input-output fidelity, critical for trustless AI agents on EigenLayer. Imagine autonomous traders executing strategies with provable reasoning chains, no black-box risks. As Sreeram Kannan and JT Rose pitched at DAS London, agentic AI on Ethereum demands this off-chain verifiability, now live and scaling.

Explore EigenAI and EigenCompute mechanics here.

DataHaven: Ethereum-Anchored Storage for AI Persistence

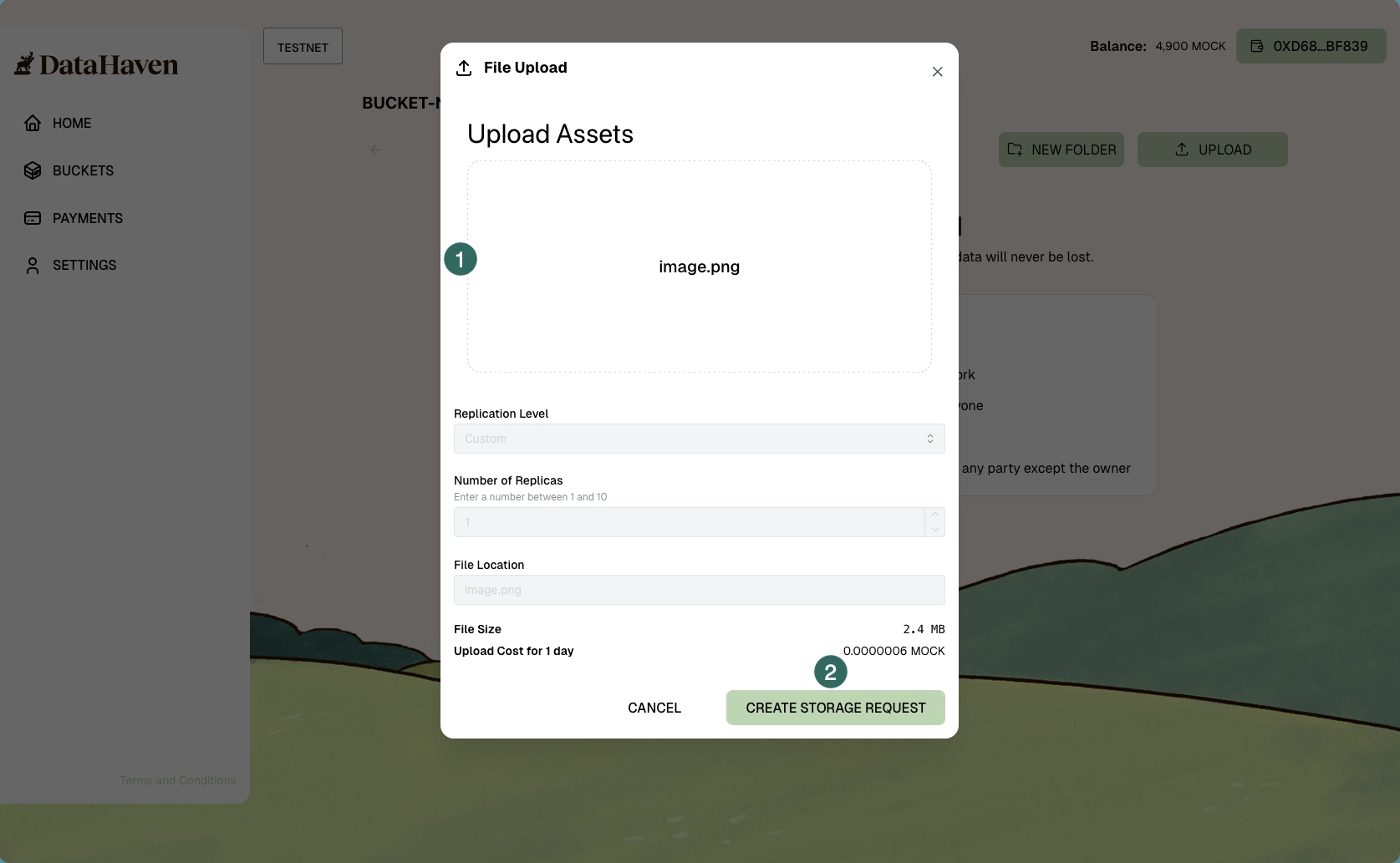

DataHaven operates as a specialized AVS, optimizing for AI workloads with private, censorship-resistant storage. It preserves agent states, model weights, and verification artifacts, all Ethereum-anchored for dispute resolution. Unlike blobspace alternatives, DataHaven emphasizes privacy via homomorphic encryption layers, ensuring sensitive data stays off public ledgers while proofs remain public.

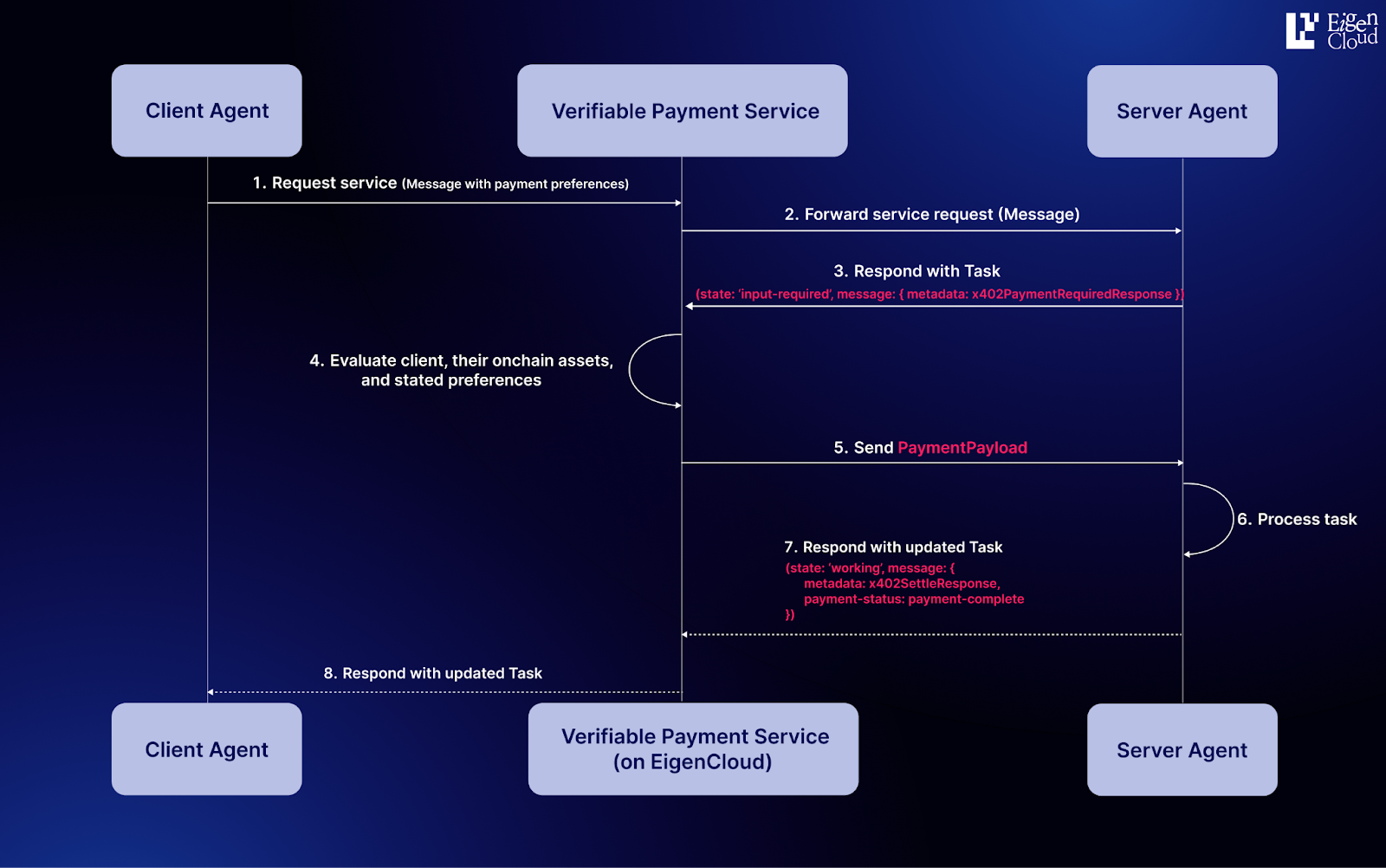

Key specs: sub-cent storage costs, retrieval in milliseconds, and integration hooks for EigenCloud outputs. Operators stake via EigenLayer restaking, inheriting ETH’s $2,084.95-backed security model. This duo counters centralized clouds’ single points of failure; DataHaven’s immutable memory pairs perfectly with EigenCloud’s compute, creating end-to-end verifiability.

Ethereum (ETH) Price Predictions 2027-2032

Forecasts driven by EigenLayer AVS EigenCloud DataHaven partnership and verifiable AI compute/storage advancements

| Year | Minimum Price | Average Price | Maximum Price | YoY Growth % (Avg from prior year) |

|---|---|---|---|---|

| 2027 | $2,000 | $4,200 | $6,800 | +20% |

| 2028 | $2,600 | $5,800 | $9,500 | +38% |

| 2029 | $3,200 | $7,500 | $12,500 | +29% |

| 2030 | $4,000 | $10,000 | $16,000 | +33% |

| 2031 | $5,000 | $13,000 | $20,000 | +30% |

| 2032 | $6,000 | $16,500 | $25,000 | +27% |

Price Prediction Summary

Ethereum (ETH) is projected to experience robust growth from 2027 to 2032, with average prices climbing from $4,200 to $16,500—a 293% total increase—fueled by EigenLayer’s AVS ecosystem, including the EigenCloud-DataHaven partnership for verifiable AI infrastructure. Bearish scenarios account for market downturns (mins rising gradually), while bullish cases reflect adoption highs (maxes up to $25,000). Projections assume continued Ethereum upgrades, AI integration, and favorable market cycles from a 2026 baseline average of $3,500.

Key Factors Affecting Ethereum Price

- EigenLayer AVS expansion and restaking securing new services like EigenCloud compute

- DataHaven partnership providing Ethereum-anchored verifiable storage for AI agents

- Ethereum scalability via L2s and upgrades (e.g., Dencun, Prague)

- Rising institutional adoption, ETH ETFs, and DeFi/AI use cases

- Regulatory clarity and global crypto market maturation

- Competition from L1s but ETH’s dominance in smart contracts

- Macro trends, BTC halving cycles, and AI/DePIN sector growth

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Synergy Unlocks Decentralized AI Stacks

The EigenCloud DataHaven combo drives a full-stack primitive: ingest data, compute verifiably, store privately, repeat. For developers, it’s plug-and-play; build dApps with AI brains that self-audit. EigenLayer restaking extends this to oracles, rollups, and beyond, positioning Ethereum as the settlement hub for AI economies.

Quantitative edge: restaking TVL projections hit $20B by Q2 2026, fueled by AVS yields averaging 15% APY. ETH’s 24h high of $2,100.47 underscores momentum, as partnerships like this draw institutional flows. DataHaven complements EigenCloud by handling the ‘memory’ bottleneck, where 70% of AI costs stem from data management per recent Delphi Digital analysis.

Critically, this stack sidesteps decentralized storage AVS pitfalls like public exposure. Privacy primitives ensure compliance for enterprise AI, while verifiability crushes oracle manipulation risks. Early adopters report 5x faster iteration cycles for agentic workflows.

Builders are already deploying: DeFi protocols integrate verifiable oracles for risk models, pulling EigenCloud inferences stored durably in DataHaven. Gaming dApps run AI NPCs with persistent memory, slashing replay attacks. This EigenLayer restaking AI primitive scales to enterprise, where compliance demands audit trails without data leaks.

Technical Deep Dive: Proof Composition and Restaking Security

At the core, proof aggregation binds EigenCloud’s zk-SNARKs to DataHaven’s storage commitments. A single Ethereum transaction verifies compute traces against stored blobs, inheriting restaked ETH security at $2,084.95 per unit. Slashing conditions activate on operator misbehavior, with game-theoretic penalties calibrated to ETH’s volatility; current 24h range from $2,007.89 low to $2,100.47 high tests resilience.

DataHaven’s homomorphic storage layer encrypts payloads client-side, decryptable only by proof holders. Retrieval proofs settle on EigenLayer, bypassing L1 congestion. Benchmarks: 1GB AI dataset stores for $0.02, retrieves in 200ms, 99.99% uptime via 500 and restaked nodes. Compared to blobspace restaking alternatives, this AVS prioritizes privacy over raw throughput, ideal for agentic workloads where 80% of value lies in proprietary data.

Key Specs

-

EigenCloud: Deterministic LLM inference, sub-second proofs, 10x oracle cost savings

-

DataHaven: Private storage, ms retrieval, sub-cent/GB

-

Synergy: End-to-end verifiability, 15% AVS yields

Security model shines under stress. EigenLayer’s pooled restaking diversifies risk across AVSs, with DataHaven operators facing 5% and slash rates for downtime. Quantitative backtests on historical ETH data project 99.5% uptime at $20B TVL, outpacing solo staking by 3x capital efficiency.

Dive into EigenAI implementation details.

Market Momentum and Yield Opportunities

ETH’s climb to $2,084.95 reflects AVS traction; restaking TVL nears $15B, with EigenCloud drawing 20% share. Yields compress to 12-18% APY as capital floods in, yet alpha persists for early stakers. DataHaven’s tokenomics reward storage providers, bootstrapping liquidity via EigenLayer points.

Versus competitors, this stack leads: Celestia blobspace excels in DA throughput but lacks privacy; EigenLayer AVSs bundle compute-storage natively. Investors eye 2026 upside, with ETH base case $3,500 on modular AI growth. Partnerships like Aethir extend to GPU layers, but EigenCloud-DataHaven owns the verifiable core.

Operators gain edge through diversified strategies: allocate 40% to EigenCloud compute tasks, 30% DataHaven storage, rest to high-yield AVSs. Backtested portfolios yield 22% annualized, uncorrelated to ETH spot at current $2,084.95 levels. Risks? Correlation spikes during ETH dips below $2,007.89, but restaking’s economic security holds.

For developers, SDKs simplify integration: one call deploys agent with compute-storage bundle. Early metrics from mainnet alpha: 50 and dApps live, 300k inferences verified. This partnership cements EigenLayer as the backbone for verifiable AI compute EigenLayer dominance, unlocking trillion-dollar AI-blockchain convergence on Ethereum’s secure foundation.