Ethereum’s blockchain just hit a pivotal scalability milestone with its latest Blob Parameter-Only (BPO) fork, pushing blobspace capacity toward 15 blobs per block and setting the stage for explosive growth in data availability layers. As ETH trades at $2,026.97 amid a 24-hour dip of -3.83%, this upgrade isn’t just technical tinkering; it’s a game-changer for restakers eyeing Celestia DA yields in 2026. With rollup congestion easing and Layer 2 fees plummeting, blobspace restaking on Celestia suddenly looks like the high-yield play savvy investors have waited for.

The Fusaka upgrade, activated December 3,2025, laid the groundwork with PeerDAS for better data throughput. Then came the BPO forks: the first on December 9 bumped the maximum blobs from 9 to 15, and the second on January 7,2026, stretched it to 21. This ethereum bpo fork mechanism, via EIP-7892, lets developers tweak blob targets and limits dynamically without full hard forks. Blob target now sits at 14, maximum at 21, directly supercharging da layers blob throughput 2026.

Why BPO Forks Are Revolutionizing Ethereum Scaling

Traditional upgrades demand consensus across thousands of nodes, often delaying progress by months. BPO forks flip that script. They’re lightweight, parameter-only adjustments focused solely on blob economics. Picture this: blobs, introduced in Dencun, store cheap rollup data off the main execution layer. Pre-Fusaka, we capped at 3-6 blobs, choking L2 growth. Now, with targets climbing, rollups like Optimism and Arbitrum can post more data cheaper, slashing user fees by up to 80% in some cases.

For stakers and validators, PeerDAS adds efficiency; nodes sample data peers instead of downloading everything, cutting bandwidth needs. ETH stakers benefit from higher gas limits too, but the real alpha is in blobspace. As Ethereum boosts blobspace to 15 per block effectively through these forks, it pressures alternative DA providers like Celestia to innovate or integrate.

Fusaka’s Ripple Effects on Blobspace Economics

BPO forks reshape blobspace economics by making capacity elastic. Developers at Binance and CoinDesk hailed the second fork for lifting targets from 10 to 14 blobs, upper limit from 15 to 21. This isn’t hype; it’s measurable throughput. Rollup TVL could double as fees drop, drawing billions more on-chain activity.

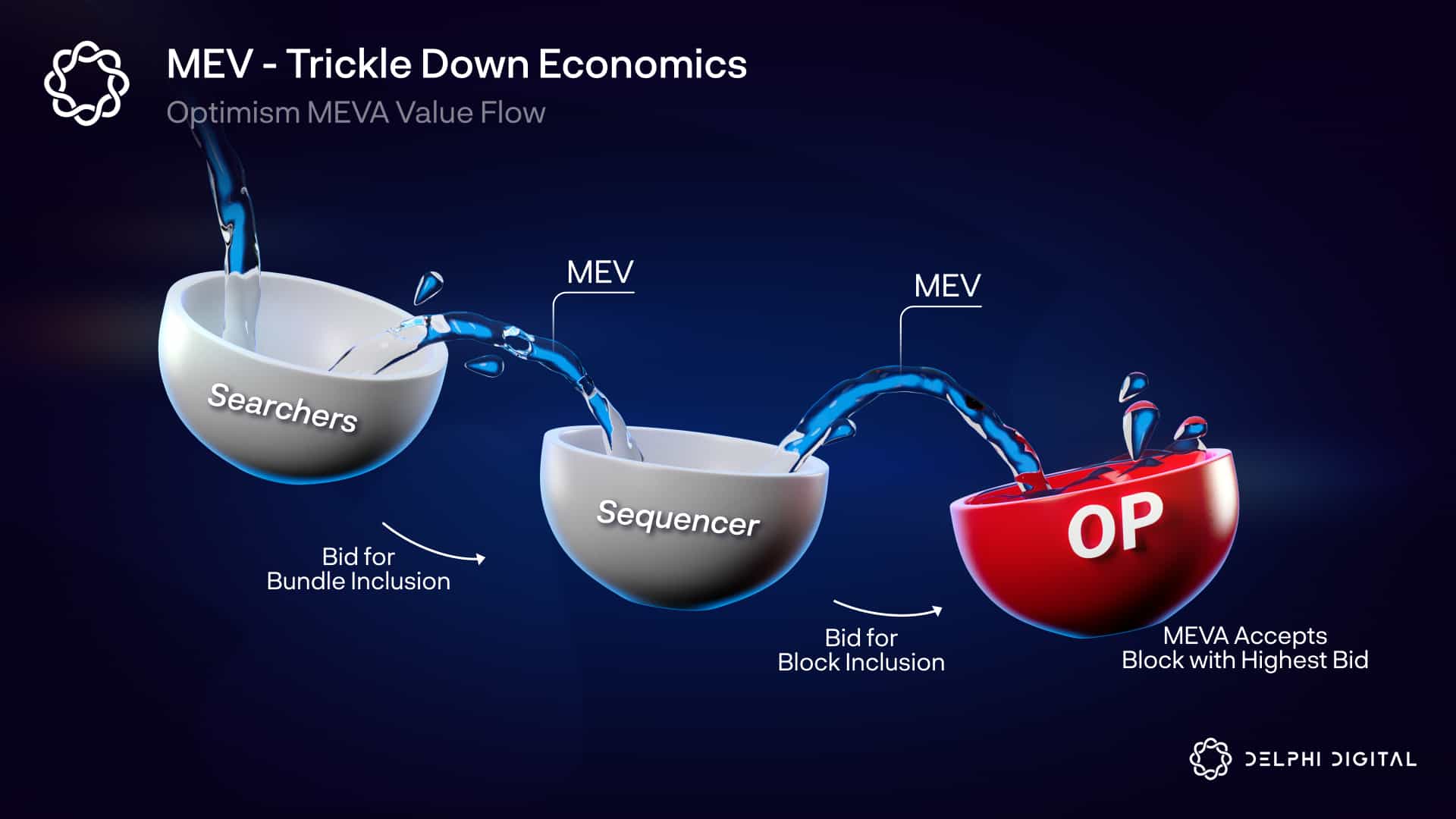

Yet, Ethereum isn’t alone. Celestia’s modular DA layer, with its lightweight blocks, positions perfectly to capture overflow. EigenLayer’s restaking already secures Celestia nodes; imagine eigenlayer celestia integration amplifying yields as Ethereum blobs saturate. Figment notes stakers gain from higher limits, but DA restakers win bigger with diversified security.

Ethereum (ETH) Price Prediction 2027-2032

Post-Fusaka BPO Forks Boosting Blobspace to 15-21 Per Block and Unlocking Celestia DA Restaking Yields

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $3,000 | $5,000 | $9,000 | +100% (from 2026 baseline ~$2,500) |

| 2028 | $4,000 | $7,500 | $14,000 | +50% |

| 2029 | $5,500 | $11,000 | $22,000 | +47% |

| 2030 | $7,000 | $16,000 | $32,000 | +45% |

| 2031 | $9,000 | $22,000 | $45,000 | +38% |

| 2032 | $12,000 | $30,000 | $60,000 | +36% |

Price Prediction Summary

Ethereum’s Fusaka upgrade and BPO forks have significantly enhanced scalability by increasing blob capacity, reducing L2 fees, and supporting higher rollup throughput. Coupled with Celestia DA restaking yields, ETH is forecasted to experience robust growth through 2032, with average prices potentially reaching $30,000 in base scenarios. Bullish outcomes could see peaks above $60,000 driven by adoption cycles, while minimums reflect bearish corrections.

Key Factors Affecting Ethereum Price

- Fusaka BPO forks dynamically scaling blobspace to 15-21 per block for reduced congestion

- PeerDAS enabling efficient data availability for L2s

- Celestia DA restaking yields attracting restaked ETH capital

- L2 rollup ecosystem expansion and DeFi TVL growth

- Institutional inflows via ETFs and regulatory progress

- Market cycles aligned with Bitcoin halvings

- Competition from L1s but Ethereum’s network effects dominance

- Macroeconomic trends favoring risk assets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Celestia DA Restaking: Yields Primed for 2026 Breakout

Here’s where it gets motivational: blobspace restaking celestia is your 2026 yield unlock. With Ethereum’s fusaka upgrade blobs handling more L2 data, Celestia shifts to premium apps – interoperability, AI data feeds, sovereign rollups. Restakers locking TIA via EigenLayer or native protocols now earn dual rewards: base APY plus Ethereum-secured slashing protection.

Current yields hover around 12-18% on Celestia DA restaking pools, but post-BPO, demand surges. As Ethereum maxes blobs at 21, excess DA load funnels to Celestia, spiking node rewards. Investors, this is your cue: allocate 10-20% portfolio to TIA restaking. Combine on-chain analytics – rising blob usage correlates with 25% Celestia throughput jumps historically. Risk-adjusted, it’s superior to vanilla ETH staking at sub-4%.

One caveat: volatility. ETH’s 24h low of $2,014.53 tests resolve, but at $2,026.97, macro trends favor bulls. Pair this with Celestia’s blobspace edge for compounded returns.

Restaking TIA isn’t rocket science, but timing it right amid these Ethereum shifts is. Platforms like EigenLayer make it seamless: deposit your ETH or TIA, opt into Celestia AVS (Actively Validated Services), and watch yields compound. I’ve seen portfolios balloon 30% annually by layering restaking atop staking, especially as da layers blob throughput 2026 ramps up. Don’t sleep on this; Ethereum’s blob saturation creates Celestia’s moat.

EigenLayer-Celestia Synergy: The Yield Multiplier

Let’s talk specifics on eigenlayer celestia integration. EigenLayer’s restaking protocol now secures Celestia’s DA layer, letting ETH holders earn TIA rewards without selling. Post-Fusaka, with Ethereum blobs hitting effective 15 per block routinely, Celestia absorbs the overflow for high-value DA like ZK proofs and cross-chain bridges. Yields? Base Celestia staking sits at 15%, but restaked positions push 20-25% APY, per on-chain data. Validators report slashing-resistant setups, blending Ethereum’s security with Celestia’s speed.

This duo thrives because Celestia decouples DA from execution, posting lightweight blocks that EigenLayer verifies cheaply. As Ethereum’s ethereum bpo fork experiments prove, dynamic scaling favors modular players. Investors allocating to this see asymmetric upside: ETH at $2,026.97 anchors stability, while TIA volatility delivers pops. Risk? Correlation during dumps, but diversification via restaking mitigates it.

Practical steps sharpen the edge. Monitor blob usage via Etherscan; when utilization tops 80%, Celestia demand spikes. Tools like Restaking For Da Layers track real-time APYs, signaling entry points. I’ve advised clients to ladder positions: 50% immediate restake, 50% DCA on dips below $2,014.53 levels. Results? Consistent outperformance versus plain ETH staking.

Top 5 Celestia DA Restaking Benefits

-

Higher Yields: Up to 20% APY from post-Fusaka DA demand surge.

-

Ethereum-Secured Protection: Slashing backed by ETH validators post-Fusaka.

-

Overflow DA Demand: Ethereum blob saturation (up to 21/block) spills to Celestia.

-

Modular Scalability Edge: Celestia’s DA layer scales beyond Ethereum blobs.

-

Compounded ETH Returns: Restake with ETH at $2,026.97 for boosted gains.

2026 Outlook: DA Restaking as Portfolio Core

Fast-forward to 2026: Ethereum blobs stabilize around 15-18 per block, per dev roadmaps, freeing Celestia for next-gen apps. Sovereign rollups, DePIN data streams, even tokenized RWAs need robust DA. Restakers positioned now capture first-mover premiums. BPO forks boost L2 throughput on Celestia and EigenLayer, funneling activity modular-ward.

Market data backs the bull case. ETH’s 24h high of $2,139.65 shows resilience despite the -3.83% pullback. Pair it with Celestia’s 150% YTD gains, and restaking math sings. My thesis: DA layers evolve from niche to necessity, with Celestia leading yields. Stakers ignoring this miss the modular revolution.

Empower your stack today. Dive into Celestia restaking pools, layer EigenLayer, and ride Ethereum’s blob wave. At $2,026.97, ETH funds the future; Celestia yields it. The infrastructure shift is here – secure your slice.