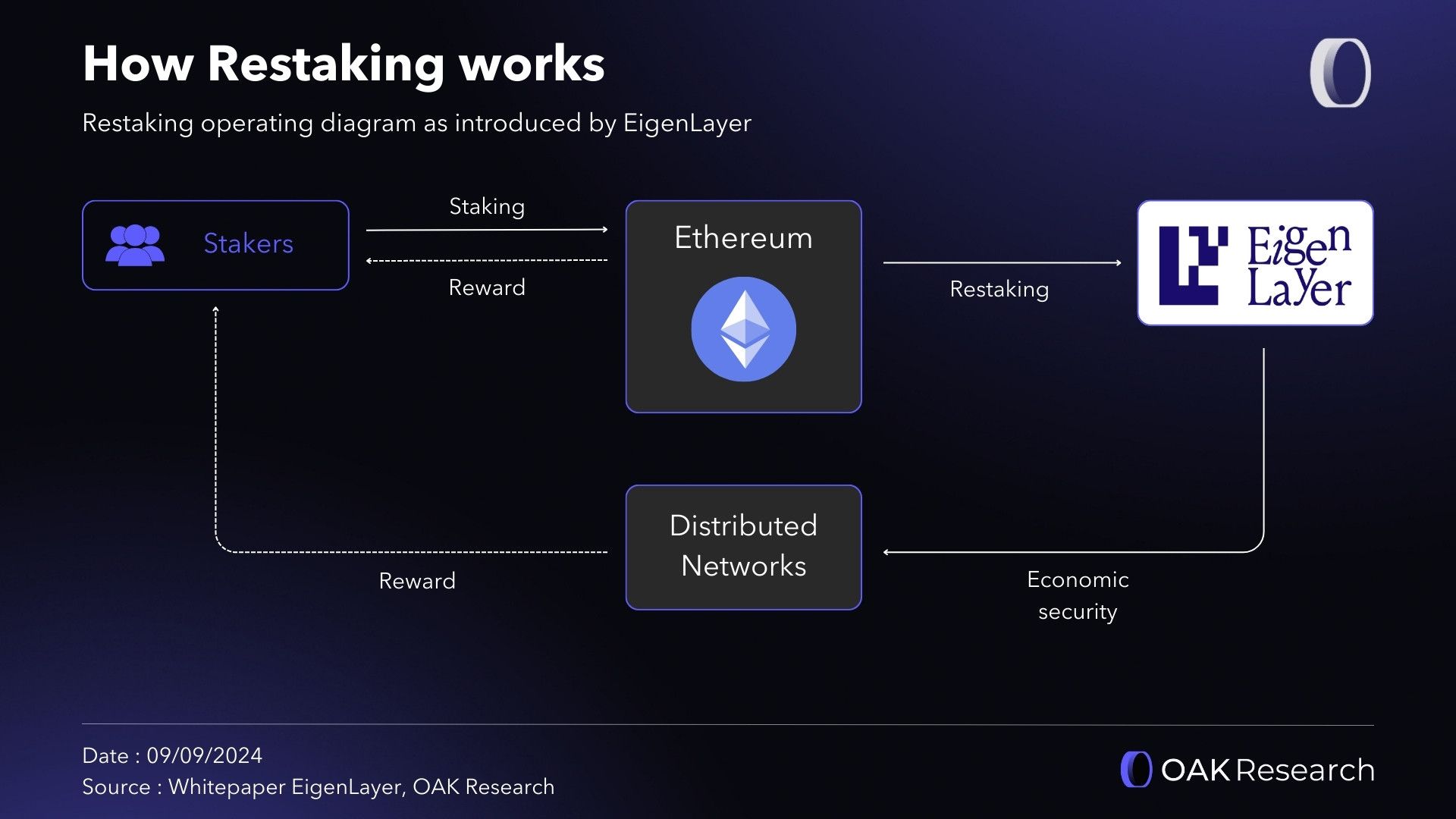

Imagine a world where your restaked assets power not just security, but the very backbone of data availability at modular blockchain scalability levels we’ve only dreamed of. Enter EigenDA’s PeerDAS upgrade, a game-changer set to supercharge blobspace restaking Celestia and EigenLayer integrations in 2025. As Ethereum’s Fusaka upgrade lights up on December 3, this Peer Data Availability Sampling tech slashes bandwidth needs, multiplies blob throughput up to 8x, and opens floodgates for L2 rollups hungry for cheap, abundant space.

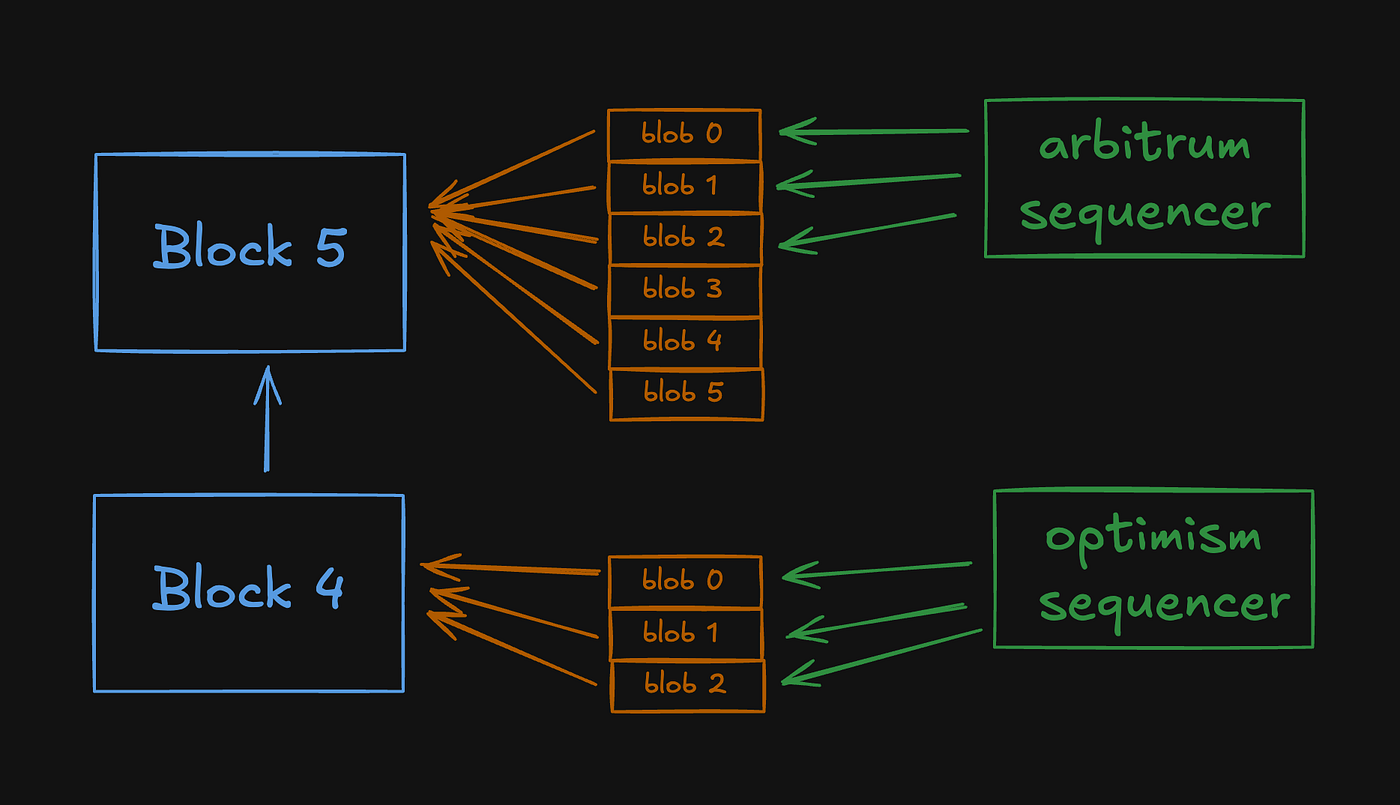

Restakers, this isn’t hype; it’s the tide turning toward explosive yields. EigenLayer’s middleware genius already lets staked ETH secure multiple networks, but PeerDAS takes it further by letting nodes sample data proofs instead of hoarding full blobs. Validators breathe easy, hardware stays lean, and rollups like those on Optimism scale without breaking the bank. With $37B already locked in rollup security, PeerDAS targets 48 blobs, stabilizing fees and fueling user activity.

EigenDA PeerDAS: The Scalability Engine Ignites

Dive deeper into EigenDA PeerDAS, EigenLayer’s native DA protocol evolving fast. Announced expansions support native token restaking for L2s, and now PeerDAS leverages sampling to verify availability without the full download grind. Picture this: Ethereum’s Fusaka hard fork, post-Pectra, activates PeerDAS, reducing resource usage while bloating blobspace capacity. Node operators win with simpler ops; L2s get cheaper, faster txs. EigenDA even offers one-click rollup deploys, pulling in players like Celo transitioning to modular stacks.

PeerDAS multiplies blob throughput, potentially 8x, transforming L2 scalability overnight.

For EigenLayer users farming EIGEN points via LSTs and AVSs, this means maximized rewards in 2025. Restake smarter, secure DA services, and ride the points wave toward airdrops. It’s practical power: less data load equals more efficient security sharing across chains.

Celestia Matcha Meets EigenLayer: Blobspace Synergy Unleashed

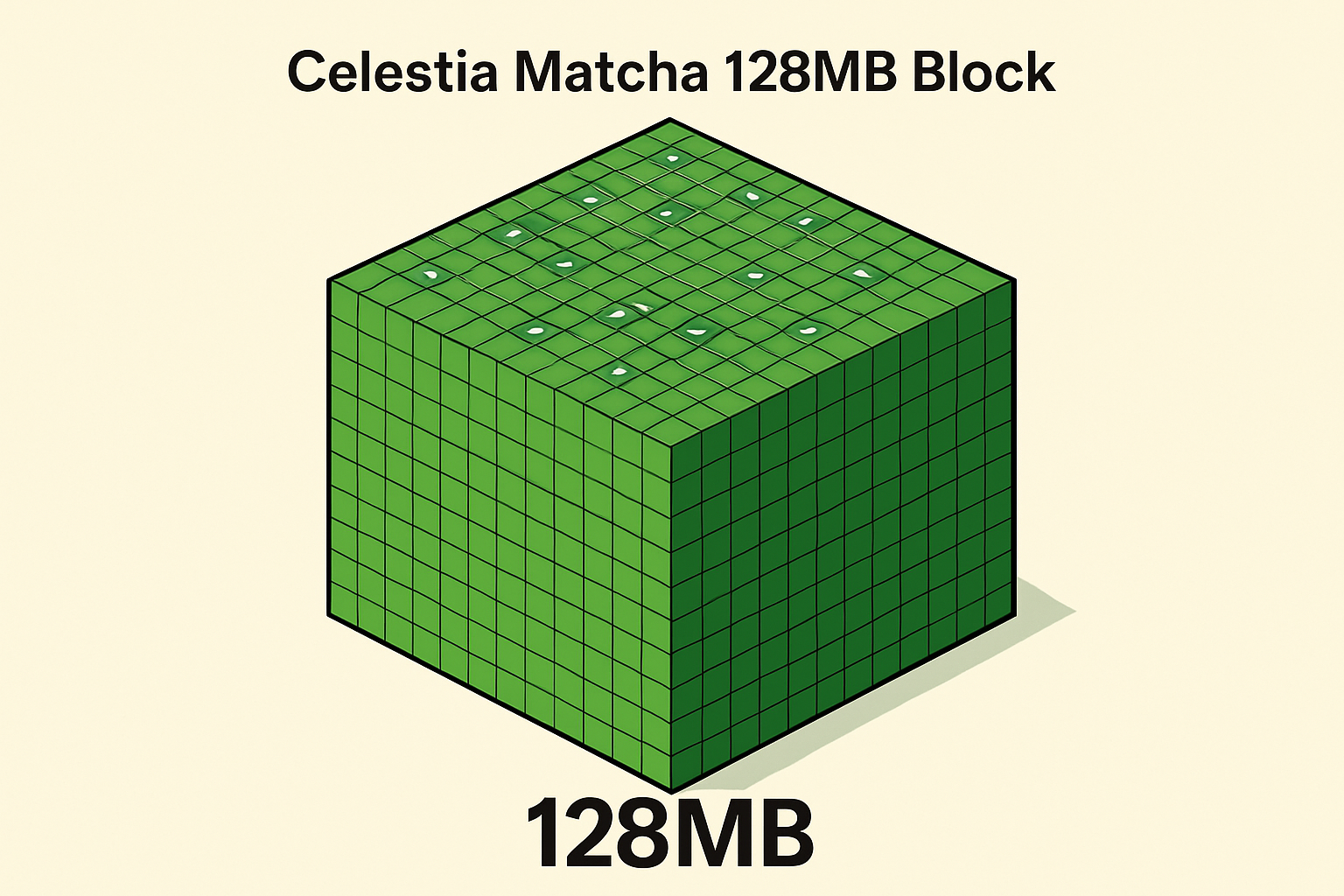

Now layer in Celestia’s Matcha upgrade, bumping blocks to 128MB while curbing inflation. This duo with PeerDAS crafts a restaking powerhouse for EigenLayer DA restaking 2025. Celestia handles sovereign rollups; EigenDA secures them via restaked ETH. Blobspace becomes the contested arena, where providers stake for DA yields. Check out how EigenLayer restaking arms Celestia blobspace providers at this guide.

Modular chains thrive here. PeerDAS eases Ethereum’s blob params via lightweight forks, per Markets. com insights, fitting Ethereum’s long-term roadmap. TradingView notes Fusaka as the second 2025 fork, priming for Prague/Electra in Q2. Kiln. fi and Figment echo: sampling scales without validator pain. QuickNode adds fee stability, perfect for sustained growth.

PeerDAS & Matcha Key Wins

-

8x Blob Throughput: Supercharge L2 scalability with PeerDAS sampling for massive data gains.

-

128MB Celestia Blocks: Matcha upgrade unlocks huge blocks, fueling modular chain growth.

-

Reduced Bandwidth: Verify data availability smartly—less load, more efficiency for nodes.

-

Lower L2 Costs: Slash fees and ops expenses, making rollups cheaper and faster.

-

Enhanced Restaking Yields: Boost EigenLayer rewards via optimized blobspace security.

-

Modular Security Boost: Restake assets for ironclad protection across ecosystems.

Fusaka Upgrade Blobs: Fueling the Restaking Boom

Fusaka upgrade blobs optimization isn’t just Ethereum housekeeping; it’s rocket fuel for restakers. By Q4 2025, with Fusaka live, expect blob targets soaring, data loads plummeting. EigenDA expands here, supporting rollups with one-click EigenDA deploys. Bitrue’s take on 2025 rewards? Optimize LST/AVS participation now to farm those points.

Everstake nails EigenLayer’s restaking core: reuse staked ETH across networks. PeerDAS amplifies this for DA, making blobspace restaking a yield magnet. Optimism’s $37B rollup TVL screams demand for low-cost space. As Fidelity’s 2025 report hints, PeerDAS rolls post-Prague/Electra, cementing 2026 dominance. Restakers, position early: secure DA, scale L2s, and capture the modular surge.

This fusion enhances scalability, bolsters security via shared stakes, and trims costs for rollup crews. It’s the practical path to thriving in decentralized infra.

Smart restakers are already pivoting portfolios toward DA services, locking in yields before the blobspace rush hits peak velocity. EigenLayer’s AVS participation lets you deploy capital across EigenDA and Celestia integrations, turning idle stakes into multi-layered income streams. Picture farming EIGEN points while securing blob throughput; it’s not passive income, it’s active momentum capture.

Practical Plays: Restaking Strategies for 2025 DA Yields

Let’s get tactical. Start by optimizing LSTs like stETH or cbETH on EigenLayer, channeling them into EigenDA AVSs. With PeerDAS slashing bandwidth, DA operators need less hardware firepower, lowering entry barriers for node runners. Pair this with Celestia’s Matcha: 128MB blocks mean more data slots for rollups, and restakers bidding via EigenLayer snag premium yields. Dive into blobspace auctions shaping DA economics at this deep dive.

Target Celo’s EigenDA shift or Optimism’s rollup stack; one-click deploys make it developer-friendly. Validators post-Fusaka handle 48-blob targets effortlessly, stabilizing fees for sustained L2 traffic. My hybrid scan? Sentiment spikes on TradingView signal EIGEN momentum, blending with technical breakouts. Ride it: allocate 20-30% of your restake bag to DA-specific AVSs now, rebalance quarterly as Prague/Electra primes PeerDAS for 2026.

Costs drop, security scales, and yields compound. Bitrue’s 2025 guide nails it: max points via active participation, eyeing airdrops. This isn’t speculation; it’s engineered edge in modular blockchain scalability.

Market Projections: Blobspace Boom Metrics

EigenLayer (EIGEN) Price Prediction 2026-2031

Post-PeerDAS Upgrade and Fusaka: Scaling Blobspace Restaking for Celestia and EigenLayer

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2026 | $12.00 | $30.00 | $55.00 | +150% |

| 2027 | $20.00 | $50.00 | $90.00 | +67% |

| 2028 | $30.00 | $75.00 | $140.00 | +50% |

| 2029 | $40.00 | $105.00 | $200.00 | +40% |

| 2030 | $60.00 | $150.00 | $280.00 | +43% |

| 2031 | $90.00 | $210.00 | $380.00 | +40% |

Price Prediction Summary

EIGEN is forecasted to see robust growth from 2026-2031, fueled by PeerDAS blob throughput expansion (up to 8x), Celestia Matcha upgrade, and surging restaking TVL on EigenLayer amid Ethereum’s Fusaka scalability boost. Base case average rises from $30 to $210, with bullish highs over $380 by 2031, accounting for market cycles, L2 adoption, and regulatory factors.

Key Factors Affecting EigenLayer Price

- PeerDAS upgrade scaling blobspace and reducing validator bandwidth in 2026

- Ethereum Fusaka upgrade enabling higher blob targets and L2 growth

- Celestia Matcha upgrade increasing block sizes to 128MB for modular chains

- EigenLayer restaking TVL expansion and AVS rewards/aidrops

- Broader L2/rollup adoption driving demand for EigenDA

- Crypto market cycles with potential 2025-2026 bull run

- Regulatory developments and competition in restaking protocols

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Expect blobspace TVL to balloon as $37B rollup security hunts cheap DA. PeerDAS’s 8x throughput multiplier, per Kiln. fi, funnels Ethereum traffic without validator burnout. Figment highlights hardware relief; QuickNode promises fee floors. Celestia’s inflation curb pairs perfectly, creating a yield flywheel. Restakers securing both? You’re the infrastructure kings of 2026.

EigenLayer Technical Analysis Chart

Analysis by Nina Bartlett | Symbol: BINANCE:EIGENUSDT | Interval: 4h | Drawings: 8

Technical Analysis Summary

Aggressively mark the sharp downtrend from the post-Fusaka hype peak at $4.00 on Nov 28 using a red downtrend_line connecting 2025-11-28 high to today’s low at $3.60. Draw strong horizontal_line support at $3.50 (prior swing low) and resistance at $3.95 (recent breakdown level). Use fib_retracement from the Nov 25 low to Dec 3 high for pullback targets. Place long_position entry zone at $3.55 with arrow_mark_up, profit_target at $4.20 and stop_loss at $3.40. Vertical_line at Fusaka upgrade on Dec 3. Callout volume spike on downside and MACD bearish divergence. Rectangle consolidation pre-breakdown Nov 28-Dec 1. Overall, ride the dip for momentum bounce in line with EigenDA PeerDAS tailwinds.

Risk Assessment: high

Analysis: Volatile post-upgrade action with high reward potential on restaking narrative, but sharp downside momentum requires tight stops

Nina Bartlett’s Recommendation: Go aggressively long on this dip – ride the EigenDA wave to $4.50, high tolerance for the swing!

Key Support & Resistance Levels

📈 Support Levels:

-

$3.5 – Strong prior swing low coinciding with 0.618 fib retracement

strong -

$3.4 – Psychological and volume cluster support

moderate

📉 Resistance Levels:

-

$3.95 – Recent breakdown level from Dec 1 high

strong -

$4.2 – Next extension target post PeerDAS sentiment shift

moderate

Trading Zones (high risk tolerance)

🎯 Entry Zones:

-

$3.55 – Aggressive dip buy at support confluence with volume divergence

high risk -

$3.65 – Secondary entry on confirmed bounce above EMA

medium risk

🚪 Exit Zones:

-

$4.2 – Profit target at prior high extension

💰 profit target -

$3.4 – Tight stop below key support

🛡️ stop loss -

$4.5 – Aggressive stretch target on breakout

💰 profit target

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Climax volume on downside with divergence

Sellers exhausting, priming reversal

📈 MACD Analysis:

Signal: Bearish crossover but histogram contracting

Momentum fading, bullish divergence emerging

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Disclaimer: This technical analysis by Nina Bartlett is for educational purposes only and should not be considered as financial advice.

Trading involves risk, and you should always do your own research before making investment decisions.

Past performance does not guarantee future results. The analysis reflects the author’s personal methodology and risk tolerance (high).

| Upgrade | Key Impact | Restaking Opportunity |

|---|---|---|

| PeerDAS (EigenDA) | 8x blob throughput, sampling tech | DA AVS yields up 3-5x |

| Matcha (Celestia) | 128MB blocks, lower inflation | Blob provider staking premiums |

| Fusaka (Ethereum) | 48-blob target, reduced data load | L2 fee stability boosts volume |

This table crystallizes the synergy: each upgrade amplifies the others, turning restaking into a scalability multiplier. EigenLayer’s native token support expands L2 options, drawing Celo and beyond. Everstake’s restaking primer underscores the reuse magic; now DA layers it on.

Challenges? Sure, coordination risks in AVS slashing, but EigenLayer’s maturing contracts mitigate them. My take: overweight DA over general security AVSs. With Fusaka live December 3,2025, the window narrows. Deploy now, track via ethrestaking. com rollup lists, and watch modular chains redefine throughput.

The EigenDA PeerDAS upgrade isn’t a footnote; it’s the engine propelling blobspace restaking Celestia and EigenLayer DA restaking 2025 into overdrive. Position boldly, manage risks tightly, and harvest the tides of tomorrow’s decentralized data revolution.