In the modular blockchain landscape of 2025, EigenLayer restaking Celestia emerges as a cornerstone for blobspace restaking providers seeking secure DA yields. With Ethereum trading at $2,741.28 and Celestia at $0.560654 as of December 1, validators face a pivotal choice: leverage restaking to compound returns while bolstering data availability layers. EigenLayer’s protocol, securing roughly $19.5 billion in TVL, allows ETH stakers to extend their security to services like Celestia’s blobspace, creating layered yields that outpace traditional staking.

This synergy isn’t mere hype. Celestia blobspace providers, responsible for publishing and verifying rollup data, demand robust economic security. EigenLayer’s Actively Validated Services (AVS) framework steps in, enabling operators to restake LSTs or native ETH, earning premiums on top of base APYs. About one-quarter of staked ETH now flows through EigenLayer, signaling deep market trust despite risks like correlation slashing.

EigenLayer’s Restaking Backbone Meets Celestia DA

EigenLayer restaking Celestia integration transforms blobspace economics. Celestia, as a sovereign DA layer, offloads data posting from execution-heavy chains, slashing costs for L2s. Yet, its blobspace auctions require vigilant providers to prevent data withholding attacks. Enter EigenLayer: operators deposit into AVSs tailored for DA, where restaked ETH enforces slashing conditions aligned with Celestia’s consensus.

Consider the mechanics. A validator restakes 32 ETH via an LST like stETH into EigenLayer, then opts into a Celestia-specific AVS. They earn EigenLayer points, potential EIGEN airdrops, and DA-specific rewards. This yield optimization could push effective APYs beyond 10% in 2025, per current trajectories, far surpassing solo staking’s 4-5%.

Modular blockchains are eating monolithic chains; Celestia and EigenLayer matter profoundly in securing scalable DA.

EigenDA, EigenLayer’s native DA AVS, competes directly, but Celestia DA restaking appeals to providers valuing sovereignty. EigenDA ties yields to ETH restaking; Celestia allows TIA incentives, diversifying exposure. In a market pitting Celestia against EigenDA and Avail, restaking providers prioritize interoperability.

Quantifying Yields: From ETH Staking to Blobspace Premiums

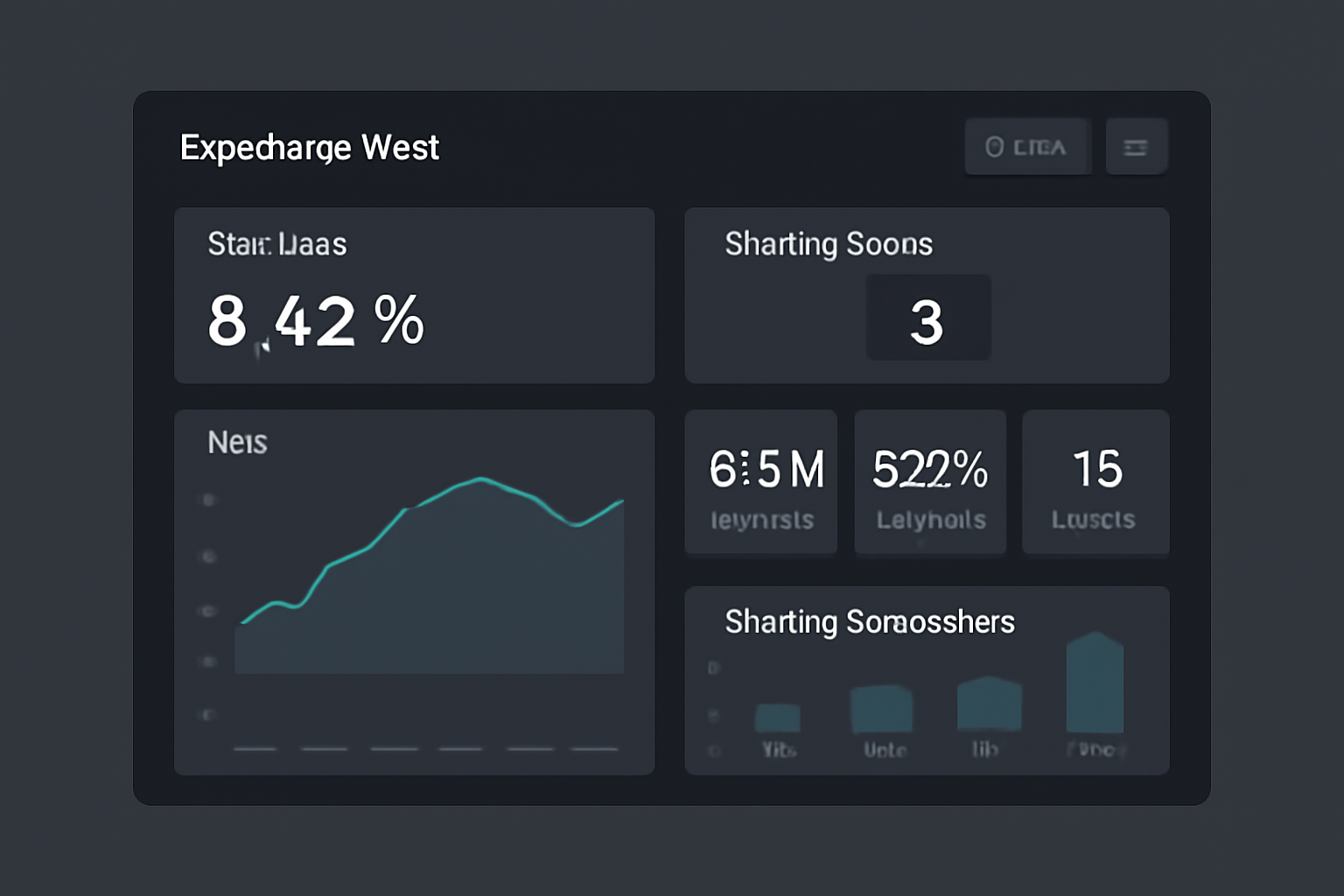

Discipline demands numbers. EigenLayer’s restaking revolution, fueled by liquid staking tokens, unlocks multi-tiered yields. Base ETH staking yields ~4%; restaking adds 2-5% from AVSs. For Celestia blobspace providers, premiums stem from blob auctions, where high demand for cheap DA space bids up operator rewards.

At current ETH prices of $2,741.28, a 32 ETH position (~$87,720) generates ~$3,500 annually from staking alone. Layer on 3% restaking rewards: and $2,630. Celestia-specific DA yields, modeled on TIA’s $0.560654 valuation, could append 1-2% via token emissions, totaling ~9% blended APY. Risks? Slashing correlations loom if Ethereum falters, but diversified AVS selection mitigates this.

| Layer | APY Estimate | Risk Factor |

|---|---|---|

| ETH Staking | 4-5% | Low |

| EigenLayer Restaking | and 2-5% | Medium |

| Celestia Blobspace | and 1-3% | High |

This table underscores the yield stack. Providers optimizing LST participation farm EIGEN points, positioning for 2025 airdrops. Yet, patience pays: over-optimizing for points invites impermanent loss in volatile LSTs.

EigenLayer (EIGEN) Price Prediction 2026-2031

Forecasts amid restaking adoption, EigenDA expansion, and Celestia integrations for secure DA yields

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY % Change (Avg from Prior) |

|---|---|---|---|---|

| 2026 | $4.00 | $8.50 | $14.00 | +42% |

| 2027 | $6.00 | $12.00 | $20.00 | +41% |

| 2028 | $9.00 | $17.00 | $28.00 | +42% |

| 2029 | $13.00 | $24.00 | $40.00 | +41% |

| 2030 | $18.00 | $33.00 | $55.00 | +38% |

| 2031 | $25.00 | $45.00 | $75.00 | +36% |

Price Prediction Summary

EIGEN prices are projected to grow progressively from a 2025 baseline of ~$6, driven by restaking yields and DA demand. Bullish max scenarios reflect adoption booms (up to 12x by 2031), while mins account for market cycles and competition. Average outlook suggests 7x growth by 2031 amid Ethereum ecosystem maturity.

Key Factors Affecting EigenLayer Price

- Restaking adoption securing AVSs like EigenDA and Celestia blobspace

- Rising DA demand from L2 rollups and modular blockchains

- Ethereum price recovery and LST integrations boosting TVL (> $20B currently)

- Technological advancements in yield optimization and airdrop incentives

- Regulatory progress in DeFi staking; competition from Avail but EigenLayer lead

- Market cycles: post-2025 consolidation leading to 2028 bull run

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Risks and Realities for Disciplined Providers

Blobspace restaking providers must confront realities. EigenLayer’s dominance-25% of staked ETH-breeds concentration risk. A systemic Ethereum downturn at $2,741.28 cascades to AVSs. Celestia’s modular design shines in scalability but exposes providers to oracle failures in blob verification.

Security forums highlight this: Reddit’s ethstaker notes economic trust, yet urges diversification. My view? Allocate 20-30% of stakes to Celestia DA restaking, balancing with EigenDA for hybrid security. This hedges while capturing modular blockchain security premiums. Forward adoption in rollups amplifies demand, per HTX Research, positioning restakers ahead of the curve.

Navigating blobspace auctions via EigenLayer demands analytical rigor. Providers auditing smart contracts and monitoring TVL flows gain edges. In 2025’s DeFi boom, this isn’t speculation; it’s structured alpha generation.

Operators succeeding in this arena treat restaking as a portfolio strategy, not a yield chase. By dissecting AVS slashing parameters and blobspace demand signals, they calibrate exposure to Celestia’s TIA emissions alongside ETH base rewards. This disciplined approach, rooted in macro analysis, separates signal from noise in 2025’s restaking yields landscape.

Practical Implementation: Restaking ETH for Celestia Blobspace Security

Transitioning from theory to execution requires precision. Blobspace restaking providers integrate EigenLayer by selecting LSTs with low correlation risks, such as cbETH or weETH, then delegating to Celestia-aligned AVSs. Current market dynamics, with ETH at $2,741.28, favor operators who monitor blob auction fills; high utilization rates, driven by L2 data surges, inflate provider bids.

Once delegated, providers attest to Celestia data roots, earning dual rewards: EigenLayer points for EIGEN airdrop eligibility and TIA-denominated premiums. This EigenLayer Celestia integration not only secures modular blockchain security but also diversifies beyond ETH’s -0.0967% 24-hour dip. My take: prioritize AVSs with proven uptime, as blobspace restaking providers ignoring operator decentralization court underperformance.

Comparative Edge: Celestia vs. EigenDA in Restaking Economies

Celestia DA restaking stands out for its sovereignty, contrasting EigenDA’s Ethereum-centric model. While EigenDA leverages EigenLayer’s $19.5 billion TVL for seamless L2 onboarding, Celestia’s blobspace auctions foster competitive yields untethered from ETH volatility. Providers blending both capture orthogonal risks: Celestia’s scalability premiums pair with EigenDA’s native security.

| DA Layer | Restaking Yield Source | Security Model | 2025 APY Potential |

|---|---|---|---|

| Celestia | Blob auctions and TIA | Modular sovereignty | 1-3% addon |

| EigenDA | ETH restaking and AVS | Ethereum aligned | 2-4% addon |

| Avail | Light client proofs | KZG commitments | 0.5-2% addon |

This breakdown, drawn from 2025 DA comparisons, reveals Celestia’s edge in cost efficiency for high-throughput rollups. Yet, EigenLayer restaking Celestia shines brightest for providers eyeing hybrid setups, where TIA at $0.560654 offers asymmetric upside amid DA market maturation.

Forward thinkers audit these layers through on-chain metrics: Celestia’s namespace utilization versus EigenDA’s sampling efficiency. In my analysis, blobspace restaking providers allocating 40% to Celestia DA restaking position for the modular shift, where data availability decouples from execution, unlocking trillions in L2 value settlement.

Outlook: Sustained Yields in a Maturing Ecosystem

As rollups proliferate, demand for secure DA intensifies, propelling restaking yields 2025 trajectories. EigenLayer’s framework, now embedding one-quarter of staked ETH, evolves with operator sets specializing in Celestia blobspace. Expect refined slashing economics and cross-chain bridges to amplify interoperability, rewarding patient allocators.

Providers who master this nexus avoid the pitfalls of over-leveraged points farming, focusing instead on sustainable APY stacks. With ETH holding at $2,741.28, the protocol’s resilience underscores its macro viability. Blobspace restaking providers, armed with analytical discipline, stand to harvest compounded returns in decentralized infrastructure’s next phase.