In 2025, EigenLayer has become the backbone for verifiable AI agents in modular DeFi, addressing the fundamental challenge of trust in off-chain computation. As Ethereum (ETH) holds steady at $2,770.74, the need for cryptoeconomic guarantees in decentralized agent infrastructure is more acute than ever. With the mainnet launch of EigenAI and EigenCompute, EigenLayer is transforming how smart contracts and autonomous agents interact with real-world data and complex computations, without sacrificing transparency or security.

Restaking as a Security Primitive for Verifiable AI

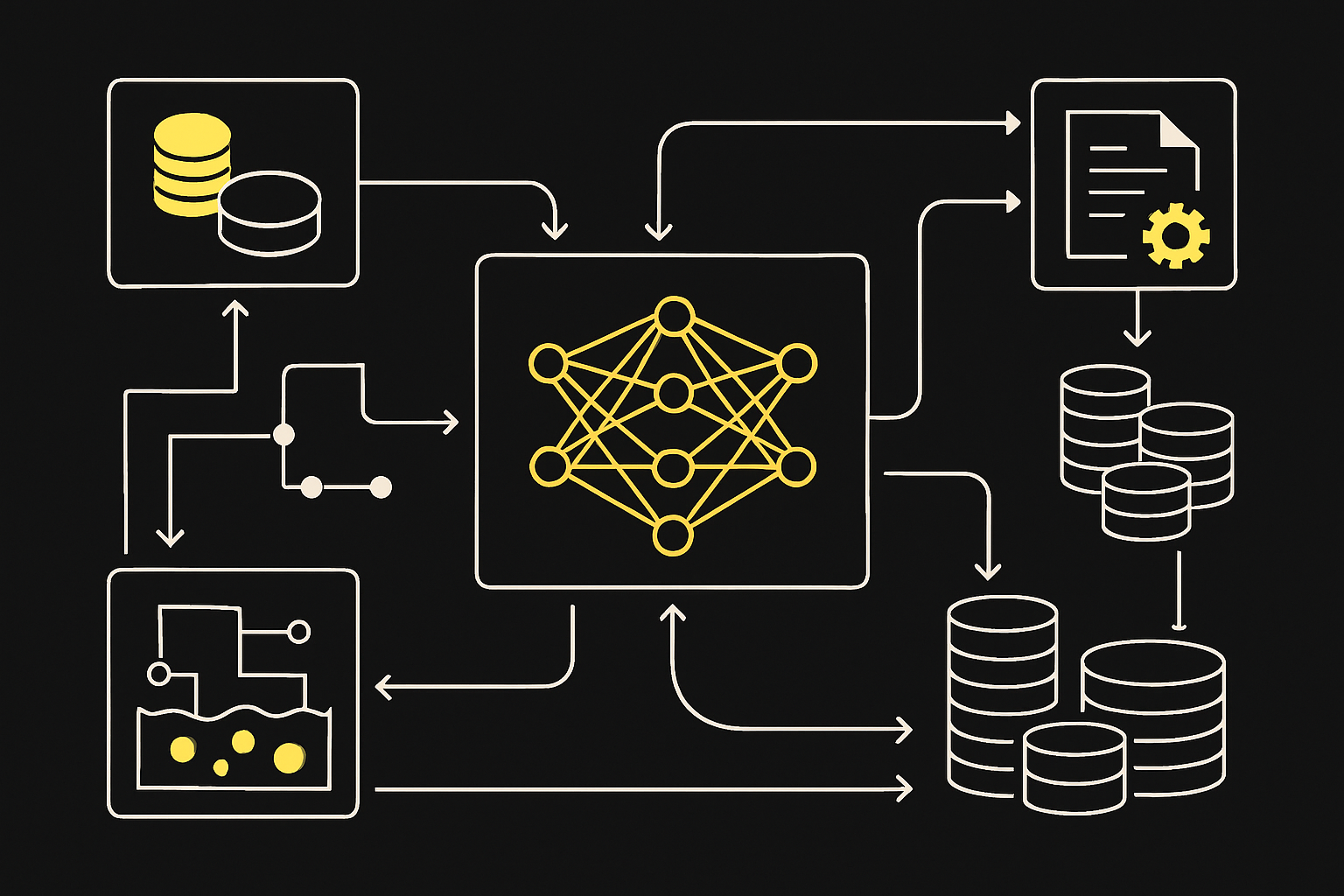

At its core, restaking lets Ethereum validators extend security to new protocols by locking up their staked ETH or liquid staking tokens. This innovation means that high-value protocols, especially those requiring external data validation or intensive computation, can inherit Ethereum’s robust trust layer without fragmenting validator incentives. For AI workloads, where model outputs must be both correct and tamper-resistant, restaking provides a direct economic incentive for validators to honestly attest to inference results or data listings.

The rise of EigenAI and EigenCompute on mainnet alpha signals a paradigm shift: verifiable AI is no longer theoretical. These modules allow developers to build modular DeFi protocols that can outsource heavy computation, such as LLM-based risk analysis or on-chain credit scoring, to off-chain agents while maintaining cryptographic assurance of correctness.

How EigenAI and EigenCompute Enable Modular DeFi Agents

The introduction of EigenAI and EigenCompute has unlocked transparent, verifiable computation for modular agent frameworks in DeFi. By leveraging these primitives, developers can:

- Outsource complex logic: Offload resource-heavy tasks (e. g. , market prediction, compliance screening) to external AI agents.

- Guarantee correctness: Use cryptographic proofs backed by restaked ETH to ensure that outputs are tamper-proof and auditable on-chain.

- Simplify composability: Build plug-and-play AI modules that interface seamlessly with existing DeFi smart contracts.

This architecture marks a departure from traditional oracles or centralized compute providers. Now, every step, from data ingestion to model inference, is subject to economic slashing conditions if manipulated or falsified results are detected by the validator set.

Real-World Deployments: DIN, CoinFello and Verifiable Trading Agents

The impact of EigenLayer’s verifiable compute stack is already visible across several high-profile deployments:

- Decentralized Infrastructure Networks (DIN): Launched as an AVS on EigenLayer after repeated centralized cloud outages, DIN leverages Ethereum’s restaked security to keep Web3 infrastructure resilient and censorship-resistant.

- CoinFello by HyperPlay Labs: A conversational agent integrated with MetaMask Smart Accounts via EigenCloud enables users to automate complex DeFi strategies using natural language, with all actions cryptographically verified through EigenLayer’s compute layer.

- FereAI x EigenCloud: In automated trading, FereAI processes real-time market data with verifiable inference proofs. This ensures that every trade executed by the agent is transparently auditable and backed by economic guarantees, a critical requirement as ETH price volatility remains high around $2,770.74.

Together these use cases illustrate why modular DeFi in 2025 relies so heavily on on-chain verifiable compute: it’s not just about automation but about building systems where every agent action can be independently verified, and economically enforced, by anyone participating in the network.

As more DeFi protocols and AI-powered agents migrate to EigenLayer’s shared security model, the importance of cryptoeconomic guarantees becomes even more pronounced. The validator set is directly incentivized to challenge or slash dishonest computation, ensuring that both off-chain AI outputs and on-chain actions remain trustworthy. This cryptographic accountability is a step-change from legacy models where opaque API calls and centralized compute left users exposed to silent failures or adversarial manipulation.

Key to this ecosystem is the Active Validation Service (AVS), which acts as the decentralized arbiter for agent actions. AVSs are tasked with verifying everything from LLM-generated recommendations to cross-chain liquidity operations. By leveraging restaked ETH, they align economic incentives across all participants, making it prohibitively expensive to collude or corrupt results at scale.

This design has enabled new classes of modular DeFi agents that can:

- Manage risk autonomously: AI agents can rebalance portfolios or trigger liquidations based on real-time data, all provably correct via EigenCompute.

- Facilitate cross-protocol arbitrage: Modular agents can interact with multiple DeFi platforms, executing trades only when verifiable conditions are met and slashing is enforceable in case of misbehavior.

- Orchestrate decentralized governance: Agents can aggregate sentiment, propose upgrades, or tally votes with transparent logic and verifiable execution trails.

Security Implications and Future Directions

The introduction of Level 1 Agents, combining AVS-backed policy enforcement with modular toolkits for LLMs and agent memory, sets a new baseline for trust in autonomous systems. By embedding slashing conditions into every layer of agent interaction, from data ingestion to action execution, EigenLayer ensures that malicious behavior is not only detectable but economically disincentivized.

This architecture unlocks further innovation: DeFi protocols can now safely integrate AI-driven features such as personalized lending rates, dynamic collateralization thresholds, or even on-chain asset management without ceding control to centralized actors. The result is a composable mesh of autonomous services where trust derives directly from Ethereum’s $2,770.74 security base, not from opaque intermediaries.

The partnership momentum continues into late 2025 as projects like Enjoyoors and Kite AI leverage EigenLayer’s restaking primitives for omnichain liquidity management and verifiable inference marketplaces. As these integrations mature, expect a surge in developer tooling focused on plug-and-play agent frameworks and standardized proof formats for AI outputs, critical infrastructure for scaling modular DeFi securely.

Why On-Chain Verifiability Matters in a Volatile Market

The current ETH price at $2,770.74, coupled with persistent volatility in both crypto and TradFi markets, underscores the necessity for robust verification mechanisms underpinning automated financial decisions. In this environment, only protocols anchored by strong cryptoeconomic guarantees, like those offered by EigenLayer, can deliver the transparency required by institutional capital and sophisticated end users alike.

For an in-depth breakdown of how restaking powers these advances in verifiable AI infrastructure, see our detailed guide: How EigenAI and amp; EigenCompute Enable Verifiable AI on Ethereum With EigenLayer Restaking.

The trajectory is clear: by converging modular DeFi architecture with on-chain verifiable compute, EigenLayer has catalyzed a new era where autonomous agents are not just programmable but provably trustworthy at scale. As this infrastructure matures through 2025 and beyond, expect further convergence between decentralized finance primitives and advanced AI tooling, each reinforcing the other through cryptographic guarantees rather than blind trust.