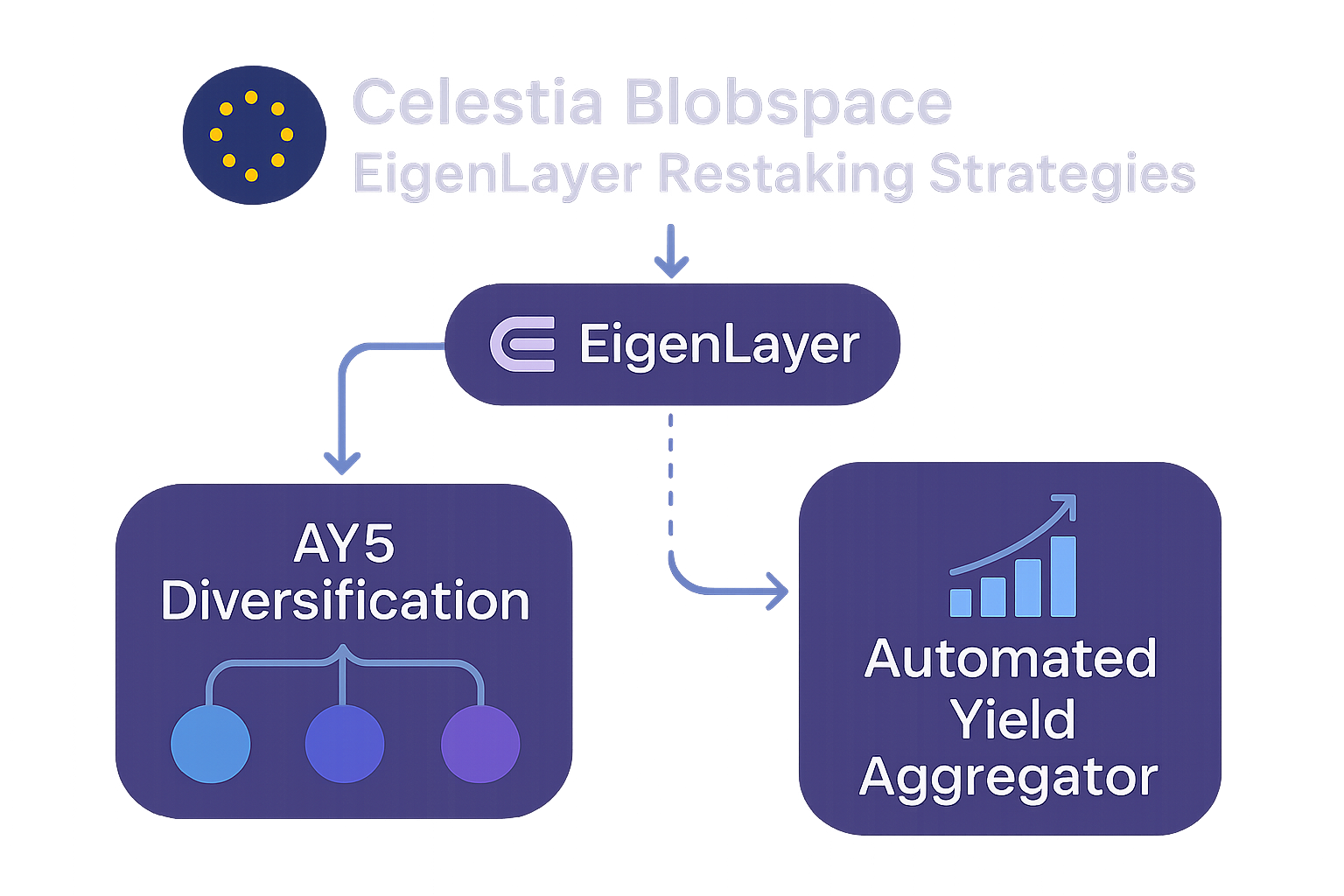

In the fast-evolving modular blockchain landscape, maximizing yield is no longer just about picking the right token or network. It’s about leveraging the intersection of innovative data availability (DA) solutions like Celestia’s blobspace and advanced restaking protocols such as EigenLayer. If you’re a developer or investor aiming to extract every drop of value from your staked assets, understanding the nuances of blobspace restaking is crucial.

The Yield Frontier: Why Blobspace and Restaking Matter Now

As of October 31,2025, Celestia’s modular DA layer has become a cornerstone for rollups seeking scalable, low-cost transaction data storage. At the same time, EigenLayer’s restaking model is rewriting the rules for capital efficiency by letting ETH stakers secure multiple protocols, earning additional rewards without unstaking their principal. The synergy between these two platforms is catalyzing a new era of modular blockchain yield strategies.

This isn’t just theoretical: real-time data shows that diversified restaking on EigenLayer can push total yields far beyond what traditional staking offers. But to truly maximize your returns, you need to deploy targeted strategies that take advantage of both platforms’ unique mechanics.

Strategy #1: Diversify Restaked Assets Across Multiple AVSs on EigenLayer to Compound Yield

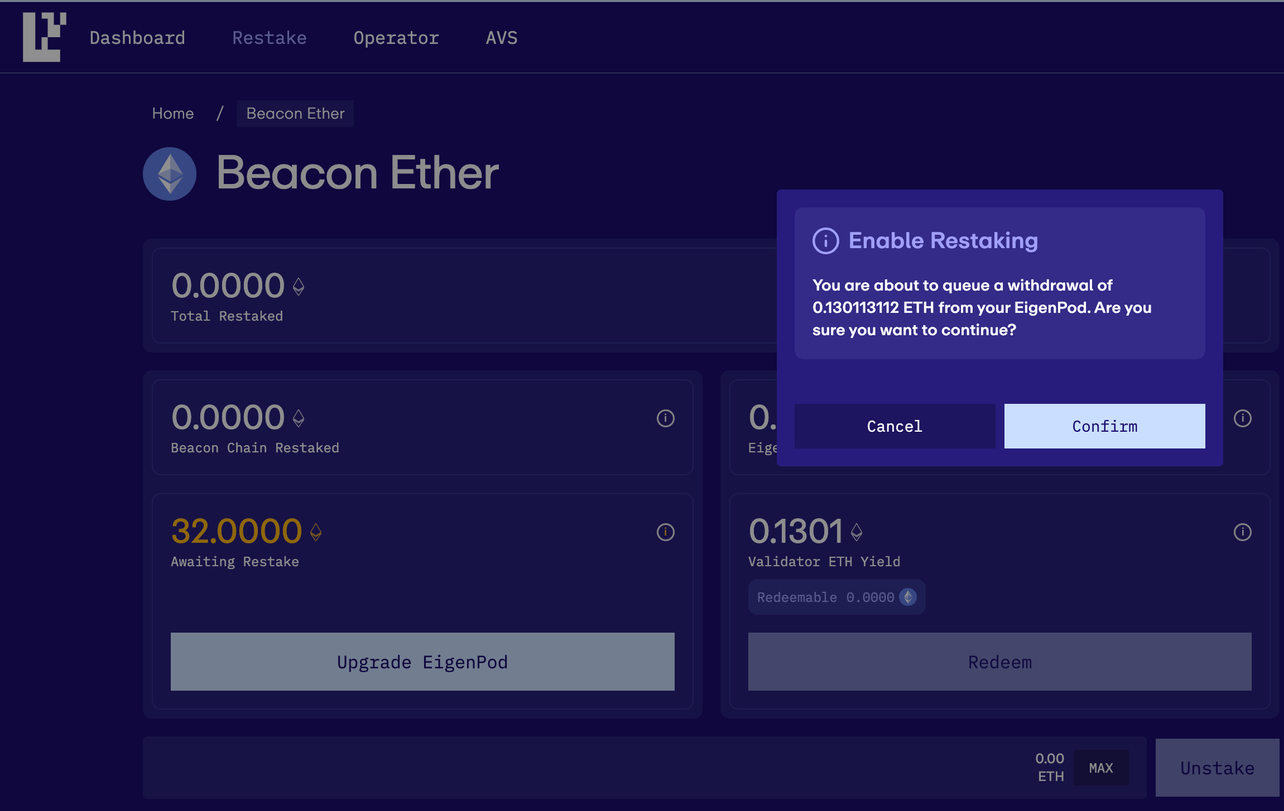

The first pillar of high-performance yield optimization is diversification. On EigenLayer, Actively Validated Services (AVSs) represent different protocols or networks that require security from stakers. By allocating your capital across multiple AVSs, you tap into several reward streams simultaneously, compounding your overall return while spreading risk.

- Why it works: Each AVS offers its own incentives, often in unique tokens or service fees. By participating in several AVSs at once, you’re not only increasing your earning potential but also hedging against underperformance in any single protocol.

- How to execute: Start by analyzing available AVSs on EigenLayer for their reward rates and risk profiles. Use tools like Dune Analytics or EigenLayer dashboards to track yields and monitor performance across networks.

- Nina’s tip: Don’t just chase headline APYs, consider uptime requirements and slashing risks for each AVS before committing large amounts.

This approach positions you at the heart of modular blockchain innovation while maintaining flexibility as new AVSs launch and evolve.

Strategy #2: Leverage Celestia’s Blobspace Auctions by Participating Early in High-Demand Periods for Enhanced Rewards

The next lever for maximizing yield taps directly into Celestia’s unique market structure: blobspace auctions. When demand spikes for DA (for example during major rollup launches or NFT drops), blobspace becomes more valuable, driving up auction rewards for participants who provide storage capacity at the right time.

- Tactical entry: Monitor key events on Celestia’s roadmap and community channels to anticipate periods of elevated demand. Early participation during these windows can lock in premium yields before competition drives down margins.

- Savvy allocation: Use historical auction data and predictive analytics to identify recurring high-yield periods, then schedule your participation accordingly.

- Nina’s tip: Set alerts for protocol upgrades or ecosystem partnerships that could trigger surges in blobspace utilization; being early is everything here.

This strategy isn’t just about timing; it’s about being plugged into the pulse of the modular blockchain ecosystem so you can act decisively when opportunity knocks.

The Restaking Edge: Automation and Aggregation

The third core strategy focuses on harnessing automation through cutting-edge protocols and aggregators designed specifically for restaking workflows. In an environment where opportunities shift rapidly between AVSs and DA solutions, minimizing downtime and optimizing reallocation are essential for sustained high yields. We’ll dive deeper into automated restaking protocols and yield aggregators in the next section, including practical steps to keep your capital working around the clock without manual intervention.

Automated restaking protocols and yield aggregators are quickly becoming the secret weapon for modular blockchain power users. These platforms actively monitor the performance of AVSs, blobspace demand, and current yield rates, reallocating your staked assets dynamically to wherever the risk-reward ratio is most favorable. This level of automation means you’re never leaving yield on the table due to human error or delayed reactions.

- Why leverage automation: Manual management of multiple AVSs and DA auctions is not only time-consuming but can result in missed opportunities or unnecessary downtime. Automated protocols ensure your capital is always optimally allocated, compounding gains and reducing idle periods.

- How to implement: Explore leading restaking aggregators that support Celestia’s blobspace and EigenLayer’s AVSs. Set your preferences for risk, desired minimum yield thresholds, and reallocation frequency. Most platforms offer dashboards with real-time analytics so you can track performance at a glance.

- Nina’s tip: Don’t set-and-forget: periodically review aggregator settings as new AVSs launch or as market volatility shifts. Adaptability is key to staying ahead of the curve.

Top 3 Strategies to Maximize Yield with Blobspace Restaking

-

Diversify Restaked Assets Across Multiple Active Validated Services (AVSs) on EigenLayer to Compound YieldBy allocating your restaked ETH across several AVSs—such as EigenDA, AltLayer, and Espresso—you can tap into multiple reward streams. This approach not only boosts your overall yield but also spreads risk, as each AVS offers unique incentives and slashing conditions. Research each AVS’s reward structure and risk profile before diversifying.

-

Leverage Celestia’s Blobspace Auctions by Participating Early in High-Demand Periods for Enhanced RewardsCelestia’s blobspace auctions let rollups and validators bid for data availability space. By entering auctions during peak demand (such as major rollup launches or network upgrades), you can earn higher rewards for providing blobspace. Monitor Celestia’s auction schedules and participate proactively for maximum returns.

-

Utilize Automated Restaking Protocols and Yield Aggregators to Optimize Reallocation and Minimize DowntimePlatforms like EtherFi and Swell enable automated restaking and yield aggregation. These tools help you continuously reallocate assets to the most lucrative AVSs and minimize idle periods, ensuring your capital is always working. Set up automated strategies to respond to changing market conditions and maximize efficiency.

Mitigating Risks While Chasing Yield

Pursuing higher yields through diversification, auction timing, and automation isn’t without its pitfalls. Slashing penalties on EigenLayer are real if you violate AVS rules, while smart contract vulnerabilities can expose your assets across both Celestia and restaking protocols. To mitigate these risks:

- Diversify not just across AVSs but also across platforms – don’t put all your capital into a single aggregator or service.

- Stay current on audits: Only use protocols with recent third-party security audits and active bug bounty programs.

- Monitor governance updates: Both Celestia and EigenLayer regularly update their protocol rules; missing a change could impact your rewards or introduce new risks.

The modular ecosystem rewards those who balance ambition with caution, ride the waves of innovation but always manage your exposure wisely.

Level Up Your Modular Blockchain Yield Game

The future belongs to those who understand how to orchestrate their assets across emerging DA layers like Celestia and flexible security markets like EigenLayer. By following this curated playbook, diversifying across multiple AVSs, timing your entry into blobspace auctions during high-demand surges, and embracing automated reallocation tools, you’re not just keeping up with DeFi’s evolution; you’re shaping it.

If you want more hands-on guidance or deeper dives into technical strategies for blobspace restaking, check out our advanced resources at Restaking For DA Layers. Stay nimble, stay informed, and let innovation work for you!