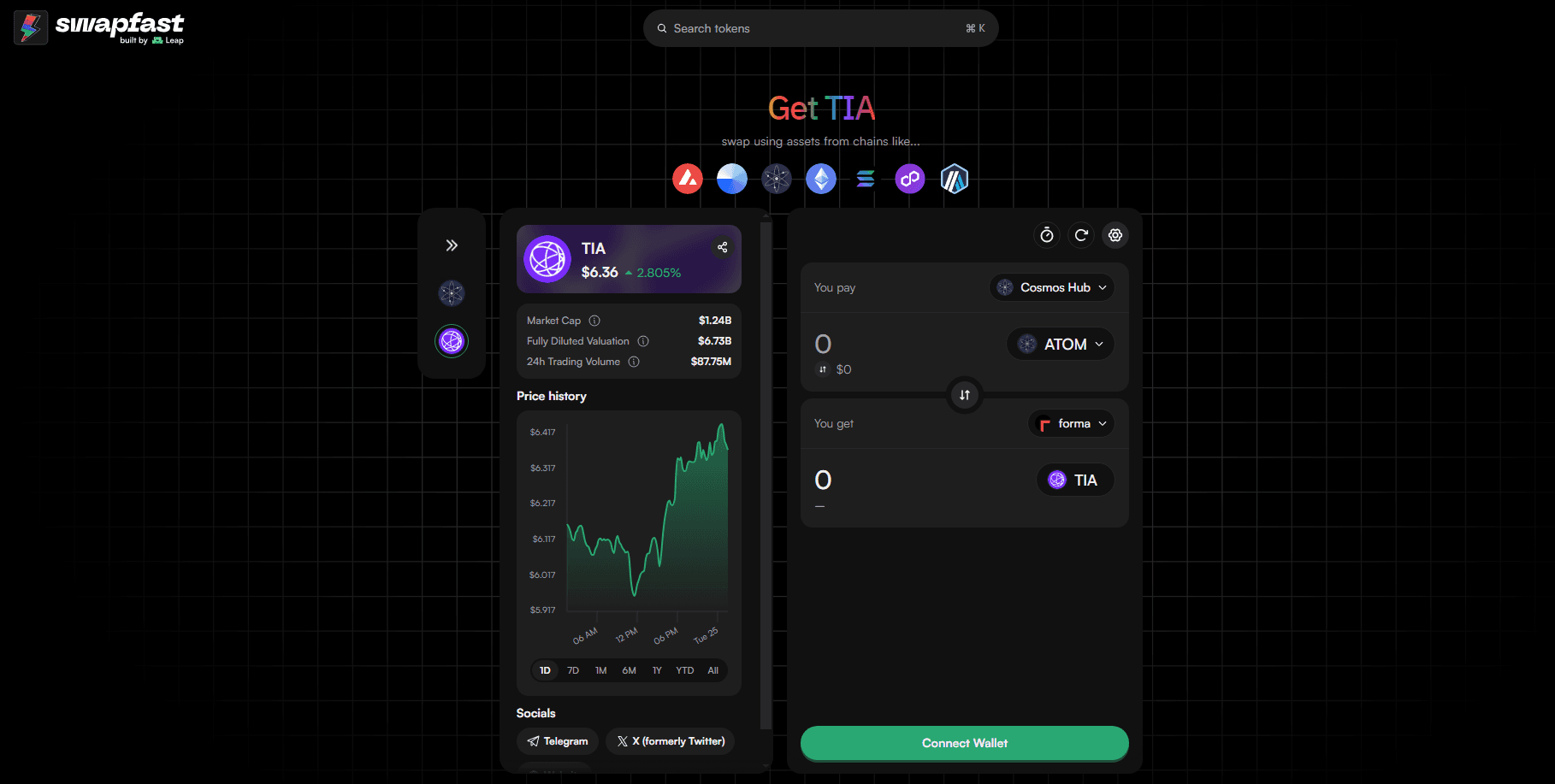

Celestia’s modular blockchain vision is rapidly transforming how builders and investors approach decentralized infrastructure. With the rise of blobspace markets and DA restaking protocols, maximizing yield on Celestia isn’t just about staking TIA – it’s about deploying capital across the ecosystem’s most dynamic opportunities. As of October 25,2025, Celestia’s native token TIA is trading at $1.03, reflecting a steady climb as users seek out advanced yield strategies in the evolving modular landscape.

Leverage Liquid Staking Platforms for TIA: Liquidity Meets Compounding Rewards

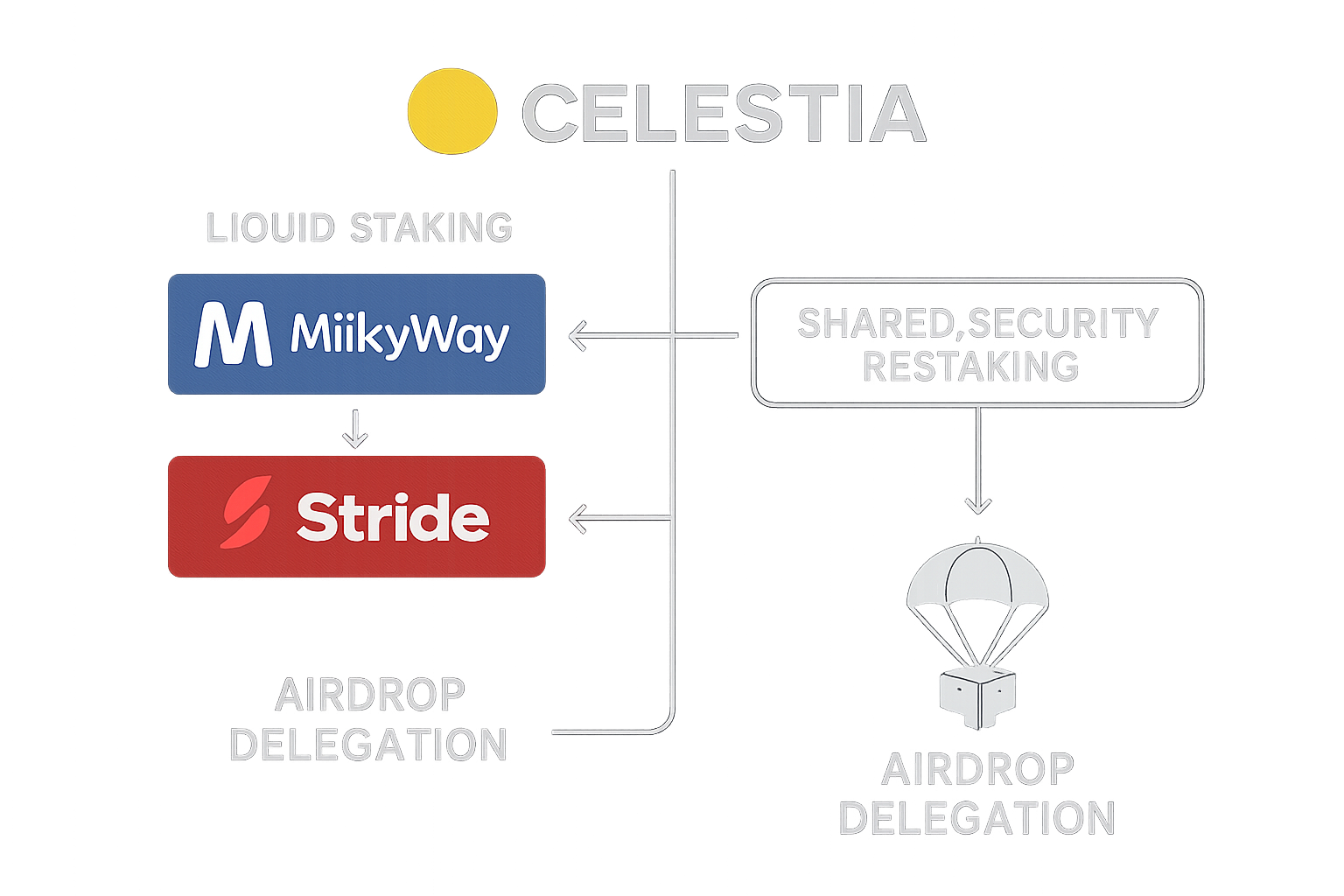

The first pillar of modern Celestia blobspace restaking strategies is harnessing the power of liquid staking. Platforms like MilkyWay and Stride let you stake your TIA while receiving a liquid derivative (such as stTIA) in return. This means your assets are not locked up; instead, you can deploy stTIA across DeFi protocols for additional yield streams or swap back to TIA when liquidity calls.

This approach compounds your returns by stacking native staking rewards with DeFi yields – all without sacrificing flexibility. For example, by staking through MilkyWay, you tap into automated reward optimization tools and governance participation, letting you actively shape protocol direction while earning more. To explore MilkyWay’s liquid staking paradigm in detail, check out their official overview.

Participate in Shared Security Restaking Protocols: Double Down on Yield and Network Resilience

The next frontier for maximizing yield within Celestia is participating in shared security restaking protocols. In this model, your staked TIA doesn’t just secure the core Celestia chain; it also helps secure additional Data Availability (DA) layers or rollups built atop Celestia’s architecture. By opting into these shared security frameworks (often via platforms integrating with EigenLayer-style mechanisms), you unlock extra reward streams for providing cross-chain security guarantees.

This strategy is gaining momentum because it aligns incentives between validators, stakers, and new DA layers – all while boosting overall network resilience. According to recent research on the Celestia Forum, integrating liquid staking within shared security frameworks is one of the most promising ways to enhance both yield and systemic robustness in 2025.

Celestia (TIA) Price Prediction 2026-2031

Professional Outlook Based on Blobspace Demand, Restaking Trends, and Modular Blockchain Adoption

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.85 | $1.15 | $1.50 | +11.7% | Recovery after consolidation; increased blobspace demand, but competition from other modular chains. |

| 2027 | $0.95 | $1.35 | $1.90 | +17.4% | Bullish scenario if restaking and liquid staking protocols drive TIA demand; regulatory clarity improves sentiment. |

| 2028 | $1.10 | $1.65 | $2.30 | +22.2% | Adoption of modular data availability grows; key integrations (e.g., Blobstream) expand TIA utility. |

| 2029 | $1.30 | $2.05 | $2.90 | +24.2% | Mainstream rollup adoption and sustained DeFi activity lift TIA; increased staking and protocol upgrades. |

| 2030 | $1.55 | $2.55 | $3.70 | +24.4% | Potential bull cycle; Celestia becomes a core DA layer for L2s, though macro/regulatory risks remain. |

| 2031 | $1.80 | $3.10 | $4.60 | +21.6% | Mature ecosystem, broad developer and DeFi adoption; competition and market saturation cap upside. |

Price Prediction Summary

Celestia (TIA) is positioned for steady growth from 2026 to 2031, leveraging increasing demand for modular data availability and innovative staking strategies. While short-term volatility may persist, the long-term outlook is bullish amid growing adoption and ecosystem expansion, though risks from competition and regulation remain.

Key Factors Affecting Celestia Price

- Blobspace market demand and transaction fee trends

- Growth and adoption of liquid staking and restaking protocols (e.g., MilkyWay, Stride)

- Integration with major blockchains (e.g., Ethereum via Blobstream)

- Network upgrades and modular blockchain adoption rates

- Regulatory developments impacting staking and data availability

- Competition from other data availability and modular blockchain solutions

- Macroeconomic cycles and overall crypto market sentiment

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Utilize Multi-Phase Airdrop Participation and Delegation Rotation: Capture Early Incentives

A key advantage for early adopters in the modular blockchain space has been aggressive participation in multi-phase airdrops and strategic delegation rotation. Celestia has pioneered this approach by rolling out phased airdrops that reward active engagement – whether you’re an early staker, protocol governor, or DA layer supporter.

To maximize returns here, keep a close eye on upcoming airdrop phases announced via official channels and consider rotating your delegation among validators or DA layers that offer bonus incentives during specific periods. This method isn’t just about chasing free tokens; it’s about positioning yourself at the forefront of emerging sub-ecosystems within Celestia’s growing modular stack.

Top 3 Advanced Celestia Blobspace Restaking Strategies

-

Leverage Liquid Staking Platforms (e.g., MilkyWay, Stride) for TIA Stake your TIA tokens using trusted liquid staking platforms like MilkyWay or Stride. These protocols let you earn staking rewards while receiving liquid tokens (like stTIA), which you can deploy across DeFi for extra yield—maximizing returns and maintaining flexibility, even as TIA trades at $1.03 (as of October 25, 2025).

-

Participate in Shared Security Restaking Protocols Boost your yield by engaging with shared security restaking frameworks. By restaking TIA to secure both Celestia and its Data Availability (DA) layers, you contribute to network security and unlock enhanced rewards—benefiting from the modular blockchain’s robust incentive structure.

-

Utilize Multi-Phase Airdrop Participation and Delegation Rotation Maximize early incentives by actively participating in Celestia’s multi-phase airdrops and rotating your TIA delegations. This approach helps capture bonus rewards, stay ahead of new opportunities, and optimize your overall yield as new phases and integrations roll out.

Why These Strategies Work Together

The real magic happens when you combine these approaches: leverage liquid staking for baseline compounding, opt into shared security restaking to amplify rewards across layers, then actively rotate delegations to capture every available incentive from phased airdrops. This synergy turns passive holding into an active yield-maximizing playbook tailored for Celestia’s unique architecture.

By weaving these advanced blobspace restaking strategies together, you unlock a multi-dimensional yield engine that’s impossible to achieve through traditional staking alone. The modular nature of Celestia means your capital can flow seamlessly between opportunities, adapting as new protocols, DA layers, and incentive programs emerge.

Risk Management and Practical Considerations

Of course, maximizing yield in any modular blockchain environment also requires a sharp focus on risk management. Liquid staking platforms like MilkyWay and Stride are designed for flexibility and compounding, but always research their smart contract audits and track record before committing large positions. Shared security restaking, while powerful for increasing rewards, can introduce correlated risks if multiple layers encounter issues simultaneously. Diversifying across multiple DA layers or validators can help mitigate this.

When it comes to multi-phase airdrops and delegation rotation, timing is everything. Monitor official Celestia channels closely for snapshot announcements or new incentive rounds. Participating early often brings outsized rewards, but avoid over-rotating delegations simply for short-term gains; sustained engagement with reputable validators typically yields the best long-term results.

Celestia’s Current Price Action: TIA Holds Steady at $1.03 as Restaking Demand Grows

As of October 25,2025, TIA is trading at $1.03, reflecting steady confidence as more users deploy these layered yield strategies. This price stability is underpinned by growing demand for blobspace and the expanding ecosystem of DA restaking protocols, factors likely to drive further innovation in both staking products and reward mechanisms.

The future of modular blockchain yield optimization will be defined by adaptability and integration. By staying nimble, leveraging liquid staking for compounding rewards, participating in shared security frameworks to stack incentives, and rotating delegations during multi-phase airdrops, you’re not just riding the next wave of decentralized finance; you’re shaping it.

Pro tip: Use tools like Celestia’s staking calculator or MilkyWay’s automated dashboards to model your expected returns under different scenarios. Staying data-driven helps you pivot quickly as new opportunities arise.

Whether you’re an active validator or a hands-off investor looking to maximize passive returns, these advanced blobspace restaking strategies position you at the cutting edge of modular blockchain innovation. The Celestia ecosystem is only getting started, and those who master these techniques today will be the leaders of tomorrow’s decentralized infrastructure.