Celestia has emerged as a foundational technology in the modular blockchain movement, offering a radically new approach to scaling decentralized finance (DeFi). By decoupling consensus and data availability from execution, Celestia enables developers to build highly customizable, sovereign rollups that leverage the network’s robust data layer. This separation is not just a technical upgrade – it fundamentally changes the way DeFi applications can be built, scaled, and secured.

Celestia’s Modular Architecture: The Backbone of Next-Gen DeFi

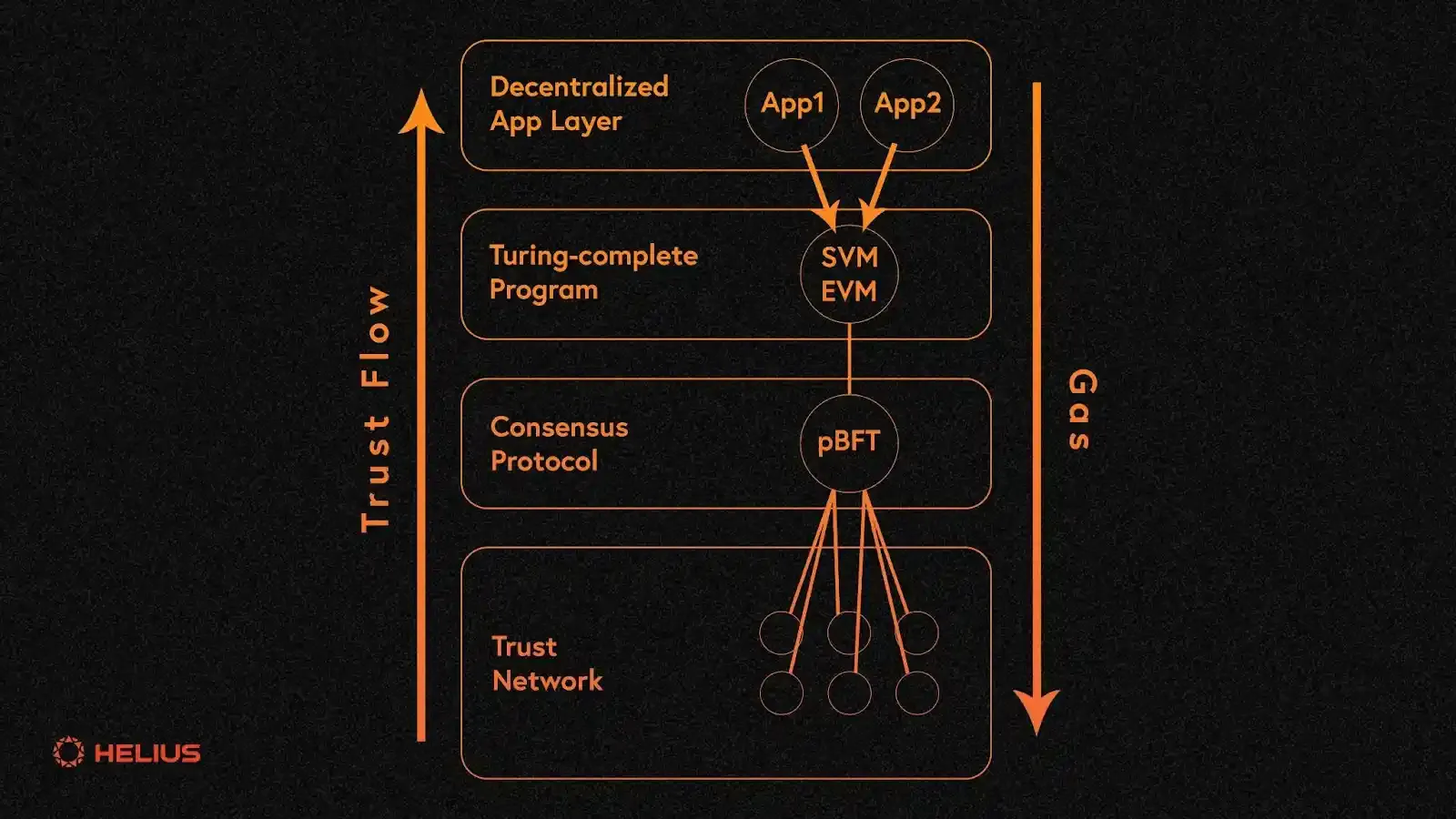

At the core of Celestia modular DeFi is its minimalist design. Rather than handling all aspects of blockchain operation in one monolithic layer, Celestia specializes in consensus and data availability. This means execution environments – where smart contracts and DeFi logic run – can be deployed as independent rollups on top of Celestia’s secure base. These rollups inherit the network’s data availability guarantees without needing their own validator set, drastically reducing operational overhead and increasing flexibility for developers.

This approach allows teams to launch custom DeFi chains tailored to specific use cases or regulatory requirements. For example, a lending protocol could deploy as its own sovereign rollup with unique risk parameters while still leveraging Celestia’s shared security model. The result? Enhanced scalability, lower costs, and unprecedented freedom for protocol architects.

Blobspace Restaking: Unlocking Yield and Security for DA Layers

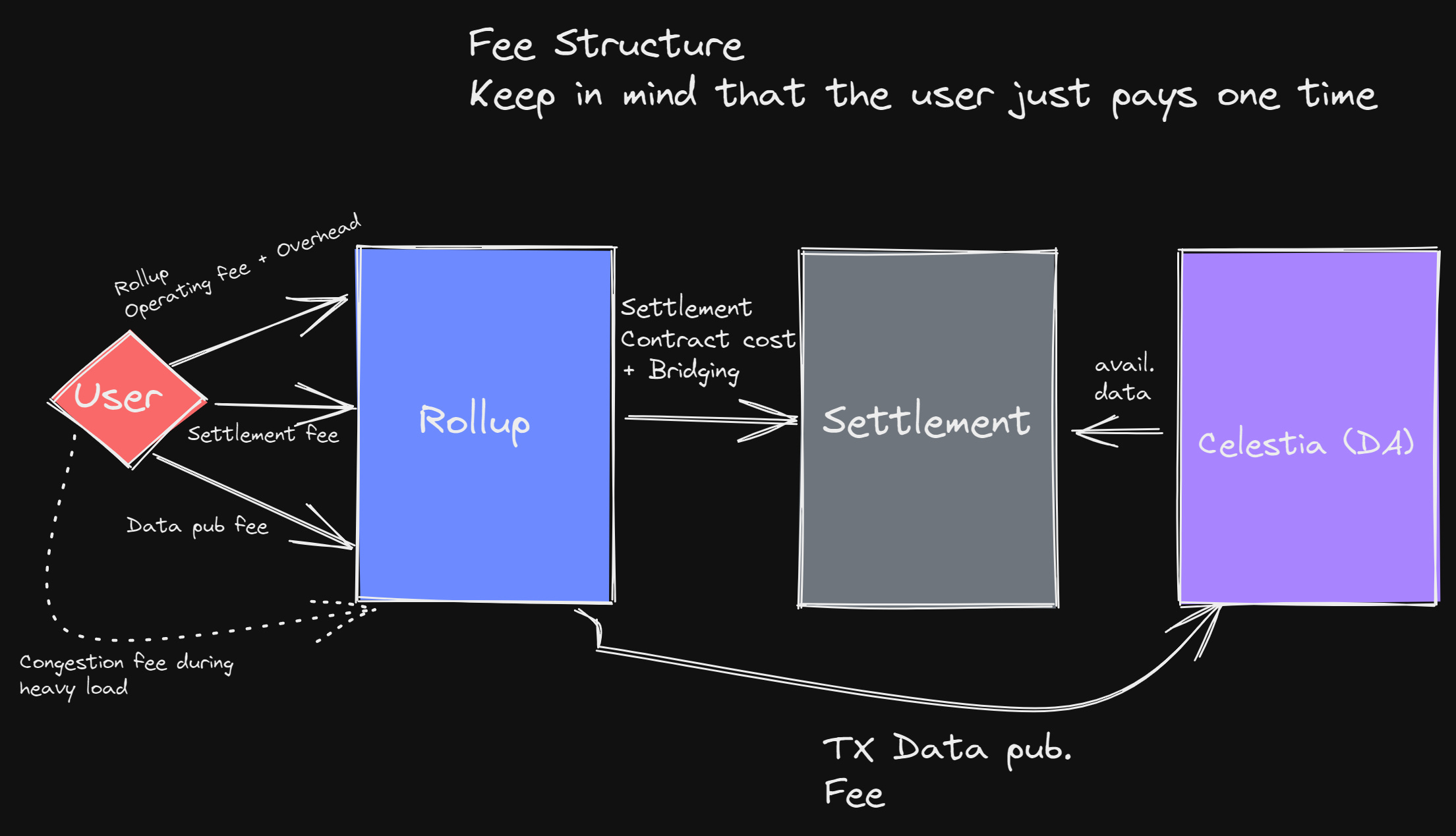

The innovation doesn’t stop at architecture. One of Celestia’s most compelling features is its blobspace: dedicated blockspace for storing large batches of transaction data (“blobs”). In the context of blobspace restaking Celestia, this resource becomes an economic engine for both validators and DeFi participants.

When blobspace is priced in TIA – currently trading at $1.02 – every uptick in network activity directly increases demand for the native token. Validators are incentivized not only to secure consensus but also to maximize efficient use of blobspace by supporting high-throughput rollups. For users and stakers, this dynamic creates new yield opportunities through restaking protocols that allocate rewards based on blobspace utilization.

MilkyWay: The Modular Staking Portal Powering Liquid Restaking

No discussion of Celestia’s impact on DeFi would be complete without examining MilkyWay – a purpose-built staking portal designed for the modular ecosystem. MilkyWay enables TIA holders to stake their assets while retaining liquidity through liquid staking tokens (LSTs), allowing them to remain active participants across multiple DeFi protocols even while earning staking rewards.

This dual-purpose system addresses one of the major hurdles in traditional staking: capital inefficiency. By introducing restaked relayers and flexible slashing mechanisms (in partnership with SuperSight), MilkyWay also enhances cross-chain reliability and security – two critical factors as modular blockchains become increasingly interconnected.

The synergy between Celestia blockchain DeFi, blobspace economics, and advanced restaking protocols like MilkyWay is creating fertile ground for innovation. Developers now have unprecedented tools to optimize yield, manage risk, and scale securely within a truly modular framework.

The Market Context: TIA Price Dynamics and Ecosystem Growth

The current price of TIA stands at $1.02, reflecting steady growth amid heightened interest in modular blockchain solutions. Recent phased airdrops have further driven engagement among both developers and end-users, onboarding new participants into the ecosystem and stimulating experimentation with sovereign rollups.

Celestia (TIA) Price Prediction 2026-2031

Professional outlook for TIA based on DeFi modularity, staking innovation, and evolving market conditions

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.90 | $1.15 | $1.60 | +12.7% | Consolidation after modular DeFi adoption, with volatility; bearish scenario if DeFi growth slows |

| 2027 | $1.05 | $1.40 | $2.10 | +21.7% | Increased mainstream adoption of modular blockchains and staking; bullish if MilkyWay and AVS gain traction |

| 2028 | $1.25 | $1.85 | $2.80 | +32.1% | Broader DeFi integration and cross-chain utility; positive regulatory environment could accelerate growth |

| 2029 | $1.40 | $2.20 | $3.50 | +18.9% | Sustained ecosystem expansion, more sovereign rollups; competition from rival modular solutions may cap upside |

| 2030 | $1.60 | $2.55 | $4.20 | +15.9% | Wider institutional interest and scaling breakthroughs, but macro market cycles impact sentiment |

| 2031 | $1.80 | $2.95 | $5.00 | +15.7% | Matured modular DeFi market, Celestia established as core infrastructure; upside driven by global DeFi adoption |

Price Prediction Summary

Celestia (TIA) is positioned for steady growth over the next six years, leveraging its modular blockchain architecture, staking innovations like MilkyWay, and increasing DeFi adoption. While the minimum price scenarios reflect potential for downside due to market volatility or regulatory headwinds, the average and maximum projections anticipate progressive adoption and ecosystem expansion. By 2031, if Celestia cements its role as a foundational layer for modular DeFi, TIA could see significant appreciation, especially in bullish market conditions.

Key Factors Affecting Celestia Price

- Adoption of modular DeFi and rollups on Celestia

- Success and utility of MilkyWay staking and restaking solutions

- Overall crypto market cycles and risk sentiment

- Regulatory clarity and global DeFi policy frameworks

- Competition from other data availability and modular blockchain platforms

- Growth in cross-chain and AI-native blockchain use cases

- Sustained developer activity and network usage (blobspace demand)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As more protocols tap into Celestia’s abundant blockspace (with ambitious plans to scale up to 1-gigabyte blocks), we’re seeing an explosion in both throughput capacity and application diversity. This positions Celestia as not just another blockchain but as an indispensable infrastructure layer underpinning the future of scalable DeFi.

Looking ahead, the interplay between blobspace restaking Celestia and modular DeFi applications is set to redefine capital efficiency and protocol incentives. As more rollups leverage Celestia’s data availability, the demand for TIA – still precisely at $1.02 – will increasingly be linked to real economic activity within the ecosystem. This creates a direct feedback loop: higher application throughput means more blobs, which in turn drives validator rewards and yields for restakers.

For developers, this environment unlocks new strategies for yield optimization. By participating in restaking protocols that allocate rewards based on actual blobspace consumption, DAOs and individual users alike can maximize returns while supporting critical network functions. This is a significant leap from traditional monolithic chains, where staking yield is often decoupled from real network utility.

Key Innovations: Modular Staking, Restaked Relayers and Liquid Yield

Key Innovations Powering Celestia Modular DeFi

-

Separation of Consensus and Data Availability: Celestia pioneered the decoupling of consensus and data availability from execution, allowing developers to launch custom rollups and blockchains without managing their own validator sets. This modular architecture enhances scalability and flexibility for DeFi applications.

-

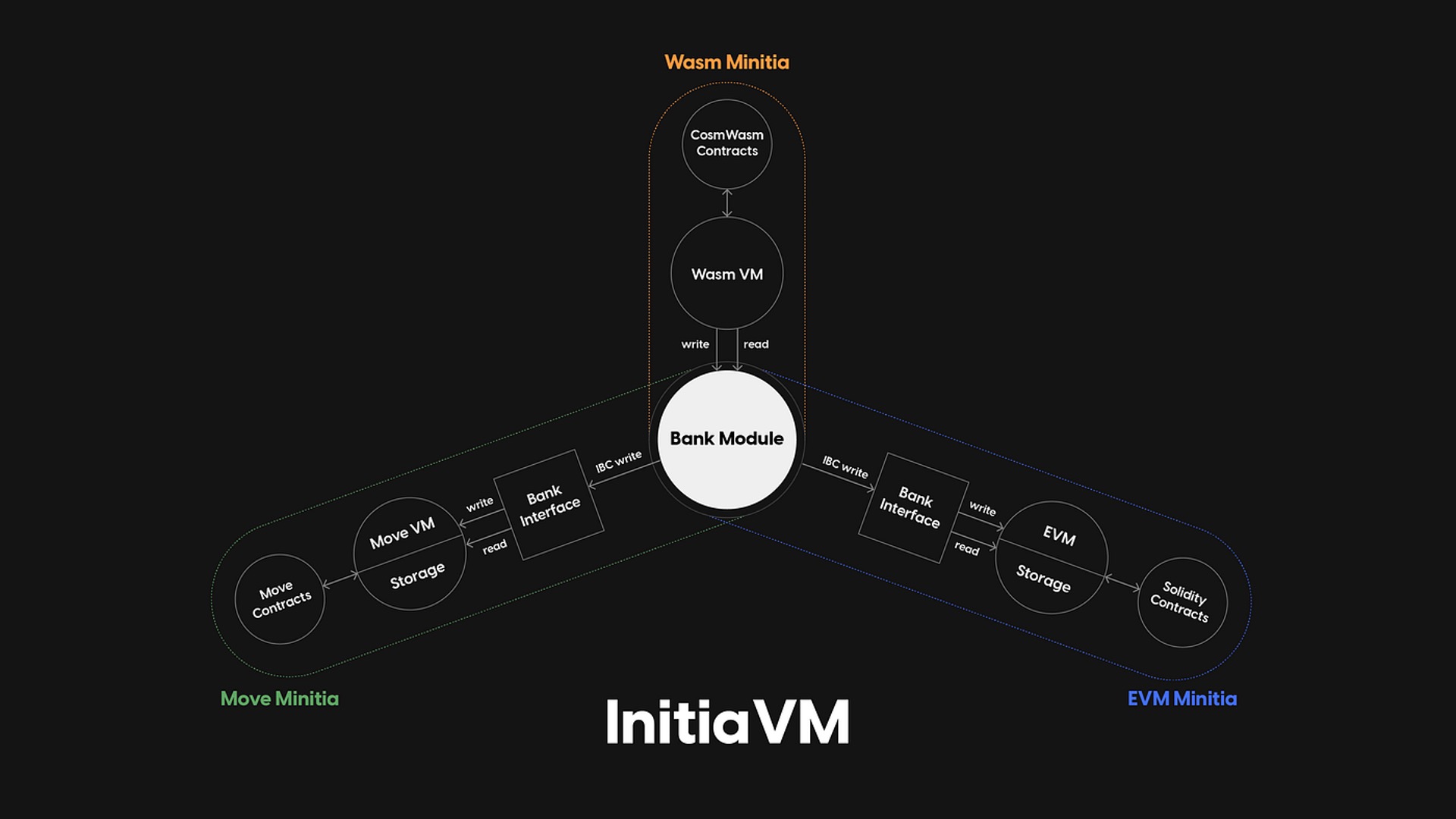

Sovereign Rollups for Custom DeFi Solutions: By enabling sovereign rollups, Celestia empowers developers to create independent chains with unique execution environments. These rollups leverage Celestia’s data availability layer, resulting in more efficient, scalable, and cost-effective DeFi protocols.

-

MilkyWay: Modular Staking and Restaking Portal: MilkyWay provides TIA token holders with a modular staking platform that preserves liquidity. Users can stake TIA—currently priced at $1.02—while remaining active in DeFi, boosting both security and participation in the ecosystem.

-

Restaked Relayer Incentives for Reliable Cross-Chain Communication: MilkyWay’s Restaked Relayer solution incentivizes IBC relayers to optimize performance, strengthening the reliability of cross-chain data transfers and supporting seamless interoperability across modular DeFi platforms.

-

Flexible Slashing and AI-Native Integrations: Through partnerships like SuperSight, MilkyWay introduces flexible slashing mechanisms and AI-native blockchain services. This approach balances security with performance incentives, fostering innovation and resilience in modular DeFi.

MilkyWay’s integration with liquid staking tokens (LSTs) also means that capital is no longer locked or siloed. Participants can stake TIA, receive LSTs representing their position, and deploy these assets across DeFi protocols on both Celestia-native and external blockchains via AVSs (Actively Validated Services). This composability is already attracting liquidity providers seeking both security and flexibility.

Moreover, MilkyWay’s Restaked Relayer solution tackles one of the persistent challenges in cross-chain communication: incentivizing honest IBC relayers. By tying relayer rewards to performance and introducing flexible slashing mechanisms (especially relevant as AI-native services like SuperSight come online), MilkyWay strengthens the reliability of data transfer between modular chains – a foundational requirement as DeFi grows more interconnected.

What to Watch: The Next Phase for Modular Blockchain DeFi

The coming months will be pivotal as Celestia approaches its ambitious scaling targets. With abundant blockspace on the horizon and robust price support at $1.02, attention will shift to how well new rollups can capitalize on these resources. Expect increased experimentation with restaking protocols designed specifically for DA layers, pushing the boundaries of what’s possible in decentralized finance.

For investors and builders alike, understanding how blobspace pricing interacts with validator incentives – and how platforms like MilkyWay enable yield stacking without sacrificing liquidity or security – will be essential. The modular blockchain era isn’t just about scalability; it’s about unlocking new forms of value creation that were impossible under legacy architectures.

Celestia’s minimalist approach doesn’t just scale blockchains; it empowers a new generation of DeFi architects to build faster, safer, and more adaptive financial systems.

If you’re interested in advanced yield strategies or want to explore how restaking mechanics are shaping DA layer economics, don’t miss our deep dive: The Future of Blobspace Auctions: How Restaking Shapes DA Layer Economics.