Celestia has emerged as the modular blockchain sector’s definitive solution for data availability (DA) layers, fundamentally reshaping how decentralized applications scale. By decoupling consensus and data availability from execution, Celestia provides developers with a flexible, scalable foundation for building next-generation blockchains. As of October 2025, Celestia’s native token TIA trades at $0.9948, reflecting its growing adoption and the increasing demand for robust DA infrastructure.

Celestia’s Modular Architecture: Separating Consensus, Data Availability, and Execution

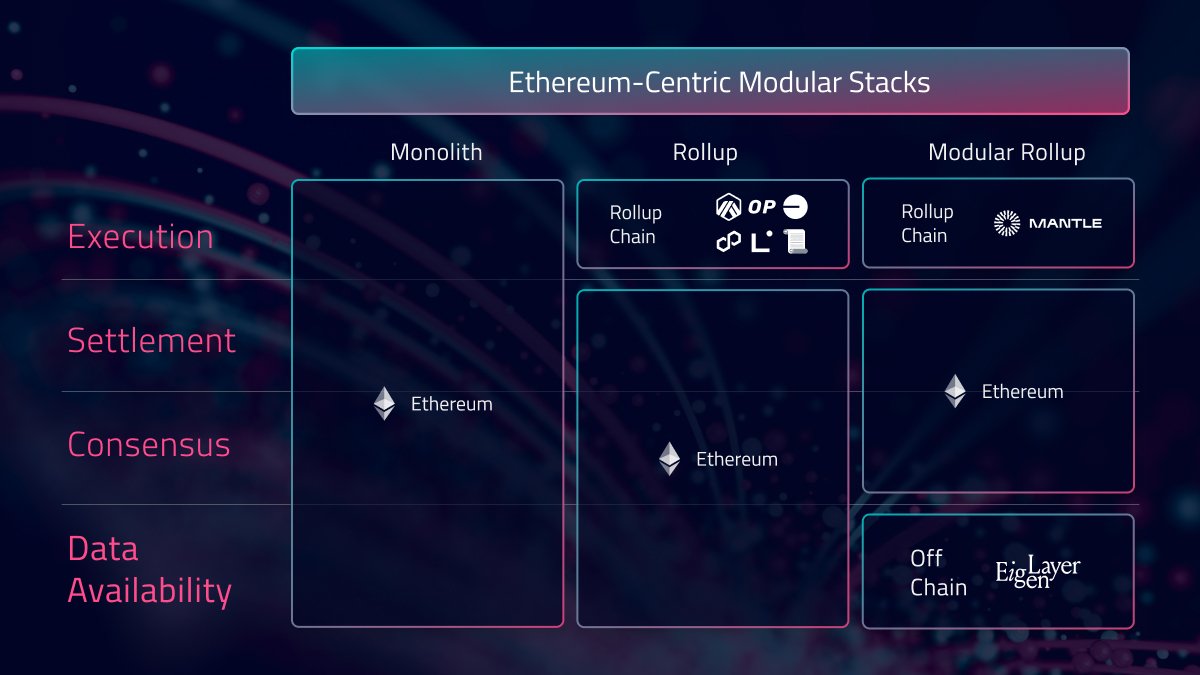

Traditional blockchains like Ethereum and Bitcoin bundle consensus, execution, and data availability into a single monolithic layer. While this model ensures tight coordination, it imposes hard scalability limits. Celestia’s architecture disrupts this paradigm by isolating the consensus and DA layer, allowing execution environments (such as rollups) to operate independently. This separation unlocks several key advantages:

- Customizability: Developers can deploy bespoke execution environments without inheriting the limitations of existing L1 chains.

- Horizontal scalability: Multiple execution layers can share a single DA layer, multiplying throughput across the ecosystem.

- Security: The consensus layer secures data availability for all connected applications, leveraging staked TIA as economic backing.

This modular approach is critical for addressing the scaling bottlenecks of monolithic blockchains. For a deeper dive into how modular DA layers overcome Merkle tree-based scalability limits, see this detailed analysis.

Innovations in Data Availability: DAS and Namespaced Merkle Trees

Celestia’s technical edge lies in two innovations: Data Availability Sampling (DAS) and Namespaced Merkle Trees (NMTs). DAS enables light nodes to efficiently verify that block data is truly available without downloading or storing entire blocks. Instead, nodes sample random pieces of block data – encoded using a 2-dimensional Reed-Solomon scheme – and if enough pieces are accessible, the entire block is assumed available with high probability. This approach allows Celestia’s throughput to scale with the number of light nodes, not just full nodes.

NMTs further streamline data access by organizing block data into namespaces, each mapped to a specific application or rollup. Applications can then retrieve only their relevant data, verifying completeness and integrity without parsing unrelated blobs. This design is essential for supporting a diverse ecosystem of rollups and DA consumers.

Celestia’s Role in the Modular Blockchain Stack

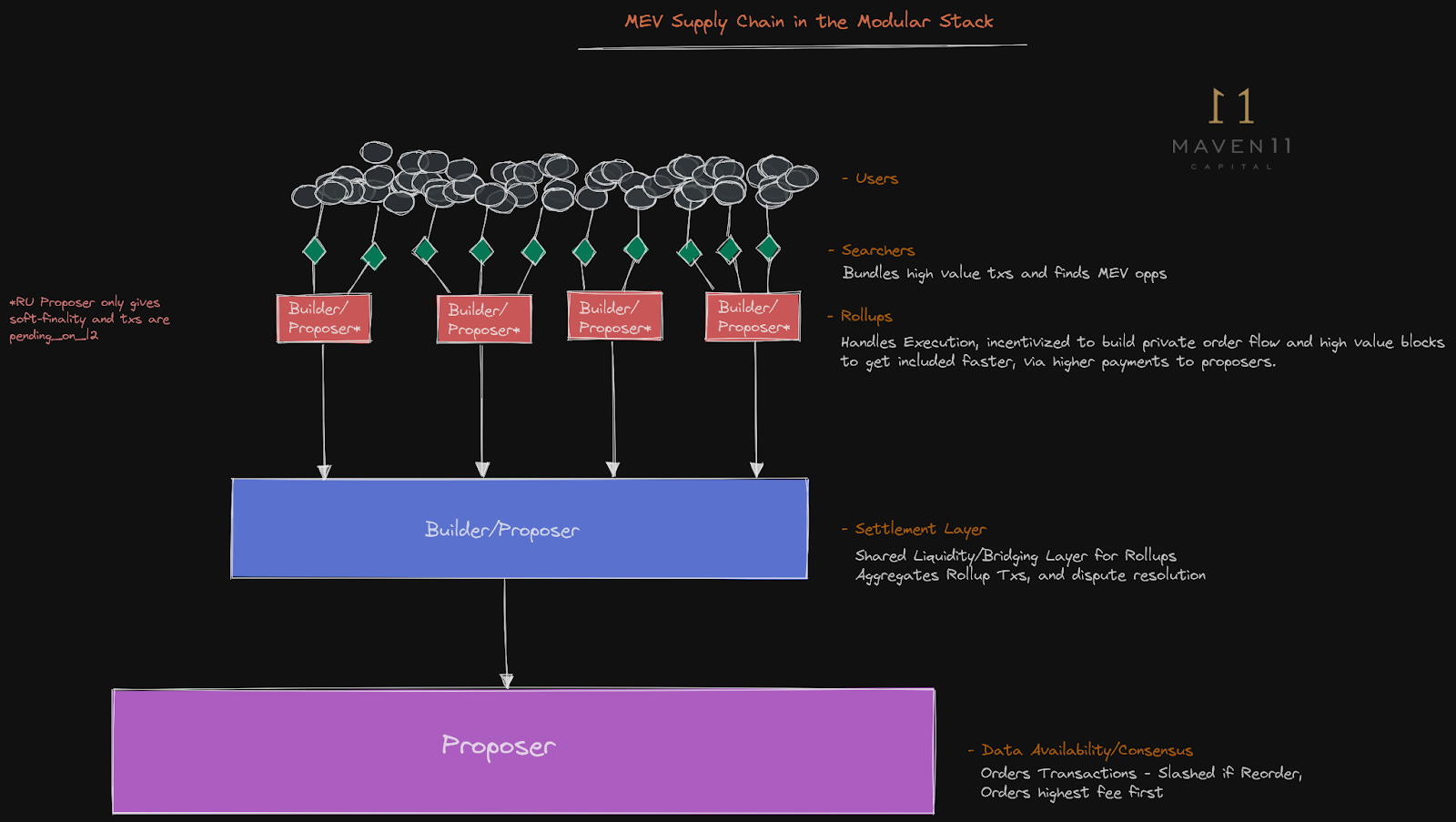

In the modular blockchain stack, each layer is optimized for a specific function:

- Execution Layer: Handles smart contract logic and transaction processing (e. g. , rollups).

- Settlement Layer: Resolves disputes, verifies proofs, and bridges between execution environments.

- Consensus and amp; Data Availability Layer: Orders transactions and guarantees that all necessary data is available for verification.

Celestia operates as the consensus and DA backbone, enabling execution and settlement layers to plug in seamlessly. This architecture is fueling a new wave of Rollup-as-a-Service projects – including Caldera, Conduit, and Eclipse – which leverage Celestia’s DA guarantees to offer scalable rollup solutions. Collaborations with Optimism Labs further extend Celestia’s reach, allowing rollups built on the Optimism stack to tap into Celestia’s high-throughput blobspace.

Blobspace Restaking: The Next Frontier

As demand for blobspace grows, restaking protocols are emerging to maximize yield while reinforcing security for DA layers like Celestia. Blobspace restaking enables participants to earn additional rewards by supporting both consensus and data availability – a trend set to accelerate as more modular blockchains adopt Celestia’s model.

Celestia (TIA) Price Prediction 2026-2031

Professional forecast based on Celestia’s data availability innovations, modular blockchain adoption, and evolving crypto market dynamics.

| Year | Minimum Price | Average Price | Maximum Price | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.85 | $1.15 | $1.60 | +16.3% | Recovery from 2025 lows; increased modular blockchain adoption; competition pressure remains |

| 2027 | $1.00 | $1.38 | $2.10 | +20.0% | Bullish scenario as RaaS partnerships mature; regulatory clarity improves; possible tech upgrades |

| 2028 | $1.22 | $1.70 | $2.65 | +23.2% | Broader enterprise and DeFi adoption of Celestia DA; positive market cycle; scaling roadmap progresses |

| 2029 | $1.45 | $2.05 | $3.40 | +20.6% | Sustained modular blockchain growth; increased rollup usage; potential for new competitors |

| 2030 | $1.65 | $2.32 | $4.00 | +13.2% | Market matures; Celestia entrenched as leading DA layer; tech improvements stabilize |

| 2031 | $1.50 | $2.20 | $3.70 | -5.2% | Potential market correction/consolidation; competition and tech disruption risk |

Price Prediction Summary

Celestia (TIA) is positioned for gradual growth over the next six years, driven by rising adoption of modular blockchain architectures, increasing demand for scalable data availability solutions, and ongoing technological improvements. Price volatility will persist, with bullish years linked to adoption breakthroughs and bearish scenarios tied to regulatory, competitive, or macroeconomic pressures. The average price is projected to rise from $1.15 in 2026 to a peak of $2.32 in 2030 before a mild correction in 2031.

Key Factors Affecting Celestia Price

- Adoption rate of modular blockchains and rollup technologies

- Success of Rollup-as-a-Service (RaaS) partnerships and integrations

- Execution of Celestia’s technical roadmap (e.g., scaling throughput, DAS improvements)

- Market cycles and overall crypto sentiment

- Regulatory developments impacting DA layers and interoperability

- Emergence of competing DA solutions (e.g., NEAR DA, EigenLayer)

- Macroeconomic conditions and risk appetite in crypto markets

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With Celestia’s blobspace becoming a sought-after resource, the economics of data availability are rapidly evolving. Blobspace restaking protocols not only incentivize validators to secure the network but also create new yield opportunities for stakers and DA service providers. This dual-purpose staking model is poised to become a cornerstone for modular blockchain DA layers, as competition intensifies among rollups and decentralized applications seeking reliable, scalable data availability.

Security remains paramount in this landscape. By leveraging TIA as both a staking asset and a payment mechanism for blobspace, Celestia ensures that economic incentives are directly aligned with network integrity. Validators who restake TIA are not only rewarded for consensus participation but also for guaranteeing that application data remains available and verifiable on-chain. This alignment is critical as modular blockchain adoption accelerates and the value at risk within these ecosystems increases.

Real-World Impact: Scaling Rollups, Lowering Costs

The practical effects of Celestia’s approach are already visible across the modular blockchain ecosystem:

Projects Leveraging Celestia’s DA Layer for Scalability

-

Caldera: A leading Rollup-as-a-Service (RaaS) provider, Caldera integrates Celestia’s data availability layer to enable scalable and customizable rollups for Web3 applications.

-

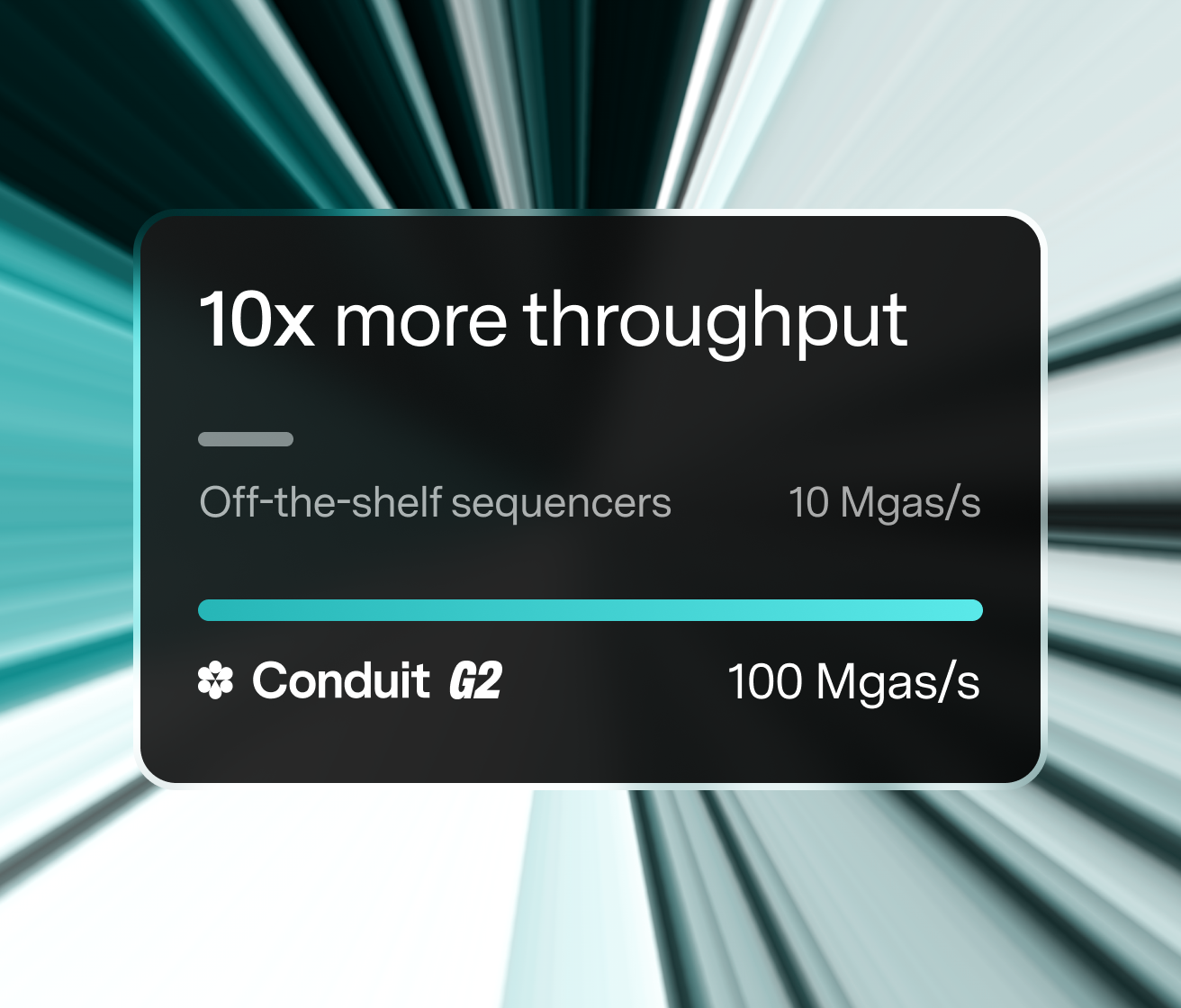

Conduit: This RaaS platform utilizes Celestia’s DA layer to deliver high-throughput, modular rollups, empowering developers to launch scalable blockchains efficiently.

-

Eclipse: Eclipse leverages Celestia for data availability, offering customizable rollups that combine the Solana virtual machine with modular DA to boost scalability and performance.

-

Optimism Stack Rollups: Through collaboration with Optimism Labs, rollups built on the Optimism stack can now utilize Celestia’s DA layer, providing developers with more flexible and scalable modular blockchain configurations.

-

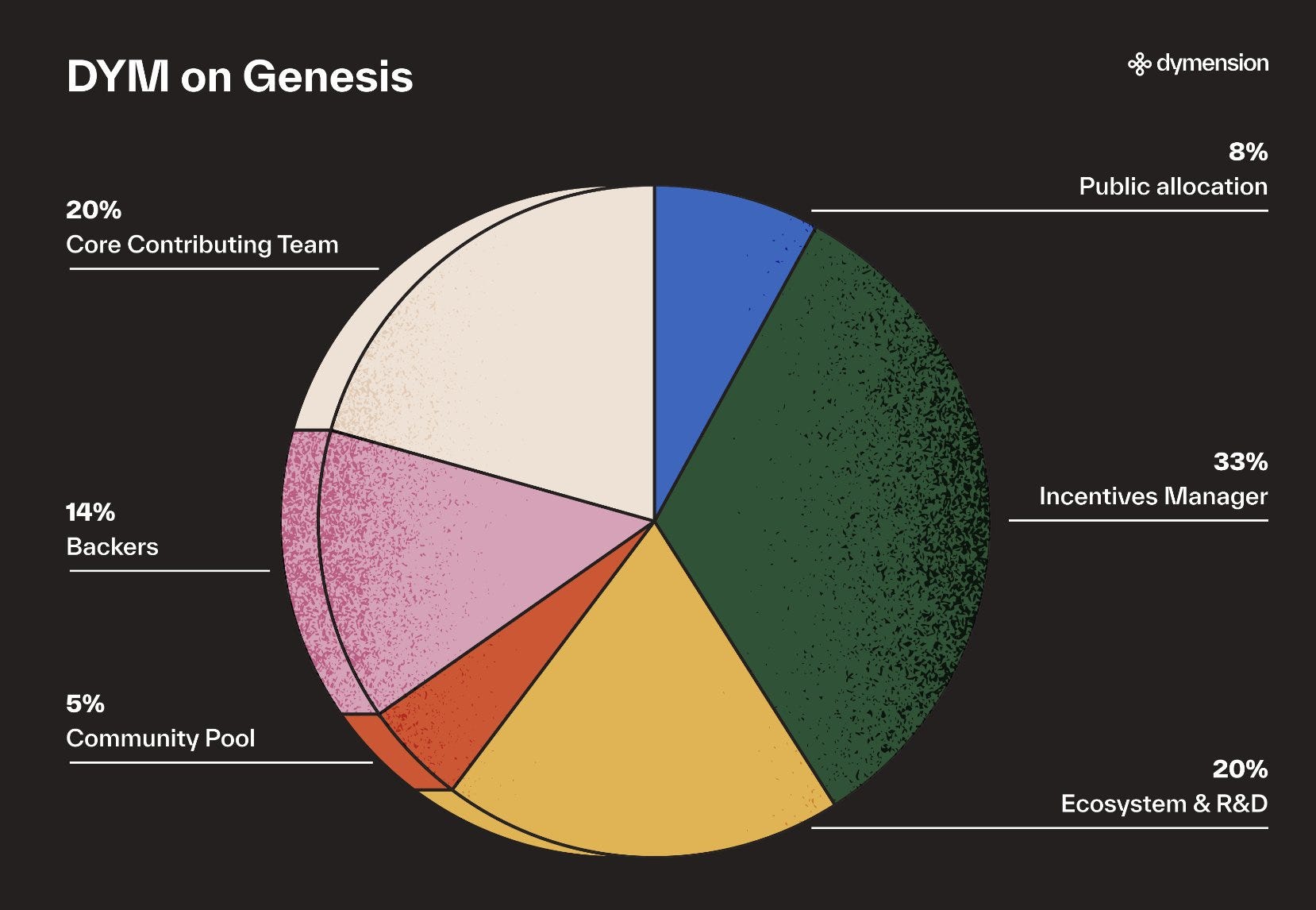

Dymension: Dymension, a modular blockchain network focused on rollup deployment, integrates Celestia’s DA layer to ensure secure and scalable data availability for its rollups.

By offloading data availability to Celestia, rollups can dramatically reduce their operating costs while increasing throughput. Developers gain the flexibility to launch custom execution environments without being bottlenecked by monolithic L1 constraints. The result is an environment where innovation flourishes, new DeFi protocols, gaming platforms, and cross-chain bridges can all tap into high-throughput DA without sacrificing security or decentralization.

This paradigm shift is especially relevant as more blockchains explore modularity. Notably, NEAR Protocol’s entry into the DA space underscores how demand for scalable, independent data availability solutions is outpacing legacy models. For developers seeking a deeper understanding of how DA layers like Celestia improve rollup scalability, this technical guide offers critical context.

Market Context: TIA Price Stability Reflects Growing Adoption

As of October 2025, TIA trades at $0.9948, reflecting steady demand from developers and stakers leveraging Celestia’s DA infrastructure. While price action remains relatively stable (24h change: -0.000790%), the underlying utility of TIA, securing consensus, paying for blobspace, enabling restaking, continues to deepen its role within the modular blockchain stack.

The next phase will see increased composability between execution environments, settlement layers, and DA providers like Celestia. As more protocols integrate blobspace restaking into their security models and more applications migrate to modular stacks, expect both adoption metrics and TIA’s economic significance to rise in tandem.

The bottom line: Celestia’s innovations in data availability sampling (DAS), namespaced Merkle trees (NMTs), and blobspace economics are setting new standards for modular blockchain infrastructure. For those building or investing in decentralized systems seeking true scalability without compromise on security or flexibility, understanding, and leveraging, Celestia’s architecture is now mission-critical.