In the fast-evolving world of Web3 infrastructure, EigenLayer restaking is emerging as a transformative force for decentralized AI and cloud computing. As blockchain applications scale in complexity, the need for robust, shared security becomes paramount. EigenLayer’s model enables Ethereum stakers to repurpose their staked ETH to secure a range of decentralized services, extending trust far beyond Ethereum’s native consensus. With the current price of Ethereum at $4,036.66, this model is not just about maximizing yield – it’s about anchoring next-generation protocols in proven cryptoeconomic security.

How Restaking Powers Verifiable Cloud Computing

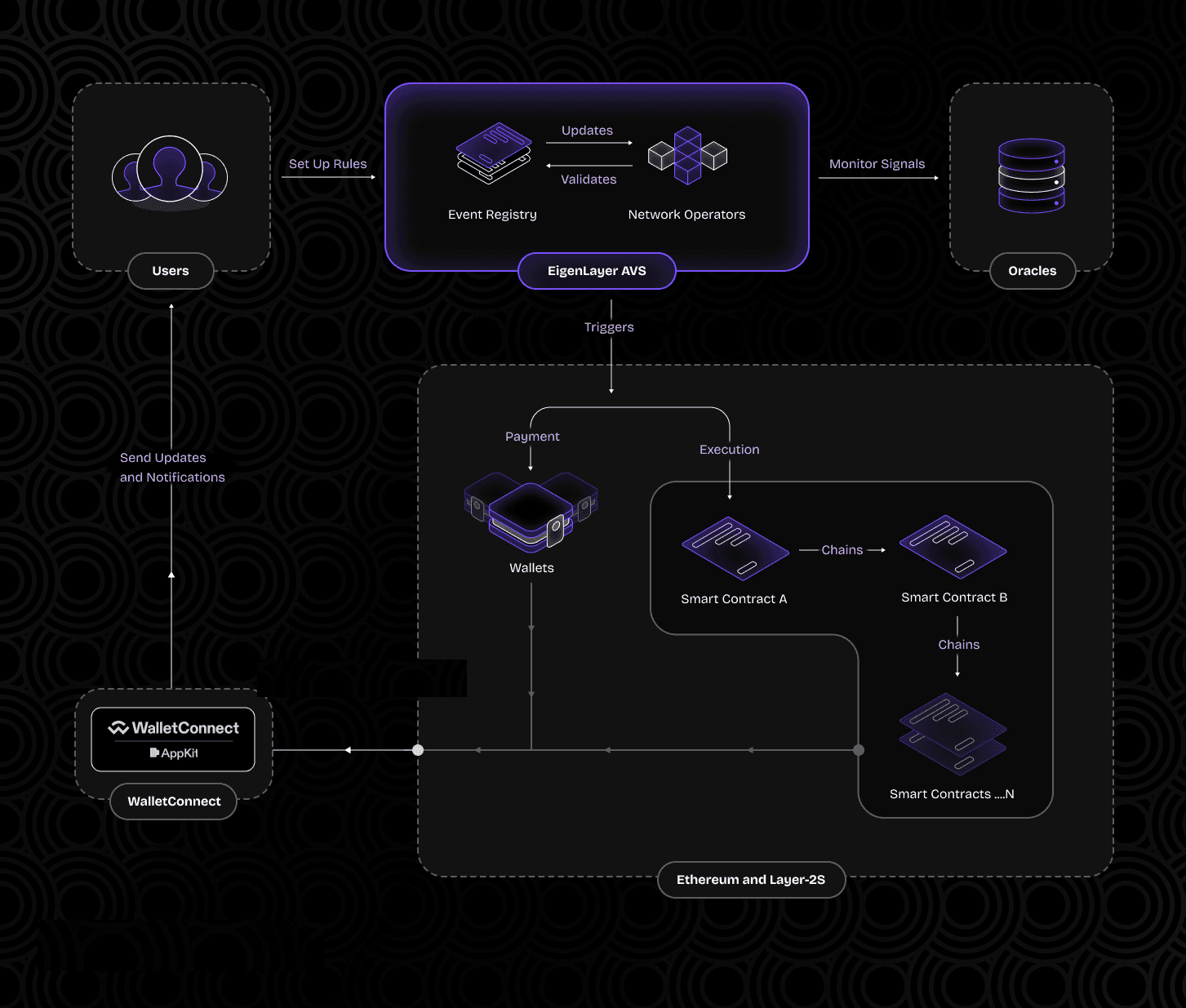

The traditional cloud landscape is dominated by centralized providers who control access, pricing, and data governance. In contrast, EigenLayer introduces a verifiable cloud paradigm where security is decentralized and programmable. By allowing ETH holders to restake assets across multiple protocols, EigenLayer creates a shared security layer that can be tapped by emerging decentralized clouds like Aethir and EigenCloud.

This approach solves two critical challenges for Web3: it removes the need for every new protocol to bootstrap its own validator set (an expensive and slow process), and it enables composability between services that inherit the economic guarantees of Ethereum itself. The result? A more resilient foundation for decentralized computation, storage, and AI inference marketplaces.

Securing Decentralized AI: From Theory to Practice

The intersection of AI and blockchain is no longer theoretical. Projects like Ritual are leveraging EigenLayer’s restaking mechanism to build AI-powered DApps with strong onchain guarantees. Through this collaboration, developers can launch smart agents or DeFi applications that are protected by Ethereum-level security primitives – not simply wishful thinking but cryptoeconomic reality.

Kite AI’s integration goes one step further by using restaked validators to verify off-chain computations in its marketplace for models and datasets. This means users can trust that an AI model’s output or a dataset’s provenance has been cryptographically validated by actors with real economic skin in the game – all anchored in the same trust assumptions as Ethereum itself.

Top 3 Use Cases Enabled by EigenLayer Restaking for Decentralized AI

-

AI-Powered Decentralized Applications (DApps) via Ritual: EigenLayer’s partnership with Ritual enables the creation of AI-enabled DApps, such as on-chain smart agents and AI-driven DeFi protocols. By leveraging Ethereum’s restaked security, these applications inherit robust cryptoeconomic guarantees, fostering trust and innovation in decentralized AI services.

-

Verifiable AI Model and Data Marketplaces with Kite AI: Kite AI integrates EigenLayer’s restaking technology to bring verifiable trust to its AI marketplace. Restaked validators verify AI computations and asset listings, ensuring the accuracy and reliability of models, datasets, and agents—all anchored in Ethereum’s security framework.

-

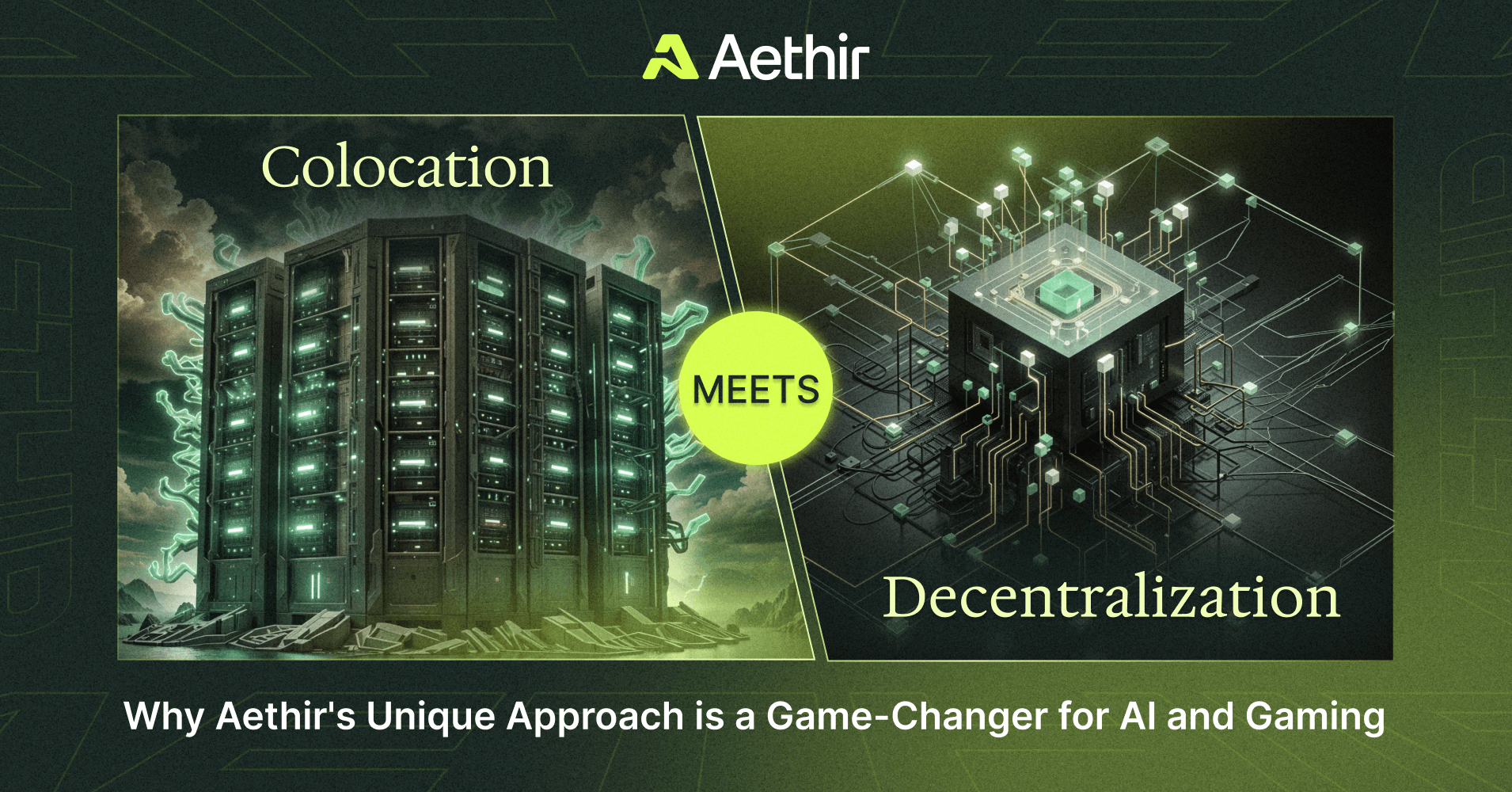

Decentralized Cloud Infrastructure Security through Aethir: Aethir utilizes EigenLayer’s restaking solutions to secure its decentralized cloud computing platform. This integration enhances the security and scalability of distributed GPU and compute services, supporting large-scale AI workloads with Ethereum-grade trust and generating significant on-chain revenue for the ecosystem.

Restaking Revenue and Market Impact at Current ETH Prices

The financial incentives behind restaking are equally compelling. At an ETH price of $4,036.66, stakers are not only earning rewards from securing Ethereum but also from providing critical infrastructure to new sectors like decentralized GPU clouds and verifiable AI computation. For example, the partnership between EigenLayer and Aethir is projected to generate significant annual on-chain revenue streams for stakers willing to participate in securing these networks (source).

This multi-protocol yield stacking could reshape how institutional capital views staking strategies – not just as passive income but as active participation in securing tomorrow’s digital infrastructure.

Ethereum (ETH) Price Prediction 2026-2031: Impact of EigenLayer Restaking Adoption

Professional ETH forecasts reflecting EigenLayer’s decentralized AI & cloud integrations. Baseline as of Oct 2025: $4,036.66 per ETH.

| Year | Min Price (Bearish) | Avg Price (Base Case) | Max Price (Bullish) | YoY Avg % Change | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,600 | $4,600 | $5,800 | +14% | Early scaling of EigenLayer; ETH benefits from new DeFi and AI DApps, volatility persists as regulatory clarity develops. |

| 2027 | $4,000 | $5,400 | $7,200 | +17% | Wider adoption of restaking in AI/cloud; ETH network fees rise, ETH burns increase, but macro uncertainty may cap upside. |

| 2028 | $4,500 | $6,250 | $8,900 | +16% | Decentralized AI/cloud see mainstream pilots; ETH becomes backbone for multiple sectors, though competition from L2s and alt-L1s intensifies. |

| 2029 | $5,000 | $7,200 | $10,800 | +15% | ETH’s security premium grows with institutional adoption of EigenLayer; regulatory environment stabilizes, but global recession risk remains. |

| 2030 | $5,500 | $8,300 | $13,200 | +15% | AI and cloud DApps drive ETH demand; restaking yields attract new capital, though tech risk and scalability debates continue. |

| 2031 | $6,200 | $9,600 | $15,800 | +16% | Ethereum cements role as decentralized trust layer for AI/cloud; ETH price reflects high demand for cryptoeconomic security, but cycles and innovations in competing chains may cause periodic corrections. |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is progressive, supported by EigenLayer’s transformative restaking model driving demand from decentralized AI and cloud sectors. Average price forecasts anticipate steady growth, with potential for outsized gains if Ethereum maintains dominance as the primary security layer for emerging applications. However, volatility and competition remain significant factors.

Key Factors Affecting Ethereum Price

- Adoption rate of EigenLayer by AI and cloud projects

- Growth of decentralized AI and cloud computing sectors

- Ethereum’s network upgrades and scalability improvements

- Regulatory clarity and global digital asset policy

- Emergence of competing restaking or modular security solutions

- Macro-economic cycles and institutional adoption

- Potential ETH supply shocks (burning, staking, or unlocks)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

As adoption accelerates, the restaking model is becoming a linchpin for trustless, composable Web3 infrastructure. With ETH holding steady at $4,036.66, the economic gravity of Ethereum security is drawing in a new class of protocols and investors. These actors are not simply chasing yield; they’re underwriting the reliability of decentralized AI agents, verifiable cloud storage, and permissionless computation.

Emerging Ecosystem: Cross-Protocol Security and Innovation

What sets EigenLayer apart is its ability to foster an ecosystem where diverse services share a common security substrate. This shared layer means that networks like EigenCloud, Aethir’s GPU marketplace, and Ritual’s AI DApps all benefit from Ethereum’s robust validator set, without reinventing the wheel for each new protocol.

For developers, this translates to faster launches and greater assurance that their applications will remain secure against malicious actors. For users, it means interacting with AI models or decentralized apps whose outputs are verifiable and whose incentives are transparently aligned with network health.

The Institutional Shift: Restaking as a Portfolio Strategy

The narrative around staking is shifting rapidly. Once viewed as a passive yield mechanism, restaking now enables active risk management across multiple protocols. Institutions and sophisticated investors are beginning to see restaked ETH not just as an asset but as programmable collateral, one that can be allocated dynamically based on risk/reward profiles across verifiable cloud computing, AI inference marketplaces, and more.

This shift is likely to accelerate as more protocols integrate with EigenLayer’s model. The emergence of liquid restaking tokens (LRTs) further enhances capital efficiency by allowing stakers to maintain liquidity while supporting multiple networks simultaneously.

Risks and Forward-Looking Considerations

No system is without trade-offs. The rehypothecation-like nature of restaking introduces new attack surfaces: if a validator misbehaves across multiple protocols, slashing penalties could cascade. This makes robust slashing conditions and transparent governance crucial for long-term sustainability.

Nevertheless, the upside remains significant. As more decentralized AI projects demand verifiable trust, and as cloud computing moves further from centralized silos, EigenLayer’s role as a cryptoeconomic backbone will only grow in relevance.

Key Risks & Mitigation Strategies for EigenLayer Restakers

-

Slashing Risk: Restaking exposes participants to slashing penalties if validators misbehave or fail to meet protocol requirements. Mitigation: Use reputable node operators, monitor validator performance, and diversify across multiple operators to reduce exposure.

-

Smart Contract Vulnerabilities: Smart contracts underpinning EigenLayer and integrated protocols may contain bugs or exploits.Mitigation: Choose protocols with audited contracts and active bug bounty programs. Stay informed about security updates from EigenLayer and its partners.

-

Liquidity Risk: Restaked assets may be locked or subject to withdrawal delays, limiting access to funds during market volatility.Mitigation: Understand the unbonding periods and liquidity constraints before restaking. Consider using liquid staking tokens (LSTs) for additional flexibility.

-

Protocol Integration Risk: Integrations with third-party platforms like Ritual, Kite AI, or Aethir may introduce operational or security risks.Mitigation: Research the track record and security posture of integrated platforms. Diversify restaking allocations across multiple protocols to minimize potential impact.

-

Market Volatility: The value of staked assets such as Ethereum (ETH) can fluctuate significantly. As of now, ETH is priced at $4,036.66.Mitigation: Monitor market conditions, use risk management strategies, and avoid overexposure to volatile assets.

-

Centralization Risk: Concentration of restaked assets among a few large operators or protocols can undermine decentralization.Mitigation: Support decentralized validator sets and distribute restaked assets across multiple operators and protocols.

The Road Ahead for Decentralized AI Security

The coming year will be pivotal for both EigenLayer and the broader modular blockchain ecosystem. As ETH continues to trade at $4,036.66, expect further integrations between EigenLayer and next-generation platforms seeking scalable security guarantees.

Whether you’re building decentralized AI agents or managing a portfolio of digital assets, understanding how restaking weaves together yield generation with real-world utility is essential for staying ahead in this rapidly evolving landscape.