Blockchain scaling is at a crossroads. Monolithic blockchains are straining under the weight of user demand, while rollup-centric architectures promise a more scalable, customizable path forward. Enter Celestia, the modular blockchain protocol that’s rewriting the rules for rollup scaling solutions by decoupling data availability from execution. With Celestia’s mainnet live and TIA trading at $1.08, the modular era is no longer theory – it’s here, and it’s changing the economics of decentralized applications.

Why Data Availability Matters in Blockchain Scaling

Every blockchain, from Bitcoin to Ethereum, faces a fundamental challenge: how do you ensure that all transaction data is available to the network, so that anyone can verify the chain’s integrity? This is the data availability problem, and it’s a core bottleneck for scaling. Traditional chains require every validator to download and store all transaction data, leading to massive inefficiencies and high costs as usage grows. For developers, this means limited throughput and sky-high gas fees when demand spikes.

Celestia’s solution is both radical and refreshingly practical. By specializing purely in consensus and data availability, Celestia allows execution environments (like rollups) to run independently on top. The result: developers can launch custom rollup chains without the overhead of running a full blockchain. Data is published to Celestia, which guarantees its availability using cutting-edge cryptography and sampling techniques – no more monolithic bottlenecks.

Celestia’s Modular Architecture: Decoupling Execution, Consensus, and Data

What makes Celestia unique is its modular blockchain architecture. Instead of one chain doing everything, Celestia splits responsibilities:

- Consensus – Orders transactions, secures the network

- Data Availability – Ensures all transaction data is published and available

- Execution – Handled by independent rollups, not Celestia itself

This separation supercharges scalability. Rollups and layer 2s can publish their transaction data to Celestia, leveraging its secure consensus and cheap blobspace. They don’t need to worry about Sybil resistance or running expensive validators – Celestia handles that. According to Celestia’s official docs, this approach drops developer costs by roughly 95% compared to legacy monolithic chains.

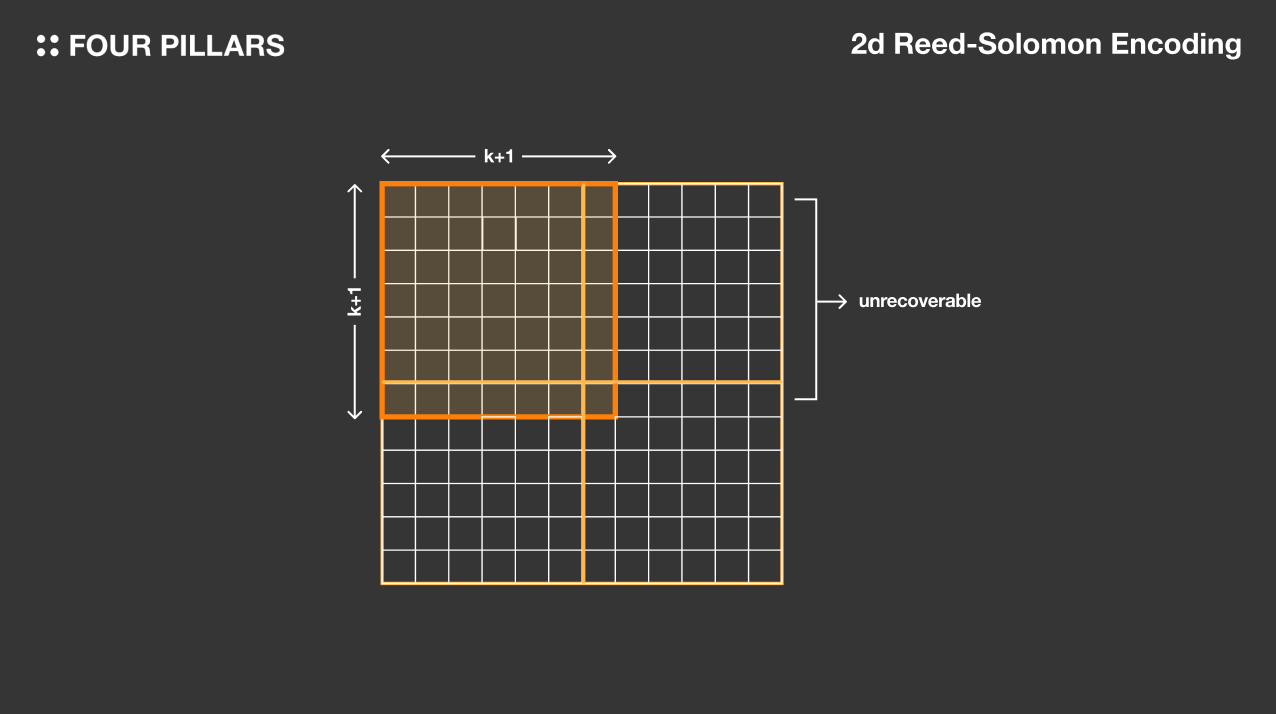

Celestia’s data availability sampling (DAS) is the secret sauce here. Nodes no longer need to download every byte of every block. Instead, they randomly sample small chunks of data, and if enough honest nodes can reconstruct the block from these samples, the data is deemed available. This innovation enables even lightweight nodes to confidently verify the chain, boosting decentralization and scalability in one stroke.

Rollups and Blobspace: Scaling Without Compromise

With mainnet live since October 31,2023, Celestia has rapidly become the data backbone for a new wave of rollups. Frameworks like Arbitrum Orbit and the OP Stack are integrating with Celestia, allowing developers to deploy high-throughput, customizable chains that inherit Celestia’s security and data guarantees. Read more about Celestia’s integration with Arbitrum Orbit for technical details.

Here’s where the concept of blobspace comes in. Rollups post their transaction data as “blobs” to Celestia’s DA layer. Thanks to DAS, these blobs are provably available and can be verified by anyone, anywhere. This architecture not only slashes costs but also unlocks new use cases for fully-onchain applications that simply weren’t feasible under previous data models.

Celestia (TIA) Price Prediction 2026–2031

Professional outlook based on Celestia’s modular blockchain adoption, technology trends, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.95 | $1.30 | $1.85 | +20% | Market recovery phase, increased rollup adoption, but still volatile |

| 2027 | $1.10 | $1.60 | $2.30 | +23% | Growing modular blockchain usage, integration with L2s, positive regulatory signals |

| 2028 | $1.35 | $2.05 | $2.90 | +28% | Broader DeFi and rollup ecosystem expansion, potential for mainstream developer adoption |

| 2029 | $1.60 | $2.55 | $3.60 | +24% | Matured data availability market, competition increases but Celestia retains lead |

| 2030 | $1.90 | $3.10 | $4.25 | +22% | Large-scale enterprise and institutional adoption, improved scalability tech |

| 2031 | $2.20 | $3.65 | $5.10 | +18% | Possible cycle top, high adoption but macro crypto volatility resurfaces |

Price Prediction Summary

Celestia (TIA) is positioned to benefit from the ongoing modular blockchain trend and the growing need for scalable data availability solutions. The average price is expected to trend upward year-over-year, reflecting increased adoption, technical improvements, and integration with major rollup frameworks. However, price volatility and competition remain significant factors, with the potential for both bullish and bearish scenarios each year.

Key Factors Affecting Celestia Price

- Adoption of modular blockchains and rollups in DeFi and enterprise sectors

- Success and scalability of Celestia’s data availability solutions (DAS, Rollkit)

- Integration with leading rollup and L2 frameworks (e.g., Arbitrum Orbit, OP Stack)

- Regulatory clarity and global crypto policy developments

- Market sentiment and broader crypto cycles (bull/bear markets)

- Emergence of new competitors in the data availability space

- Technological innovation and network upgrades on Celestia

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Celestia in the Market: TIA Price Action and Ecosystem Growth

As of today, Celestia (TIA) is trading at $1.08, with a 24-hour change of -$0.06 (-0.06%). The intraday high sits at $1.14, while the low is $1.05. This price action reflects a market that’s still digesting the implications of modular blockchains and the rapid adoption of DA layers for rollup scaling. With the modular thesis gaining steam and more rollups choosing Celestia as their DA backbone, TIA’s role as a core infrastructure asset is only getting stronger.

Celestia’s momentum is driven by a vibrant ecosystem and a relentless focus on developer empowerment. The launch of Rollkit is a perfect example: this modular rollup framework allows teams to spin up their own rollups on top of Celestia’s DA layer, experimenting with different execution environments, proof schemes, and governance models. Developers can choose between optimistic or zk rollup modes, tailoring their stack to their project’s unique needs. This flexibility is fueling a new generation of onchain applications that can scale without compromise.

Let’s break down why Celestia’s approach is resonating across the blockchain space:

Top 5 Reasons Developers Choose Celestia for Rollup Scaling

-

1. Modular Architecture for Maximum FlexibilityCelestia separates consensus and data availability from execution, allowing developers to create customized rollup chains without the burden of maintaining a full blockchain. This modular approach streamlines development and enhances scalability.

-

2. Data Availability Sampling (DAS) Boosts EfficiencyCelestia uses Data Availability Sampling, enabling light nodes to verify data availability by sampling small portions of each block. This innovation increases network scalability and reduces resource requirements for nodes.

-

3. Significant Cost Reduction for DevelopersBy eliminating data availability as a core bottleneck, Celestia reduces costs for developers by approximately 95%. This makes deploying and scaling rollups far more affordable compared to traditional monolithic blockchains.

-

4. Seamless Integration with Leading Rollup FrameworksCelestia integrates with popular frameworks like Arbitrum Orbit and the OP Stack, giving developers access to robust tools for launching high-throughput, customizable rollup chains.

-

5. Live Mainnet and Rapid Innovation with RollkitSince its mainnet launch on October 31, 2023, Celestia has enabled real-world rollup deployments. The Rollkit framework further accelerates experimentation, allowing developers to deploy rollups across the modular stack with support for both zk and optimistic proofs.

First, cost efficiency is a game-changer. By offloading data availability to Celestia, rollups can offer dramatically lower fees, making fully-onchain games, DeFi protocols, and even social networks economically viable for the first time. Second, permissionless deployment means anyone can launch a rollup without gatekeepers or expensive validator sets. Third, security is inherited from Celestia’s robust consensus, so new chains don’t need to bootstrap their own security from scratch.

But perhaps most exciting is the pace of ecosystem growth. Since mainnet, dozens of projects have announced plans to build rollups using Celestia as their DA layer. From high-frequency trading platforms to decentralized identity solutions, the modular paradigm is unlocking use cases that monolithic chains simply couldn’t handle at scale.

What’s Next for Modular Blockchains? The Road Ahead for Celestia and Rollup Scaling

Looking forward, the modular blockchain movement is poised to accelerate. As more rollup frameworks integrate with Celestia, expect to see an explosion of experimentation at the application layer. Projects can iterate rapidly, swapping out execution environments or proof systems as the technology evolves, all while relying on Celestia for scalable, trust-minimized data availability.

For investors and builders, the $1.08 TIA price marks an inflection point, not just for Celestia, but for the entire modular thesis. As adoption grows and the economics of onchain data shift, the value proposition of DA layers like Celestia becomes increasingly clear. The days of monolithic bottlenecks are numbered; the future belongs to flexible, modular architectures that empower developers to build without limits.

Whether you’re a developer seeking to launch your own rollup, a validator looking to support the next wave of decentralized infrastructure, or an investor tracking the evolution of DA layers, Celestia offers a front-row seat to blockchain’s most important scaling revolution. Stay tuned as the modular era unfolds, this is just the beginning.