Blobspace auctions are rapidly becoming the cornerstone of data availability (DA) layer economics. With the advent of Ethereum’s EIP-4844, rollups gained access to dedicated blobspace for transaction data, decoupling DA costs from traditional gas fees and unlocking new economic models for both users and validators. The fixed 128 KB blob size has driven innovation in how rollups consume and share space, pushing the ecosystem toward more dynamic, market-driven solutions.

Blobspace Auctions: The New Battleground for DA Efficiency

At its core, blobspace auctions allocate scarce on-chain storage to the highest bidders, primarily rollups seeking to post transaction data securely and efficiently. While EIP-4844’s introduction slashed costs by offering a cheaper alternative to calldata, it also surfaced inefficiencies: many rollups underutilize their allocated blobs due to variable throughput needs. This underutilization leads to higher per-user costs and wasted capacity.

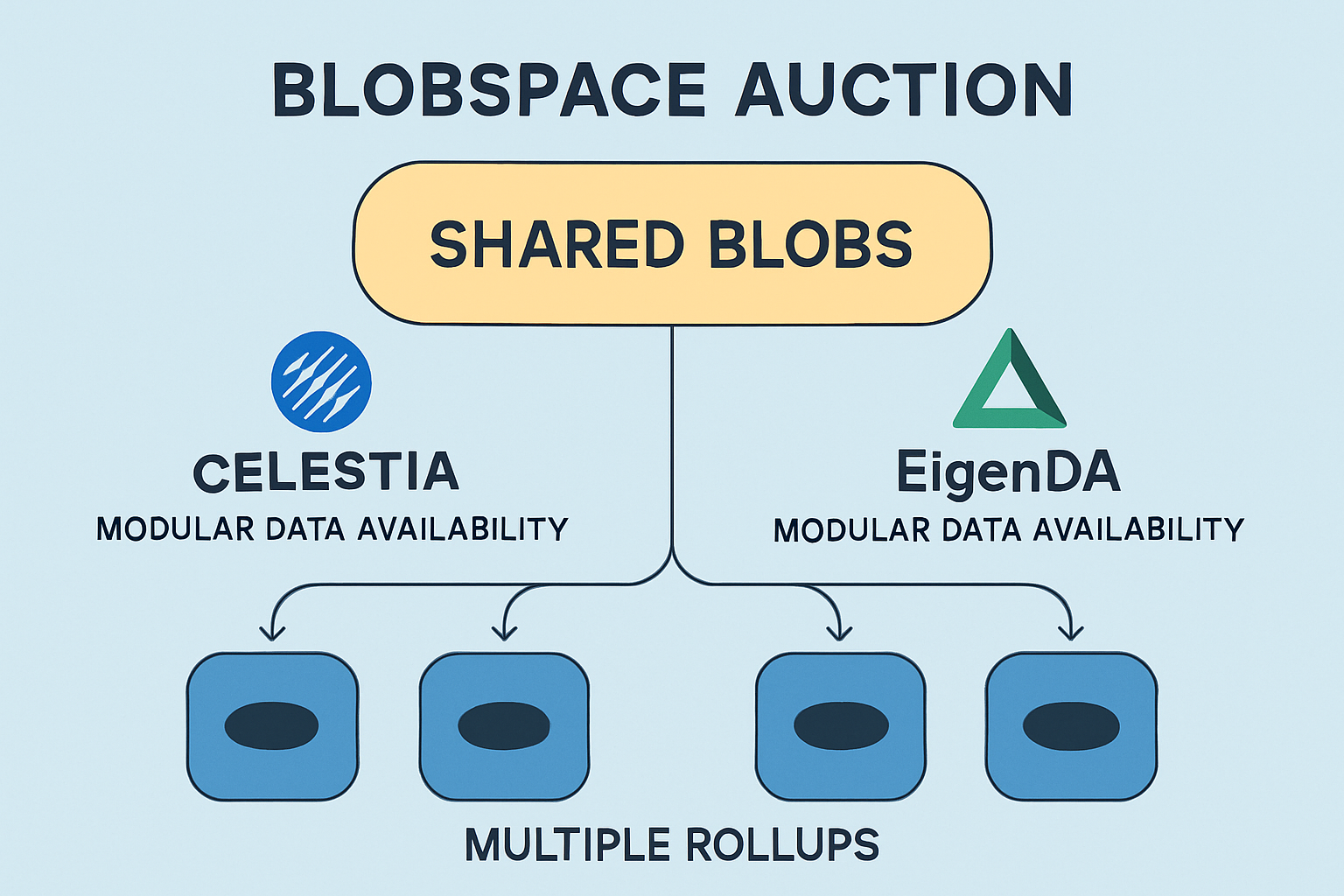

Emerging solutions like blob sharing, where multiple rollups cohabit a single blob, are gaining traction as a direct response. By pooling demand, these mechanisms optimize usage and drive down effective costs, improving both user experience and network resource allocation. For a technical deep dive on this evolution, see the recent research at arxiv.org.

Restaking: Redefining Capital Efficiency in DA Layers

The integration of restaking into DA layers marks a paradigm shift in network security and validator incentives. Restaking allows staked assets, most notably ETH, to be reused across multiple protocols or services without fragmenting security guarantees or requiring new validator sets. In practice, this means Ethereum validators can opt into securing EigenDA via EigenLayer’s restaking primitive while still maintaining their primary duties.

This approach delivers dual benefits: validators earn additional rewards by supporting EigenDA, while rollups gain access to scalable DA secured by Ethereum’s robust economic base. According to Twinstake, early data suggests that restaked validators can capture a significant share of new DA revenue streams without diluting their original incentives.

Celestia vs EigenLayer: Competing Visions for Modular DA Economics

The race between Celestia blobspace auctions and EigenLayer DA economics is shaping the future modular stack. Celestia takes an application-agnostic approach, its dedicated blobspace is priced independently from execution layers like Ethereum, allowing developers to build atop a neutral DA substrate (Celestia Blog). Meanwhile, EigenLayer leverages Ethereum-native restaking to secure its own DA service (EigenDA), promising Ether-level security for all participating L2s.

Celestia vs EigenLayer: Key Blobspace & DA Model Differences

-

Data Availability Model: Celestia operates as a dedicated modular DA layer, offering independent blobspace that is priced separately from Ethereum gas, with its own validator set. EigenLayer enables restaking of ETH to secure EigenDA, a DA service built on Ethereum, leveraging Ethereum’s existing validator set for security.

-

Security Mechanism: Celestia uses its native staking token (TIA) and validator set to secure blobspace. EigenLayer utilizes ETH restaking, allowing Ethereum validators to secure additional services like EigenDA, increasing capital efficiency.

-

Blobspace Pricing & Auctions: Celestia prices blobspace independently from Ethereum, with auctions and fees determined by its own network demand. EigenDA prices DA relative to Ethereum’s ecosystem, with costs influenced by ETH staking dynamics and restaking incentives.

-

Validator Participation: Celestia requires a separate validator set and staking of TIA to participate in consensus and DA. EigenLayer allows existing Ethereum validators to opt-in for EigenDA by restaking ETH, lowering the barrier for participation and increasing validator rewards.

-

Modularity & Ecosystem Integration: Celestia is designed as a fully modular DA layer, enabling any rollup or chain to leverage its blobspace via solutions like Blobstream. EigenLayer is Ethereum-native, focusing on extending Ethereum’s security to DA and other services through restaking.

-

Economic Incentives: Celestia rewards TIA stakers/validators directly from blobspace fees. EigenLayer enables additional rewards for ETH stakers by providing DA, improving capital efficiency and validator income through restaking.

This divergence creates distinct economic dynamics:

- Celestia: Focuses on maximizing resource utilization through open auctions and cross-rollup collaboration.

- EigenLayer: Prioritizes capital efficiency by stacking services atop existing ETH stakes, reducing infrastructure duplication.

The result is an increasingly competitive landscape where capital allocation decisions hinge on yield opportunities, security assurances, and operational flexibility, all mediated through evolving auction mechanisms.

As the market matures, the interplay between blobspace auctions and restaking will determine which DA layers capture the most value. The modular blockchain thesis is being stress-tested in real time as capital, developer mindshare, and user flows converge on platforms that offer both efficiency and security at scale.

Yield Dynamics: How Restaking Reshapes Incentives

Restaking is not just a technical innovation, it’s fundamentally altering the yield landscape for validators and investors. With protocols like EigenLayer, Ethereum validators can now allocate their staked ETH across multiple services, extracting additional returns from securing DA layers such as EigenDA. This stacking of yields creates a new risk/reward calculus: validators must weigh potential slashing risks against higher aggregate rewards from supporting multiple protocols.

For rollups and dApps, these economics translate directly into lower data costs and greater availability guarantees. As more validators opt into restaking frameworks, DA services become more robust and cost-effective, an essential feature for rollup-centric scaling strategies. Early evidence points to a virtuous cycle: increased validator participation drives down DA costs, which in turn attracts more usage and further validator engagement.

Risks and Bottlenecks: Where Blobspace Auctions Could Break Down

Despite rapid progress, several bottlenecks remain. Blobspace fragmentation, especially in fixed-size models like Ethereum’s 128 KB blobs, can lead to inefficiency if rollups cannot coordinate sharing or if demand spikes unpredictably. Restaking introduces its own risks: correlated slashing events or protocol-level bugs could propagate losses across multiple services secured by the same capital base.

Additionally, as more DA layers experiment with auction mechanics (e. g. , partial block auctions or priority fees), market manipulation and frontrunning become real concerns. Ensuring credible commitments from block proposers is an open research problem (Blocknative). Robust cryptoeconomic design will be critical to prevent cartelization or validator collusion as these markets scale.

What Comes Next for Modular DA Layers?

The next phase of competition will likely see tighter integration between blobspace auction mechanisms and restaking frameworks. Expect to see:

- Dynamic pricing models for blobspace that adapt to real-time network demand

- Cross-chain data availability proofs leveraging both Celestia’s neutral substrate and EigenLayer’s Ethereum-native security

- New forms of validator coordination to maximize yield while minimizing systemic risk

The ultimate winners will be those protocols that best align incentives across users, validators, and developers, delivering scalable data availability without sacrificing decentralization or security. As modular blockchains continue to evolve, keeping pace with innovations in blobspace auctions and restaking will be critical for anyone seeking an edge in the emerging DA layer economy.