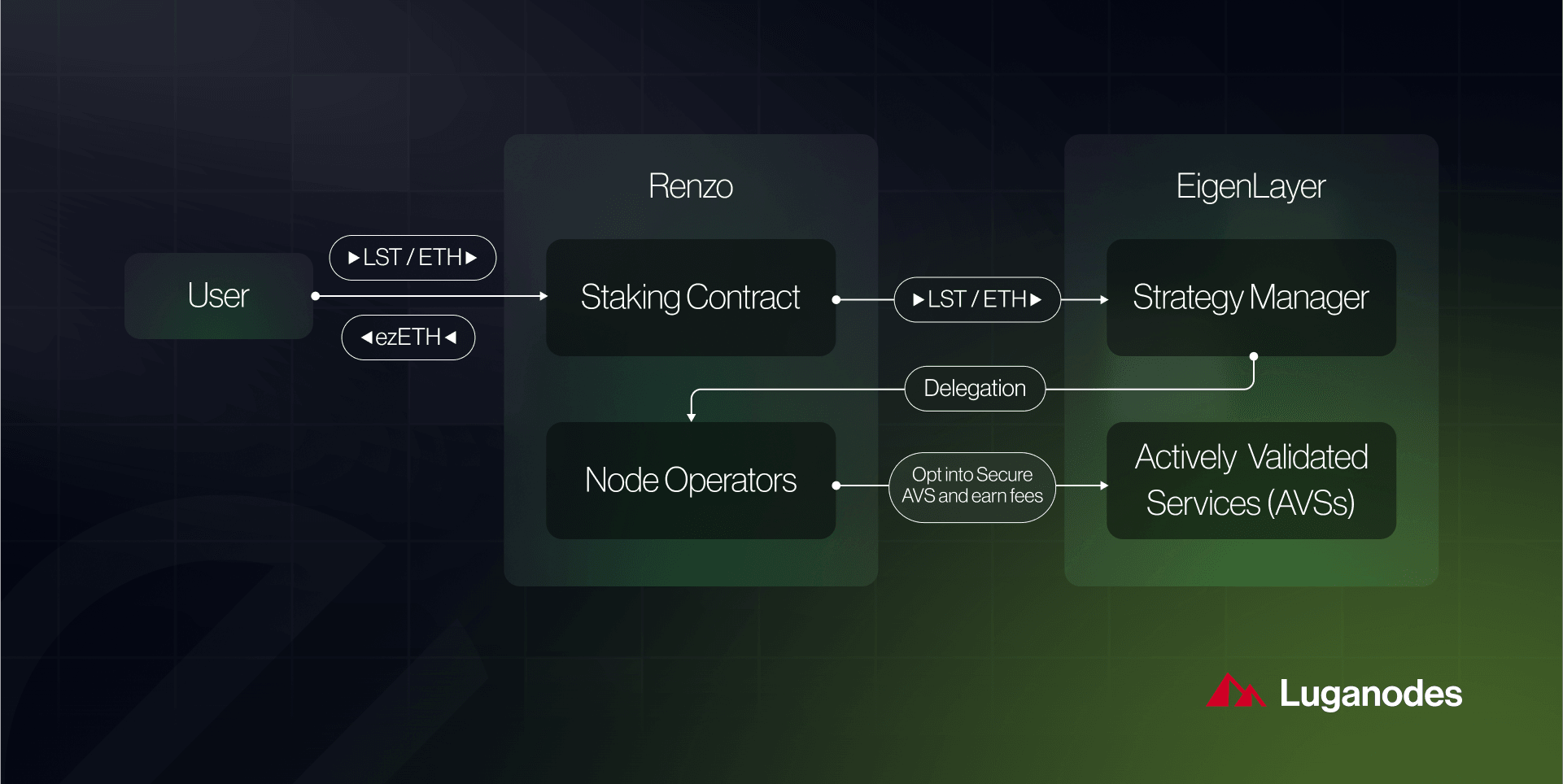

Restaking has rapidly become a cornerstone of modular blockchain infrastructure, especially as protocols like EigenLayer and Celestia drive innovation in data availability (DA) layers. The appeal is clear: by restaking DA layer assets, users can amplify their yield potential and help bootstrap new networks with additional security. But as with any powerful new primitive, restaking introduces unique risks that are often misunderstood or underestimated by even experienced DeFi participants.

This article dives into the top three risks every participant should scrutinize before restaking DA layer assets on platforms like EigenLayer and Celestia. If you’re aiming to maximize rewards without exposing yourself to unnecessary loss, understanding these pitfalls is critical.

1. Slashing Risk from Protocol Misbehavior

The most acute risk in DA layer restaking is slashing. When you restake assets on EigenLayer to secure DA layers such as Celestia, your funds inherit not only the original protocol’s slashing conditions but also the rules and penalties of each new protocol they secure. If any supported protocol behaves maliciously or fails to maintain liveness/finality guarantees, your entire staked principal can be partially or fully slashed.

This is not just theoretical: if a validator set supporting a DA layer like Celestia fails to deliver data on time or colludes against network rules, all restakers backing those validators may see their ETH or TIA slashed, even if the root cause was out of their direct control. This creates a complex web of shared risk that can amplify losses compared to traditional single-protocol staking.

If you want to dig deeper into how these mechanisms work in practice, I recommend reviewing this breakdown on restaking risks.

2. Liquidity Constraints and Withdrawal Delays

Liquidity risk is often overlooked until it matters most. Restaked assets are typically subject to extended lock-up periods, sometimes lasting days or even weeks, especially during periods of high network stress or major protocol upgrades. This means if you need access to your funds quickly, you could find yourself stuck in withdrawal queues that lengthen precisely when market volatility spikes.

This constraint exposes users to forced holding periods, during which asset prices may fluctuate significantly. In extreme cases, mass withdrawals can create bottlenecks that further delay exits and compound losses if prices drop sharply while users wait for their turn in the queue.

The bottom line: always consider your personal liquidity needs before committing assets to a restaking protocol, especially one securing high-growth DA layers where demand (and thus congestion) can change rapidly.

Top Liquidity Risks When Restaking DA Layer Assets

-

Slashing Risk from Protocol Misbehavior: Restaked assets on DA layers like Celestia via EigenLayer are subject to slashing if the underlying or restaked protocol behaves maliciously or fails to meet liveness/finality guarantees. This can result in a direct loss of principal, especially when validators are penalized for actions outside the user’s control.

-

Liquidity Constraints and Withdrawal Delays: Restaking DA layer assets can introduce extended lock-up periods and withdrawal queues, particularly during network congestion or protocol upgrades. This limits user access to funds and increases exposure to sudden market volatility, making it harder to exit positions promptly.

-

Protocol-Specific Smart Contract Vulnerabilities: Emerging restaking protocols often use complex or untested smart contracts. Bugs or exploits in these contracts—especially in fast-evolving modular ecosystems—can compromise user funds, highlighting the need for rigorous contract audits and ongoing monitoring.

3. Protocol-Specific Smart Contract Vulnerabilities

The modular blockchain ecosystem evolves at breakneck speed, and so do its attack surfaces. Most emerging restaking protocols rely on intricate smart contracts that orchestrate delegation, reward distribution, slashing logic, and cross-chain communication. These contracts are often new and untested at scale.

If a vulnerability exists, whether due to coding errors or novel exploits, it could be used by attackers to drain user funds or manipulate protocol behavior in ways that trigger cascading failures across connected networks. Given the composability ethos driving platforms like EigenLayer and Celestia, a single bug can have outsized consequences for everyone involved.

This risk isn’t just theoretical; history is littered with examples where smart contract bugs led to millions lost overnight. For more details on how these vulnerabilities manifest specifically in DA layer restaking protocols, see this comprehensive analysis.

Auditing and code review processes are improving, but the sheer complexity of modular restaking means that even well-intentioned teams can miss subtle flaws. When you restake assets, you’re betting not only on the economic soundness of the project but also on the technical rigor of its developers. Always check for recent audits, bug bounty programs, and community transparency before allocating significant capital to a new restaking protocol.

The interconnectedness of DA layers like Celestia with EigenLayer amplifies these risks. An exploit in a single contract could ripple through multiple protocols, impacting both restakers and the underlying networks they help secure.

Best Practices: Navigating DA Layer Restaking Safely

Given these risks, slashing, liquidity constraints, and smart contract vulnerabilities, how can you participate in DA layer restaking without exposing yourself to outsized losses? Consider the following strategies:

Top Risks When Restaking DA Layer Assets

-

Slashing Risk from Protocol Misbehavior: Restaked assets on DA layers like Celestia via EigenLayer are subject to slashing if the underlying or restaked protocol behaves maliciously or fails to meet liveness/finality guarantees. This can result in a direct loss of principal for users, as slashing penalties are enforced when validators violate protocol rules or experience downtime.

-

Liquidity Constraints and Withdrawal Delays: Restaking DA layer assets can introduce extended lock-up periods and withdrawal queues, especially during periods of high network stress or protocol upgrades. This limits user access to their funds and increases exposure to market volatility, making it harder to react quickly to changing market conditions.

-

Protocol-Specific Smart Contract Vulnerabilities: Emerging restaking protocols may have untested or complex smart contracts, making them susceptible to bugs or exploits. These vulnerabilities could compromise user funds, particularly in rapidly evolving modular ecosystems like those built on EigenLayer and Celestia.

Diversification is your friend. Don’t overexpose yourself to a single network or validator set. Distribute your staked assets across multiple protocols with different risk profiles and withdrawal mechanics. This helps insulate you from chain-specific failures or slashing events triggered by isolated incidents.

Stay informed about protocol upgrades and governance changes. Rapid iterations are common in modular ecosystems. Join governance forums, subscribe to security updates, and monitor audit reports so you’re never caught off guard by changes that could affect your risk exposure or withdrawal timelines.

Assess your personal liquidity needs honestly. If you may need access to funds on short notice, consider using protocols with shorter withdrawal windows or maintaining a portion of your portfolio in liquid assets outside of restaking platforms. Remember: yield is only valuable if you can actually realize it when needed.

The Future of Restaking: Risk-Reward Recalibrated

The promise of DA layer restaking is enormous, from boosting security for next-gen rollups to enabling permissionless innovation across Ethereum’s modular stack. But this promise comes with new responsibilities for users. You must weigh higher yields against real risks: slashing from protocol misbehavior, liquidity bottlenecks during stress events, and the ever-present specter of smart contract exploits.

The landscape will evolve rapidly as more capital flows into DA layer ecosystems like Celestia via EigenLayer. Those who thrive will be the ones who prioritize due diligence over FOMO, who treat every new opportunity as an exercise in risk management as much as yield optimization.

If you’re looking for deeper dives into technical specifics or want to connect with other security-conscious stakers, check out resources like this guide on understanding restaking. As always: knowledge is the best shield.