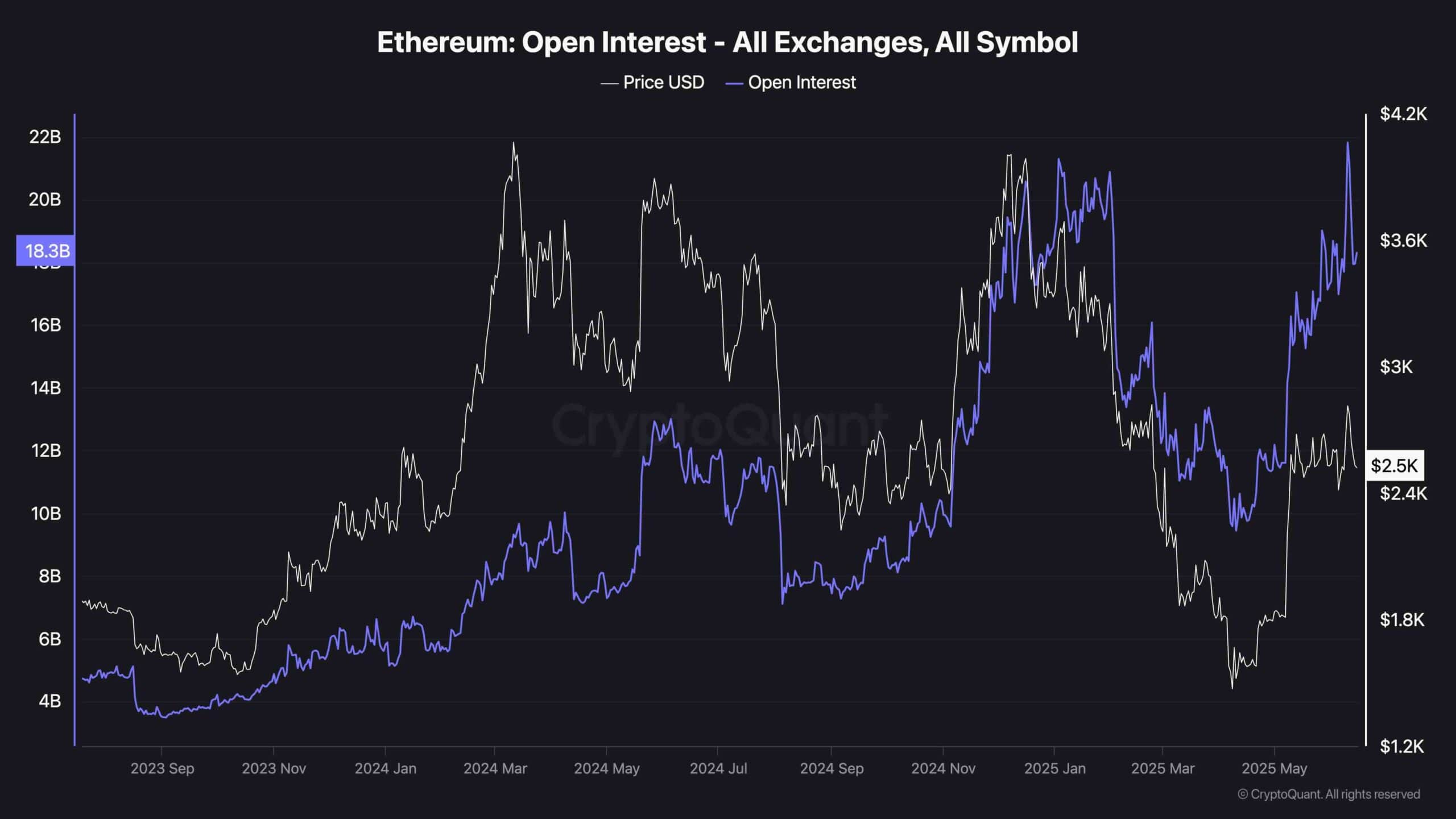

The modular revolution is in full swing, and for DA layer enthusiasts, restaking on EigenLayer is your ticket to amplifying both yield and impact. As of September 20,2025, Ethereum (ETH) is trading at $4,464.82, making the decision to restake your assets even more compelling. With EigenLayer’s innovative protocol, you can leverage your staked ETH or liquid staking tokens (LSTs) to secure data availability (DA) services like EigenDA, boosting security for the entire ecosystem while unlocking new rewards.

Why Restake on EigenLayer? The Modular Advantage

Restaking isn’t just a buzzword, it’s a practical way to maximize capital efficiency and actively participate in Ethereum’s evolving infrastructure. By reusing staked ETH or LSTs such as stETH, rETH, or cbETH within EigenLayer, you help power modular blockchain services without needing extra collateral. For DA layer fans, this means directly supporting projects that make scalable blobspace and decentralized data availability a reality.

Step 1: Acquire ETH or LSTs Compatible with EigenLayer

Your first move is simple but strategic: secure the assets you’ll restake. Head to a reputable exchange or DeFi platform and purchase either native ETH or supported LSTs (like stETH, rETH, cbETH). Double-check compatibility, only certain tokens are accepted by EigenLayer smart contracts. With ETH at $4,464.82, timing your entry could also influence your long-term returns.

Step 2: Connect Your Wallet to the Official EigenLayer App

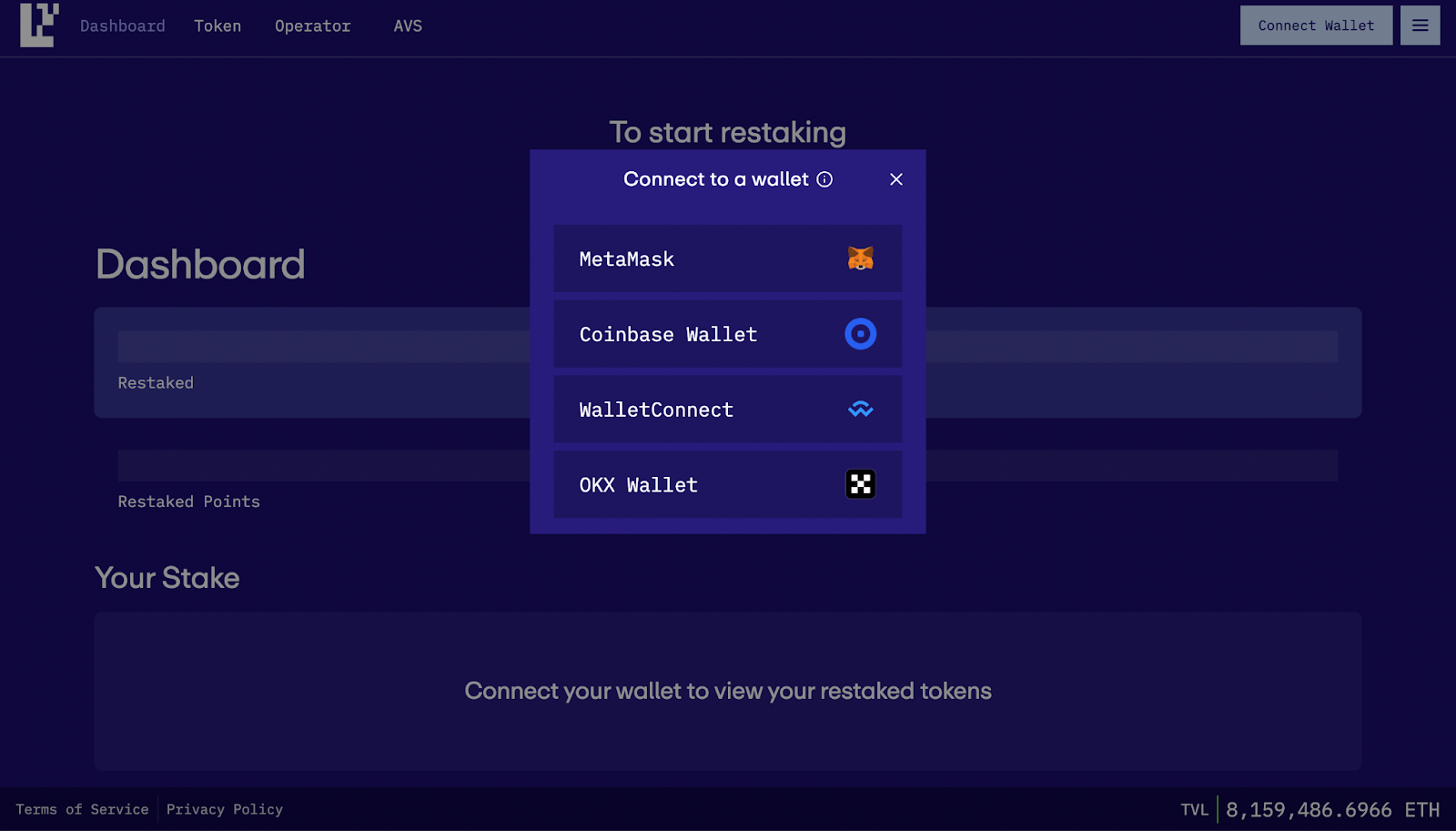

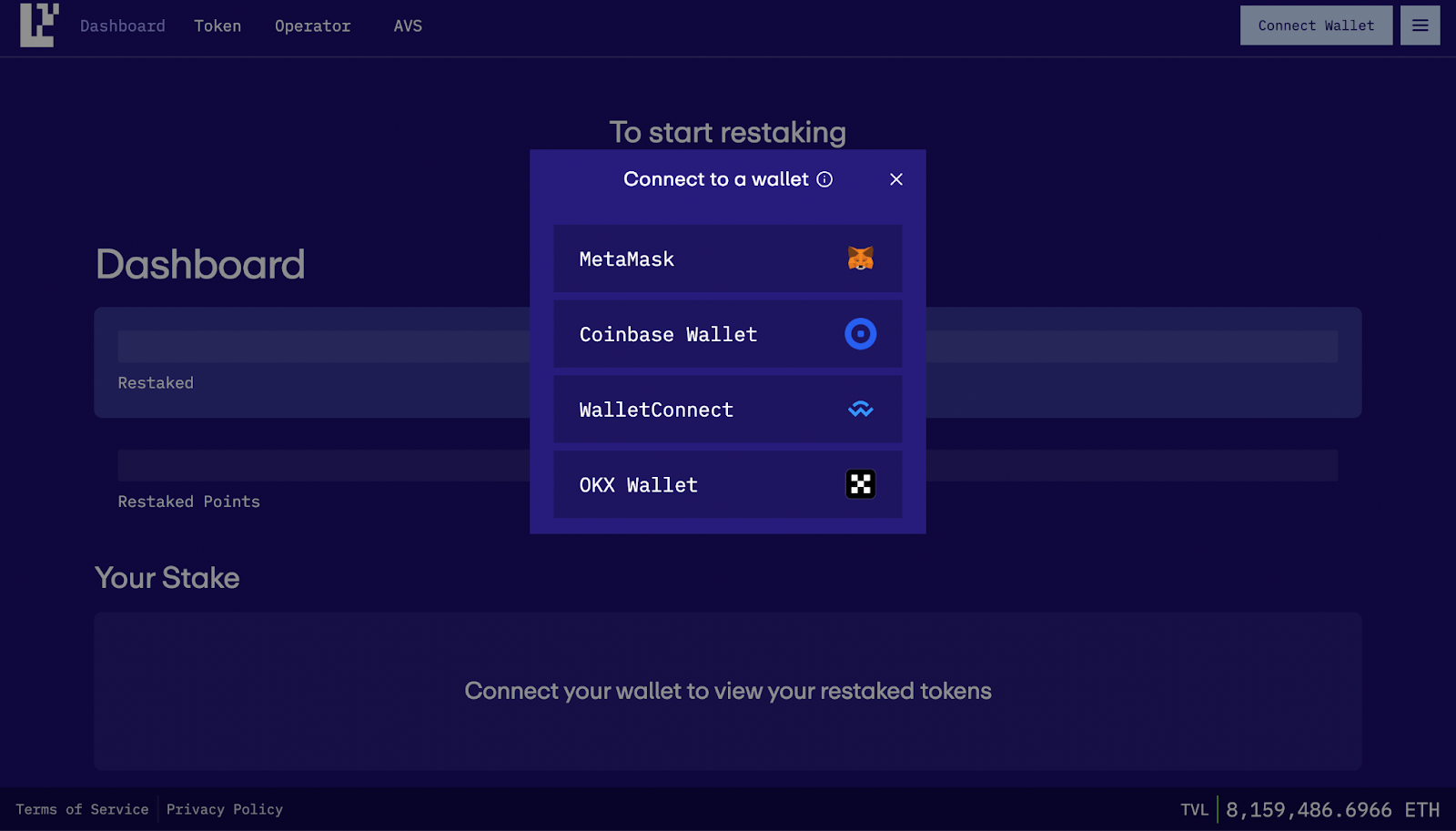

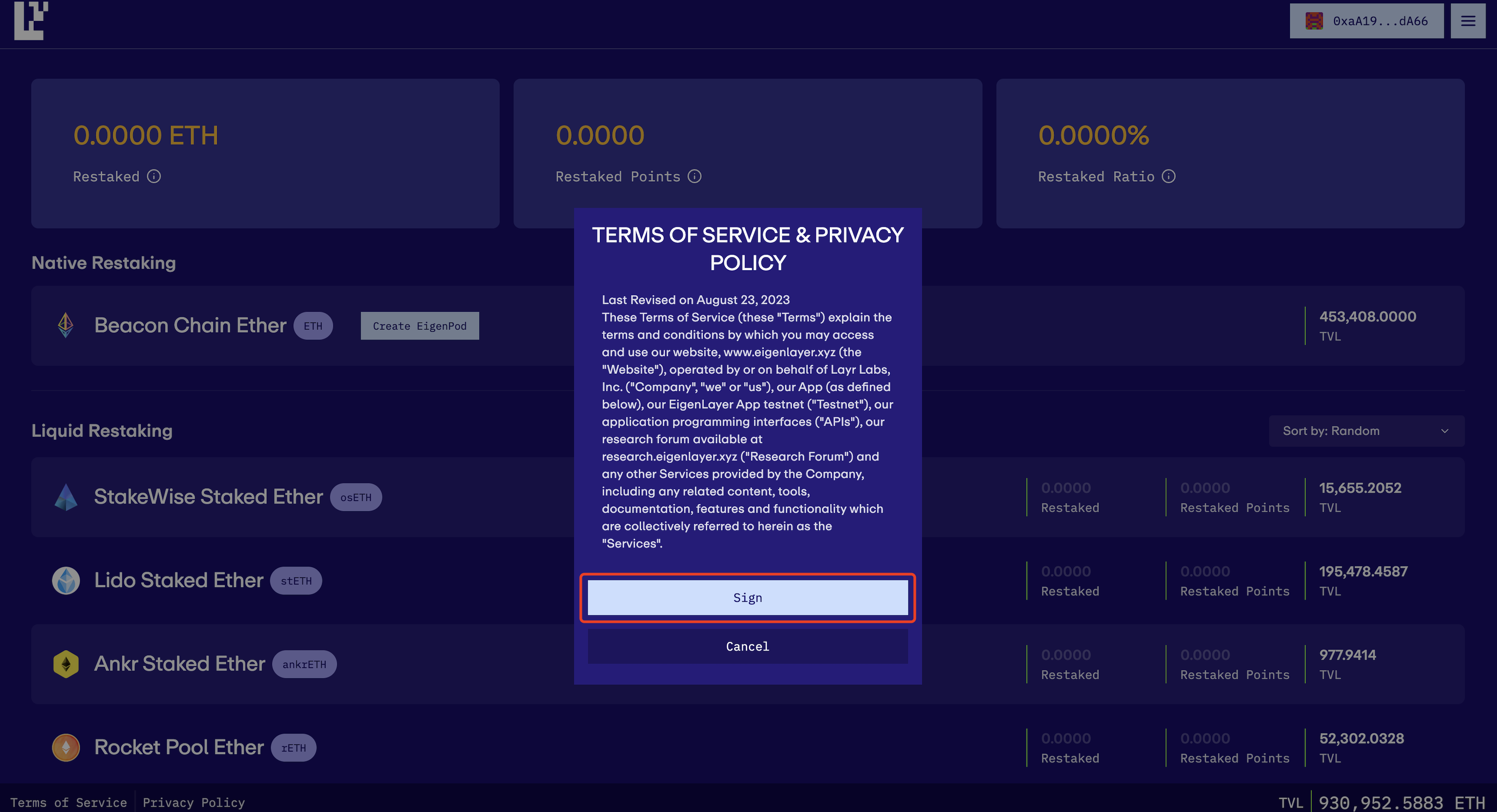

Once your assets are ready, it’s time to gear up for action:

- Connect your Ethereum wallet (MetaMask is a go-to option for most users) to the official EigenLayer app.

- Verify network compatibility: Ensure you’re on Ethereum mainnet, not a testnet, to avoid costly mistakes.

- Security tip: Always double-check URLs and bookmark the official app for future use.

Step 3: Deposit Your Assets into EigenLayer’s Smart Contracts

This is where theory meets practice. Initiate the restaking process by depositing your ETH or LSTs into EigenLayer’s smart contracts:

- If using native ETH: You’ll need to set up an EigenPod, which acts as your validator withdrawal address linked directly to EigenLayer (see detailed guide here). Platforms like P2P. org streamline this step within their dApps.

- If using LSTs: The process may vary slightly, follow prompts in the app and ensure you’re selecting compatible tokens.

- Confirm transactions in your wallet. Once complete, you’ve officially started contributing collateral toward securing DA services!

The Power of Restaked Points and Security Considerations

Your journey doesn’t end at deposit, by restaking, you start accruing restaked points, which measure both quantity and duration of your contribution. These points are key for tracking rewards and gauging impact within the ecosystem (learn more here). Remember: withdrawals have a mandatory 7-day delay, a crucial security feature designed to keep the system robust against attacks.

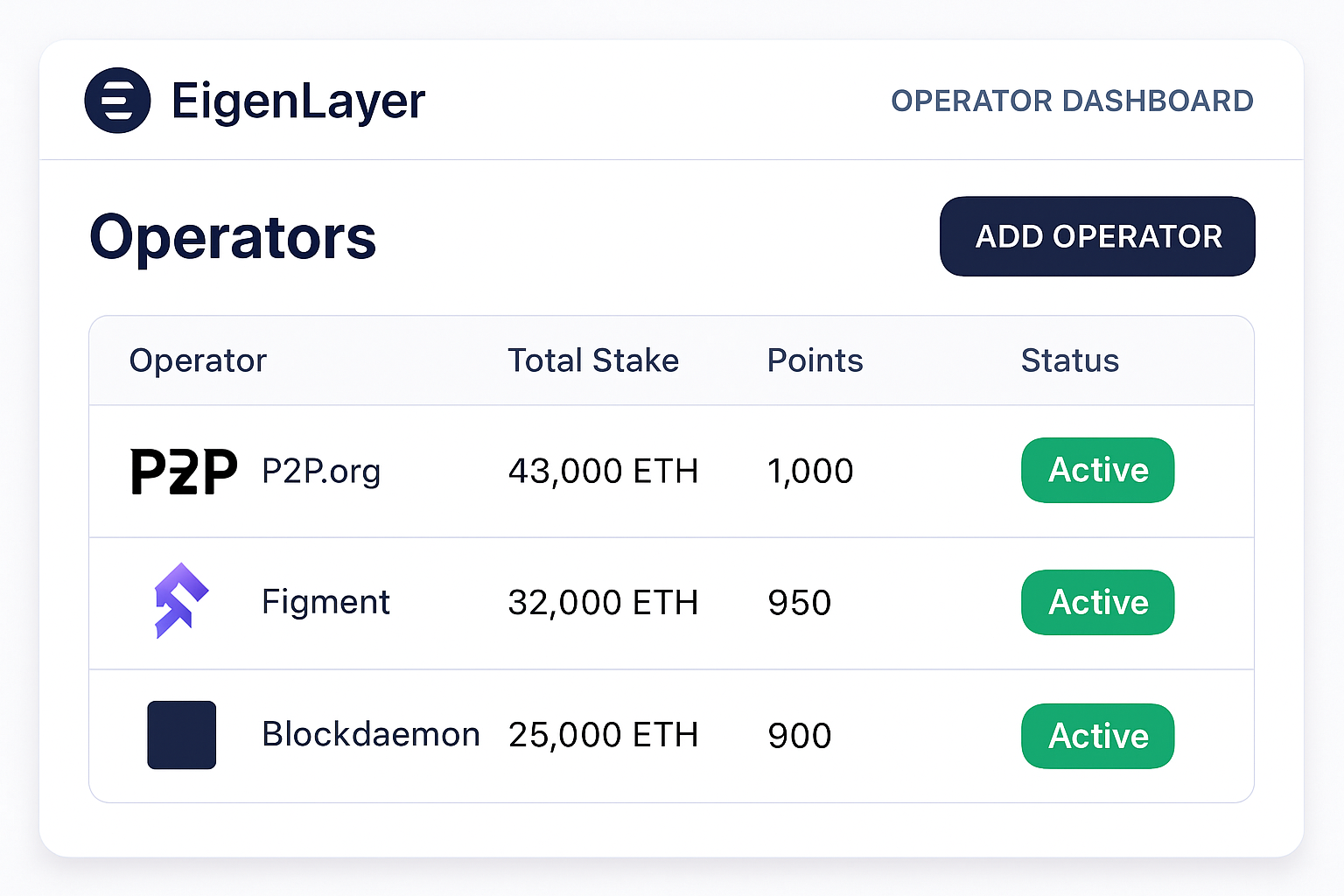

Step 4: Delegate to a Trusted Operator Supporting DA Layer Services

With your assets now restaked, it’s time to put them to work by delegating to an operator. Operators are the backbone of EigenLayer, they run the infrastructure for Actively Validated Services (AVSs), including DA layer protocols like EigenDA. Here’s how you maximize your impact and rewards:

- Browse the operator list in the EigenLayer app, filtering for those with proven support for DA services.

- Evaluate performance metrics: Look at uptime, slashing history, commission rates, and community reputation. Remember, your yield and the security of DA layers depend on your choice.

- Select and delegate: Click ‘Delegate’ next to your chosen operator and confirm in your wallet. Each EigenPod can be delegated to one operator, if you want exposure to multiple operators or AVSs, set up additional EigenPods as needed.

Step-by-Step Restaking Guide for DA Layer Enthusiasts

-

Acquire ETH or liquid staking tokens (LSTs) compatible with EigenLayer on a reputable exchange or DeFi platform. Supported LSTs include stETH (Lido), rETH (Rocket Pool), and cbETH (Coinbase). As of September 20, 2025, Ethereum (ETH) is trading at $4,464.82.

-

Connect your Ethereum wallet (e.g., MetaMask) to the official EigenLayer app and verify network compatibility. Ensure you are on the Ethereum mainnet for full functionality and security.

-

Deposit your ETH or LSTs into EigenLayer’s smart contracts to initiate the restaking process. This step enables your assets to participate in securing data availability services and earn potential rewards.

-

Select and delegate to a trusted operator supporting DA layer services, considering performance, security, and commission rates. Leading operators include P2P.org, Figment, and Blockdaemon—all with robust DA support and transparent stats.

-

Monitor your restaked assets and rewards through EigenLayer’s dashboard, and periodically reassess operator performance for optimal returns. Review metrics like restaked points, uptime, and reward history to maximize your staking efficiency.

This delegation step is where you directly contribute to securing modular data availability while opening up avenues for additional rewards. Don’t just set it and forget it, operator performance can change rapidly as new AVSs launch and competition heats up.

Step 5: Monitor Your Restaked Assets and Optimize for Yield

The modular blockchain ecosystem is dynamic, so should be your strategy! After delegating, make a habit of monitoring both your assets and rewards using the EigenLayer dashboard. Here’s what sets high performers apart:

- Track restaked points: These determine your share of protocol rewards and signal your contribution to network security.

- Review reward accruals: Consensus layer rewards typically sweep into your EigenPod every few days; keep tabs on them via the dashboard.

- Reassess operator performance regularly: If an operator’s uptime drops or their commission spikes, don’t hesitate to reallocate. The best yields often come from proactive management, not passive holding.

Key Considerations for DA Layer Enthusiasts

The power of restaking is amplified when you understand its nuances. Here are some expert tips tailored for DA layer participants:

- Diversification matters: If you’re serious about supporting multiple AVSs or hedging risk, consider splitting assets across several EigenPods/operators.

- Stay updated: New DA protocols are launching at a rapid pace, early delegation can mean outsized influence (and potentially better rewards).

- Security first: Always use official URLs, double-check smart contract addresses, and keep private keys secure. The modular future is bright but only if you protect your stack!

- Withdrawal planning: Factor in the mandatory 7-day withdrawal delay when managing liquidity or planning rotations between operators/services.

Snapshot: The Complete Restaking Flow for DA Layers

The modular era demands both agility and diligence. By following these five actionable steps, acquire compatible ETH/LSTs, connect securely to EigenLayer, deposit into smart contracts, delegate strategically to top DA-supporting operators, and actively monitor/rebalance, you’ll not only earn more but also help shape the data backbone of tomorrow’s decentralized web.

If you’re ready to ride this wave of innovation while maximizing returns at today’s ETH price of $4,464.82, restaking on EigenLayer is your all-access pass. Stay nimble, stay informed, and let your capital work harder across every layer that matters!