Real-time tracking of DA layer restaking yields has become indispensable for modular blockchain participants seeking to maximize returns and manage risk. As protocols like Celestia and EigenLayer redefine the economics of decentralized data availability, yield monitoring is no longer a passive exercise. Instead, it requires disciplined engagement with specialized dashboards and analytics tools built for the modular era.

Yield volatility, validator performance, protocol upgrades, and shifting AVS (Actively Validated Service) incentives all impact restaking returns. The market’s increasing sophistication means that relying on generic DeFi trackers or manual calculations is a recipe for missed opportunities and suboptimal allocation. Instead, dedicated platforms now aggregate live data from DA layers, providing actionable insights for both institutional allocators and individual stakers.

Five Essential Tools to Track DA Layer Restaking Yields

Top 5 DA Layer Restaking Yield Dashboards

-

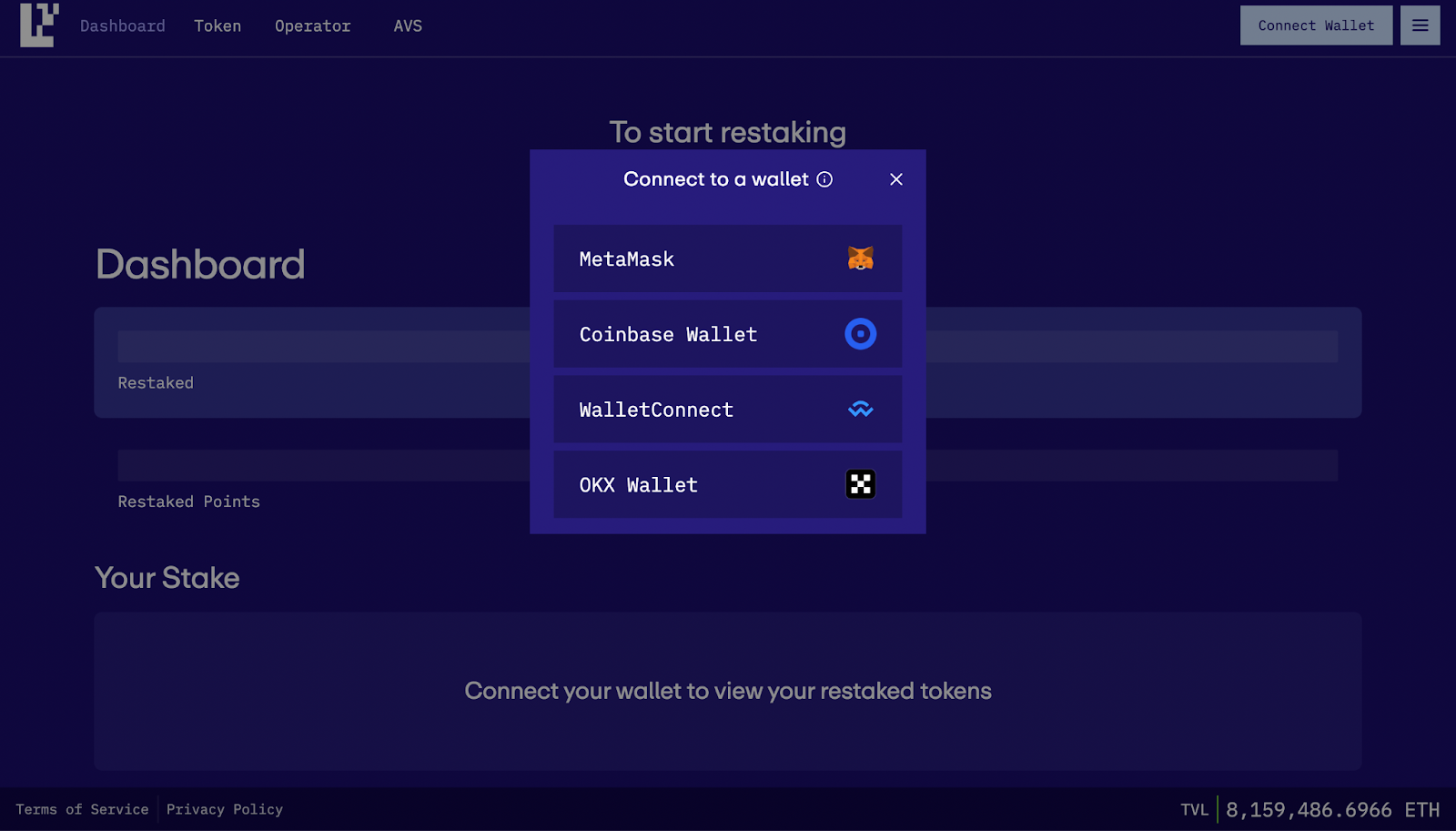

EigenLayer Restaking Dashboard (official): The primary dashboard for monitoring real-time restaking activity, rewards, and AVS (Actively Validated Services) participation on EigenLayer. Provides granular data on staked ETH, restaked assets, and yield breakdowns, making it indispensable for users seeking transparency and up-to-the-minute analytics.

-

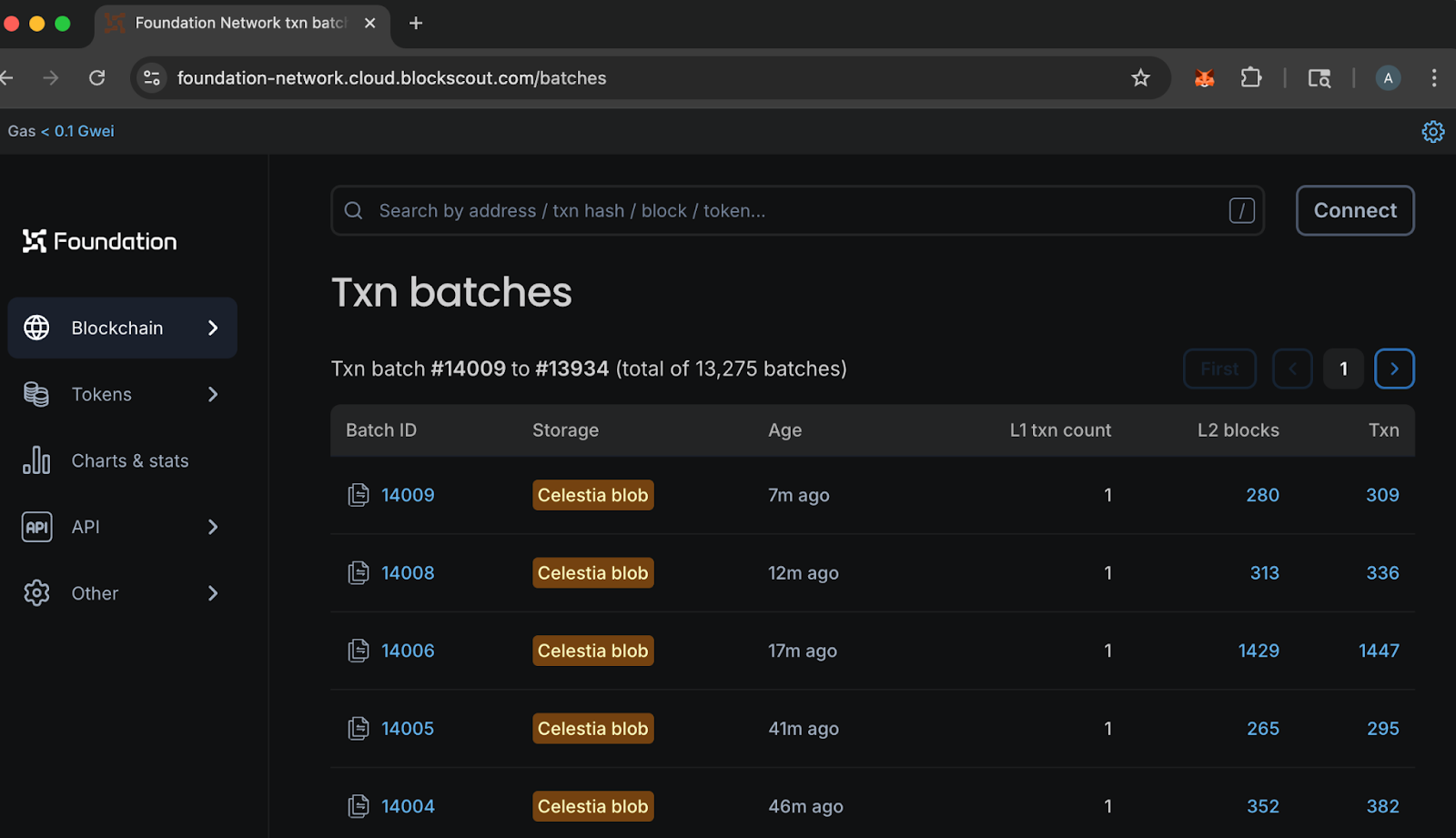

Celestia Explorer (explorer.celestia.org): The official block explorer for Celestia, enabling users to track DA layer transactions, validator performance, and restaking-related activities. Its intuitive interface and comprehensive on-chain data make it a go-to resource for monitoring Celestia’s modular data availability layer.

-

EigenLayer Rewards Tracker by EigenCloud: A specialized analytics tool from EigenCloud that aggregates and visualizes restaking rewards across EigenLayer. It features customizable reward tracking, historical yield graphs, and AVS-specific breakdowns, empowering users to optimize their staking strategies.

-

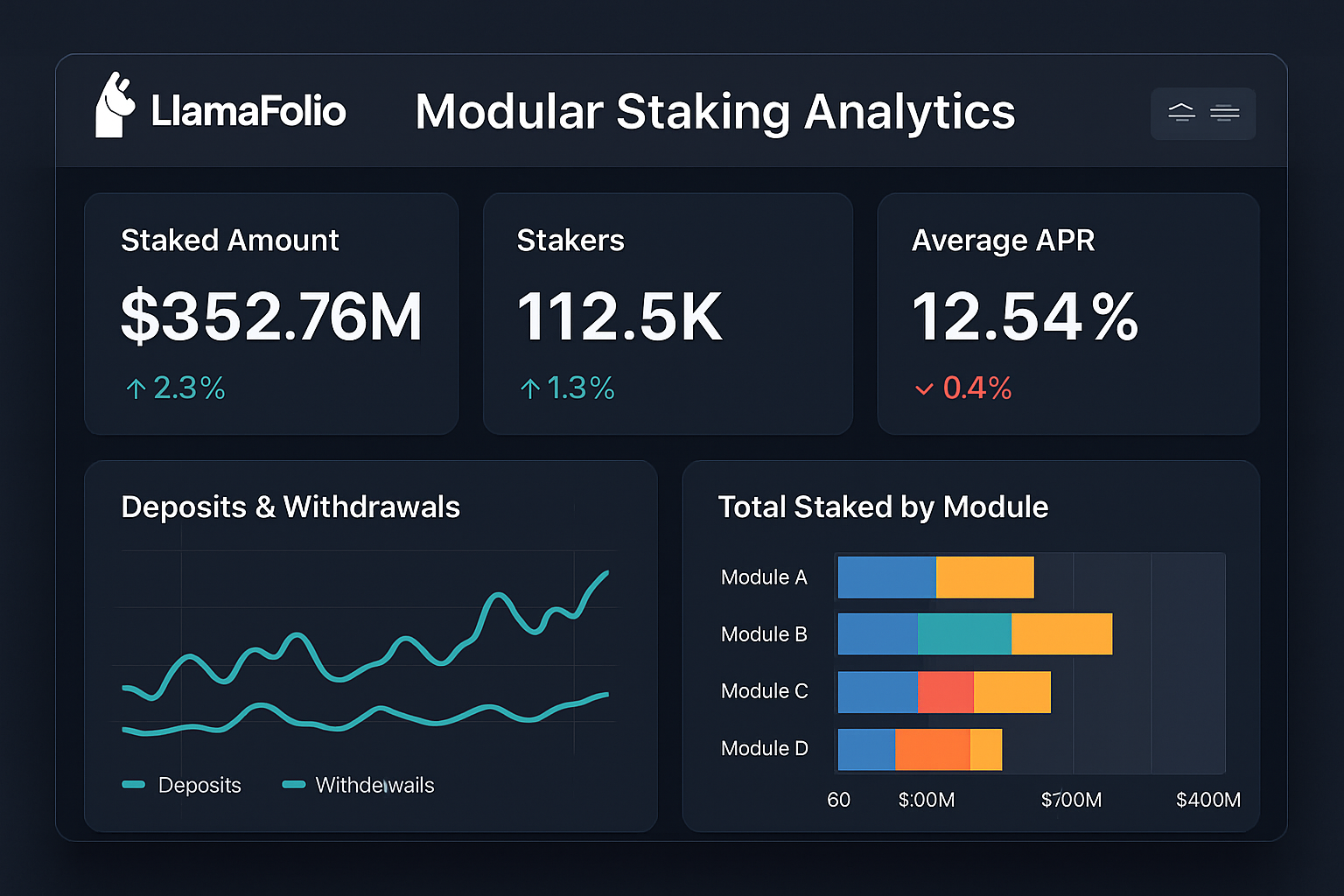

LlamaFolio Modular Staking Analytics: This multi-protocol analytics suite provides detailed insights into modular staking and restaking yields, including support for EigenLayer and Celestia. Users benefit from cross-chain portfolio tracking, advanced yield analytics, and comparative performance metrics.

-

Restake.Finance Yield Aggregator: An aggregator platform that consolidates yield data from major DA layer restaking protocols. Restake.Finance offers real-time APY comparisons, risk analysis, and actionable insights, helping users maximize returns while managing exposure across multiple DA layers.

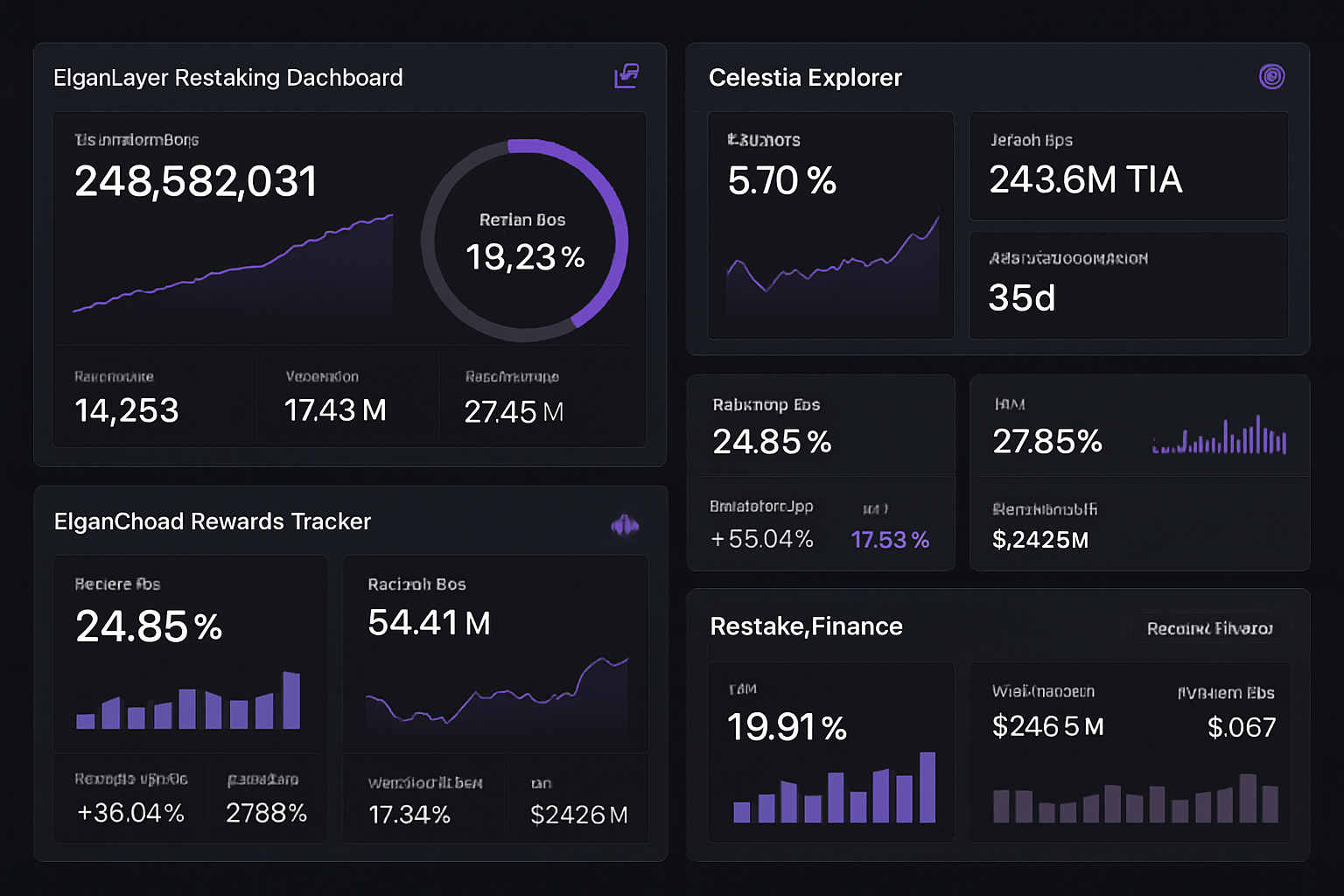

1. EigenLayer Restaking Dashboard (official): This is the primary portal for monitoring restaked ETH positions within the EigenLayer ecosystem. It delivers granular data on your principal amount, current APY/APR rates, pending rewards across AVSs, and any slashing events in real time. For active stakers optimizing between security provisioning and yield maximization, this dashboard is non-negotiable.

2. Celestia Explorer (explorer. celestia. org): As Celestia’s modular DA stack gains traction among rollups and dApps, its official explorer provides direct insight into validator performance metrics, block rewards distribution, and network-wide staking trends. Power users leverage this transparency to spot emerging yield opportunities as new AVSs onboard or as protocol parameters shift.

3. EigenLayer Rewards Tracker by EigenCloud: Built by the EigenCloud community for power users seeking deeper analytics than the official dashboard provides. This tracker offers comparative views of historical reward rates across different AVSs secured by EigenLayer restakers, enabling more informed reallocation decisions as market conditions evolve.

4. LlamaFolio Modular Staking Analytics: LlamaFolio specializes in aggregating staking data across multiple modular chains, including both Celestia and EigenLayer, into a unified portfolio view. This tool is invaluable for cross-chain stakers who need to monitor total exposure, risk-adjusted returns, and optimize allocations in response to shifting TVL dynamics.

5. Restake. Finance Yield Aggregator: For those who prefer a meta-approach to yield management, Restake. Finance pulls live APY figures from multiple DA layer protocols into a single interface with automated alerts on rate changes or slashing events. Its advanced filters help users quickly identify outlier yields or sudden shifts in risk profiles across supported networks.

The Need for Precision: How Real-Time Data Impacts Strategy

The days of set-and-forget staking are over in the modular blockchain landscape. With AVS onboarding schedules accelerating on both Celestia and EigenLayer, and new cross-chain interoperability primitives coming online, yield curves are more dynamic than ever before. Real-time dashboards not only help you capture fleeting high-yield windows but also provide early warnings if protocol risks (such as slashing penalties or validator downtime) threaten your capital base.

Navigating Market Complexity With Specialized Dashboards

The five platforms above form the foundation of any disciplined restaker’s toolkit:

- EigenLayer Restaking Dashboard: Essential for ETH-native strategies focused on securing multiple AVSs

- Celestia Explorer: Critical for monitoring validator health and block-level economics in Celestia’s ecosystem

- EigenCloud Rewards Tracker: Offers power-user analytics not available elsewhere

- LlamaFolio Modular Staking Analytics: Unifies cross-protocol portfolio management under one roof

- Restake. Finance Yield Aggregator: Centralizes APY discovery with smart alerts for tactical adjustments