In the evolving landscape of modular blockchains, blobspace restaking is rapidly emerging as a cornerstone strategy for maximizing yield and strengthening network security. As protocols like Celestia and EigenLayer push the boundaries of data availability and composability, stakers are discovering new avenues to extract value from their capital while supporting the infrastructure that underpins decentralized applications.

Redefining Yield: The Role of Blobspace in Modular Blockchain Ecosystems

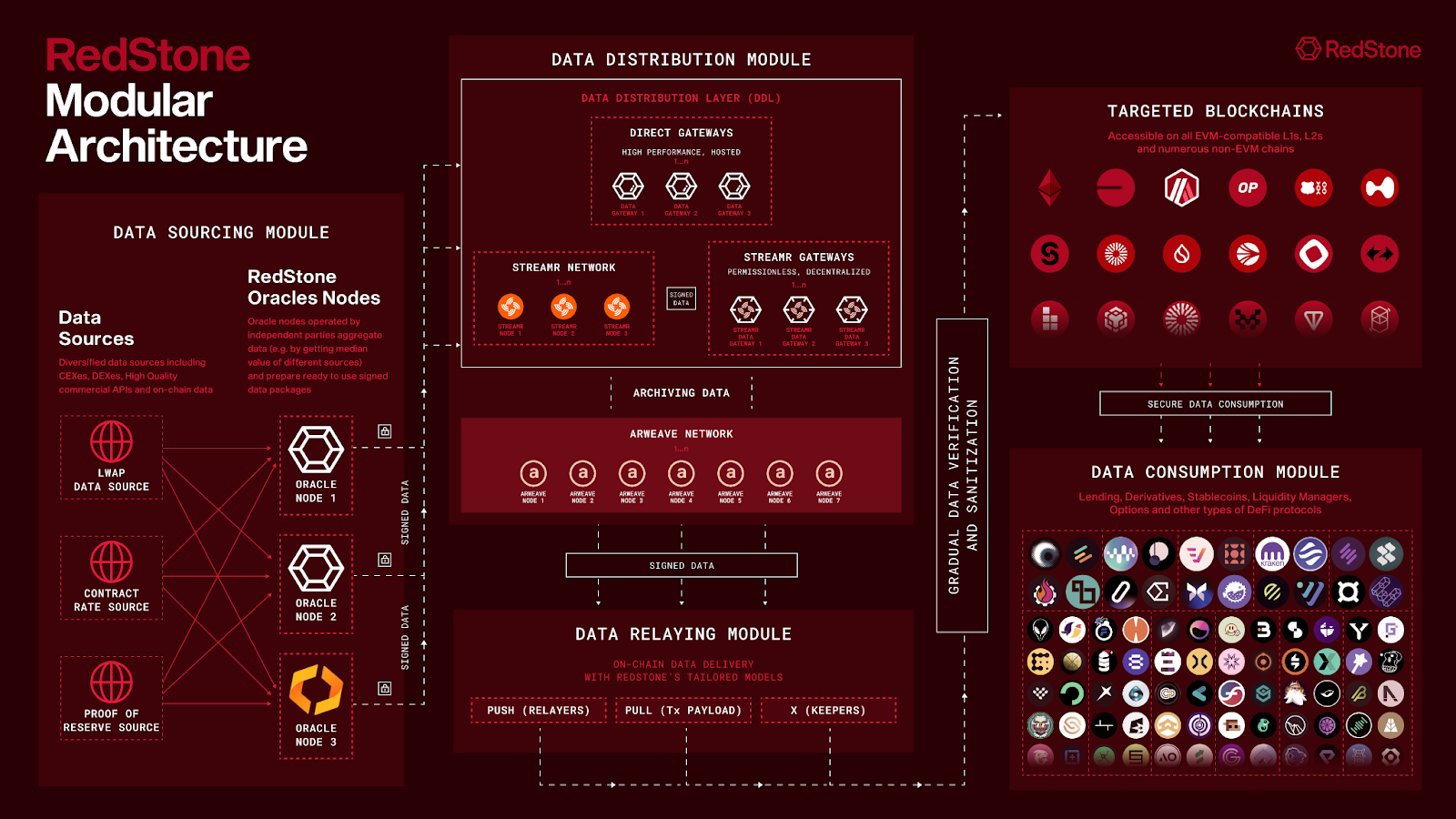

The rise of modular blockchains has shifted the paradigm from monolithic chains to architectures where consensus, execution, and data availability (DA) operate independently. In this context, blobspace – the dedicated space for storing transaction data off-chain – has become a critical resource. Protocols now allow users to restake assets originally committed for base layer security, redeploying them to secure DA layers or other services within the ecosystem.

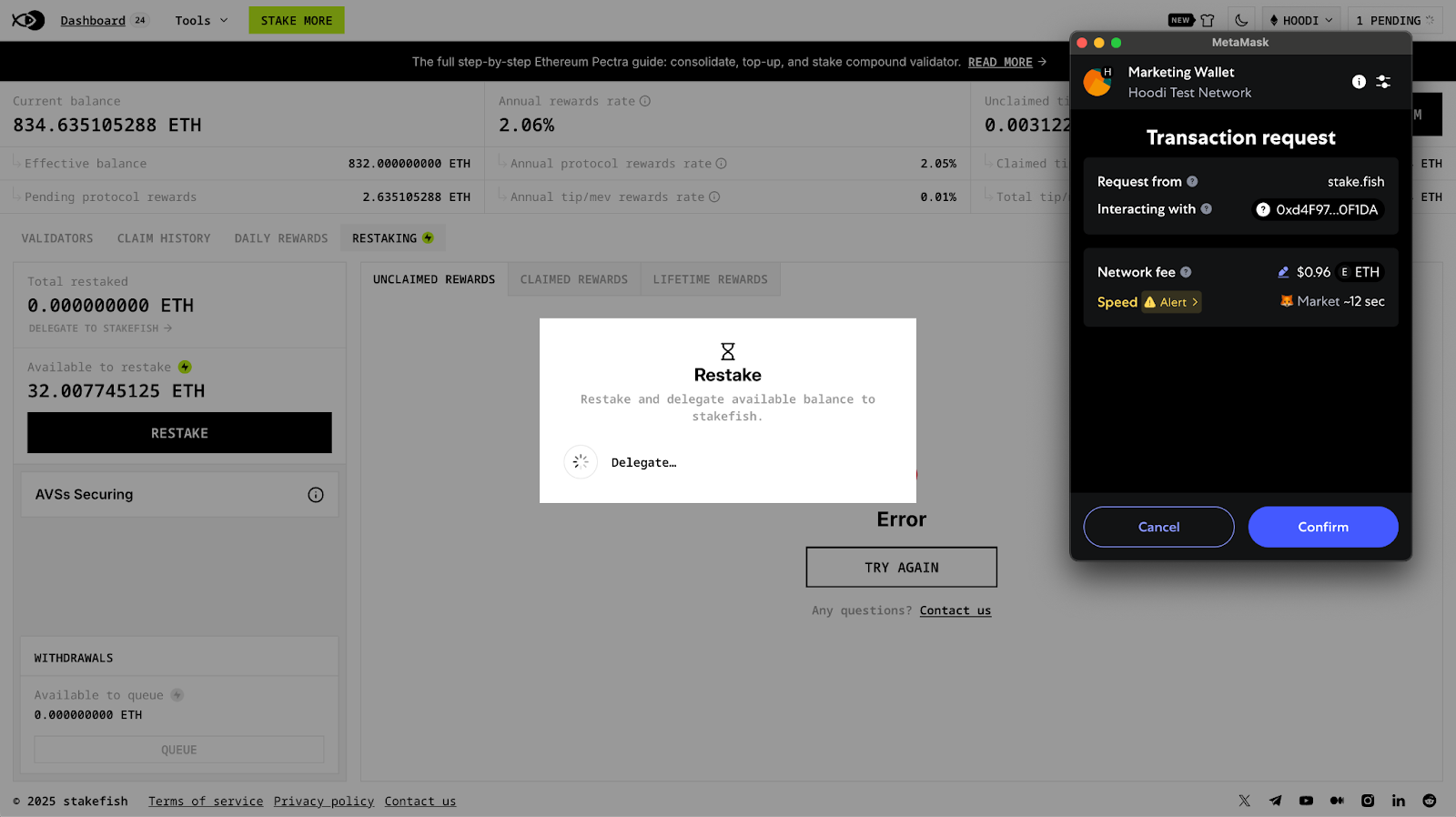

This approach not only enables stakers to earn multiple reward streams but also aligns incentives across various protocol layers. For example, by restaking ETH via EigenLayer, participants can simultaneously earn base staking rewards and additional yields from securing Actively Validated Services (AVSs) or DA modules like EigenDA. As highlighted by industry analysis, effective yields can reach into double digits without requiring further capital outlay or rehypothecation.

“Restaking leverages staked assets to boost the security of other blockchains, enhancing liquidity, scalability, and providing extra rewards. ” – 4pillars.io

Pillars of Blobspace Restaking: Key Platforms and Protocols

The modular restaking movement is being driven by a handful of innovative protocols:

Top Platforms for Blobspace Restaking in Modular Ecosystems

-

EigenLayer: The leading Ethereum-based restaking protocol, EigenLayer enables users to restake ETH or liquid staking tokens (LSTs) to secure Actively Validated Services (AVSs). This allows stakers to earn both base ETH rewards and additional AVS incentives, with effective yields often reaching 10–12%. EigenLayer is pivotal in extending Ethereum’s security to modular data availability layers and rollups.

-

Symbiotic: Launched on Ethereum mainnet in January 2025, Symbiotic is the first fully permissionless, modular restaking protocol. It supports a broad array of assets and networks, offering customizable slashing and reward mechanisms. Symbiotic’s architecture is designed for flexibility, making it a prime choice for restaking blobspace across diverse modular blockchains.

-

MilkyWay: Built atop Initia and Celestia, MilkyWay provides permissionless liquid staking and restaking services for Celestia’s blobspace. By enabling TIA holders to participate in both staking and restaking, MilkyWay enhances yield opportunities while supporting the security and scalability of Celestia’s data availability layer.

EigenLayer, built on Ethereum, stands out as the most prominent protocol allowing users to restake ETH or liquid staking tokens (LSTs) for additional yield while securing DA layers such as EigenDA. Stakers benefit from both base ETH yields and AVS-specific incentives. According to recent reports, this dual-reward model has pushed effective returns into the 10, 12% range for active participants (twendeelabs.com).

Symbiotic, launched on Ethereum mainnet in January 2025, introduces a fully permissionless and modular approach to restaking. It supports a broad array of assets beyond ETH and offers customizable slashing/reward logic – an attractive feature for developers crafting sovereign ecosystems (theblock.co). Meanwhile, protocols like MilkyWay are pioneering liquid staking and restaking solutions on Celestia’s DA layer, opening new yield opportunities for those who want exposure beyond Ethereum-centric networks.

The Mechanics: How Restaking Maximizes Yield in Practice

The core innovation behind blobspace restaking lies in its ability to stack rewards without additional principal risk exposure. By leveraging modularity:

- Staked assets are redeployed across multiple protocol layers.

- Participants earn layered rewards: base PoS yields plus DA/AVS incentives.

- This boosts overall capital efficiency: one unit of capital secures several services simultaneously.

- The system strengthens network security: more validators are incentivized to act honestly across interconnected chains.

This multi-layered approach is not without complexities. Restakers must navigate varying slashing conditions across protocols; failure or misbehavior in any service can result in loss of staked funds. Liquidity constraints may also arise if assets become locked or less transferable due to their use in multiple networks simultaneously.

Navigating Risks While Chasing Yield

The promise of modular blockchain yield is compelling but demands disciplined due diligence. As new platforms emerge offering ever-higher returns through innovative mechanisms like blobspace restaking, investors must assess:

- The robustness of each protocol’s slashing logic and security assumptions.

- The liquidity profile and withdrawal timelines associated with their staked assets.

- Diversification strategies that balance yield maximization with prudent risk management.

Increasingly, DA layers such as Celestia are positioning themselves as essential infrastructure for scaling the next generation of decentralized applications. By enabling restaking on blobspace, protocols like MilkyWay allow participants to unlock liquid staking and restaking opportunities that were previously siloed within single ecosystems. This cross-chain approach not only diversifies yield sources but also helps secure a broader array of services and rollups, reinforcing the modular thesis.

One of the most compelling aspects of blobspace restaking is its role in catalyzing a new competitive dynamic among DA providers. As more protocols vie for staked capital, the market is seeing an uptick in innovative incentive structures and reward mechanisms. Validators and delegators are now empowered to select platforms based on nuanced trade-offs between risk-adjusted yield, slashing policies, flexibility, and composability across modular stacks.

Strategic Frameworks: Restaking Strategies for 2025

For those seeking to optimize returns in this environment, disciplined strategy is paramount. The following frameworks can help stakers navigate the evolving landscape:

Top Strategies for Maximizing Yield with Blobspace Restaking

-

Choose a Robust Restaking Platform: Opt for established, modular restaking protocols such as Symbiotic, which offers permissionless, flexible restaking across multiple networks. These platforms enhance capital efficiency by enabling staked assets to secure various services simultaneously.

-

Diversify Across Multiple Modular Networks: Engage in restaking on several data availability layers and rollup-centric blockchains like Celestia. Spreading your staked assets across different protocols helps manage risk and unlocks multiple reward streams tied to blobspace demand.

-

Monitor Blobspace Demand and Token Economics: Track the usage of blobspace in networks such as Celestia, where increased demand for data availability directly impacts token incentives (e.g., TIA). Staying informed allows you to anticipate shifts in yield opportunities as network activity grows.

-

Stay Updated on Protocol Developments: Regularly review updates from modular ecosystem leaders (e.g., EigenLayer) to identify new restaking integrations, AVS launches, or changes in reward structures that can enhance your yield strategy.

-

Assess and Manage Slashing and Liquidity Risks: Carefully evaluate the slashing conditions and liquidity constraints of each protocol you restake with. Understanding these risks is crucial for protecting your principal and maintaining flexibility in volatile market conditions.

- Risk-Weighted Allocation: Assign capital based on each protocol’s security profile and historical performance rather than chasing headline yields alone.

- Diversification Across Layers: Spread staked assets not just across AVSs but also across different DA providers (e. g. , Celestia vs. EigenDA) to minimize correlated slashing risks.

- Active Monitoring: Continuously track protocol upgrades, governance changes, and emerging vulnerabilities that could impact slashing or liquidity windows.

The interplay between yield optimization and risk management will likely intensify as competition heats up among modular DA protocols. Early adopters who build adaptable frameworks stand to benefit most from the shifting incentives and technical improvements rolling out across platforms like EigenLayer, Symbiotic, and MilkyWay.

The Future of Blobspace Restaking

The modular blockchain ecosystem is still in its early innings. As more rollups and decentralized applications migrate to dedicated DA layers, demand for secure blobspace will surge, and with it, opportunities for sophisticated restakers willing to embrace complexity for higher returns. Expect continued innovation in liquid staking derivatives, dynamic slashing insurance products, and automated allocation tools tailored specifically for blobspace restaking scenarios.

The bottom line: blobspace restaking is redefining what it means to be a productive participant in modular blockchains. By combining advanced yield strategies with robust risk controls, investors can help secure tomorrow’s decentralized infrastructure, while capturing outsized rewards along the way.